AUDUSD Technical Analysis 2015, 04.01 - 11.01: Breakdown with 0.8087 Key Support and .8700 Psy Resistance

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 08:33

Forex Weekly Outlook January 5-9US ISM non-manufacturing PMI, trade balance, FOMC meeting minutes, Major employment data including the all-important Non-Farm Payrolls report, Rate decision in the UK. These are the main economic releases for this week. Let’s see, in detail, the market movers to impact Forex trading.

Last week, US jobless claims release disappointed with a 17,000 rise in the number of new claims, reaching 298,000. However, the four week moving average inched slightly to 290,750. Furthermore, Consumer confidence, released earlier, rebounded to 92.6 following 91 points in November, indicating consumers are more confident at year-end than they were at the beginning of the year. The present situation index reached its highest level since February 2008. Economists expected sentiment to reach a higher reading of 94.6. Will the US economy continue its positive trend in 2015?

- US ISM Non-Manufacturing PMI: Tuesday. 15:00. Non-manufacturing Purchasing Managers Index rebounded in November after two straight months of declines. The Index increased to 59.3 beating forecasts of 57.5. 14 industries out of the 18 surveyed reported expansion. Non-manufacturing PMI is expected to reach 58.2 in December.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. U.S. private sector added 208,000 workers in November following 230,000 jobs gain in the previous month, indicating the slowdown in global economy does not impact US domestic activity. The ongoing improvement in the labor market leads to faster wage growth. A Labor Department report showed compensation per hour increased 1.3% in the third quarter rather than the 2.3% reported in the previous month, and declined 0.9% instead of the expected 2.3% rise. ADP job gain is expected to reach 227,000 in December.

- US Trade Balance: Wednesday, 13:30. The U.S. trade deficit contracted less than expected in October reaching $43.03 billion. Lower crude oil prices had limited impact. Imports jumped 0.9%, reaching $241 billion, while exports increased 1.2% to $197.5 billion, indicating the economy was is resistant to the slowdown in global demand. Economists forecasted a deficit of $41.3 billion. Exports to the European Union increased 8.5 percent, while China saw a 36 percent jump in the value of goods it imported from the United States. Exports to Japan rose 4.0 percent, while those to Canada and Mexico – the main U.S. trading partners – reached record highs. Sustained dollar strength, however, is expected to undercut export growth in the months ahead. Imports from China hit an all-time high, leaving the politically sensitive trade gap at $32.6 billion. U.S. trade deficit is predicted to narrow to 42.3.

- US FOMC Meeting Minutes: Wednesday, 19:00. The Federal Reserve minutes from November showed some members were concerned about the moderate pace of inflation, despite the strengthening trend in the job market. Policy makers projected a weaker economic outlook and increased downside risks in Europe, China, and Japan.

- UK rate decision: Thursday, 12:00. The Bank of England kept its key interest rate at a record low of 0.50% amid weak inflation threatening economic growth. Policy makers also voted to maintain cash stimulus at £375 billion. Britain’s 12-month Consumer Price Index (CPI) rate increased to 1.3% in October from a five-year low of 1.2 percent in September, but remained far below the BoE’s government goal of 2.0%. No change in rates is expected this time.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filings initial claims for unemployment benefits in the U.S. increased last week by 17,000 to a seasonally adjusted 298,000, beating market forecast. This was the highest figure since November 22 topping analysts’ predictions for a 287,000 reading. The four-week moving average, a less volatile measure, climbed to 290,750. The number of claims is expected to reach 291,000 this week.

- Canadian employment data: Friday, 13:30. Canada’s job market had a temporary setback in November, contracting 10,700 jobs which nudged the unemployment rate slightly to 6.6%. However, despite the disappointing release, the general trend is positive showing a 146,000 job increase in the last 12 months. The majority of job addition in the last few months are in full time employment. Canadian economy is expected to expand in 2015 particularly if the US economy continues to strengthen. Canada’s job market is expected to add 10,300 positions while the unemployment rate is expected to remain at 6.6%.

- US Non-Farm Employment Change and Unemployment Rate: Friday, 13:30. The US labor expected more than expected in November, surging by 321,000 jobs after adding 243,000 on October. This was the biggest jump in employment since January 2012, reaching a12 month average of 224,000. Economists expected a gain of 231,000 positions, however wage growth was still rather weak. The unemployment rate for November was 5.8%, unchanged from October’s reading in line with market forecast. The report also said that the labor force participation rate was unchanged at 62.8%. Us labor market is forecasted to expand by 241,000 while the unemployment rate is expected to decline to 5.7%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 10:53

AUD/USD Monthly Technical Analysis for January 2015 (based on fxempire article)

The AUD/USD starts out 2015 in a position to decline further after a weak close in December. Last month, the Forex pair reaffirmed its downtrend on the monthly chart with its sustained move under the previous main bottom at .8659 and the major 50% level at .8545. Both of these prices are resistance in January. Additional resistance angles come in at .8544 and .8556. The best area to sell on a retracement is the resistance cluster at .8544 and .8545.

The main range was formed by the July 2008 bottom at .6008 and the July 2011 top at 1.1080. Its retracement zone at .8545 to .7945 is currently being tested. Last month’s sharp decline through the upper or 50% level at .8545 means the selling pressure is real which makes the Fibonacci level at .7945 the primary downside target in January. Trader reaction to this price will set the tone for the month.

If the selling pressure is strong enough to take out .7945 with conviction then look for the break to extend into the next uptrending Gann angle at .7508.

Oversold conditions could produce periodic short-covering rallies, but these rallies are likely to set up fresh shorting opportunities. Bearish traders should continue to press the market unless .8544 is taken out and this seems pretty remote given the fundamentals.

Fundamentally, the combination of a weak Australian economy and the

impending Fed interest rate hike sometime between April and June should

be the forces driving the AUD/USD lower in 2015. Low iron ore prices and

a weakening economy in China are two forces weighing on the Australian

economy. The interest rate differential is favoring the U.S. at this

time. This should be the key fundamental factor to focus on this year.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.04 21:33

Forex - Weekly outlook: January 5 - 9

The euro fell to four-and-a-half year lows against the dollar on Friday, and the greenback rose to parity against the Swiss franc after European Central Bank President Mario Draghi indicated that the likelihood of quantitative easing has increased.

In an interview with German financial newspaper Handelsblatt Draghi said the risk of the ECB not fulfilling its mandate of price stability is higher now than six months ago. The remarks indicated that the central bank is moving closer to implementing quantitative easing measures in order to spur growth and inflation.

The annual rate of euro zone inflation was just 0.3% in November, well below the ECB’s target of close to but just below 2%.

EUR/USD was down 0.85% to 1.2002 in late trade, the weakest level since early June 2010.

The single currency was also pressured lower after data showed that manufacturing activity in the euro area grew at a slower rate than initially estimated in December, adding to concerns over the outlook for fourth quarter growth.

The dollar rose to parity against the Swiss franc for the first time since December 2010, as weakness in the euro added to pressure on the Swiss National Bank to defend its 1.20 per euro exchange rate floor. USD/CHF was up 0.83% to 1.0014 in late trade.

The SNB eased monetary policy in December, when it imposed negative interest rates on commercial bank deposits.

The U.S. dollar index, which measures the greenback against a basket of six major currencies, advanced 0.91% to nine-year peaks of 91.47. The index rallied 12% in 2014, boosted by the diverging policy outlook between the Federal Reserve and central banks in Europe and Japan.

Elsewhere, sterling fell to 17-month lows after data showed that U.K. manufacturing growth slowed in December.

GBP/USD was off 1.61% at 1.5326 late Friday after a report showed that the U.K. manufacturing index unexpectedly slid to a three-month low in December.

The dollar was also higher against the yen, with USD/JPY up 0.62% to 120.49 in late trade.

USD/CAD hit five-and-a-half year highs, rallying 1.44% to 1.1784 late Friday as lower oil prices continued to pressure the commodity-exposed loonie lower.

In the week ahead, investors will be turning their attention to Friday’s U.S. nonfarm payrolls report for further indications on the strength of the recovery in the labor market. Wednesday’s Federal Reserve meeting minutes will be also closely watched, while the euro zone is to publish preliminary data on consumer prices.

Monday, January 5

- In the euro zone, Germany is to publish preliminary data on consumer price inflation, while Spain is to report on the change in the number of people employed.

- The U.K. is to release data on construction sector activity.

Tuesday, January 6

- Australia is to produce data on the trade balance.

- Elsewhere, China is to publish its HSBC service sector index.

- The U.K. is to publish a report on service sector activity.

- Later in the day, the Institute of Supply Management is to release data on non-manufacturing activity.

Wednesday, January 7

- Germany is to publish data on retail sales, as well as a report on the change in the number of people employed. The euro zone is to release preliminary data on consumer inflation and a report on the unemployment rate.

- The SNB is to publish a report on foreign currency reserves.

- The U.S. is to release a report on ADP nonfarm payrolls, in addition to data on the trade balance.

- Canada is also to report on its trade balance and publish its Ivey PMI.

- Later Wednesday, the Federal Reserve is to publish the minutes of its most recent meeting.

Thursday, January 8

- Australia is to release data on building approvals.

- The euro zone is to publish a report on retail sales.

- The Bank of England is to announce its monetary policy decision.

- The U.S. is to produce its weekly report on initial jobless claims.

- New Zealand is to publish data on building consents.

Friday, January 9

- Australia is to publish data on retail sales.

- China is to release data on consumer price inflation.

- The U.K. is to produce a report on industrial and manufacturing production, as well as data on the trade balance.

- Canada is to report on building permits and the change in the number of people employed and the unemployment rate.

- The U.S. is to round up the week with the closely watched nonfarm payrolls report, and data on wage growth.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.05 12:31

AUD/USD drops to 5-1/2 year lows (based on nasdaq article)

The Australian dollar dropped to five-and-a-half year lows against its U.S. counterpart on Monday, as demand for the greenback continued to receive broad support.

AUD/USD hit 0.8036 during late Asian trade, the pair's lowest since July 2009; the pair subsequently consolidated at 0.8057, sliding 0.42%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.05 12:39

AUD/USD Fundamental Analysis January 6, 2015 Forecast (based on fxempire article)

The AUD/USD took its clues from the US dollar this morning. The US dollar rallied as traders listened to a slew of Federal Reserve speakers, who have all shifted into high gear preparing the markets for interest rate increases in the near term. The Aussie fell 34 points to trade at 0.8057 making the RBA happy as they think the Aussie should only be valued around 75 cents. The drop in the currency is also offset by falling Chinese manufacturing data which will mean lower exports. The Aussie is trading at a 5 year low.

A combination of weak commodity prices and a surging US dollar were weighing on the local currency. The key theme in the new year has been US dollar strength and falling iron ore and coal prices. The lower Australian dollar will benefit local producers.

Late last year, major banks cut their Australian dollar forecasts against the greenback to reflect this recent strength. Currency analysts at Australia’s biggest bank now expect the Aussie to fall to 78 cents by the end of March, down from a previous forecast of 86 cents.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.06 10:15

2015-01-06 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Trade Balance]- past data is -0.88B

- forecast data is -1.59B

- actual data is -0.93B according to the latest press release

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Australia posted a seasonally adjusted merchandise trade deficit of A$925 million in November, the Australian Bureau of Statistics said on Tuesday.

That beat forecasts for a shortfall of A$1.6 billion following the upwardly revised deficit of A$877 million in October (originally A$1.323 billion).

Exports were up 1.0 percent on month to A$27.085 billion.

Non-rural goods rose A$486 million or 3 percent, while rural goods climbed A$179 million (6 percent).

Non-monetary gold tumbled A$519 million (38percent), while net exports of goods under merchanting remained steady at A$43 million. Service credits rose A$14 million.

Imports also collected 1.0 percent on month to A$28.010 billion.

Intermediate and other merchandise goods added A$224 million (2%) and consumption goods gained A$131 million (2 percent).

Non-monetary gold plunged A$90 million (27 percent) and capital goods fell A$78 million (1 percent). Service debits added A$20 million.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 33 pips price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

FOREX ANALYSIS on January 2015

nguyenhongden, 2015.01.06 18:27

AUD/USD ON JANUARY 6, 2015

It looks like AUD/USD rejected Ichimoku Resistance and want to go down again to test the lowest price 0.8035 one more time.

AUD/USD H1 chart also shows a downtrend.I would prefer to buy AUD/USD from the lowest price 0.8035 again.

Thanks!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.05 12:44

AUD/USD Technical Analysis: Rebound Hinted Above 0.80 (based on dailyfx article)

| Resistance | Support |

|---|---|

| 0.8094 | 0.8020 |

| 0.8214 | 0.7900 |

| 0.8290 | 0.7803 |

The Australian Dollar

fell to the lowest in over five years against its US namesake but

positive RSI divergence warns a rebound may be ahead. A daily close

above the 14.6% Fibonacci expansion at 0.8094 exposes the December 31

highat 0.8214. Alternatively, a turn below the 23.6% level at 0.8020 clears the way for a challenge of the 38.2% Fib at 0.8012.

Prices are wedged too closely between immediate support and resistance barriers to justify entering a trade on the long or short side from a risk/reward perspective. We will remain flat for now, waiting for a more attractive opportunity to present itself.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.06 09:41

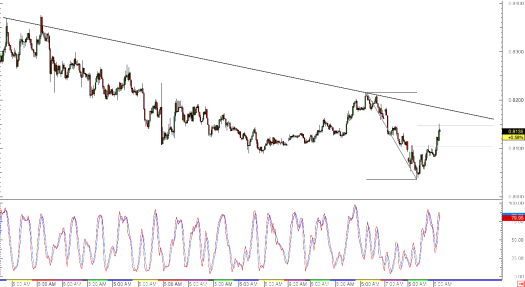

AUDUSD To Test Downtrend Resistance – Jan 6, 2015 (based on forexminute article)

AUDUSD has been trading in a steady downtrend in the past few months, with a falling trend line connecting the latest highs on the 1-hour time frame. The pair previously bounced off its lows and is showing signs of a pullback to the trend line.

Using the Fibonacci retracement tool on the latest swing high on low on the same chart shows that the 61.8% Fibonacci level lines up with the .8150 minor psychological resistance and the trend line. This could keep gains in check and push price back to its previous lows or to new ones around the .8000 major psychological support.

AUDUSD OutlookShorting at .8150 with a stop above the .8200 major psychological resistance and a target of .8000 could offer close to a 3:1 return on risk. Stochastic is almost in the overbought area, indicating that buying pressure is weakening and that sellers could start shorting the pair once more.

Event risks for this AUDUSD setup include the release of the FOMC minutes mid-week, as this might shed more light on whether or not the US central bank is ready to start tightening monetary policy this year. Hawkish remarks could add support for this bias and allow the pair’s downtrend to resume and strengthen. On the other hand, cautious comments could downplay rate hike forecasts and lead to a reversal for AUDUSD.

As for Australia, the country is set to print its building approvals and retail sales reports later in the week. Earlier today, the trade balance posted better than expected results. China will release its CPI figures on Friday and possibly show another downturn in producer price inflation.

With that, the path of least resistance for this pair is to the downside, as falling commodity prices and risk aversion are also weighing on the Australian dollar. Continued expectations of Fed tightening could keep the US dollar supported.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2015

newdigital, 2015.01.09 05:24

Price & Time: "Overlooked" Symmetry in AUD/USD

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish started after secondary flat:

W1 price is on primary bearish breakdown with trying to break 0.8087 key support level for the breakdown to be continuing.

MN price is on primary bearish breakdown with trying to break 0.8087 key support level for the breakdown to be continuing.

If D1 price will break 0.8087 key support level so the bearish breakdown will be continuing

If D1 price will break 0.8215 resistance level so it will be the market rally

If not so we can see the flat within the bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2015-01-06 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Trade Balance]

2015-01-06 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2015-01-07 13:15 GMT (or 15:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2015-01-07 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Trade Balance]

2015-01-07 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2015-01-08 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Building Approvals]

2015-01-08 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-01-09 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Retail Sales]

2015-01-09 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2015-01-09 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bearish

TREND : breakdown