Machine learning in trading: theory, models, practice and algo-trading - page 746

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

To calculate the next candle is real, but it is not real to do it with each in a long series.

Remember the old example from the site"Neural Networks Free and Serious" - the author simply describes a simple neural network. Not much of a model. On a retrained plot it is just a grail. But that's not the point. Let's see her backtest of profitable trades of all 58% - not 80% or 70%, but only 58 for 8% more than the coin flip forecast. Once again, I know the network is retrained, now I'm probably going to get jumped on that it's all wrong. I just want to say grail - 58% profitable trades. 58% of Orentir in forecasting

In my understanding, the NS must have at least 2 signs, or better 3. Short-term, medium-term, and long-term description of the market condition. The others can be added, if they have some extra information in addition, for example autoregression of n-th order of the sign on itself, etc., that would take into account the dynamics of the signs.

As for the outputs - it is stupid to feed fixed values. A better solution would be to feed probabilities of growth/decline by n points at given sl\tp levels that can also be dynamic, that is if we classify signals

For regression, i.e. for N-bar forecasting we just need an additional module which processes forecast results and adaptively defines sl\tp/trailing depending on the forecast

But as mentioned above, these are all outdated techniques which do not work at all on the market due to difficulty (impossibility) of expert evaluation of real, not temporal, relationship sign/target one.

That's what I mean. Everything is long outdated. and we have to come back to the original question. What do we know about the future movement. What information can we tell where the price will be in 1 hour or 5 minutes?

To predict adequately on N bars it is necessary IMHO to predict 100% on 1 bar, then 2,3,4,5 ...N . If we can't predict 1 bar adequately what error will be on 5 bar? It will be incommensurable large....That's my point. It's all long out of date. So we have to come back to the original question. What do we know about future movements. What? What information can we tell about where price will be in 1 hour or 5 minutes?

I started with simple waving tips, then with incremental waving tips, then delta waving tips... Now I'm working on something like borscht of turkeys )))) to feed one input line instead of 20...

That's my point. It's all long out of date. So we have to come back to the original question. What do we know about future movements. What? what information can we tell about where the price will be in 1 hour or 5 minutes?

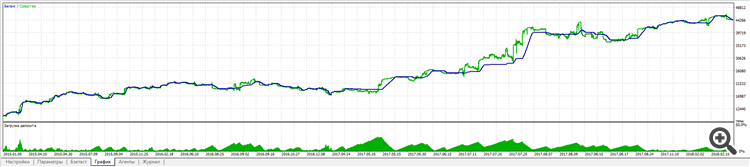

I believe that the duration of the backtest period, and only it, can play the role of judge. If there is no explicit backtesting of deals by dates or their sequences, and there are thousands or tens of thousands of deals over several years with a smooth increase, then it's already good

And what kind of information is not so important.

That's my point. It's all long out of date. So we have to come back to the original question. What do we know about future movements. What? What information can we tell about where the price will be in 1 hour or 5 minutes?

Nothing is obsolete. Knowledge is eternal, like Stephen Hawking!

It has been said a billion times already that we have to work with the purest increments (see toxic's posts) and the sum of them. At the level of increments, the processes are almost stationary. I think Kolmogorov still developed methods for predicting stationary processes :)))))

I believe that the duration of the backtest period, and only it, can play the role of the judge. If there is no explicit backtesting of deals by dates or their sequences, but there are thousands or tens of thousands of deals over several years with a smooth increase, then it's already good

not bad from the point of view of working out the system on historical data, despite the fact that learning can be enabled there after some interval. the trouble comes when even this option with re-learning bangs and stops working in the present... It's easy to choose the right input data for the machine in the past as well, but it doesn't guarantee that it will work in the present and future, I attach three years of training, taking into account that every three weeks retraining took place. and yes 56% of winners seems to be a grail already.

Nothing is obsolete. Knowledge is eternal, like Stephen Hawking!

It has been said a billion times already that one should work with the purest increments (see toxic's posts) and their sum. At the level of increments, the processes are almost stationary. I think Kolmogorov still developed methods for predicting stationary processes :)))))

I tried it with pure increments, I couldn't get anything out of it... I must have set the target wrong... can you give me a hint?

not bad from the point of view of working out the system on historical data, despite the fact that there may be training enabled at some interval. the trouble comes when even this option with retraining bangs and stops working in the present... In the past it is easy to pick up the right input data for the machine, but this does not guarantee that it will work in the present and future, I enclose three years of training, taking into account that every three weeks retraining took place. and yes 56% of winning seems to be a grail.

But the fact that you've been stomping around for a year is embarrassing, and you have a very large bias towards longs, which is already overfitting.

I try to analyze the series of deals so that they were evenly distributed, and a small deviation from the norm would mean that something went wrong.

But the fact that I have been stomping around for a year is embarrassing.

I try to analyze just a series of deals, so that they would be evenly distributed, and a slight deviation from the norm would mean that something went wrong

just stomping around for a year shows that the set of predictors did not want to fit into the market condition (another phase has come), but then it seemed to work again .... There are a lot of such tests, but I understand that I shouldn't try to get into the market with it, it's the same minefield... If someone may be interested it may be useful, I'm trying to analyze not the next bar but the price for the next 200 bars. I'm trying to analyze samples from 500-600 input data, while the number of samples is from 2000 to 10000.