Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read November 2014

newdigital, 2014.11.24 12:51

Trend Following (Updated Edition): Learn to Make Millions in Up or Down Marketsby Michael W. Covel

Discover the investment strategy that works in any market. The one strategy that works in up and down markets, good times and bad.

- ‘Trend Following’ has become the classic trading book — accepted by the great pro traders as their standard.. Learn how Trend Followers delivered fantastic returns while everyone else was losing their shirts.

-

Simple charts and instructions help you use Trend Following no matter where the market goes next.

Includes new profiles of top Trend Followers who’ve kept right on profiting through the toughest markets.

Trade Your Way to Financial Freedom

by

Van Tharp

The bestselling holy grail of trading information-now brought completely up to date to give traders an edge in the marketplace

“Sound trading advice and lots of ideas you can use to develop your own trading methodology.”-Jack Schwager, author of Market Wizards and The New Market Wizards

This trading masterpiece has been fully updated to address all the concerns of today's market environment. With substantial new material, this second edition features Tharp's new 17-step trading model. Trade Your Way to Financial Freedom also addresses reward to risk multiples, as well as insightful new interviews with top traders, and features updated examples and charts.

Super Trader, Expanded Edition: Make Consistent Profits in Good and Bad Markets

by

Van Tharp

"Let your profits run!" It's the golden rule by which all Super Traders live. With the help of investing guru Dr. Van K. Tharp, you can join the ranks of full-time traders who consistently master the market.

Super Trader provides a time-tested strategy for creating the conditions that allow you to reach levels of trading success you never thought possible. Providing expert insight into both trading practices and psychology, Tharp teaches you how to steadily cut losses short and meet your investment goals through the use of position sizing strategies--the keys to steady profitability. Tharp offers concepts and tactics designed to help you:

- CREATE AND MEET YOUR SPECIFIC

- UNDERSTAND THE BIG PICTURE

- CONQUER COUNTERPRODUCTIVE THINKING

- MASTER THE ART OF POSITION SIZING STRATEGIES

With Tharp's proven methods, you can live the dream of enjoying above-average profits under various market conditions--up, down, and sideways. Tharp's wisdom, perspective, and tactical expertise are legendary in the world of trading. Follow the master down the path to trading excellence with Super Trader.

How do you transform yourself from a mild-mannered investor into a proactive trader who outperforms the market day-in and day-out. Think clearly. Plan accordingly. Commit completely. In other words, become a trader. No one is better suited to help you make the transformation than legendary trading educator Dr. Van K. Tharp.

Combining the sharp insight and technical brilliance that have drawn legions of investors to his books and seminars, Tharp provides a holistic approach for becoming a successful full-time trader. His system--a meld of investing psychology and sound trading practice--is the secret to achieving optimum conditions that produce results in both bull and bear markets.

Using the lessons of Super Trader, you will approach trading as you would a small business--realistically, systematically, and enthusiastically. Drawing on his decades of experience, Tharp has created a simple plan designed to help anyone successfully navigate the market that includes the following:

- Mastering the psychology of trading

- Crafting a "business plan"--a working document to guide your trading

- Developing a trading system tailored to your personal needs and skills

- Creating position sizing strategies to meet your objectives

- Monitoring yourself constantly to minimize mistakes You can put this plan to use immediately.

Throughout the book, Tharp raises the pertinent questions you must ask yourself about becoming a trader, being a trader, and succeeding as a trader.

The rewards that come with being a Super Trader--both financial and personal--make you feel as if you can leap small buildings in a single bound.Trading Beyond the Matrix: The Red Pill for Traders and Investors

by

Van K. Tharp

How to transform your trading results by transforming yourself In the

unique arena of professional trading coaches and consultants, Van K.

Tharp is an internationally recognized expert at helping others become

the best traders they can be.

In Trading Beyond the Matrix: The Red

Pill for Traders and Investors , Tharp leads readers to dramatically

improve their trading results and financial life by looking within. He

takes the reader by the hand through the steps of self-transformation,

from incorporating "Tharp Think"--ideas drawn from his modeling work

with great traders--making changes in yourself so that you can adopt the

beliefs and attitudes necessary to win when you stop making mistakes

and avoid methods that don't work.

You'll change your level of

consciousness so that you can avoiding trading out of fear and greed and

move toward higher levels such as acceptance or joy. A leading trader

offers unique learning strategies for turning yourself into a great

trader:

- Goes beyond trading systems to help readers develop more effective trading psychology

- Trains the reader to overcome self-sabotage that obstructs trading success

- Presented through real

transformations made by other traders

Advocating an unconventional approach to evaluating trading systems and beliefs, trading expert Van K. Tharp has produced a powerful manual every trader can use to make the best trades and optimize their success.

- www.amazon.com

Safe Strategies for Financial Freedom

by

Steve Sjuggerud

Safe Strategies for Financial Freedom shows you how to know in 30

seconds whether you should be in or out of the market.

The authors show

you how great investors avoid mistakes--and win big. With Van Tharp's

legendary risk-control techniques, learn how the world's most profitable

investors reduce their risk and leave their wealth-generating potential

unlimited, and how you can too.

You'll learn how to invest wisely--in

every type of market, protecting what you earn, and developing sources

of regular income to achieve financial independence.

Safe Strategies for Financial Freedom

provides you with a specific program for freeing yourself from the

workplace--forever. Let it show you how to seize control of your

financial life by investing in the assets that will provide you with

steady income until the day when your investment income surpasses your

monthly expenses--and you are, once and for all, financially free.

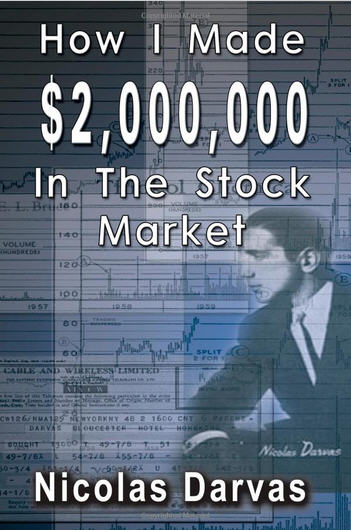

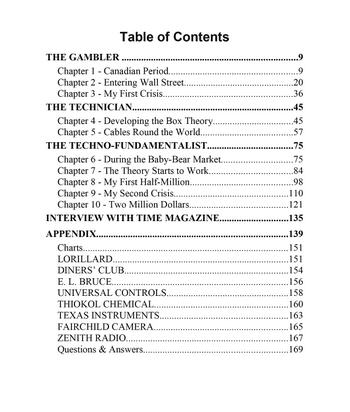

How I Made $2,000,000 in the Stock Market

by

Nicolas Darvas

Hungarian by birth, Nicolas Darvas trained as an economist at the University of Budapest. Reluctant to remain in Hungary until either the Nazis or the Soviets took over, he fled at the age of 23 with a forged exit visa and fifty pounds sterling to stave off hunger in Istanbul, Turkey. During his off hours as a dancer, he read some 200 books on the market and the great speculators, spending as much as eight hours a day studying.Darvas invested his money into a couple of stocks that had been hitting their 52-week high. He was utterly surprised that the stocks continued to rise and subsequently sold them to make a large profit. His main source of stock selection was Barron's Magazine. At the age of 39, after accumulating his fortune, Darvas documented his techniques in the book, How I Made 2,000,000 in the Stock Market. The book describes his unique "Box System", which he used to buy and sell stocks. Darvas' book remains a classic stock market text to this day.

Customer review:

1. It's very readable.

The author describes his investing style as a narrative. It takes you through his investing evolution step-by-step, detailing his actual experiences. This made it very easy to follow, and also more real.

2. It emphasizes both technical and fundamental criteria.

This is critical to good investing. Both areas tell a story. This is the best book I've seen that details an investors journey through to discover that both matter, and integrate the two pictures.

3. It makes for a better system, in some ways, than Investor's Business Daily.

I noticed other reviews that noted the similarity between IBD and Darvas. While they are similar styles, there are some key differences. First, Darvas looks for companies that have a good high-growth STORY, but does not necessarily require the company to have high-growth earnings. He doesn't look at ROI, earnings growth rate, etc. (at least not in this book)

The potential advantage of this approach over IBD is that sometimes stock prices reflect earnings potential BEFORE actual earnings show up. Alternatively, sometimes stock prices reflect perceived earnings declines BEFORE the actual decline in earnings.

4. His system makes sense from a technical standpoint, but is actually harder to do than you might think.

I like his system because it's technically sound. For example, it emphasizes taking small losses and being patient for large gains (among many other things).

Don't be fooled, however . . . it's trickier to follow that you think. Not because his system doesn't work, but because it requires a lot more discipline that you might imagine.

In his main year of gains, he records investing in only a few stocks. Also, he waits for a bull market. How many of us are really patient enough to do these two things. In reality, not many. It's just very difficult in practice.

Also, he keeps an investing journal, something which I still struggle to do, but which is essential for growth. Most people can't do this on a daily basis.

In all, it's a great book for the average investor to read and reread. I highly recommend it.

by Bruce C. N. Greenwald (Author), Judd Kahn (Author), Paul D. Sonkin (Author) and Michael van Biema (Author)

From the "guru to Wall Street's gurus" comes the fundamental techniques

of value investing and their applications Bruce Greenwald is one of the

leading authorities on value investing. Some of the savviest people on

Wall Street have taken his Columbia Business School executive education

course on the subject. Now this dynamic and popular teacher, with some

colleagues, reveals the fundamental principles of value investing, the

one investment technique that has proven itself consistently over time.

After covering general techniques of value investing, the book proceeds

to illustrate their applications through profiles of Warren Buffett,

Michael Price, Mario Gabellio, and other successful value investors. A

number of case studies highlight the techniques in practice.

Bruce C. N.

Greenwald (New York, NY) is the Robert Heilbrunn Professor of Finance

and Asset Management at Columbia University. Judd Kahn, PhD (New York,

NY), is a member of Morningside Value Investors. Paul D. Sonkin (New

York, NY) is the investment manager of the Hummingbird Value Fund.

Michael van Biema (New York, NY) is an Assistant Professor at the

Graduate School of Business, Columbia University.

Customer reviews:

"This book deserves a place on every serious investor’s shelf."

–FINANCIAL TIMES

"A

must-read for all disciples of value investing. In 1934, Graham and

Dodd created fundamental security analysis. Greenwald reinforces the

worth of this approach, incorporates new advances, and takes their work

into the twenty-first century."

–Mario J. Gabelli, Chairman, Gabelli Asset Management, Inc.

"The

new title most deserving of your time is Value Investing . . . . Its

authors aim to place their work next to Benjamin Graham’s 1950 classic,

The Intelligent Investor. My 1986 edition came with Warren Buffett’s

endorsement–‘by far the best book on investing ever written.’ Value

Investing is better."

–Robert Barker, BusinessWeek

"Greenwald

is an economist (PhD from MIT) who caught the value bug. He has updated

and expanded Graham’s ideas, and his summer seminars ($2,900 for two

days) have become popular with everyone from well-known money managers

to Columbia MBAs who couldn’t get into Greenwald’s class. But now there

is a cheaper way . . . Greenwald probably won’t outsell Graham, but I

think he ought to."

–Paul Sturm, SmartMoney magazine

"Greenwald’s

book is a lively defense of, and handbook for, value investing,

complete with glimpses of how it’s practiced by pros like Warren Buffett

and Mario Gabelli."

–George Mannes, TheStreet.com

"Essential reading for anyone looking for a fresh perspective on analyzing companies and selecting investments."

–Pat Dorsey, Morningstar.com

Safe Strategies for Financial Freedom

by

Steve Sjuggerud

Most people are only a few thousand dollars a month away from financial freedom. Financial freedom is not about millions of dollars in the bank--it's simply about generating investment income that exceeds your cost of living. Once you're there, you're financially free!

Safe Strategies for Financial Freedom shows you how to get there, from how to invest wisely and protect what you earn to proven techniques for developing sources of regular income to cover your expenses and achieve financial independence. Inside, you'll discover:

- The fastest and easiest way to get out of debt without pinching pennies

- Simple models that tell you how and when to invest in stocks, bonds, gold, and real estate

- Van Tharp's legendary risk-control techniques--How the world's most profitable investors reduce their risk and leave their wealth-generating potential unlimited

People achieve financial freedom every day--now it's your turn. Safe Strategies for Financial Freedom shares

the secrets of how you can achieve financial freedom by determining

your "financial freedom number," making the right investment moves, and

accepting nothing less than absolute success. From its risk-controlling

investment strategies to its "Why didn't I think of that?"

money-management techniques, you'll learn a financial program designed

to make you the master of your money, instead of its slave.

Written by world-renowned financial advisors Van K. Tharp, D.R. Barton, and Steve Sjuggerud, who have used these techniques to free themselves and thousands of others from jobs that barely cover expenses, this book describes:

- Your Personal Financial Freedom Number--How to build passive monthly income that frees you from the workplace

- Specific strategies for transforming your assets from money pits to money producers

- Stock market strategies that produce profits in all market environments, even major bear markets.

- The Max Yield Strategy--A once-a-year system for safe, double-digit profits

- Three proven real estate strategies for generating instant equity, long-term income, or both

Is your current plan is to spend your life working 50 or more hours a week and then saving your nickels until you retire to a modest, fixed income? You're not alone. But it might surprise you to discover just how many people are now actively taking the steps to achieve financial freedom that are contained in this book.

by William O'Neil

Through every type of market, William J. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to successful investing. O'Neil's powerful CAN SLIM Investing System--a proven seven-step process for minimizing risk and maximizing gains--has influenced generations of investors.

Based on a major study of all the greatest stock market winners from 1880 to 2009, this expanded edition gives you:

- Proven techniques for building stocks before they make big price gains

- Tips on picking the best stocks, mutual funds, and ETFs to maximize your gains

- 100 new charts to help you spot today's profitable trends

- Strategies to help you avoid the most common investor mistakes!

24 Essential Lessons for Investment Success: Learn the Most Important

Investment Techniques from the Founder of Investor's Business Daily

by William J. O'Neil

From the publisher of Investor's Business Daily and best-selling author of How to Make Money in Stocks, comes the National Bestseller, 24 Essential Lessons for Investment Success, two dozen of the most important lessons for investors. In this one accessible guide, William J. O'Neil puts his popular and easy-to-follow techniques for building a profitable portfolio firmaly in the hands of investorsand the goal of long-term financial security easily within their reach.

24 Essential Lessons for Investment Success is based upon the closely followed "26 Weeks to Investment Success" editorials that appear in Investor's Business Daily. Edited and updated, O'Neil's timeless advice encapsulates such investing nuggets as buy high and sell higher to making a million in mutual funds. Concentrate your investments in a few areas, know them well, and watch them carefully.

Don't just rely upon PE ratios and other common technical tools. Learn to use Relative Price Strength to help you choose stocks. O'Neil's cautionary yet pro-active advice has helped to make Investor's Business Daily one of America's fastest growing and most respected newspapers. Now investor's can benefit from his timeless words of wisdom, collected in one easy-to-use resource.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted

November 2014 is this one