For those who have (are) seriously engaged in co-movement analysis of financial instruments (> 2) - page 9

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

And why should they be unsteady? If the cointegration vector is calculated - i.e. a stationary linear combination of prices is obtained - the resulting process should be traded.

Stationary, but overdone. The spread between equities very rarely exceeds costs (spreads on open positions + swaps). I would like the "spread amplitude" of the process to be larger.

This cointegration vector counts theoretically, even if we know nothing about the history of the pairs. The only assumption being exploited here is the practical impossibility of classical arbitrage for us small ones. That's essentially what you're suggesting, not statarbitrage.

You've invented some sort of statar arbitration and now you're trying to undermine it. If the secret isn't so secret, give me some examples of how to undo it.

I have not invented anything, the term has existed for a long time. Statar arbitrage is trading on the difference between well correlated processes that conditionally fit into a channel. In short, channel trading.

Conventional arbitrage of three looped pairs connected by an exact vector of cointegration is also channel trading, but very narrow. But if this vector (volumes) is slightly changed (loosened), we can hope that the channel will become wider. The resulting process may turn out to be 'slightly unsteady', but only slightly. Here it is already more interesting to trade (these are just my dreams).

I didn't make anything up, the term has been around for a long time. Star arbitrage is trading on the difference between well correlated processes that conditionally fit well into a channel. In short, trading the channel.

Ordinary arbitrage of three looped pairs connected by a precise vector of cointegration is also channel trading, but very narrow. But if this vector (volumes) is slightly changed (loosened), then we can hope that the channel will become wider. The resulting process may turn out to be 'slightly unsteady', but only slightly. That's more interesting to trade (these are just my dreams).

I mean roughly the same thing only in other words.

It's clear that you are looking for something like this

I'm just trying to make it clear to the public: we build synthetics that are permanently in the channel )

hrenfx, is your recycle looking at inverted pairs?

ZS: I'm not saying you're the one who came up with the statistical arbitrage, just suggesting that the discovery belongs to mathematicians.Normal arbitrage of three looped pairs linked by an exact vector of cointegration is also trading a channel, but a very narrow one. If this vector (volumes) is slightly altered (loosened), then we can hope to see the channel become wider. The resulting process may turn out to be 'slightly unsteady', but only slightly. That's more interesting to trade (these are just my dreams).

three pairs - the essence of a crossover lock - will NOT get you anywhere... without proper lot management :) but there is no need for such complications...

it's better to work with Two Feet :) even if many pairs are included in the analysis...

that's about it:

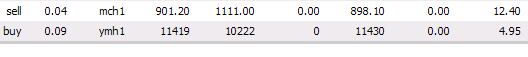

we see those instruments from the pool which have moved maximal distance from each other - and trade them ... ( this time the outermost ones were MSH1 (pink) and YMH1 (blue)

as a result - we get when they converge Plus++++

=======================================================

That's how it happened. This is another last night's paired entry! This spread worked out classically perfectly! See the picture!

========

example taken from Leonid... hope he will not mind :)

it worked... I've already told Dren to put above his Stated Spread the behaviour of all pairs individually... but haven't heard back yet :)

but I wanted to suggest him to watch out for Extreme Instruments - for they will create an Arbitrage situation - which can be worked out.... during the OOS

But if you take out the crosses, what do you get out of the EUR/USD/GBP system? We end up with two trivial locks in both pairs, which are of no use at all.

What the hell is going to happen? Like the cointegrating vector of the EURUSD + GBPUSD + EURGBP system is in fact a veiled pair of locks of two dollar majors?

...

it is more correct to work with Two Feet :) even if many pairs are included in the analysis...

But if you take out the crosses, what do you get out of the EUR/USD/GBP system? We end up with two trivial locks in both pairs, which are of no use at all.

What the hell is going to happen? Like the cointegrating vector of the EURUSD + GBPUSD + EURGBP system is in fact a veiled pair of locks of two dollar majors?

Yes, if you properly select the lots, it turns out to be a full lot :) - You may use it in places where losing lots are "forbidden" :)

Trading with two legs is not only about currencies, commodities, stocks, bonds, futures on indices ... In short, pair trading. In forex, pair trading will not work.

Why? What difference does it make which instruments are included in the Pairwise.... - you can use different bookmakers' bets :)

---

here is an example Two currency pairs - test on mt5 - lot constant 0.01

Here is an example Two currency pairs - test on MT5 - lot constant 0.01

In the tester BEAUTY :)))

And on the real?