Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.22 15:17

Forex Weekly Outlook November 24-28German Ifo Business Climate, Haruhiko Kuroda’s speeches, US and Canadian GDP data, US Core Durable Goods Orders, Unemployment claims and Housing data are the most important economic releases for this week. Here is an outlook on the highlights coming our way.

Last week, the FOMC Meeting Minutes release showed the Fed is concerned with low inflation but expects firming further out. Since quantitative easing ended, the key issue is the timing of the first rate hike. Some FOMC participants wanted to remove “considerable time” in the statement while others did not. Global economic issues such as the weakening in Europe, China and Japan and their possible impact on the US market, were also discussed. The Fed also noted the US economy continues to improve gradually. The December statement may shed more light on the timing of policy changes.

- Eurozone German Ifo Business Climate: Monday, 8:00. German business sentiment declined for the sixth month in October, reaching 103.2 after September’s reading of 104.7. Economists expected a smaller decline to 104.6. Growth in the third quarter was worse than expected with a predicted gain of 0.3%. The survey revealed a drop in current conditions to 108.4 from 110.5 in September and the outlook gauge declined to 98.3 from 99.2. Analysts predict business climate will reach 103 in November.

- Haruhiko Kuroda speaks: Tuesday, 0:00, 3:45. BOE Governor Haruhiko Kuroda will speak in Nagoya and in Tokyo. Kuroda warned inflation could fall below 1% the disappointing GDP release in November showing the economy slid into recession. BOE Governor started to implement the unprecedented asset purchases decided in the last policy meeting, despite Prime Minister Shinzo Abe’s decision to delay a sales-tax increase. Kuroda may provide clues on further easing measures to boost inflation towards the 2% target.

- US GDP data: Tuesday, 12:30. The US economy grew at a faster pace in the second quarter than estimated earlier. Gross domestic product grew at an annualized rate of 4.2%, 0.2% higher than expected. Business spending turned out better than initially estimated. Corporate profits after tax totaled a seasonally adjusted annual rate of $1.840tn, up 6% from $1.735tn in the first quarter. Personal consumption expenditures rose 2.5% in the second quarter, compared with an increase of 1.2% in the first. Durable goods increased 14.3%, compared with an increase of 3.2% in the previous period. Economists expect GDP to reach 3.3%.

- US CB Consumer Confidence: Tuesday, 12:30. U.S. consumer confidence edged up strongly in October, hitting a seven-year high of 94.5 from 89 in the previous month amid a further improvement in the Job market raising expectations for higher economic growth. In light of falling gas prices and better job figures, consumer spending is expected to rise in the coming months. U.S. consumer sentiment is predicted to rise to 95.9 this month.

- UK GDP data: Wednesday, 8:30. The U.K. economy kept growing in the second quarter, expanding by 0.8% as in the previous quarter. The reading was in line with market forecast, rising a revised 3.2% from a year earlier. Economists expect the Ukraine crisis will have negative bearings on the manufacturing sector due to a reduction in foreign demand. However once tensions ease, business confidence and investment will rebound across Europe, and the UK will return to full growth. The third quarter growth rate is expected to be 0.7%.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for long lasting goods fell unexpectedly by 1.3% in September, while expected to gain 0.4%. Excluding transportation orders, durable goods orders declined 0.2% and fell 1.5% excluding defense orders. Nondefense new orders for capital goods in September fell 5.4%, while defense new orders for capital goods rose 7.4%. However, the general trend is positive showing a stronger market demand, while aircraft orders tend to be less trustworthy. Analysts expect a decline of 0.4% in Durable Goods Orders and a 0.5% gain in core orders.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing claims for unemployment benefits fell last week to 291,000 from 293,000 in the week before. Economists expected a sharper decline to 286,000. The reading continues to suggest an ongoing improvement in the US labor market. The four-week moving average, a more stable gauge, increased 1,750 to 287,500, still showing job growth. Economists forecast 287,000 new claim this week.

- US New Home Sales: Wednesday, 14:00. Sales of new U.S. single-family homes reached a six-year high in September, rising to a seasonally adjusted annual rate of 467,000. Economists expected an even higher reading of 473,000. August’s reading was sharply revised for the worse to 466,000, indicating the housing recovery remains uncertain. The housing market regained momentum after stalling in the second half of 2013 when mortgage rates soared. Mortgage rates have declined hand in hand with the contraction in the U.S. Treasury debt yields, but slow wage growth weighs on the pace of recovery. Analysts expect new home sales to reach 471,000.

- Canadian GDP: Friday, 12:30. Canada’s economy contracted unexpectedly 0.1% in August, declining for the first time in eight months, amid a decline in energy and manufacturing activity. Economists expected a flat reading as in the previous month. The disappointing figure suggests pickup has stalled in the third quarter. Manufacturing output fell 1.2%, reversing the 1.2% gain in the prior month. Service industries gained 0.2% for the month, with wholesale trade gaining 0.5% and the finance and real estate sectors both rising 0.3% in August. Retail activity, however, declined 0.1% and transportation and warehouses dropped 0.3%. Economists forecast a 0.4% gain in September.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.23 17:44

Gold / Silver / Copper futures - weekly outlook: November 24 - 28 (based on investing article)

Gold prices rallied to a three-week high on Friday, after China’s

central bank unexpectedly cut interest rates for the first time in more

than two years.

On the Comex division of the New York Mercantile Exchange, gold futures

for December delivery rose to a session high of $1,207.60 a troy ounce,

the most since October 30, before settling at $1,197.70 by close of

trade, up $6.80, or 0.57%.

On the week, gold prices rose $12.10, or 1.01%, the second consecutive weekly gain.

Futures were likely to find support at $1,173.90, the low from November

19, and resistance at $1,216.50, the high from October 30.

Gold prices rose on news that the People's Bank of China cut its

benchmark one-year deposit rate by 25 basis points to 2.75% and trimmed

its one-year lending rate by 40 basis points to 5.6%.

The move came in response to recent signs of a slowdown in the world’s second-largest economy.

Gold can benefit from such an environment of easy money because of

expectations that ample liquidity would put a damper on the value of

paper currencies.

Meanwhile, European Central Bank President Mario Draghi reiterated on

Friday that the central bank is ready to expand its stimulus program to

raise inflation and inflation expectations as quickly as possible.

Draghi also warned about weak growth in the euro zone, saying that no improvements are expected in the coming months.

The ECB's current stimulus program includes purchases of asset-backed

securities and covered bonds, though markets are keeping a close eye out

for plans to announce purchases of government debt, a stimulus tool

known as quantitative easing.

Expectations of monetary stimulus tend to benefit gold, as the metal is seen as a safe store of value and inflation hedge.

Despite Friday's upbeat performance, gold prices are likely to remain

vulnerable in the near-term amid indications a strengthening U.S.

economic recovery will force the Federal Reserve to start raising

interest rates sooner and faster than previously thought.

In the week ahead, the U.S. is to release a string of economic reports

on Wednesday due to Thursday’s Thanksgiving holiday, including a look at

unemployment claims and durable goods orders.

Data from the Commodities Futures Trading Commission released Friday

showed that hedge funds and money managers significantly increased their

bullish bets in gold futures in the week ending November 18.

Net longs totaled 60,307 contracts, up 35.7% from net longs of 38,763 in the preceding week.

Also on the Comex, silver futures for December delivery climbed 25.8

cents, or 1.6%, on Friday to settle the week at $16.39 a troy ounce by

close of trade.

Prices hit a daily peak of $16.60 an ounce earlier Friday, the highest level since October 30.

The December silver futures contract tacked on 8.0 cents, or 0.48%, on the week, the second straight weekly advance.

According to the CFTC, net silver longs totaled 745 contracts as of last

week, compared to net shorts of 1,983 contracts in the preceding week.

Elsewhere in metals trading, copper for December delivery inched up 1.2

cents, or 0.4%, on Friday to settle at $3.031 a pound by a close of

trade.

Prices rallied to a session high of $3.077 earlier in the day, before

paring gains towards the end of the session, as traders weighed whether a

surprise rate cut in China would translate into an increase in demand

for the industrial metal.

The Asian nation is the world’s largest copper consumer, accounting for almost 40% of world consumption last year.

Despite Friday's gains, Comex copper prices shed 1.5 cents, or 0.49%, on

the week, amid ongoing concerns over the health of the global economy.

Copper is sensitive to the economic growth outlook because of its widespread uses across industries.

According to the CFTC, net copper shorts totaled 1,304 contracts as of

last week, compared to net shorts of 1,664 contracts in the preceding

week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.25 09:04

Precious Metals Exposed To Greenback Gains On Top-Tier US Data (adapted from dailyfx article)

- Crude Oil May Remain Heavy As Supply Glut Concerns Linger

- Precious Metals Exposed To USD Gains On Strong GDP Print

- Quarterly Forecast: Gold RemainsVulnerable To USD Strength

Crude oil witnessed a rocky start to the week with the WTI

benchmark off by 1.28% for the session. Global supply glut concerns

were fanned by reports that several OPEC members would be excluded from

production cuts. This comes ahead of a scheduled meeting amongst the

petroleum producers later this week. While negative supply side cues

remain, the crude benchmarks could continue to remain under pressure.

Meanwhile the precious metals witnessed a mixed session as their US Dollar

counterpart drifted sideways amid a void of major US data. Looking to

the session ahead, the greenback may take some guidance from revised Q3 GDP and Consumer Confidence

figures. Given the generally positive sentiment towards the USD at

present, it would likely take a material downside surprise to turn the

tide against the reserve currency. This in turn could leave gold and silver exposed.

Gold remains at a crossroads as trend indicators

warn of building upside momentum (20 SMA and ROC). Yet it is still

capped below key resistance at 1,208 (also the 61.8% Fib.). This leaves a

clearer setup desired to offer a more concrete technical bias.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 06:11

Gold prices may surge if Swiss vote on reserves passes (adapted from usatoday article)

Global gold prices may surge in the coming week if Swiss voters approve a controversial measure that would force their country's central bank to keep at least a fifth of its assets in gold.

If the referendum Sunday passes and the Swiss government is forced to start beefing up its reserves, the price of gold could jump to more than $1,350 an ounce — an increase of 18%, Bank of America predicts.

Spearheaded by the right-wing Swiss People's Party, the so-called Save Our Gold law would compel the Swiss National Bank, the country's central bank, to increase its gold reserves from the current 7.7% to 20% within five years.

To do that would require repatriating Switzerland's gold stored abroad and also buying approximately 1,500 tons of gold bullion at prices that have quadrupled since Switzerland began selling off its reserves in 2000.

The law would also forbid any future sales of Swiss gold.

Currently,

Switzerland, with 1,040 tons, is the world's sixth largest holder of

gold and the largest per-capita holder, according to the World Gold

Council. The United States has the world's largest reserves at 8,133.5

tons.

However, UBS currency analyst Thomas Flury said "the overall impact on the franc would not be dramatic." He predicts that the central bank might institute negative interest rates, a measure that would weaken the franc.

"What is most worrying about this initiative for global markets is the prospect of limiting the freedom to print more money by re-introducing currencies that are partially or fully backed by gold," Cocca says. "Liquidity is what keeps markets happy these days, and any prospect of less liquidity would make markets fall."

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 10:07

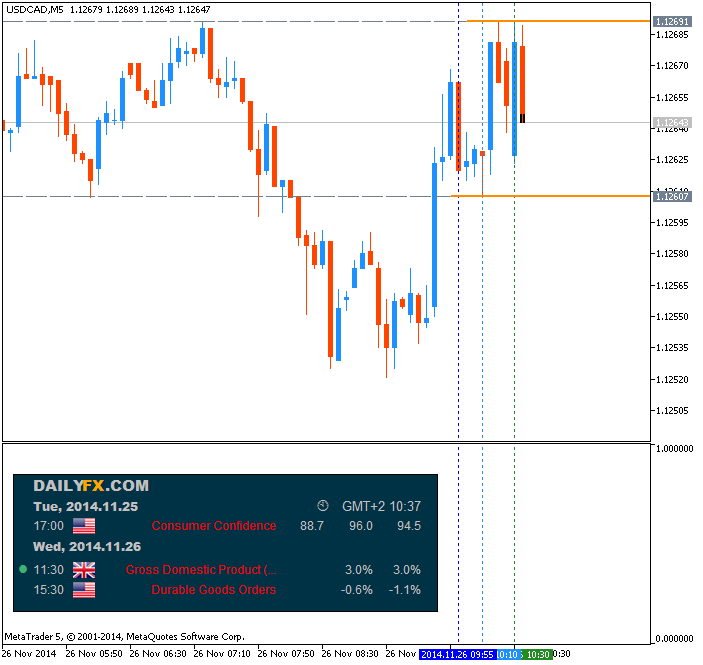

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx article)

Another 0.6% contract in orders for U.S. Durable Goods may generate a

more meaningful rebound in EUR/USD as it dampens the growth and

inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

The threat of a slower recovery may further delay the Fed’s normalization cycle as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP), and the dollar may face a larger correction over the near-term should interest rate expectations falter.

Nevertheless, the ongoing improvement in consumer confidence may

generate a better-than-expected print, and a rebound in demand for U.S.

Durable Goods may heighten the bullish sentiment surrounding the dollar

as the Fed is widely expected to raise the benchmark interest rate in

2015.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 0.6% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

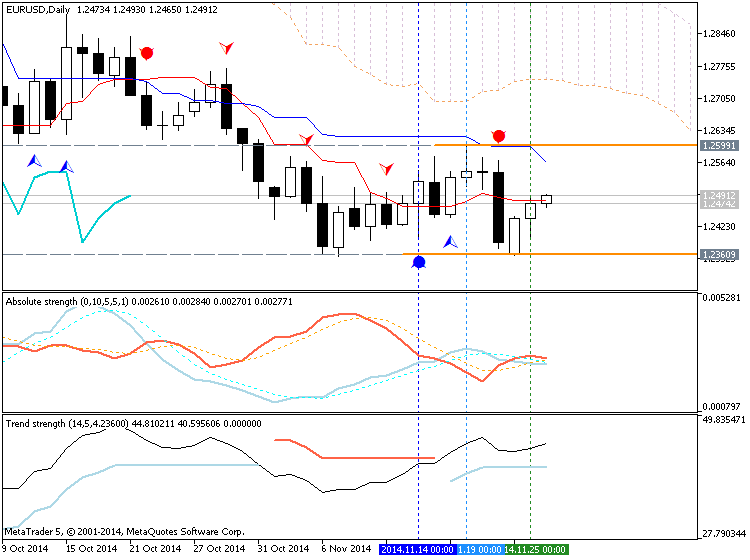

EUR/USD Daily Chart

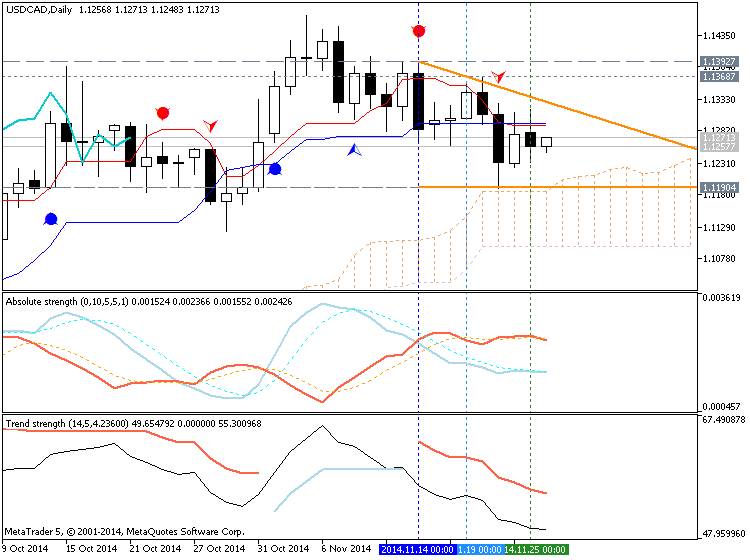

USD/CAD Daily Chart

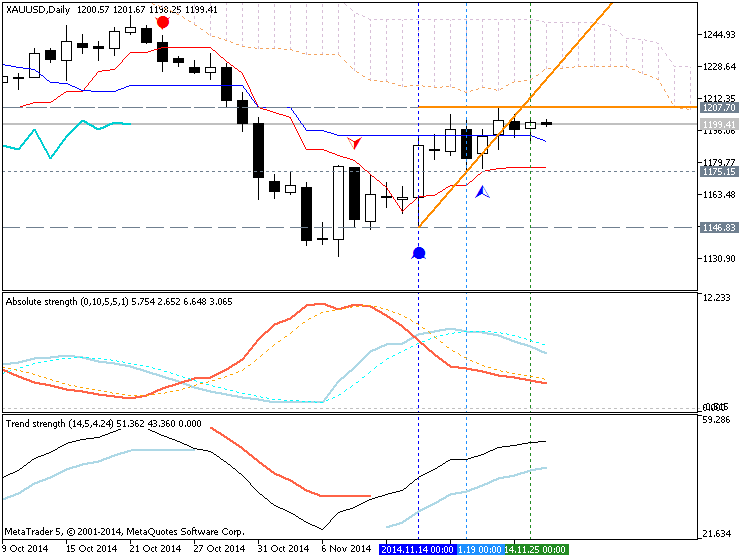

XAU/USD Daily Chart

- Will watch the November high (1.2599) as EUR/USD holds above the monthly low (1.2356).

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

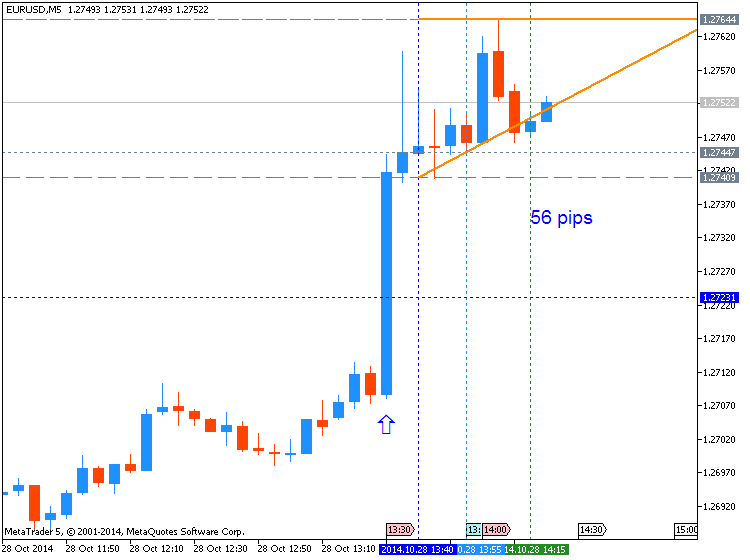

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 |

10/28/2014 12:30 GMT | 0.5% | -1.3% | + 42 | + 27 |

September 2014 U.S. Durable Goods Orders

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event:

Demand for U.S. Durable Goods slipped another 1.3% in September

following the record 18.3% contraction the month prior. Orders for

non-defense capital goods excluding aircraft, a proxy future business

investments, also fell 1.7% during the same period. The persistent

weakness in demand for large-ticket items may further dampen the outlook

for global growthamid the weakening outlook for Europe and China. The

greenback struggled to hold its ground following the worse-than-expected

print, with EUR/USD climbing above the 1.2750 handle, but there was

limited follow-through behind the market reaction as the pair closed at

1.2734.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.27 09:17

Why Gold and Silver Are at an Important 'Make-or-Break' Point

Gold and silver have been some of the worst performing markets in the past few years. After experiencing a parabolic surge in 2011, precious metals, along with other commodities, have been in a steady downtrend as the Fed continues its march toward tighter monetary policy as the economy shows continued growth. The U.S. dollar’s sharp rally since the summer also contributed to gold and silver’s punishment, while lower oil prices have further weakened the case for inflation hedges.

fter experiencing a major technical breakdown one month ago when gold dropped below its long-held $1,200 support level, precious metals have been in a holding pattern as they wait for a catalyst to cause either a bearish follow-through move or a reversal of the breakdown signals. Gold is currently sitting right underneath its key $1,200 resistance level that it has attempted to break above several times in the past week to no avail.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.28 06:11

Ed Moy: World entering era of greater gold transparency (based on mining.com article)

Edmund C Moy, former US Mint Director and senior aide to President George W Bush, recently joined gold-backed IRA provider Fortress Gold Group as chief strategist.

In this interview with MINING.com, Moy discusses growing demand from Asia, paper versus physical markets in gold, the changing central bank landscape and argues that the clamor from citizens for greater transparency about official gold holdings would only grow.

“India and China are asking why have we never headed up the IMF or the World Bank? Why is the price of gold fixed in London?

The

long term trend with central banks becoming net purchasers is a push

from Asian countries to take up their rightful place in the global

financial system and reject Western dominance. Accumulating gold is a

way of readying themselves for a post-dollar world.”

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with secondary market rally:

W1 price is on primary bearish with ranging between 1131.93 support and 1255.10 resistance levels.

MN price is on bearish market condition for trying to break 1161.17 support for the bearish to be continuing.

If D1 price will break 1204.43 resistance level so the secondary rally within primary bearish will be continuing

If D1 price will break 1146.10 support level so the primary bearish will be continuing

If not so we may see the ranging within bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2014-11-24 14:45 GMT (or 16:45 MQ MT5 time) | [USD - Services PMI]

2014-11-25 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]

2014-11-26 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - GDP]

2014-11-26 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-11-28 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - Unemployment Rate]

2014-11-28 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movementSUMMARY : bearish

TREND : ranging