For those who have (are) seriously engaged in co-movement analysis of financial instruments (> 2) - page 14

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I'm not complaining. It's just that there's a fixation on stationarity here - so I'm suggesting that this requirement be dropped.

Only for majors there are no cointegrating, of course. There will be only in "looped" systems like <EUR/GBP/USD> (i.e. EURUSD, GBPUSD, EURGBP). But it is not difficult to switch to a major-only system from "rings".

The non-uniqueness of the orthogonal vector is a fact. We need a logical criterion, which will be optimized when searching for a particular vector. For example, a criterion of "maximum trendiness". Mathematically - I do not know how. You may use the variance or its analogue for other return distributions. Another way is to require the maximum autocorrelation of synthetics. There are other criteria. Just don't suggest Hearst, it would be a lot of hassle.

Critique, hrenfx, justify why I am going the wrong way.

Only for majors there are no cointegrating ones, of course. There will only be in "looped" systems like <EUR/GBP/USD> (i.e. EURUSD, GBPUSD, EURGBP). But it is not difficult to switch to a major-only system from "rings".

Of course, it's not difficult - zero vector.

What is needed is a logical criterion which will be optimized when searching for a particular vector.

Well, there are correlations. The Canadian is oil. Australian - gold. Australian - New Zealander. Pair trading, in short.

You could do Aussie-gold-New Zealander. No longer paired. But there's a lot more room for manoeuvre now. We could also add the South African rand for the exotic. There would be four instruments that could definitely be cointegrated.

You can Aussie-gold-New Zealander. No longer paired. But there is much more room for manoeuvre now. You could also add the South African rand here for exoticism. There would be four instruments that could definitely be cointegrated.

You just said that there is no cointegrating vector for majors, and then you talk about one for 4 majors. If there were a cointegrating vector, it would be an elementary grail. There isn't one:

The bottom graph is synthetic. You can see that there is no cointegration on the OOS. Took that interval on purpose. There are some good ones, of course.

Why look for sets of majors at all? You do not need to do this. Analyse all the majors at once - the whole market.

You just said that there is no cointegrating vector for majors, and then you talk about one for 4 majors. If there were a cointegrating vector, it would be an elementary grail. There isn't one:

[...]

Why look for sets of majors at all? You don't need to do that. Analyse all the majors at once - the whole market.Theoretically, there is no way to calculate a cointegrant for the majors unless you make additional assumptions. All stat arbitrage is based on naked empiricism (fundamental, of course). As long as Canadians export a lot of oil, their currency will be tied to oil.

I like your Recycle, need to experiment with it more... And in general we should turn our brains somewhere drastically to find something.

The whole statarbitrage is based on naked empiricism (fundamental, of course). As long as Canadians export a lot of oil, their currency will be tied to oil.

Offtop:

There is such a tool for pair trading. One of the results of its application:

Corr = -0.7451, USDCAD - #CLX0, bars = 24664 (2010.05.31 13:10 - 2010.09.28 17:05), US Dollar vs Canadian - November 2010 Light, Sweet Crude Oil Future

Absolute value of the correlation coefficient at the 4-month interval 0.7451.

It is only for the cointegrant of the major zero, and for the orthogonal to the cointegrant it is non-zero. I don't claim that I don't do empiricism. But why not give it a try?

I'm going to proceed like this.

1. Choose the EUR/USD/GBP ring.

2. Find the cointegrant. This is a non-zero vector, which is what I need. What good is a zero vector to me?

3. We select the entry point of all pairs of the ring in order to fix the EURGBP rate at entry. Fix the space of volume vectors according to some criterion. For example, if we don't care about the orthogonality, then we will optimize by all vectors with definite total volume. If so, we can optimize only the vectors orthogonal to the cointegrant.

4. Choose a criterion that will be satisfied by the "maximal trend" synthetics. So far I like the autocorrelation of returns the best. It must be maximal, it is the basis for the trend trade. Equity does not have to go constantly upwards, it just has to be trending.

5. Find good quotes without holes for several years. For example forexite.com. Spreads on majors there are almost everywhere 5 pips, and that's good for checking.

6. Let's paste them into XL and run the optimization task - maximize the synthetic autocorrelation coefficient.

7. Having found a solution, bring it to the "major only" type (remove EURGBP, constructing equivalent major inputs). This will both remove unnecessary information, and minimize trading costs (spreads).

8. We check it on the OOS and rejoice if everything is OK.

Absolute value of correlation coefficient at interval of 4 months is 0.7451.

This is a low value. I have been shown much more acceptable results. Watch the intraday quotes, they seem to be better. And, of course, flip the Canadian.

1. Select the EUR/USD/GBP ring.

2. Find the cointegrant. This is a non-zero vector, which is what I need. What good is a zero vector to me?!

EURUSD^Koef1 * GBPUSD^Koef2 * EURGBP^Koef3 should be cointegrated. Obviously this would be if all the coefficients were 1/3. Look how great the cointegration turned out to be:

What good is a cointegrating vector like this to us?

3. We select entry point of all pairs of the ring, in order to fix EURGBP rate at entry. Fix the space of volume vectors according to some criterion. For example, if we do not care about the orthogonality, then we will optimize by all vectors with definite total volume. If we are worried, then we limit ourselves to those orthogonal to the cointegrant.

Throwing EURGBP out of consideration: redistributing Koef3 between Koef1 and Koef2 will result in Koef1 and Koef2 being zero. That's the meaningless cointegrating zero vector I was talking about. I don't see why you should engage in self-delusion. "Rings" are loc, zero posture. I suggest we just forget about them.

This is a low value. I've been shown much more acceptable results. Watch the intraday quotes, it seems to be better there. And of course, flip the Canadian.

What difference does it make if the canadian is inverted or not! Correlation just changes sign, all we care about is its absolute value to determine the degree of the correlation.

Here is the correlation indicator reading:

Fundamentalists and correlationists who understand at least a little bit of mathematics should be rubbed out with such charts to get their "knowledge" down

The graph shows that the market is alive and the links in it are "breathing". There is no steep alleged link between Canadian and oil. There is no cointegrator.

The graph shows that the market is alive and the links in it are 'breathing'. There is no steep alleged link between Canadian and oil. There is no cointegrator

The market is alive, the market is alive, the market will live )))

ZS: have you managed to apply all this in practice yet, any luck?

"by analysing the joint movement of financial instruments (> 2)"

https://www.mql5.com/ru/code/9385https://www.mql5.com/en/code

on the skin all on the yen, moved away from that and started switching to indices.

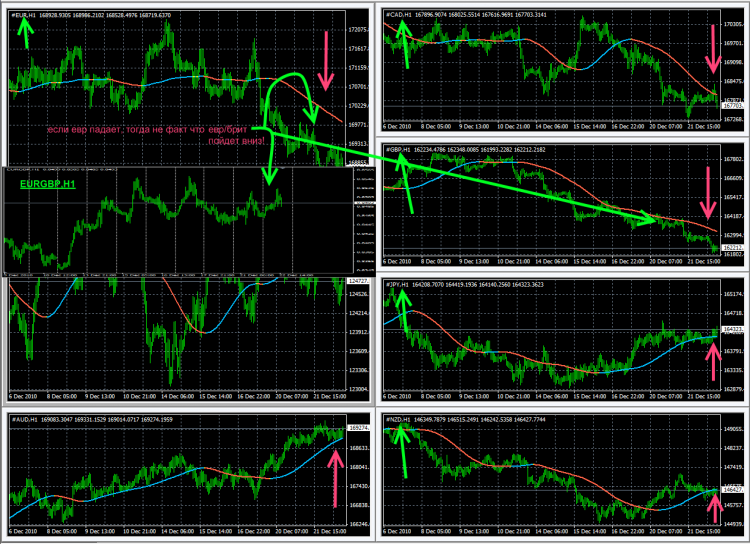

Current situation,

I think it is necessary to see the currency indices that are used for trading.