Machine learning in trading: theory, models, practice and algo-trading - page 943

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I made a decomposition of weekly TF, 1400 bars (almost all available history in the terminal)

The dates are not displayed here, so it's not very convenient. I will have to rewrite it through Plot or indicator to mark it on a chart, so far only visually

I have more pronounced tslichnosti on small mods. And the biggest one is +- 14 years (2 half-periods from 28 years), which is divided into 4 7-year cycles (as I said). And, the last 7-year cycle ended early this year (roughly), which suggests that it doesn't make much sense to teach the grid on earlier dates

There are not as pronounced cycles in the middle.

And not to rack your brains, you just need to enter all the mods in the NS, besides they do not correlate

Then it will recognize the different periodicities, and maybe not, a philosophical question, as you do so and will be :)

Thank you for sharing the results of your analysis.

Here I am looking and thinking, yes it's all bullshit :) How can we talk about the 14-year cycle, if we do not have at least a hundred observations - it's more likely by chance, well, maybe it is somehow tied to the 7-year U.S. bonds, I immediately think, but how to wait for the continuation of the banquet - a mystery. Smaller periods of observation speak about the noise, which we see every day at any TF.

Well, the change of large cycles then it is possible to catch a usual wave, if there will be no strong trends...

Let us assume that currencies have cycles. Then the question arises, do all currency pairs have different cycles or the same ones? Is it possible to take information from all currency pairs and teach one model if predictors use relative indicators?

Thank you for sharing the results of your analysis.

Here I am looking and thinking, yes all this nonsense :) How can we talk about the cycles of 14 years, if we do not have at least a hundred observations - it's more like a chance, well, maybe it is somehow tied to the 7-year U.S. bonds, I think immediately, but how to wait for the continuation of the banquet - a mystery. Smaller periods of observation speak about the noise, which we see every day at any TF.

Well, the change of large cycles then it is possible to catch a usual wave, if there will be no strong trends...

Let us assume that currencies have cycles. Then the question arises, do all currency pairs have different cycles or the same ones? Is it possible to take information for training from all currency pairs and train one model if predictors use relative indicators?

Here cycles do not mean chart changes, but changes in patterns, so what do you have to do with wagons and dashboards? I guess decomposition is a bit misleading because it displays the wrong cycles, which may be slightly different from the ones in question

I have already written above what cycles there are and you can use them to build predictors and which periods to teach. After that you can think for yourself whether you need it or not, if you're not too lazy to think :)

If there are no cycles and embedded loops, then you are trying to trade in noise, which is unrealistic. That's why I would ask this question more seriously.)

Here by cycles we do not mean a change in the graph, but a change in the patterns

I have already written above what cycles there are and you can start from this to build predictors and for what periods to teach. After that you can think for yourself, if you're not too lazy to think :)

If there are no cycles and embedded loops, then you are trying to trade in noise, which is unrealistic. That's why I would ask this question more seriously :)

Of course it can be implied, but visually we can see that the change of the movement vector is caught. If we want to speak about the change of the regularity in our business, it should be found and the trend should be excluded as a regularity which the method seems to be catching.

I trade counter-trends on forex, which is real, and many have been tested over 10 years of history and are still working.

In contrast, I trade the emotions of the crowd in the futures market, and it is only important for me to understand the range in which the crowd will give a strong excitement. That is, I trace the limitations imposed by the global trend.

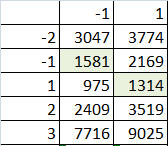

The program I use has the following picture - the hits are only 30.81%

However, if we add for example errors -2 and -1 to each other and add correctly found solutions and then set them against not correctly found ones and ignore the target number 3 because it is a filter and it will not affect the financial result, we will get the following picture

In this case, the error will be 49.19% to enter the position, which is not so bad!

I think you have made an invalid operation. Such a post facto summary table shows which classes are best predicted, but in real trading even ignoring all classes except -1 and 1 you will not know in advance if they will actually turn out to be -1 and 1.

That's the right way to do it.

In robot logic you can easily disable trading when predicting "-2", "2", "3". But you won't disable the actual result, it will be clearly visible on the account balance chart.

p.s. with three classes yet-there is no result. The first time I ran the script - it turned out that the code error. The second time I ran the script for a couple of hours, the intermediate result is below. Then I needed computer for my own needs, so I stopped training the tree, I'll run it again tonight.

y_predy_true503746470313597569I like this one better already. The tree almost always returns "0", and real input signals are quite rare. So there won't be a lot of false inputs. Those rare entry signals should only be successful.

Of course it can be implied, but visually we can see that we are catching a change in the movement vector. In order to talk about the change of the pattern in our case, it must be identified, and at the same time exclude the trend, as a pattern on which the method is caught, judging by all appearances.

if you exclude a trend, i.e. a larger cycle, then you will never catch a changing pattern

Within long, large cycles, the patterns persist because there are trends overlaid by smaller ones. This gives you stability.

If you trade with drawdowns under 100% it's just dabbling :) I used to do it with 1500% over a month and then everything crashed. I'm talking about the normal systems

Reread, about the addition of -2 and -1 now understand :)

1 and 2 must also be added.

But class 3 means losses in any case, so you can't ignore it.

I think you have made an impermissible operation. Such a summary table after the fact shows which classes are best predicted, but in real trading even ignoring all classes except -1 and 1 you will not know in advance whether they actually turn out to be -1 and 1.

That's the right way to do it.

In robot logic you can easily disable trading when predicting "-2", "2", "3". But you won't disable the actual result, it will be clearly visible on the account balance chart.

Yes, I realized late at night that I was wrong - I only counted the distribution errors of the right signals, but did not take into account that the other signals also give errors by indicating the opposite values.

Yesterday I also made a set for 2017 - there is also within 30% of the correct data, but what surprises me on different (divided into two groups of predictors) sets of predictors I get similar results. I wonder if this is a coincidence, or just an opportunity to use the forest?

I like this one better already. The tree almost always returns "0", and real input signals are quite rare. So there won't be a lot of false inputs. As long as those rare entry signals are successful.

We should see the final result. Merging is better to do from the last file attached to me - there division is slightly more accurate than 0 - all that did not make a profit, and in the earlier files 0 - is what brought a very small profit.

However, what surprised me was that by increasing the target classification worked better outside of the training sample. Maybe on the contrary, we should increase the number of different classifications?

PS I can give you access to a laptop on TW so that you do not burden your PC.

Reread, about the addition of -2 and -1 now understand :)

1 and 2 apparently also added up.

But class 3 means losses anyway, so you definitely can't ignore it.

Class 3 means a filter.

I didn't take into account that this class 3 is sometimes identified as -1,-2,1,2, and class 1 as -1, -2 and so on - there's a mistake there.

if you exclude a trend, i.e. a larger cycle, you will never catch a pattern change

Within long, large cycles, patterns persist because there are trends overlaid by smaller ones. This gives you stability.

If you trade with drawdowns under 100% it's just dabbling :) I used to do it with 1500% over a month and then everything crashed. I'm talking about the normal systems.

The trend is a simple pattern, I don't think MO should be guided by it.

Drawdown under 100% is a planned phenomenon (almost), large drawdowns there are a consequence of the fact that the capital is distributed between different accounts and TS, and it is transferred as possible/necessary to other accounts. There are signals with fixing the loss, but their reasons are as follows:

1. Hot change of TS - replaced the TS, when the last TS has not yet closed all of its positions.

2. a mistake in the file prepared for loading the settings - I mixed up the settings between different instruments

Experimental (this is the penultimate series of signals Raznica 01), which has not been tested on all symbols with basic settings and I closed the USDCHF by hand on the last bullish trend, although I see now that I could close it at breakeven. Just here the situation is that this instrument was sideways for a long time.

4. At night there was a drawdown and I did not transfer funds, because I did not monitor this situation. Since then I made a script that runs 24 hours a day on all accounts and audibly (literally voice) reports that there is not enough money in the account, which serves as a signal to deposit and this situation should not happen again, except for force majeure.

But there are those who have worked for 1.5 years without modifications.

There are many more ideas on paper - there is not enough time and effort for everything.

The trend is a simple pattern, I don't think the MoD should be guided by it.

I do not understand the meaning, not the level of abstractions, let's forget it.)