EURUSD Technical Analysis 2015, 01.02 - 08.02: Total Bearish with Possible Ranging; Monthly Breakdown Continuing

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.31 10:11

Forex Weekly Outlook February 2-6 (based on forexcrunch article)

US ISM Manufacturing PMI, Rate decision in Australian and the UK, US Trade Balance and important employment data including the big NFP event. These are forex market movers for this week. Check out these events on our weekly outlook

Last week US jobless claims plunged 43,000 to a 15 year low indicating the labor market strides in the right direction. Economists expected claims to tick down to 301,000. Earlier that week, the Fed held its monthly monetary policy meeting, repeated the “patience” wording regarding a possible rate hike. However the policy makers were more concerned about international developments and their possible effect on US future growth. The Fed also stated that the labor market has improved further and household spending rose moderately, boosted by low energy prices. Will the US economy continue to improve?- US ISM Manufacturing PMI: Monday, 15:00. Manufacturing PMI declined in December, coming in at 55.5 following 58.7 in the previous month. Economists forecasted a higher reading of 57.6. Manufacturing output is constantly expanding; however, the rate of growth has eased in the fourth quarter. Companies express growing uncertainty about the outlook in 2015, especially regarding exports. Regarding the fall in oil prices, some ISM members think it would have a good impact on the manufacturing sector while others disagree. Manufacturing PMI is expected to reach 54.9 this time.

- Australian rate decision: Tuesday, 3:30. Australia’s central bank has kept its interest rate at a record low for 17 months amid the economic transition from mining investment. Many economists believe a rate cut is in order since the economic growth has not picked up to offset the sharp decline in mining investment. Low interest rates may boost investments in the non-mining sectors. In addition. Falling commodity prices like iron and oil will weaken export revenues. No change in rate is expected now.

- NZ employment data: Tuesday, 21:45. New Zealand’s Unemployment rate was better than expected in the third quarter, falling to 5.4% from 5.6 in the prior quarter. Employment expanded 0.8%, higher than the 0.5% gain reached in the second quarter and better than the 0.6% rise forecasted by analysts. However, on a yearly base, employment expanded 3.2%, below the 3.7% seen in the previous quarter. New Zealand’s employment market is predicted to grow by 0.8, while the unemployment rate is expected to drop to 5.3%.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. U.S. private sector employment gained 241,000 jobs in December, beating forecasts of a 227,000 job addition. The increase was broad based and was not affected by oil-related companies that experienced a dramatic fall in crude prices, suggesting the US labor market is resilient and does not depend on any one industry. U.S. private employment is expected to gain 221,000 this time.

- US ISM Non-Manufacturing PMI: Wednesday, 15:00. Service sector activity expanded at the slowest pace in six months, reaching 56.2 in December, after posting 59.3 in November. Economists expected a reading of 58.2. New Orders Index was 2.5 points lower than 61.4 registered in November. Employment Index declined 0.7 points, reaching 56.0 and Prices Index plunged 4.9 points to 49.5. Service sector is forecasted to grow to 56.6.

- UK rate decision: Thursday, 12:00. The Bank of England policymakers voted unanimously to leave rates at s record-low in January amid tumbling inflation. Both Martin Weale and Ian McCafferty, formerly opposing such a move, had a change of heart as falling oil prices threatened to weaken further the already subdued inflation. The ongoing improvement in the unemployment rate and wage growth didn’t persuade MPC members to vote for a change in policy. Following this statement, economists pushed back their forecast for a rate hike to early 2016.

- US Trade Balance: Thursday, 13:30. The U.S. trade deficit contracted in November to an 11-month low reaching $39 billion, the smallest since December 2013. Falling crude oil prices helped to strengthen domestic demand, but exports fell 1.0% to $196.4 billion in November, suggesting the slowing global economy may start to affect the US market. Economists expected deficit to reach $42.3 billion. U.S. trade deficit is expected to contact further to$38 billion.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment dropped sharply to a 15 year low, indicating the US labor market continues to strengthen. However, the unbelievably low figure can be also attributed to a holiday-shortened week. The 43,000decline was much better than the 301,000 addition forecasted by analysts. The four-week moving average, fell 8,250 last week to 298,500. The number of claims is expected to reach 277,000 this time.

- Canadian employment data: Friday, 13:30. Canada’s labor market had another mild setback in December, shedding 4,300 positions after contracting 10,700 jobs in November. The unemployment rate remained unchanged at 6.6%. Full-time employment in December grew by 53,500 jobs, while part-time work dropped by 57,700 indicating the overall picture is quite positive. The 12-month gain was 185,700 positions, an increase of 1.0% , while the six-month moving average for employment growth was 22,100 jobs, up from 21,300 in November.Canada’s labor market is expected to increase by 5,100 jobs, while the unemployment rate is expected to reach 6.7%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 13:30. U.S. job growth edged up in December, rising 252,000 after a revised jump of 353,000 in November. Meanwhile, the jobless rate declined to a 6.5 year low of 5.6%. However, despite the positive figures, wages did not increase in December a worrisome sign which may compel the Fed to leave rates unchanged for an extended period. Us job market is expected to add 231,000 positions. The unemplolyment rate is forecsted to remain unchanged.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.31 15:34

EUR/USD forecast for the week of February 2, 2015, Technical Analysis

The EUR/USD pair broke

higher during the course of the week, but fell at the 1.14 level to

turn things back around and form a little bit of a shooting star. That

being the case, we feel that the market is going to continue lower,

trying to reach the 1.10 level. Ultimately, we believe that rallies

continue to offer selling opportunities, and a break below the 1.10

level probably opened the door way to the 1.00 level in the longer run.

We have absolutely no interest in buying this pair although we recognize

it has been oversold.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.02 08:51

EUR/USD Technical Analysis: Corrective Bounce Seen Ahead (based on dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.1206, 1.1074, 1.0859

- Resistance:1.1339, 1.1444, 1.1659

The Euro may be preparing correct upward against the US Dollar

after putting in a bullish Morning Star candlestick pattern. A daily

close above falling trend line resistance at 1.1339 exposes the 23.6%

Fibonacci retracement at 1.1444. Alternatively, a reversal below the

14.6% Fib expansion at 1.1206 opens the door for a challenge of the

23.6% threshold at 1.1074.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.01 19:19

EUR/USD weekly outlook: February 2 - 6 (based on investing.com article)

The euro dipped against the dollar and yen on Friday, after data showed that deflation in the single currency bloc deepened in January and amid growing concerns over Greece's future in the euro zone.

Eurostat said that the annual rate of euro zone inflation fell by 0.6% in January, after a 0.2% slip in December. Economists had expected an annual decline of 0.5%.

Meanwhile, Greece’s new government said it will not cooperate with the International Monetary Fund and the European Union and will not seek an extension to its bailout program, underlining fears over a clash with its international creditors.

EUR/USD fell 0.27% to close at 1.1287. For the week, the pair rose 0.71%, the first weekly gain in seven weeks.

The euro ended the month down 6.71% against the dollar after European Central Bank unveiled a €1.2 trillion quantitative easing program last week.

Elsewhere, EUR/GBP dipped 0.21% to settle at 0.7496 on Friday, paring the week’s gains to 0.19%, while EUR/JPY slumped 0.93% to close at 132.66.

Meanwhile, the dollar remained in demand as investors reacted to data showing the U.S. economy grew less than expected in the fourth quarter.

The Commerce Department said in a report that the economy expanded 2.6% in the final three months of 2014, below expectations for a 3.0% gain and slowing sharply from growth of 5.0% in the three months to September.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the week at 95.00, down 0.01% for the day and 0.33% lower on the week.

The dollar had strengthened broadly on Thursday after the Federal Reserve indicated that interest rates could start to rise around mid-year.

Following its policy meeting on Wednesday, the Fed said it would keep rates on hold at least until June and reiterated its pledge to be patient on raising interest rates, while acknowledging the solid economic recovery and strong growth in the labor market.

In the commodities market, oil prices scored their biggest one-day gain since June 2012 amid indication that U.S. producers may be pulling back on new production in response to low prices.

Nymex oil futures surged $3.71, or 8.33%, to $48.24 a barrel, while London-traded Brent prices soared $3.86, or 7.86%, to $52.99.

Gold was also well-supported, with prices tacking on $23.30, or 1.86%, to close at $1,279.20 following the release of weaker than expected U.S. GDP data.

In the week ahead, investors will be turning their attention to Friday’s U.S. nonfarm payrolls report for further indications on the strength of the recovery in the labor market.

Monday, February 2

- In the euro zone, Spain is to release data on the change in the number of people employed.

- In the U.S., the Institute of Supply Management is to release data on manufacturing activity. The country will also produce a report on personal income and spending.

Tuesday, February 3

- The U.S. is to release data on factory orders.

Wednesday, February 4

- The euro zone is to publish a report on retail sales.

- The U.S. is to release a report on ADP nonfarm payrolls. Later in the day, the Institute of Supply Management is to release data on non-manufacturing activity.

Thursday, February 5

- The U.S. is to produce its weekly report on initial jobless claims in addition to data on the trade balance.

Friday, February 6

- The U.S. is to round up the week with the closely watched nonfarm payrolls report, and data on wage growth.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video February 2015

newdigital, 2015.02.02 18:51

Headlines, Not Data, Driving EUR-Complex

- Daily 8-EMA has caught up to EURUSD price consolidation.

- EURGBP finds resistance at daily 13-EMA.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.03 05:35

EUR/USD Monthly Technical Analysis for February 2015 (based on fxempire article)

The EUR/USD finished sharply lower during January after the European Central Bank announced it will begin buying Euro Zone sovereign debt in an effort to revive the economy and prevent it from sliding into economic stagnation.

The plan is for the ECB to buy 60 billion Euro, or $69 billion, of government bonds a month until at least September 2016, or until there’s a “sustained adjustment in the path of inflation” toward the central bank’s target of 2 percent. The total stimulus package amounts to about 1.1 trillion Euros.

With the central bank planning to use newly printed Euros to fund its program, the Euro is expected to remain under pressure against the U.S. Dollar for close to two years. Sure there may be a few short-covering rallies along the way, but until there is meaningful improvement in the Euro Zone economy, the bias should be to the downside for this Forex pair.

The key fundamental factors driving the ECB into its decision are weak Euro Zone inflation of about -0.2 percent and 11.5 percent unemployment that may still be trying to find a bottom.

On January 29, the U.S. Federal Open Market Committee maintained its pledge to be “patient” on raising interest rates. Fed members noted global risks, saying they will monitor “international developments” when deciding how long to keep rates low. It also raised its view of the economy and labor market, but expressed concerns about low inflation, saying it even anticipates inflation to fall further in the near term.

Traders interpreted the Fed’s statement to signal the central bank will begin raising rates perhaps as early as June. With the Fed set to raise rates and the ECB just starting its quantitative easing program, the interest rate differential is heavily favoring the U.S. Dollar at this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.03 17:29

Fed's Bullard downplays 'international' nod in FOMC statement (based on reuters article)

A top Federal Reserve official on Tuesday downplayed the Fed's nod to

international developments in its latest policy statement, saying it was

simply an acknowledgement of constant U.S. central bank discussion on

the potential impact of global market events.

St. Louis Federal Reserve Bank President James Bullard said the Fed always takes international events into account and, in his view, the insertion of the word "international" was a recognition of that.

Bullard repeated his view that the Fed needs to raise rates sooner and then move gradually higher after that. He also said that the oil price plummet is distorting market-based inflation expectation measures, and that these measures should be set aside until energy prices stabilize.

Bullard was speaking at the annual Delaware Economic Forecast event at the University of Delaware.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.03 17:31

Fed should delete 'patient' from next policy statement: Bullard (based on reuters article)

The Federal Reserve should delete the word "patient" from its next policy statement, a top Fed official said on Tuesday, which would give the central bank more flexibility on when to raise interest rates.

St. Louis Fed President James Bullard said if the Fed removes "patient" from its next policy statement in March, it does not mean the central bank has to hike at the next meeting.

Removing the word at the next meeting gives the Fed better "optionality", Bullard said.

Bullard is not a voting member on this year's policy-setting committee.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.04 06:24

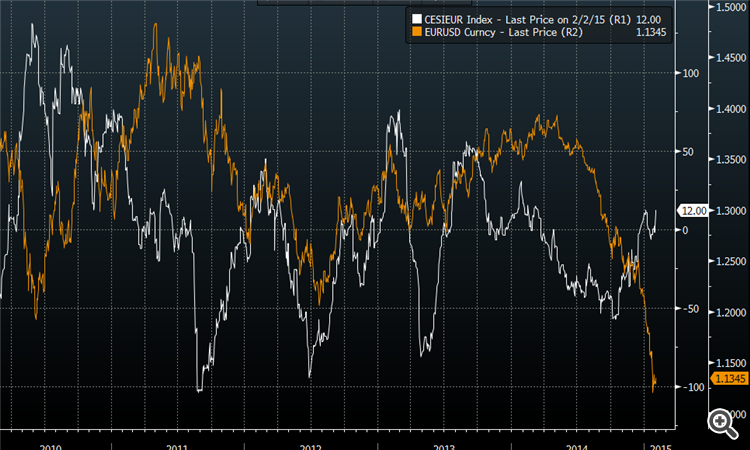

Two reasons to worry if you’re short EUR/USD (adapted from forexlive article)

Not many people out there are recommending euro longs but BAML is out with a couple of reasons to be worried if you’re short.

1) They note that last week’s inflows into European equities were the largest since June and included both the core and periphery. “We have argued that open-ended QE is negative for the Euro, but persistent equity inflows could slow and eventually even reverse the downward EUR trend,” they say.

2) Economic surprises are reversing. “US data surprises went into

negative territory last week for the first time since August, whilst EZ

data surprises are back in positive territory for the first time March

2014,” BAML says.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.04 18:30

2015-02-04 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]- past data is 56.2

- forecast data is 56.3

- actual data is 56.7 according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.7 percent in January, 0.2 percentage point higher than the December reading of 56.5 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 61.5 percent, which is 2.9 percentage points higher than the December reading of 58.6 percent, reflecting growth for the 66th consecutive month at a faster rate. The New Orders Index registered 59.5 percent, 0.3 percentage point higher than the reading of 59.2 percent registered in December. The Employment Index decreased 4.1 percentage points to 51.6 percent from the December reading of 55.7 percent and indicates growth for the eleventh consecutive month. The Prices Index decreased 4.3 percentage points from the December reading of 49.8 percent to 45.5 percent, indicating prices contracted in January when compared to December. According to the NMI®, eight non-manufacturing industries reported growth in January. Comments from respondents vary by industry and company; however, they are mostly positive and/or reflect stability about business conditions."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 23 pips price movement by USD - ISM Non-Manufacturing PMI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with secondary flat since the mddle of last week:

W1 price is on primary bearish with trying to break 1,1114 support level for the bearish to be continuing

MN price is on bearish breakdown: 1.2097 support level for broken on close MN bar. Totally bearish.

If D1 price will break 1.1097 support level on close bar so the bearish trend will be continuing for whole the week

If D1 price will break 1.1679 resistance level so we may see the market rally inside the primary bearish

If not so it will be bearish ranging between 1.1679 and 1.1097 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-02-02 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2015-02-02 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2015-02-02 13:30 GMT (or 15:30 MQ MT5 time) | [USD - PCE]

2015-02-02 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2015-02-03 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Factory Orders]

2015-02-04 08:15 GMT (or 10:15 MQ MT5 time) | [EUR - Spanish Services PMI]

2015-02-04 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - Retail Sales]

2015-02-04 13:15 GMT (or 15:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2015-02-04 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2015-02-05 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German Factory Orders]

2015-02-05 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Trade Balance]

2015-02-06 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging