Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.13 11:22

Forex Weekly Outlook Dec.15-19The US dollar retraced some of the previous gains but managed to retrace the retracement as well. Japan’s Lower House Elections, UK inflation and employment data and the most important event: the last Fed decision for the year are the main highlights for this week. Follow along as we explore the Forex market movers.

The US consumer is certainly upbeat: US retail sales release showed Americans spent 0.7% more in November compared to the previous month and core sales followed suit. Also confidence is high, the highest since January 2007 according to UoM. This is partially attributed to the collapse in oil prices, which is hurting the Canadian dollar. In the euro-zone, the highly anticipated TLTRO fell short of predictions, strengthening the notion that QE is coming to the old continent. The antipodean currencies took different directions: the Aussie got a target of 0.75 from the central bank, while the New Zealand’s central bank seemed upbeat. Volatility continues being high despite the upcoming holidays. And now, we have the most important central bank speaking out:

- Japan Lower House Elections: Sunday. Japanese Prime Minister Shinzo Abe’s ruling party is expected to win sweeping victory according to media projection. Abe’s Liberal Democratic Party (LDP) is expected to take 303-320 seats of the powerful chamber’s 475 seats, reaching “super majority” needed to override votes in the upper house. The elections were called after Abe decided to push back the next sales tax hike as the previous one threw the country into recession. With high expectations, a failure to win a convincing majority could send the yen soaring and USD/JPY plunging down.

- UK inflation data: Tuesday, 9:30. UK inflation edged up to an annual rate of 1.3% in October, following 1.2% in the previous month. Analysts expected CPI to remain at 1.2%. Prices in the recreation and culture sectors increased while transport costs, as well as food and non-alcoholic beverages, fell. Despite this rise, the Bank of England warned the inflation rate could dip to as low as 1% in the coming months. However, the small rise in the rate of inflation is unlikely to alter the central bank’s decision to keep its key interest rate at 0.5% for the time being. Inflation is expected to reach 1.2% in November.

- German ZEW Economic Sentiment: Tuesday, 10:00. German economic sentiment rebounded in November, rising 15.1 points from October to 11.5. Analysts expected a modest improvement of 4.5 points towards 0.9 points. The recent encouraging signs of growth in the Eurozone suggesting the economy is stabilizing, contributed to the rise in sentiment. Economic sentiment is expected to edged up to 19.8 in December.

- UK Governor Mark Carney speaks: Tuesday, 10:30. Mark Carney, head of the Bank of England is scheduled to hold a press conference and talk about the Financial Stability Report in London. Despite elevated household confidence, as well as other economic indicators, including a recent positive trend in wage growth, the Eurozone struggling economy poses the major threat to the UK’s recovery.

- US Building Permits: Tuesday, 10:30. The number of permits for single- and multi-family housing edged up 4.8% in October, reaching a 1.08 million-unit pace, the highest since June 2008. The sharp rise in October was preceded by another increase in the prior month indicate a recovery trend in the housing market. However, the recent acceleration in demand is expected to boost wages and contribute to economic growth. The number of permits for single- and multi-family housing is forecasted t reach 1.06 million.

- UK employment data: Wednesday, 9:30. The number of unemployed in the UK fell by 20,400 in October, reaching 931,700, the lowest level since August 2008. The sharp drop continued a positive trend in the UK labor market with an 18,400 fall in September and a 33,400 decline in August. The ongoing improvement in the job market is an encouraging sign that wages will eventually pick-up and boost UK’s domestic economy. Claimant Count Change is expected to drop by 19,800 this time. It is also important to note wages: a rise of 1.3% is expected in average hourly earnings. The unemployment rate is predicted to tick down to 6% from 5.9% last time.

- US inflation data: Wednesday, 13:30. U.S. consumer prices remained unchanged in October, following September’s rise of 0.1%. Analysts expected a 0.1% decline in October. On a yearly base, consumer price index also remained unchanged from September’s increase of 1.7%. Excluding food and energy costs core consumer prices gained 0.2% in line with market forecast. On an annual basis, core CPI rose 1.8%, and remains below the Federal Reserve’s target of 2.0%. CPI is expected to decline 0.1%, while core CPI is predicted to gain 0.1%.

- Fed decision: Wednesday, 19:00, press conference at 19:30. In the last FOMC gathering in October, the Fed ended QE3 as expected, ending all doubts. Their bullish view of the labor market gave a boost to the dollar. The main focus of this meeting is the “considerable time” phrase related to the timing of the first rate hike. There is speculation that the Fed will alter the phrasing and call for patience on the rate hikes. Given the recent jobs report, which finally included a rise in wages, there is also a chance that the Fed totally removes this wording thus hinting of an earlier rate hike, perhaps even in March. In addition to the statement, the Fed releases its forecasts, including the famous “dot chart”. The last release showed rates rising to 1.375 on average by the end of 2015. Will this average be pushed back with lower inflation expectations? And last but not least, Fed Chair Janet Yellen meets the press and reporters will likely try to extract some more specific wording about the timing of rate hikes. There are quite a few wild cards here and volatility is certainly expected to be wild. All in all, an upbeat view on the US economy should keep the dollar bid, while dovish caution, something that the Fed does very often, would weigh on the greenback.

- NZ GDP: Wednesday, 21:45. New Zealand’s economy expanded at the fastest pace in 10 years in the second quarter, as Gross domestic product edged up 3.9% on a yearly base and 0.7% from the first quarter. Both readings exceeded market forecast. Strong domestic demand is the major growth force in New Zealand’s economy, but surging exports to China have also contributed to this expansion. Gross Domestic Product is expected to gain 0.7% in the third quarter.

- German Ifo Business Climate: Thursday, 9:00. German business sentiment rebounded in November, reaching 104.7 from 103.2 posted in the prior month. The reading was better than the 103 points forecasted by analysts, signaling the downturn trend in German economy has halted. The slowdown in economic activity was led by the euro-area partners’ sluggish demand and a sharp drop in exports to Russia. The third quarter growth rate reached just 0.1% after a 0.1% contraction in the first quarter. However recent economic data suggest an ongoing improvement in the German economy. German business sentiment is expected to improve further to 105.6.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits dropped 3,000 last week, reaching 294,000, staying below the 300,000 level. Analysts expected claims to reach 299,000. However, despite the fall in weekly claims, the number of continuing claims increased from 2.372 million to 2.514 million. The 4-week moving average increased to 299,250, from 299,000 posted last week. The number of initial claims for unemployment benefits is expected to reach 297,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 15:00. The Philly Fed manufacturing survey jumped from 20.7 in October to 40.8 in November posting the highest reading since December 1993. The big rise suggests increased growth in manufacturing activity. New orders and shipments showed similar improvement this month. Employment was higher and the outlook indicator showed expected growth will continue over the next six months. Manufacturing activity in the Philadelphia area is predicted to rise to 26.3 this time.

- Japan rate decision: Friday. The Bank of Japan’s November Statement revealed the bank is willing to step up its operations of quantitative and qualitative monetary easing and presented its assessment of the outlook of the Japanese economy. The Policy Board members stated the weaknesses in demand after the consumption tax hike implementation. Prime Minister Shinzo Abe announced he would postpone the 2 percentage point tax hike scheduled for next October and also called for a general election.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.15 06:27

EUR/USD Technical Analysis: Buyers Targeting 1.25 Figure (based on dailyfx article)

| Resistance | Support |

|---|---|

| 1.2501 | 1.2373 |

| 1.2658 | 1.2246 |

| 1.2913 | 1.2146 |

The Euro advanced against the US Dollar as expected

having completed a bullish Morning Star candlestick pattern. Near-term

resistance is at 1.2501, the 14.6% Fibonacci retracement, with a break

above that on a daily closing basis exposing the 23.6% level at 1.2658.

Alternatively, a reversal below wedge top resistance-turned-support at

1.2373 clears the way for a test of the December 8 low at 1.2246.

Prices are too close to resistance to justify entering long from a risk/reward perspective. On the other hand, the absence of a defined bearish reversal signal suggests that taking up the short side is premature. With that in mind, we will remain flat for now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.15 16:25

Technical analysis for EURUSD and AUDUSD (based on dailyfx article)

- EUR/USD has moved steadily higher since finding support early last week ahead of the 15th square root relationship of the year’s high in the 1.2250 area

- A daily close over the 2nd square root relationship of the year’s low at 1.2470 will turn us positive on the exchange rate

- Weakness below 1.2360 is needed to reinstill downside momentum in the euro

- A very minor turn window is eyed on tomorrow/Wednesday

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.2360 | 1.2415 | 1.2425 | 1.2470 | 1.2495 |

- AUD/USD fell to a new low for the year on Monday before rebounding again off a median line related to the 2013 high

- Our near-term trend bias is lower in the Aussie while below .8405

- A close under .8205 is needed to set off a new leg lower in the rate

- A turn window of some importance is eyed right here

- A close above .8405 would turn us positive on AUD/USD

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| AUD/USD | .8125 | .8205 | .8225 | .8280 | .8405 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.13 13:27

EUR/USD forecast for the week of December 15, 2014, Technical Analysis (based on fxempire article)

The EUR/USD pair broke higher during the course of the week, but as you

can see struggled at the 1.25 handle. This is an area that has been

resistive in the past, so it makes sense that we would run into

resistance again. We believe that the downtrend is most certainly still

in effect, but we do not have a resistant candle to start selling yet.

Because of this, we are on the sidelines as far as longer-term trades

are concerned, but we certainly wouldn’t be interested in buying this

market.

After all, we are heading towards the end of the year, and the liquidity

will all but disappear. With that, we think that short-term traders

only can be bothered to be in this marketplace, and that sudden erratic

corrections can occur at any time. I have a yellow box drawn on the

chart which for me signifies when the trend changes. If we get above

there, extensively the 1.30 handle, we could see the market go much

higher. Probably to the 1.135 level would be the next target at that

point time, but it takes a lot for that to happen in our opinion.

More than likely, the market will probably do very little over the next

couple of weeks, at least as far as anything along the lines of a

substantial move. Ultimately, the market could bounce a bit from here

and offer a selling opportunity but we would need to see the resistive

candle form in order to do so. Perhaps we may get a little bit of a late

December surprise, but ultimately we feel that this market is going to

continue going lower once the liquidity returns the marketplace.

Looking at the longer-term charts, we believe that the 1.2050 level is

the target given enough time, and as a result we are not interested in

buying under any circumstances, even though we do recognize that a bit

of a bounce could happen. We believe that 2015 will be very hard on the

Euro as well.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.14 09:29

EUR/USD Weekly Outlook (based on investing actionforex article)

EUR/USD's rebounded last week indicated short term bottoming at 1.2246. Further recovery could be seen back to 1.2599 resistance. Considering bullish convergence condition in daily MACD, break of 1.2599 will be the first sign of medium term bottoming and bring stronger rebound to 1.2886 key resistance next. On the downside, break of 1.2246 is needed to confirm fall resumption. Otherwise, we'd expect more corrective trading ahead.

In the bigger picture, overall price actions from 1.6039 long term top is viewed as a corrective pattern. Fall from 1.3993 is tentatively viewed as the third leg of such pattern and should target 1.1875 low and below. On the upside, break of 1.2886 resistance will bring some consolidations first before staging another decline.

In the long term picture, EUR/USD turned into a long term consolidation pattern since reaching 1.6039 in 2008. Such consolidation is still in progress. And break of 1.2042 will likely pave the way to 61.8% retracement of 0.8223 to 1.6039 at 1.1209. Before that, EUR/USD would continue to engage in sideway trading between 1.1875 and 1.5143 in medium term.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.17 06:01

EUR/USD Technical Analysis: Euro Pops to One-Month High (based on dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.2491, 1.2397, 1.2340

- Resistance:1.2566, 1.2642, 1.2735

The Euro advanced against the US Dollar as expected having completed a bullish Morning Star candlestick pattern. Near-term resistance is at 1.2566, the 50% Fibonacci retracement, with a break above that on a daily closing basis exposing the 61.8% level at 1.2642. Alternatively, a reversal below the 38.2% Fib at 1.2491 clears the way for a test of the 23.6% retracement at 1.2397.

Our long-term outlook calls for a broadly stronger US Dollar against its key counterparts. With that in mind, we will treat the ongoing EURUSD bounce as a chance to get short at more attractive levels once a clear-cut trade setup presents itself rather than a buying opportunity.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.17 15:01

2014-12-17 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]- past data is 0.0%

- forecast data is -0.1%

- actual data is -0.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.3 percent before seasonal adjustment.

The gasoline index posted its sharpest decline since December 2008 and was the main cause of the decrease in the seasonally adjusted all items index. The indexes for fuel oil and natural gas also declined, and the energy index fell 3.8 percent. The food index rose 0.2 percent with major grocery store food groups mixed.

The index for all items less food and energy increased 0.1 percent in November. The shelter index rose 0.3 percent, and the indexes for medical care, airline fares, and alcoholic beverages also rose. In contrast, the indexes for apparel, used cars and trucks, recreation, household furnishings and operations, personal care, and new vehicles all declined in November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 13 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.17 21:01

2014-12-17 19:30 GMT (or 21:30 MQ MT5 time) | [USD - FOMC Press Conference]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Press Conference] = It's among the primary methods the Fed uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, along with commentary about economic conditions such as the future growth outlook and inflation. Most importantly, it provides clues regarding future monetary policy.

==========

The Fed is unlikely to start its rate hike process for "at least the next couple of meetings," Fed Chair Janet Yellen said.

The Fed surprised some Wednesday

by leaving the phrase "considerable time" in its statement, but as a

reference to the timing of rate hikes rather than a policy.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 120 pips price movement by USD - FOMC Press Conference news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.18 05:54

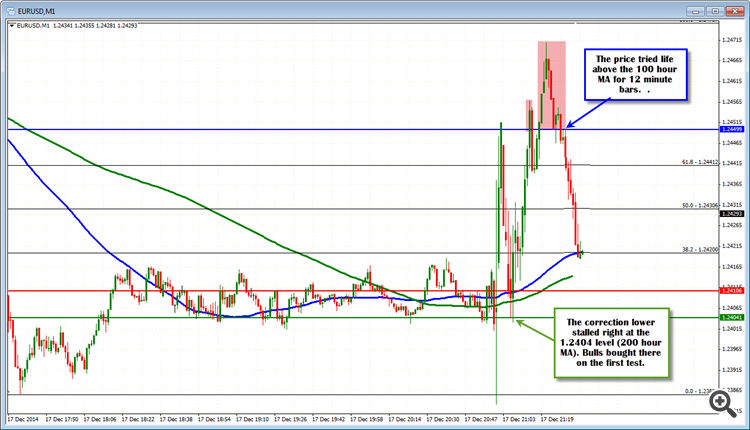

EURUSD rises on the Feds give and take statement, then comes back off (based on forexlive article)

CE Inflation projections are lower to 1% -1.6% from 1.6% – 1.9% but the Core PCE they only lowered by 0.1% to 1.5%-1.8% from 1.6% -1.9%.

As Adam points out there is a lot of hedging going on.

Technically, the EURUSD has found support at the 200 hour MA on the first dip after the initial rise. That level is currently at the 1.2404 level. The 1 minute chart above shows the up and down volatility and the bounce off that level. If the market is to turn, it needs to get below this level.

On the topside the 100 hour MA at the 1.2450 area saw price action remain above that MA for a total of 12 minutes. The move back below, has shown the disappointment. We will see if Yellen can now push the pair one way or the other. .

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.18 17:03

EUR/USD Technical Analysis: Prices Retreat Below 1.24 Mark (based on dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.2324, 1.2249, 1.2173

- Resistance:1.2418, 1.2569, 1.2676

The Euro turned sharply lower against the US Dollar,

with sellers reclaiming a foothold below the 1.24 figure. A daily close

below the intersection of falling wedge top resistance-turned-support

and the 38.2% Fibonacci expansion at 1.2324 exposes the 50% level at

1.2249. Alternatively, a turn above the 23.6% Fib at 1.2418 opens the

door for a challenge of the December 16 high at 1.2569.

Risk/reward considerations argue against entering short with prices in close proximity to support. On the other hand, the absence of a defined bullish reversal signal suggests taking up the long side is premature. We will remain flat for now, waiting for a more actionable opportunity to present itself.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish market condition with trying to break 1.2494 resistance level:

W1 price is on primary bearish market condition with breaking 1.2270 support on open W1 bar for now.

MN price is on bearish breakdown by breaking 1.2357 support level with Chinkou Span line of Ichimoku indicator crossing the price from above to below.

If D1 price will break 1.2247 support level so the primary bearish will be continuing

If D1 price will break 1.2494 resistance level so the secondary rally may be started within the primary bearish with possible reversal to bullish condition

If not so we may see the ranging within bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-12-15 11:00 GMT (or 13:00 MQ MT5 time) | [EUR - German Buba Monthly Report]

2014-12-16 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Flash Manufacturing PMI]

2014-12-16 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-12-16 08:30 GMT (or 10:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-12-16 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2014-12-16 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Building Permits]

2014-12-17 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - CPI]

2014-12-17 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

2014-12-17 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-12-18 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-12-18 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2014-12-19 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Current Account]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : breakout