Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.28 20:19

Forex Weekly Outlook December 1-5US ISM Manufacturing PMI, Rate decision in Australia, the UK and the Eurozone, Important employment events in Canada and the US including the important NFP release. These are Forex Market Movers This Week. Check out these events on our weekly outlook.

Last week, US data showed mixed results. Durable goods orders advanced unexpectedly 0.4% but missed on the core, posting 0.9% decline. Jobless claims disappointed crossing the 300,000 line for the first time in nearly three months with a 21,000 jump to 313,000. New Home Sales rose for the third straight month to a seasonally adjusted annual rate of 458,000 units but missed forecast for a higher gain of 471,000 units. Nevertheless, the second GDP release came out better than the first estimate, showing a 3.9% growth rate in the third quarter reflecting upward revisions to business and consumer spending, as well as to inventories. Due to the flood of US economic data released at once before Thanksgiving, volatility tends to be higher. Will the US data continue to show resilience?

- US ISM Manufacturing PMI: Monday, 15:00. US manufacturing PMI came in at 59.0 in October following 56.6 in the prior month. The release was higher than the 56.5 forecasted, contradicting the US manufacturing PMI from Markit Economics report showing manufacturing activity slowed to its lowest since July. Economists expect manufacturing PMI will reach 57.9 this time.

- Australian rate decision: Tuesday, 3:30. Australia’s central bank kept the cash rate at 2.5% in November, noting that rates will remain unchanged in the coming months and that currency remains overvalued. Governor Glenn Stevens has seeks to stimulate domestic growth drivers to boost economic growth. The RBA’s The growth outlook was less optimistic than in the previous report, but with diminished worries about the housing market. No change in rates is forecasted.

- Australia GDP: Wednesday, 0:30. The Australian economy expanded a seasonally-adjusted 0.5% in the second quarter after 1.1% growth registered in the first quarter. The release was better than the 0.4% rise forecasted by analysts. On an annual basis, GDP grew 3.1%, lower than the 3.4% recorded in Q1. Exports fell 0.9% compared to a 4.2% gain in the first quarter, while imports edged up to a 3.7% expansion from a 1.2% decline in the first quarter. Economists expect an annual growth of 3.0% in 2014, and a 2.8% gain in 2015. The third quarter GDP is predicted to be 0.7%.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. The US labor market continued to strengthen in October, registering a pick-up of 230,000 in private sector hiring, after a 225,000 gain in the previous month. However the third quarter slowdown is expected to continue towards the end of 2014 which could badly affect the job market. A gain of 223,000 jobs is expected in November.

- Canadian rate decision: Wednesday: 15:00. Stephen Poloz head of the BOC decided to maintain borrowing costs due to sluggish growth of global economy. Poloz noted that rates could go up or down, depending on economic headwinds from the global economy. However, most economists expect the next rate move will be up, and that it will likely come by mid-2015. Overnight rate is expected to remain unchanged.

- US ISM Non-Manufacturing PMI: Wednesday: 15:00. US service-sector growth slowed in October to 57.1 from 58.6 in September. The index has been declining since July reaching its slowest pace of growth in 6 months. Nevertheless, the index is above 50 indicating growth. New business expanded in October, a good sign for economic growth. Employment remained strong, but business outlook was more pessimistic. US service-sector is expected to reach 57.5.

- UK rate decision: Thursday, 12:00. Bank of England voting members decided to keep interest rates at 0.5% in November. The stimulus program remained unchanged at £375 billion. Economists expected a rate hike in November, after Mark Carney, the Governor of the Bank of England noted the decision surrounding the timing of the first rate hike was “becoming more balanced” and “could happen sooner than markets expect”. The Official Bank Rate is predicted to remain unchanged this time.

- Eurozone rate decision: Thursday, 12:45. Mr. Draghi, the president of the European Central Bank, promised in October that more aggressive measures are being prepared, in the form of the large-scale bond purchases known as quantitative easing to boost growth in the Eurozone. The same promise was delivered in November with no substantial measures. Many economists expected real action in the form of the US QE. Even the Bank of Japan started its own QE program. Even though the Euro area economy is not in deflation, prices are falling constantly damaging companies’ revenues and raising unemployment. Real measures are expected on the December meeting.

- US Unemployment Claims: Thursday: 13:30. The number of Americans seeking U.S. unemployment benefits edged up to 313,000 last week, crossing the 300,000 line for the first time in nearly three months. The 21,000 jump beat forecasts for a 287,000 reading. The four-week average, a less volatile measure, rose 6,250 to 294,000. This sudden rise does not suggest a downturn trend, but is probably related to seasonal layoffs in sectors affected by the cold weather, such as construction. Economists expect US weekly unemployment claims to reach 297K

- Canadian employment data: Friday, 13:30. Canada’s job market unexpectedly increased by 43,100 positions in October, pushing unemployment rate down to a nearly six-year low of 6.5%. Analysts expected a contraction of 5,000 jobs following September’s gain of 74,100 positions. The jobless rate, declined from 6.8% in September, to the lowest since November 2008, suggesting the labor market is regaining strength. The labor participation rate, stayed at 66%, the lowest since November 2001. Full-time jobs increased by 26,500, while part-time positions increased by 16,500. Canada’s job market is expected to add 5,300 jobs while the unemployment rate is predicted to reach 6.6%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 13:30. The US job market gained fewer than expected positions in October adding 214,000, but the Unemployment rate declined to its lowest level since 2008 reaching 5.8%. However, despite the forecast of 235,000 job addition, October’s gain is still considered positive. Wage growth remained sluggish, as wages increased 0.1% month-on-month, missing expectations for growth of 0.2%. Year-over-year, wages grew 2%, below expectations for a 2.1% gain. US job gain in November is expected to be 225,000, while the unemployment rate is predicted to remain unchanged at 5.8%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.01 06:46

USD/JPY Technical Analysis: Buyers Threaten 119.00 Anew (adapted from dailyfx article)

| Resistance | Support |

|---|---|

| 119.24 | 116.96 |

| 120.48 | 115.71 |

| 122.49 | 113.70 |

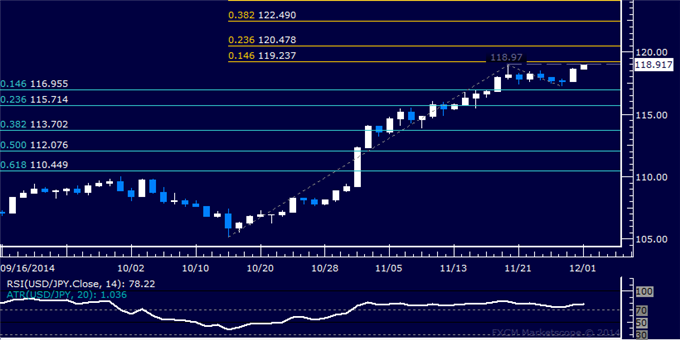

The US Dollar looks poised to launch another assault on the 119.00 figure against the Japanese Yen following a brief corrective pullback. Near-term resistance is in the 118.97-119.24 area, marked by the November 20 high and the 14.6% Fibonacci expansion, with a break above that on a daily closing basis exposing the 23.6% level at 120.48. Alternatively, a reversal below the 14.6% Fib retracement at 116.96 opens the door for a test of the 23.6% threshold at 115.71.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.01 16:28

2014-12-01 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]- past data is 59.0

- forecast data is 57.8

- actual data is 58.7 according to the latest press release

if actual > forecast (or actual data) = good for currency (for ГЫВ in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

U.S. Manufacturing Index Falls Less Than Expected In November

Activity in the U.S. manufacturing sector grew at a slightly slower rate in the month of November, according to a report released by the Institute for Supply Management on Monday, although the index of activity in the sector fell by much less than anticipated.

The ISM said its purchasing managers index edged down to 58.7 in November from 59.0 in October, with a reading above 50 indicating continued growth in the manufacturing sector. Economists had expected the index to drop to a reading of 57.8.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5: 32 pips by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.02 07:01

USD/JPY Remains Overbought- Weighed by Risk for Higher JGB Yields

Risk for higher-yielding Japanese Government Bonds (JGB) may further

cloud the outlook for USD/JPY especially as the December 14 snap

election looms.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.02 20:37

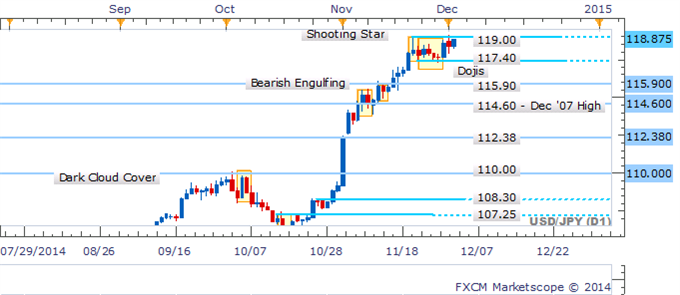

USD/JPY Awaiting Breakout Above 119 With Bearish Patterns Lacking (based on dailyfx article)

- Strategy: Flat, Pending Long On Daily Close Above 119.00

- Dojis Indicated Reluctance From The Bears Near 117.40

- Intraday Chart Reveals Absence Of Key Reversal Patterns

USD/JPY has managed to regain some upward momentum after a string of Dojis suggested reluctance from the bears to lead the pair lower. With key reversal patterns lacking the prospect of a pullback is questionable. Amid a core uptrend a break of the nearby 119.00 ceiling may herald a push towards the next definitive resistance level at 119.80.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.03 10:38

EUR/USD & USD/JPY in focus, Crude lower, US30 near record as US macro dataForum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.03 16:37

EUR/USD Nears Week Long Range Break; JPY-crosses Continue Run (based on dailyfx article)

- EURUSD H4 MACD nears sell point below signal line.

- JPY-crosses see broad continuation in BoJ-inspired trend.

Event risk is at its lowest point of the week on Tuesday, but it's shaping up to be the 'calm before the storm' if anything. Numerous 'medium' and 'high' rated events will help unleash volatility starting tomorrow, including the European Central Bank meeting on Thursday and the November US labor market report on Friday.

Ahead of then, we're starting to see the ranges that persisted around the holiday trading conditions last week start to bend, just not yet break. One of these instances is occurring in EURUSD, where the closing highs and lows on H4 charts going back to November 27 are starting to be probed.

Elsewhere, the big theme at present is the ongoing Japanese Yen depreciation. USDJPY's triangle/flag going back to November 17 is on the verge of cracking higher; and the momentum in EURJPY and GBPJPY sees continuation higher as well, irrespective of event risk.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.03 22:39

USD/JPY Aims Higher After Climb Above 119 With Reversal Signals Absent (based on dailyfx article)

- Strategy: Long (From: 119.20), Stop: 119.00 (Daily Close), Target 1: 119.80, Target 2: 124.10

- Breakout Amid Absence Of Reversal Signals Opens Further Gains

- Intraday Chart Reveals Some Caution From The Bulls

Awaiting Breakout Amid Absence Of Bearish Signals

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.04 06:43

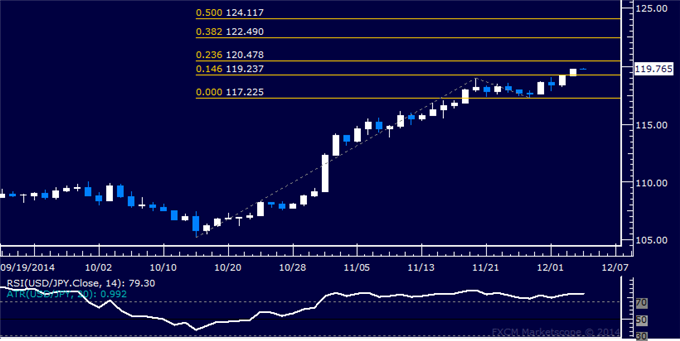

USD/JPY Technical Analysis: Aiming Above 120.00 Figure (based on dailyfx article)

| Resistance | Support |

|---|---|

| 120.48 | 119.24 |

| 122.49 | 117.23 |

| 124.12 | 116.23 |

The US Dollar looks to be accelerating against the Japanese Yen

anew, with prices poised to advance beyond the 120.00 figure. A daily

close above the 23.6% Fibonacci retracement at 120.48 exposes the 38.2%

level at 122.49. Alternatively, a reversal below the 14.6% Fib at 119.24

clears the way for a test of the November 27 low at 117.23.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.05 05:29

EUR/USD Rallies to 1.24 after ECB Disappointment (based on marketpulse article)

The euro started trade on Friday higher against most of its peers but could struggle to extend gains if U.S. employment data due later in the day re-energize dollar bulls.

Investors were forced to trim bearish positions in the common currency overnight after the European Central Bank (ECB) disappointed some by not immediately expanding its stimulus program.

As a result, the euro jumped to $1.2457 from a two-year trough around $1.2279. It has since steadied at $1.2380.

It climbed towards a six-year peak of 149.12 yen set on Nov. 20, rising as far as 148.95 before losing a bit of steam to last fetch 148.27 yen.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish for trying the breakout on open D1 bar:

W1 price is on primary bullish since the end of October after the secondary correction.

MN price is on bullish breakout by breaking 112.46 support level on close MN1 bar..

If D1 price will break 116.33 support level so the secondary correction will be started

If D1 price will break 118.97 resistance level so the primary bullish will be continuing

If not so we may see the ranging within bullish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2014-11-30 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Capital Spending]

2014-12-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-12-01 01:35 GMT (or 03:35 MQ MT5 time) | [JPY - Manufacturing PMI]

2014-12-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-12-01 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-12-01 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Monetary Base]

2014-12-02 01:30 GMT (or 03:30 MQ MT5 time) | [JPY - Average Cash Earnings]

2014-12-05 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : bullish

TREND : breakout