Good afternoon!

I want to clarify theIneffective Transaction Charge

I contacted technical support exchanger:

The answer I got from the exchange:

From the correspondence above it follows that if you have a number of transactions per day does not exceed 10-20 pcs,

it is not necessary to fully calculate benefits for transactions, but just use

count the number of transactions per day, which has a free limit of 2000.

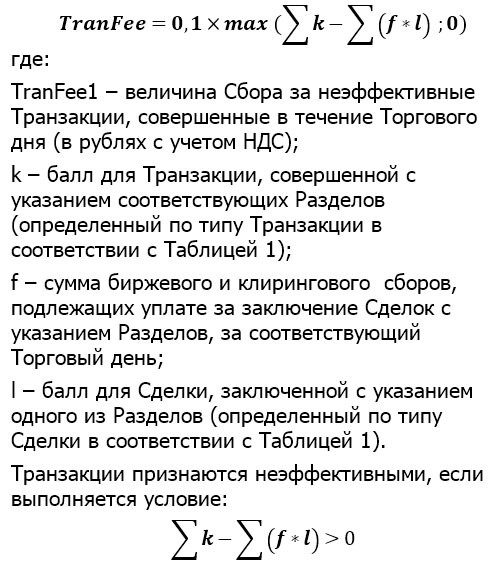

The parameter "l" is completely unclear from the calculation formula

l is the score for a Transaction entered into indicating one of the Sections (determined by the type of Transaction according to Table 1).

I have sent a request to the exchange for this parameter (meaning the volume of the transaction).

it is a simple ratio,

for an ordinary futures - row 1, coeff =40,

for an illiquid futures - row 2, also coefficient = 40, (if you are not a market maker - row 6).

the volume is taken into account when calculating the formula, by multiplying 40 by the exchange commission.

you can take the sum of all commissions for a trading day and multiply it by 40 - this amount should be greater than or equal to the sum of all transactions,

then there will be no extra commission.

100 trades for one lot will be equal to 1 trade for 100 lots.

That's true, but somehow matching my transactions to the exchange fee according to the above formula didn't stop me from paying a 10k fine once in a week.

This is what the BCS sent me:

Hello. I am attaching the formula for exceeding the transaction threshold:

The Transaction Fee is determined each Trading Day separately for each section of the clearing registers for Transactions in respect of futures contracts and in respect of options contracts.

The Transaction Fee is not charged if the number of Transactions executed with reference to the clearing register section for which the said fee is determined is less than or equal to the relevant threshold value (hereinafter referred to as the "Threshold"). The Threshold is set equal to 2,000 (two thousand) Transactions.

The calculation of the fee for Transactions shall be made according to the following formula:

Fee = max(T-Round(F / K);0)*0.1, where:

-Fee - the amount of the fee for Transactions executed during the Trading Day;

-T - the number of Transactions executed during the Trading Day indicating the section of the clearing registers for which the fee for Transactions is determined;

-F - value of the exchange fee payable for conclusion of futures contracts (if a Transaction fee is determined for futures contracts) or for conclusion of options contracts (if a Transaction fee is determined for options contracts), obligations under which are recorded on the clearing registers section for which the Transaction fee is determined;

-K - coefficient of influence of the value of the exchange fee on the value of the fee for Transactions (K = 0.03 for the clearing registers section specified in the agreement on performance of obligations of the market maker under option contracts; K = 0.05 for other clearing registers sections);

-Round() - mathematical rounding function to integers.

it is just a coefficient,

for an ordinary futures - line 1, coeff = 40,

for an illiquid futures - line 2, also coefficient = 40, (if you are not a market maker - line 6).

the volume is taken into account when calculating the formula, by multiplying 40 by the exchange commission.

you can take the sum of all commissions for a trading day and multiply it by 40 - this sum should be higher or equal to the sum of all transactions,

then there will be no extra commission.

100 trades of one lot will be equal to 1 transaction of 100 lots.

Right, Sergei!

Read carefully what I wrote in the first post.

( there will be no line 6 unless you are a market maker)

That's true, but for some reason the compliance of my transactions with the exchange fee according to the above formula did not prevent me once from paying 10k in fines for the week.

This is what they sent me from BKS:

Hello. I enclose the formula for exceeding the transaction threshold:

The Transaction Fee is determined every trading day separately for each section of the clearing registers for Transactions in respect of futures contracts and option contracts.

The Transaction Fee is not charged if the number of Transactions executed with the indication of the clearing register section for which the said fee is determined is less than or equal to the relevant threshold value (hereinafter referred to as the "Threshold"). The Threshold is set equal to 2,000 (two thousand) Transactions.

The calculation of the fee for Transactions shall be made according to the following formula:

Fee = max(T-Round(F / K);0)*0.1, where:

-Fee - the amount of the fee for Transactions executed during the Trading Day;

-T - the number of Transactions executed during the Trading Day indicating the section of the clearing registers for which the fee for Transactions is determined;

-F - value of the exchange fee payable for conclusion of futures contracts (if a Transaction fee is determined for futures contracts) or for conclusion of options contracts (if a Transaction fee is determined for options contracts), obligations under which are recorded on the clearing registers section for which the Transaction fee is determined;

-K - coefficient of influence of the value of the exchange fee on the value of the fee for Transactions (K = 0.03 for the clearing registers section specified in the agreement on performance of obligations of the market maker under option contracts; K = 0.05 for other clearing registers sections);

-Round() - mathematical rounding function to integers.

The formula is defined in the exchange document and looks like this:

And what the broker has replied to you is a figment of ....

P/S The transaction has a volume. And what is given above causes a question (as the commission of the exchange is charged precisely on the volume of transaction, but not on the fact of the transaction).

Just need to find out l = 40 for a transaction with any volume or not.

Tomorrow they will answer, then it will be clear how to count if there are more than 10-20 deals per trading day.

Sergei!

Re-read carefully what I wrote in the first post.

( there will be no line 6 unless you are a market maker)

What did I write wrong or what is unclear?

Line 6 is for market makers - that's me for an example. A market maker does not pay fees on illiquid instruments.

That's true, but for some reason the compliance of my transactions with the exchange fee according to the above formula did not prevent me once from paying 10k in fines for the week.

Here's what the BCS sent me:

Hello. I am attaching the formula for exceeding the transaction threshold:

The Transaction Fee is determined each Trading Day separately for each section of the clearing registers for Transactions in respect of futures contracts and in respect of options contracts.

The Transaction Fee is not charged if the number of Transactions executed with reference to the clearing register section for which the said fee is determined is less than or equal to the relevant threshold value (hereinafter referred to as the "Threshold"). The Threshold is set equal to 2,000 (two thousand) Transactions.

The calculation of the fee for Transactions shall be made according to the following formula:

Fee = max(T-Round(F / K);0)*0.1, where:

-Fee - the amount of the fee for Transactions executed during the Trading Day;

-T - the number of Transactions executed during the Trading Day indicating the clearing registers section for which the fee for Transactions is determined;

-F - value of the exchange fee payable for conclusion of futures contracts (if a Transaction fee is determined for futures contracts) or for conclusion of options contracts (if a Transaction fee is determined for options contracts), obligations under which are recorded on the clearing registers section for which the Transaction fee is determined;

-K - coefficient of influence of the value of the exchange fee on the value of the fee for Transactions (K = 0.03 for the clearing registers section specified in the agreement on performance of obligations of the market-maker under option contracts; K = 0.05 for other clearing registers sections);

-Round() - mathematical rounding function to integers.

Apparently it's an old formula or the broker is cheating.

What did I write wrong or what is unclear?

Line 6 for market makers is me for an example. A market maker does not pay fees on illiquid instruments.

The formula for the calculation is defined in the exchange document and looks like this

And what the broker has answered you is a mere bunker ....

P/S The transaction has a volume. And what is given above causes a question (as the commission of the exchange is charged precisely on the volume of transaction, but not on the fact of the transaction).

Just need to find out l = 40 for a transaction with any volume or not.

Tomorrow they will answer, then it will be clear how to count if the transaction is more than 10-20 deals per trading day.

I = 40 for any transaction,

the bigger the volume, the bigger the commission, when you multiply 40 by the commission, the volume is taken into account.

For example, for 1 lot of RTS commission will be = 2RUB, respectively 2*40=80,

for 10 lots RTS commission will be 20rub. respectively 20 * 40 = 800.

p.s. So it turns out, the bigger the volume of trades - the more often you can move orders.

I = 40 for any transaction,

The bigger the volume, the bigger the commission, when you multiply 40 by the commission the volume is taken into account.

For example, for 1 lot of RTS commission will be = 2rub, respectively 2*40=80,

for example, for 10 lots of RTS, the commission will be 20RUB.

I also think so....

But it is better to clarify. Isn't it so?

P/S Sergey!

Almost what you asked for

- www.mql5.com

I think so too....

BUT, better to clarify. Isn't it?

P/S Sergei!

Almost what you asked for

Of course, an official explanation wouldn't hurt.

For full satisfaction, the tap function is lacking like this:

AccountInfoInteger(ACCOUNT_TRANSACTION_SESSION) // - количество транзакций за текущую сессию.

If the exchange keeps count of the number of transactions, you can probably get this data in the terminal.

We should ask MQ developers to add such a feature.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good afternoon!

I want to clarify theIneffective Transaction Charge

I contacted technical support exchanger:

The answer I got from the exchange:

From the correspondence above it follows that if you have a number of transactions per day does not exceed 10-20 pcs,

it is not necessary to fully calculate benefits for transactions, but just use

count the number of transactions per day, which has a free limit of 2000.

The parameter "l" is completely unclear from the calculation formula

l is the score for a Transaction entered into indicating one of the Sections (determined by the type of Transaction according to Table 1).

I have sent a request to the exchange for this parameter (meaning the volume of the transaction).