You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

!!!!!!!!!

All bars are based on bids.

It turns out that incorrect statements are made from an empty place due to ignorance of the existence of Ask price.

The first two examples are solved. I'm waiting for clarifications on the third.

P.S. Renat, I beg you very much not to make hasty conclusions. We can all see that you have a hot temper. But there are certain limits. I think you also don't know a lot of things in this world, especially in areas that are not directly related to your work. There's no shame in that. Special thanks for explaining to me the technology of bar building. Moreover, I`ve read about it before and it`s just not imprinted in my mind. Now I will remember it.

>>>explanatory for someone who has been interested in forex to varying degrees for over 10 years :)

!!!!!!!!!

What would that mean :)

The difference between Ask and Bid, as well as the terminology, was something I learned for the first time in 1998 (I don't even remember exactly), when I tried to go from theory to practice and opened my first demo account with fxeuroclub. I would immediately understand everything as soon as I tried to do something, but I've never thought about the method of drawing bars until now :) I did not think about it at all. I prefer figures. A chart is a subjective thing.

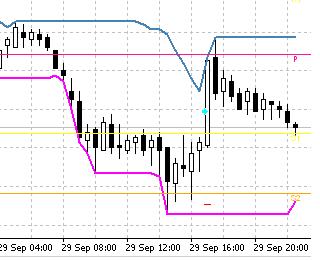

A snippet from recent history.

EURUSD M30 - tester:

Position opening condition :

As can be seen from the chart, the condition worked in the tester. Not in real time on the demo. So far I have only one explanation: price has not bounced from the maximum by enough pips in real time (last line). The other lines were executing. MP variable too (I have a separate indicator). It is calculated like this:

Can anyone confirm or refute my suspicions that in this case the data simulation results in the tester did not match the real price series?

This can be explained in the following trivial way. A requote happened on the real market and you had a small slippage in the OrderSend function (many beginners usually set slippage for opening at market equal to 0!!!), or the Expert Advisor just did not handle this situation with non-opening of an order. I always set slippage for myself equal to 5 pips when opening at market. As a result, I have not yet noticed any problems with opening orders, although I am constantly comparing the tester results with real ones.

Real price series and they don't have to match the results of their modelling in the tester. They don't owe anyone anything at all.

This thread started with a comparison of simulation results on different timeframes. And you jumped to comparing real and simulated series.

Try version 157, if you can find it with someone. Probably that's where the truth is buried deep down! As they say, it's a ruddy old horse, isn't it? :o))))))))))

2SNSH

Try version 157, if you can find it with someone. Probably that's where the truth is buried deep down! As they say, it's a ruddy old horse, isn't it? :o))))))))))

I meant is there any difference when downloading the history from the Date bank and getting it in real time over the same period from the same DC and the impact on testing.

>the condition on the tester worked. In real time on the demo it didn't.

This can be explained in the following trivial way. A requote took place on the real account and the slippage in the OrderSend function was small (many beginners usually set the slippage at market opening equal to 0!!!), or the Expert Advisor just did not handle the situation with non-opening of an order. I personally always have slippage equal to 5 pips when opening by market. As a result, I have not noticed any problems with order opening yet, although I am constantly comparing the tester's and real-time results.

Honestly, it's a terrible shame that I forgot the basics. I mean the bar building. It's been too long of a break. Spent almost four years building a house, so I've almost forgotten everything else. Only about half a year ago I started to get interested in the market again. Like from scratch, honestly :). Although, of course, I'm lying. Things are simpler than then. And with autotrading there was even a purpose in life. (Wouldn't turn out to be just a skyline :).