Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.22 15:17

Forex Weekly Outlook November 24-28German Ifo Business Climate, Haruhiko Kuroda’s speeches, US and Canadian GDP data, US Core Durable Goods Orders, Unemployment claims and Housing data are the most important economic releases for this week. Here is an outlook on the highlights coming our way.

Last week, the FOMC Meeting Minutes release showed the Fed is concerned with low inflation but expects firming further out. Since quantitative easing ended, the key issue is the timing of the first rate hike. Some FOMC participants wanted to remove “considerable time” in the statement while others did not. Global economic issues such as the weakening in Europe, China and Japan and their possible impact on the US market, were also discussed. The Fed also noted the US economy continues to improve gradually. The December statement may shed more light on the timing of policy changes.

- Eurozone German Ifo Business Climate: Monday, 8:00. German business sentiment declined for the sixth month in October, reaching 103.2 after September’s reading of 104.7. Economists expected a smaller decline to 104.6. Growth in the third quarter was worse than expected with a predicted gain of 0.3%. The survey revealed a drop in current conditions to 108.4 from 110.5 in September and the outlook gauge declined to 98.3 from 99.2. Analysts predict business climate will reach 103 in November.

- Haruhiko Kuroda speaks: Tuesday, 0:00, 3:45. BOE Governor Haruhiko Kuroda will speak in Nagoya and in Tokyo. Kuroda warned inflation could fall below 1% the disappointing GDP release in November showing the economy slid into recession. BOE Governor started to implement the unprecedented asset purchases decided in the last policy meeting, despite Prime Minister Shinzo Abe’s decision to delay a sales-tax increase. Kuroda may provide clues on further easing measures to boost inflation towards the 2% target.

- US GDP data: Tuesday, 12:30. The US economy grew at a faster pace in the second quarter than estimated earlier. Gross domestic product grew at an annualized rate of 4.2%, 0.2% higher than expected. Business spending turned out better than initially estimated. Corporate profits after tax totaled a seasonally adjusted annual rate of $1.840tn, up 6% from $1.735tn in the first quarter. Personal consumption expenditures rose 2.5% in the second quarter, compared with an increase of 1.2% in the first. Durable goods increased 14.3%, compared with an increase of 3.2% in the previous period. Economists expect GDP to reach 3.3%.

- US CB Consumer Confidence: Tuesday, 12:30. U.S. consumer confidence edged up strongly in October, hitting a seven-year high of 94.5 from 89 in the previous month amid a further improvement in the Job market raising expectations for higher economic growth. In light of falling gas prices and better job figures, consumer spending is expected to rise in the coming months. U.S. consumer sentiment is predicted to rise to 95.9 this month.

- UK GDP data: Wednesday, 8:30. The U.K. economy kept growing in the second quarter, expanding by 0.8% as in the previous quarter. The reading was in line with market forecast, rising a revised 3.2% from a year earlier. Economists expect the Ukraine crisis will have negative bearings on the manufacturing sector due to a reduction in foreign demand. However once tensions ease, business confidence and investment will rebound across Europe, and the UK will return to full growth. The third quarter growth rate is expected to be 0.7%.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for long lasting goods fell unexpectedly by 1.3% in September, while expected to gain 0.4%. Excluding transportation orders, durable goods orders declined 0.2% and fell 1.5% excluding defense orders. Nondefense new orders for capital goods in September fell 5.4%, while defense new orders for capital goods rose 7.4%. However, the general trend is positive showing a stronger market demand, while aircraft orders tend to be less trustworthy. Analysts expect a decline of 0.4% in Durable Goods Orders and a 0.5% gain in core orders.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing claims for unemployment benefits fell last week to 291,000 from 293,000 in the week before. Economists expected a sharper decline to 286,000. The reading continues to suggest an ongoing improvement in the US labor market. The four-week moving average, a more stable gauge, increased 1,750 to 287,500, still showing job growth. Economists forecast 287,000 new claim this week.

- US New Home Sales: Wednesday, 14:00. Sales of new U.S. single-family homes reached a six-year high in September, rising to a seasonally adjusted annual rate of 467,000. Economists expected an even higher reading of 473,000. August’s reading was sharply revised for the worse to 466,000, indicating the housing recovery remains uncertain. The housing market regained momentum after stalling in the second half of 2013 when mortgage rates soared. Mortgage rates have declined hand in hand with the contraction in the U.S. Treasury debt yields, but slow wage growth weighs on the pace of recovery. Analysts expect new home sales to reach 471,000.

- Canadian GDP: Friday, 12:30. Canada’s economy contracted unexpectedly 0.1% in August, declining for the first time in eight months, amid a decline in energy and manufacturing activity. Economists expected a flat reading as in the previous month. The disappointing figure suggests pickup has stalled in the third quarter. Manufacturing output fell 1.2%, reversing the 1.2% gain in the prior month. Service industries gained 0.2% for the month, with wholesale trade gaining 0.5% and the finance and real estate sectors both rising 0.3% in August. Retail activity, however, declined 0.1% and transportation and warehouses dropped 0.3%. Economists forecast a 0.4% gain in September.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.23 17:37

USD/CAD weekly outlook: November 24 - 28 (based on investing article)

The U.S. dollar fell to three-week lows against the Canadian dollar

on Friday following the release of stronger-than-forecast Canadian

inflation data, while an unexpected rate cut by China’s central bank and

higher oil prices also boosted the commodity exposed Canadian dollar.

USD/CAD fell to lows of 1.1191, before pulling back to 1.1231 in late trade, off 0.63% for the day.

The Canadian dollar was boosted after Statistics Canada reported that

the annual rate of inflation rose to a one year high of 2.4% in October,

up from 2.0% in September and compared to expectations for an unchanged

reading.

The robust data was seen as increasing the likelihood that the Bank of

Canada would have to adjust expectations while making monetary policy

decisions.

The loonie, as the Canadian dollar is also known, received an additional

boost after China’s central bank unexpectedly cut interest rates for

the first time in more than two years on Friday.

The move came in response to recent signs of a slowdown in the world’s second-largest economy.

Oil prices moved higher following China’s rate cut, which fuelled hopes for increased demand for raw materials, including oil.

Oil prices also found support amid growing expectations that the

Organization of the Petroleum Exporting Countries may decide to curb

production at its upcoming meeting next week.

Oil prices have been falling since June pressured lower by concerns that global production will outstrip demand.

In the week ahead, the U.S. is to release a string of economic reports

on Wednesday ahead of Thursday’s Thanksgiving holiday, including a look

at unemployment claims and durable goods orders. Tuesday’s report on

Canadian retail sales and Friday’s data on economic growth will also be

in focus.

Tuesday, November 25

- Canada is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to release revised data on third quarter gross domestic product and a report on consumer confidence.

- The U.S. is to release a flurry of data ahead of Thursday’s holiday, including reports on durable goods orders, unemployment claims, personal income and spending, as well as reports on new and pending home sales and revised data on consumer sentiment.

- Markets in the U.S. are to remain closed for the Thanksgiving Holiday.

- Canada is to publish data on the current account.

- Canada is to round up the week with its monthly GDP report.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 06:08

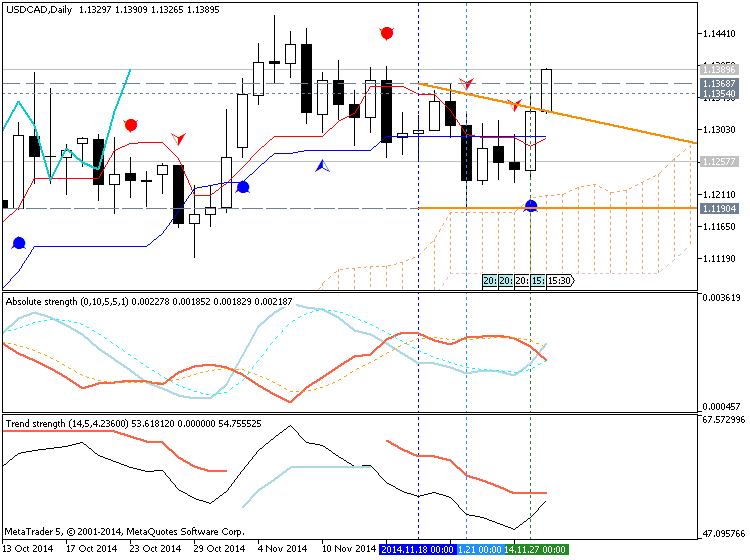

USD/CAD Technical Analysis: Passing on Short Trade Setup (based on dailyfx article)

- USD/CAD Technical Strategy: Flat

- Support: 1.1177, 1.1142, 1.1110

- Resistance: 1.1329, 1.1389, 1.1466

The US Dollar

may have marked a critical reversal downward against its Canadian

namesake after prices pierced a barrier guiding the uptrend since

September. Near-term channel support is at 1.1177, with a break below

that on a daily closing basis exposing the 38.2% Fibonacci retracement

at 1.1142. Alternatively, a reversal above trend line

support-turned-resistance at 1.1329 clears the way for a test of the

23.6% Fib expansion at 1.1389.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 10:07

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx article)

Another 0.6% contract in orders for U.S. Durable Goods may generate a

more meaningful rebound in EUR/USD as it dampens the growth and

inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

The threat of a slower recovery may further delay the Fed’s normalization cycle as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP), and the dollar may face a larger correction over the near-term should interest rate expectations falter.

Nevertheless, the ongoing improvement in consumer confidence may

generate a better-than-expected print, and a rebound in demand for U.S.

Durable Goods may heighten the bullish sentiment surrounding the dollar

as the Fed is widely expected to raise the benchmark interest rate in

2015.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 0.6% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

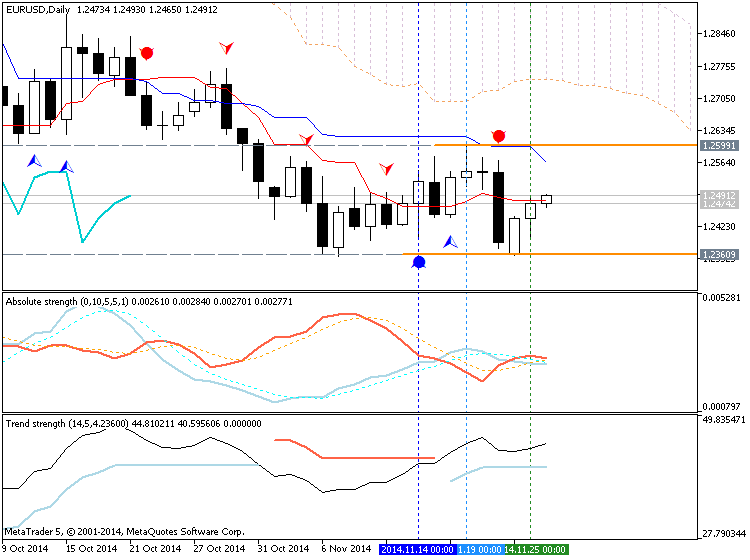

EUR/USD Daily Chart

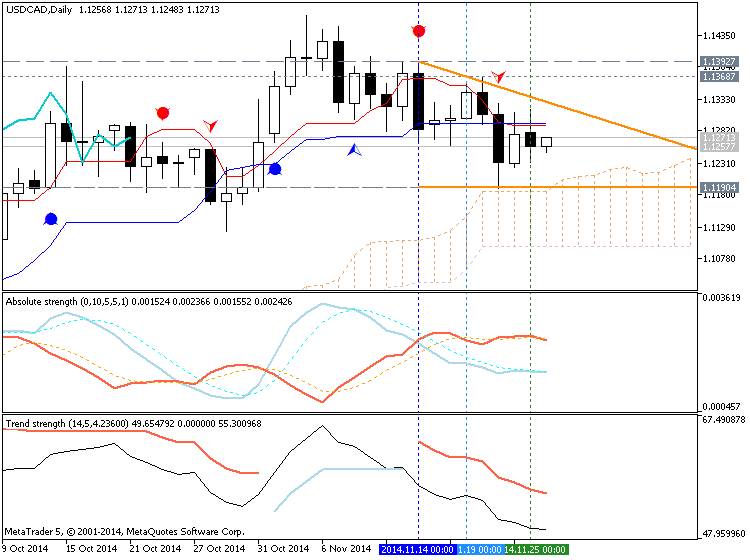

USD/CAD Daily Chart

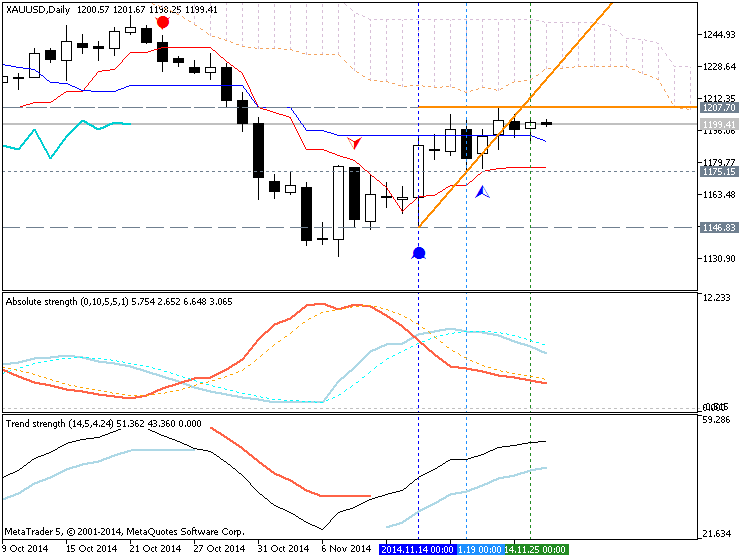

XAU/USD Daily Chart

- Will watch the November high (1.2599) as EUR/USD holds above the monthly low (1.2356).

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 |

10/28/2014 12:30 GMT | 0.5% | -1.3% | + 42 | + 27 |

September 2014 U.S. Durable Goods Orders

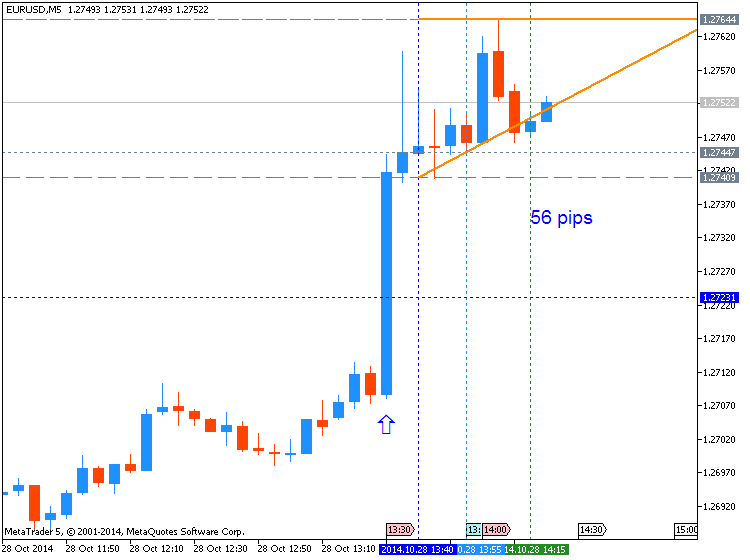

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event:

Demand for U.S. Durable Goods slipped another 1.3% in September

following the record 18.3% contraction the month prior. Orders for

non-defense capital goods excluding aircraft, a proxy future business

investments, also fell 1.7% during the same period. The persistent

weakness in demand for large-ticket items may further dampen the outlook

for global growthamid the weakening outlook for Europe and China. The

greenback struggled to hold its ground following the worse-than-expected

print, with EUR/USD climbing above the 1.2750 handle, but there was

limited follow-through behind the market reaction as the pair closed at

1.2734.

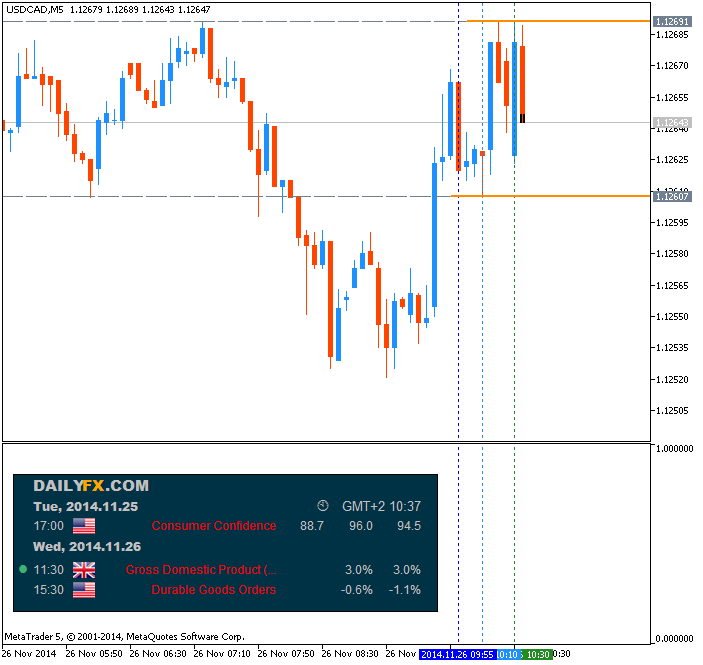

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5: 11 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.27 08:56

USD/CAD Technical Analysis: Long Trade Sought on Pullback (based on dailyfx article)

- Support: 1.1167, 1.1116, 1.1043

- Resistance: 1.1328, 1.1389, 1.1466

The US Dollar

may have begun a significant downward reversal against its Canadian

counterpart after prices overcome support guiding the uptrend since

September. A daily close below channel support at 1.1167 exposes the

1.1116-42 area marked by a rising trend line set from July and the 38.2%

Fibonacci retracement. Alternatively, a reversal above the 1.1300-28

zone (channel top, trend line support-turned-resistance) opens the door

for a challenge of the 23.6% Fib expansion at 1.1389.

newdigital:

If D1 price will break 1.1259 support level so the secondary correction will be continuing with good possibility to the reversal of the price movement from bullish to the bearish on this timeframe

If D1 price will break 1.1401 resistance level so the primary bullish will be continuing

If not so we may see the ranging within bullish market condition.

- Recommendation for long: watch D1 price to break 1.1401 resistance for possible buy trade

- Recommendation

to go short: watch D1 price to break 1.1259 support level for possible sell trade

- Trading Summary: bullish

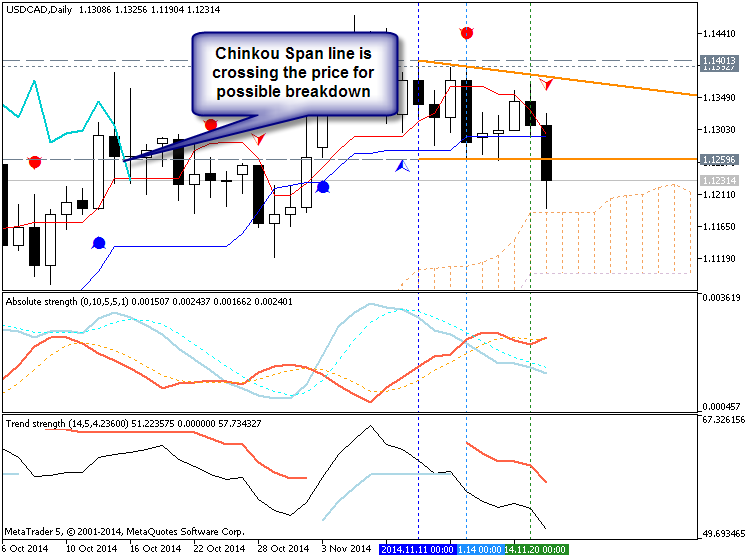

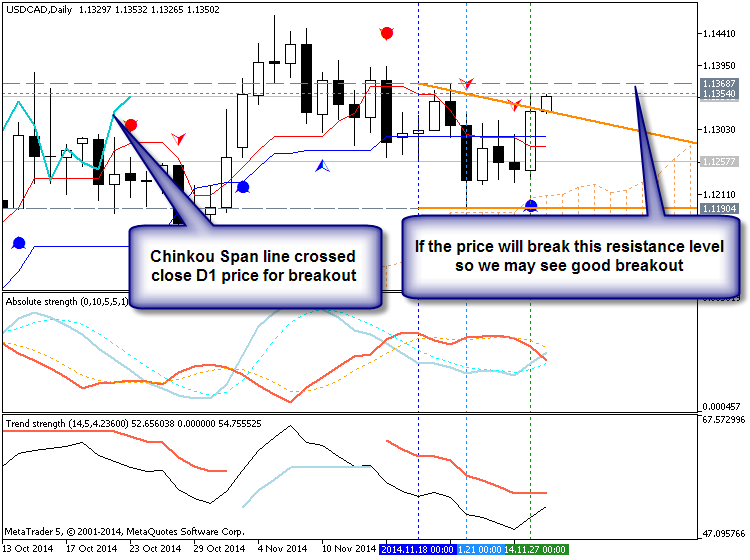

End-of-week technical analysis:

Resistance level (1.1401) was not broken but the price is going for good breakout :

- Chinkou Span line broke the price from below to above on close D1 bar

- Nearest resistance level for the price on the way to uptrend is 1.1368

We can compate D1 chart which I made one week ago with D1 chart which I made right now

D1 one week ago:

D1 for now:

That is why the analysts like W1 timeframe more than D1: everything is changed on D1 in more quickly basis.

- Recommendation for long: watch D1 price to break 1.1401 resistance for possible buy trade

- Recommendation

to go short: N/A

- Trading Summary: bullish

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.28 12:09

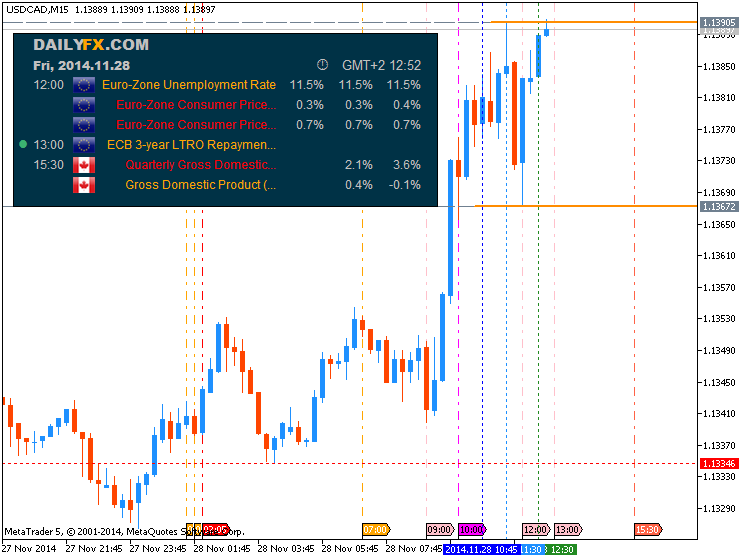

Trading the News: Canada Gross Domestic Product (GDP) (based on dailyfx article)

Canada’s 3Q Gross Domestic Product (GDP) report may generate a near-term

bounce in USD/CAD as the growth rate is expected to increase an

annualized 2.1% following the 3.1% expansion during the three-months

through June.

What’s Expected:

Why Is This Event Important:

A marked slowdown in economic activity may undermine the appeal of the

Canadian dollar as the Bank of Canada (BoC) remains reluctant to further

normalize monetary policy, and the USD/CAD may continue to track higher

in December as Governor Stephen Poloz continues to talk down interest

rate expectations.

How To Trade This Event Risk

Bearish CAD Trade: 3Q GDP Slows to 2.1% or Lower

- Need green, five-minute candle following a dismal GDP report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long USD/CAD with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

USD/CAD Daily Chart

- Need a break of the bearish trends in price & the RSI to revert back to the approach of looking for opportunities to buy-dips.

- Interim Resistance: 1.1370 (23.6% retracement) to 1.1380 (78.6% expansion)

- Interim Support: 1.1155 (78.6% retracement) to 1.1165 (23.6% expansion)

| Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| 2Q 2014 |

08/29/2014 12:30 GMT | 2.7% | 3.1% | - 7 | + 30 |

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5: 58 pips price movement by CAD - GDP news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish with secondary correction:

W1 price is on primary bullish with the correction just started on open W1 bar.

MN price is on bullish market condition for trying to break 1.1385 resistance level for the bullish to be continuing.

If D1 price will break 1.1259 support level so the secondary correction will be continuing with good possibility to the reversal of the price movement from bullish to the bearish on this timeframe

If D1 price will break 1.1401 resistance level so the primary bullish will be continuing

If not so we may see the ranging within bullish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-11-25 13:30 GMT (or 15:45 MQ MT5 time) | [CAD - Retail Sales]

2014-11-25 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]

2014-11-25 15:00 GMT (or 17:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-11-26 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-11-26 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-11-26 15:00 GMT (or 17:00 MQ MT5 time) | [USD - New Home Sales]

2014-11-27 13:30 GMT (or 15:30 MQ MT5 time) | [CAD - Current Account]

2014-11-28 13:30 GMT (or 15:30 MQ MT5 time) | [CAD - GDP]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movementSUMMARY : bullish

TREND : correction