You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

https://www.mql5.com/ru/code/9780

https://www.mql5.com/ru/code/9397if the dollar index indicator is used on M5, it converges in values (+/- 0.2) with http://www.marketwatch.com/investing/index/DXY

for the calculation of inverse values it is necessary to increase to the negative degree

I have found the calculation of other currency indices, I will do it

I looked at the second link and understood it.

Thanks a lot. :)

As for the subject, as "food for thought" - the indices cannot be calculated by calculating through the dollar index, here is a basket for the aussie:

couldn't find such information in runet, at most - selling signals of support and resistance levels of indices, first found the New Zealand index on the website of the national bank of New Zealand, then the Australian on the website of the national bank of Australia, well then found all at once on one bank website

As for the subject, as "food for thought" - the indices cannot be calculated by calculating through the dollar index, here is a basket for the aussie:

couldn't find such information in runet, at most - selling signals of support and resistance levels of indices, first found the New Zealand index on the website of the national bank of New Zealand, then the Australian on the website of the national bank of Australia, well then found all at once on one bank website

Igor, please share the link to the table.

Search rules: http://www.itraxx.com/download/products/guides/Markit_iBoxxFX_Index_Guide.pdf

Thank you. Tried looking for it myself, couldn't find it.

Igor, please share the link to the table.

well, this is the correct calculation of currency indices, and no bullshit like in the first posts of this thread

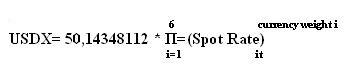

For example there is a formula to calculate the dollar index

Spot Rate - this is the spot quote of currency i at time t

It

Currency weight i is the weight of currency i in trade relations with the US

We can say that the index is a temporary product of the index constant 50.14348112. The USD Index was first fixed at 100 in 1973, when the Smithsonian Agreement introduced a system of new exchange rates that allowed for possible fluctuations of around 2.25%, which in itself was a big step forward. The index has since been adopted as the benchmark. The current value of the dollar index shows the change in the ratio of the dollar to a bicurrency basket of six currencies relative to the 1973 standard. The specific weight of the currency is equated to the share of trade with the USA for that country. For the Eurozone it is about 57%, the UK about 12%, Japan 13.5%, Switzerland 3%, Sweden 4%, Canada about 9%.

How to calculate these values (from what) -0.576 ; 0.136........ and the number itself 50.14348112 ?

And how do you calculate these very values (from what) -0.576 ; 0.136........ and the number itself 50.14348112 ?

you guys.

57.6% -> -0.576

11.9% -> 0.119

13.6% -> 0.136

and so on. The coefficient 50.14348112 is chosen so that at the moment of fixation it was exactly 100.

Before copying, you should understand the subject.