Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.07 18:17

Forex Weekly Outlook November 10-14UK jobs data, Inflation report followed by Mark Carney’s speech, US Unemployment Claims, Retail sales and consumer confidence are the major market movers for this week. Here is an outlook on the highlight events.

Last week, the October Non-Farm Payrolls release was mixed with a lower than expected jobs gain of 214K compared to 256K in the previous month, while Unemployment reached the lowest level since July 2008 with a 5.8% rate, beating estimates for a 5.9%. Overall the report stayed positive backing the Fed’s decision to end its massive bond-buying program aimed to stimulate the economy. However, the job market participation rate increased mildly to 62.8% from 62.7% in September, remaining at its lowest level in nearly four decades, taking some shine away from the official NFP report.

- UK Employment data: Wednesday, 8:30. Britain’s labor market continues to recover at a slower pace. The unemployment rate fell more than expected in the three months to August reaching 6.0%. The number of jobless claims declined by 18,600 in September, following a 37,200 contraction in the previous month. Analysts expected a higher figure of 34,200. Furthermore, wage growth lags behind inflation having negative effects on living standards and job creation posted the weakest rise since the spring of last year. The number of jobless claims in Britain declined by 24,900 in October.

- Mark Carney speaks: Wednesday, 9:30. BOE Governor Mark Carney will speak about the Inflation Report in London. Carney stated in September that the BoE will start raising rates next spring, if the labor market continues to improve. However in case inflation risks build up, the bank will act to contain excess pressures. Market volatility is expected.

- UK BOE Inflation Report: Wednesday, 9:30. The Inflation Report released in August, the Bank raised its 2014 growth forecast to 3.5% from 3.4% amid continuous improvement in the labor market. However wage growth projections declined 1.25% below inflation levels. Rate hikes are likely to be gradual and limited due to the slowdown in recovery and poor wage growth.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined further last week, reaching 278,000 from 288,000 in the prior week. The reading was better than the 285,000 figure forecasted by analysts, indicating the US job market continues to strengthen boosting consumer confidence. US jobless claims is expected to reach 282,000 this week.

- US Retail sales: Friday, 12:30. Retail sales declined 0.3% in September amid lower spending after a 0.6% gain in the previous month. Economists projected a minor drop of 0.1%. Sales declined at automobiles, furniture, building-supply outlets and clothing merchants. The lack of substantial wage gains limited consumer spending. The manufacturing sector weakened along with concerns of slower global growth. Meantime, retail sales excluding volatile categories such as food services, auto dealers, home-improvement stores and service stations declined 0.2%, the first drop since January, after increasing 0.4% in the prior month. Economists expected a 0.2% gain. Both retail sales and Core sales are expected to gain 0.2% in October.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. U.S. consumer sentiment edged up in October to 86.4, the highest in more than seven years, amid positive response on personal finances and the national economy. This 1.8 point rise was better than the 84.3 forecasted by economists. The survey’s one-year inflation expectation declined to 2.8 from 3.0, while five-to-10-year inflation remained at 2.8. U.S. consumer confidence is expected to increase further to 87.3 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.10 11:52

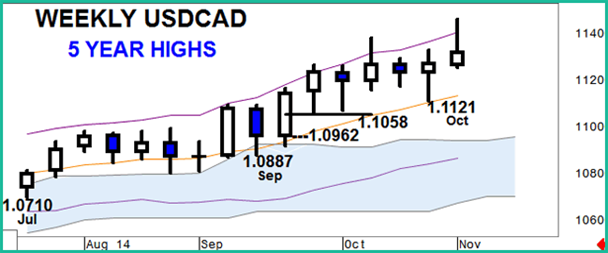

Keltner channels lead USDCAD higher (based on tradingfloor article)

Initial demand took USDCAD to the most positive levels traded for five

years last week. Although last week ended with some sharp profit taking,

a second positive weekly performance in a row, bullish daily and weekly

Keltner channels and the support of the 13-day moving average keep the

focus on the topside.

Entry: 1.1225/35 area and dip to 1.1267.

Stop: 1.1220 offered.

Target: 1.1400 and 1.1468.

Time horizon: This week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.11 05:58

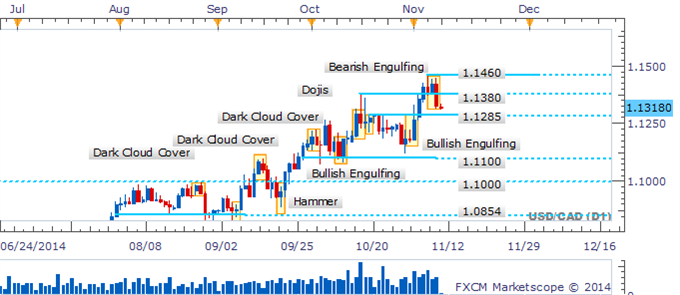

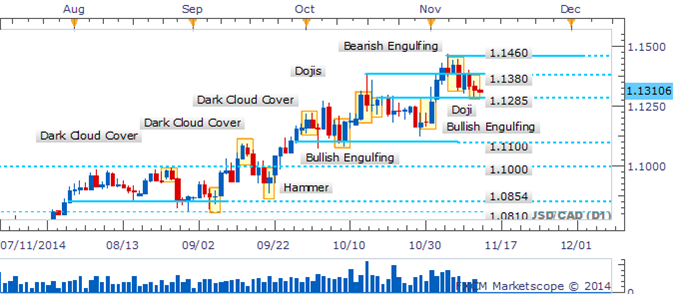

USD/CAD Sharp Pullback Produces A Bearish Engulfing Formation (based on dailyfx article)

- Strategy: Flat

- Bearish Pattern Emerges After Sharp Pullback

- Dojis In Intraday Trade Signal Indecision

USD/CAD has retreated back below the former 1.1380 peak, leaving behind a Bearish Engulfing formation.

Similar pullbacks have proven shallow in the past and the latest dip

may prove no different. Buyers may look to step up at former

resistance-turned-support at the 1.1285 mark.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.12 05:16

USD/CAD Technical Analysis: Digesting Losses Above 1.13 (based on dailyfx article)

- USD/CAD Technical Strategy: Flat

- Support: 1.1311, 1.1215, 1.1138

- Resistance: 1.1395, 1.1454, 1.1550

The US Dollar is digesting losses above the 1.13 figure against its Canadian namesake having run into resistance below the 1.15 mark. Near-term support is at 1.1311, the 23.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 1.1215-47 area (38.2% level, rising trend line). Alternatively, a reversal above the 14.6% Fib expansion at 1.1395 clears the way for a test of the 23.6% threshold at 1.1454.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.12 16:50

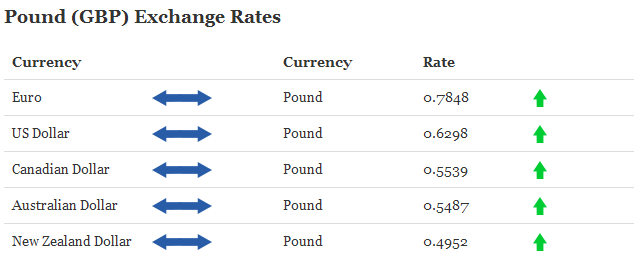

GBP/CAD, USD/CAD Exchange Rates Bearish after BoE Inflation Report (based on futurecurrencyforecast article)

The Pound to Canadian Dollar (GBP/CAD) exchange rate has softened after a mixed day for UK data. In addition, the US Dollar to Canadian Dollar (USD/CAD) currency pair also recorded losses as the ‘Buck’ pauses in its recent rally.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.13 09:08

USD/CAD Bears Lose Confidence As A Doji Emerges (adapted from dailyfx article)

- Strategy: Flat, Long On Close > 1.1460

- Doji Suggests Indecision From Traders Near 1.1280

- Morning Star Formation Awaiting Confirmation

USD/CAD has posted a Doji on the daily, which signals reluctance from the bears to drag the pair lower. With a medium-term uptrend intact the latest pullback could prove transitory. Clearance of former support-turned-resistance at 1.1380 may open a retest of the recent peak at 1.1460.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.14 07:59

USD/CAD Technical Analysis: Treading Water Above 1.13 (based on dailyfx article)

Talking Points:

- USD/CAD Technical Strategy: Flat

- Support: 1.1311, 1.1262, 1.1215

- Resistance: 1.1435, 1.1531, 1.1608

The US Dollar

is digesting losses above the 1.13 figure against its Canadian namesake

having run into resistance below the 1.15 mark. Near-term support is at

1.1311, the 23.6% Fibonacci retracement, with a break below that on a

daily closing basis exposing a rising trend line at 1.1262.

Alternatively, a reversal above the 23.6% Fib expansion at 1.1435 clears

the way for a test of the 38.2% threshold at 1.1531.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish with secondary correction started on open D1 bar with trendline which is ready to be crossed from above to below..

H4 price is on secondary correction with primary bullish market condition:

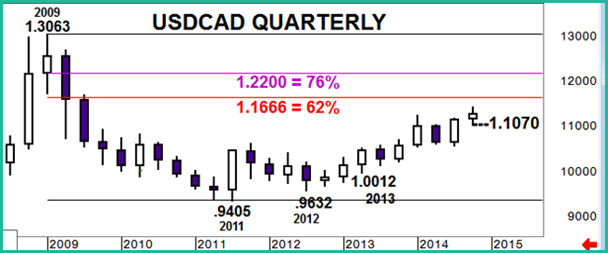

W1 price is on primary bullish with 1.1385 resistance level.

MN price: the bar was opened and closed above Ichimoku cloud/kumo it was reversed from ranging to the bullisgh market condition with 1.1385 as the nearest resistance level.

If D1 price will break 1.1466 resistance level so the primary bullish will be continuing (good to open buy trade for example)

If not so we may see the ranging or correction within bullish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-11-10 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - CPI]

2014-11-10 13:15 GMT (or 14:15 MQ MT5 time) | [CAD - Housing Starts]

2014-11-12 16:25 GMT (or 17:25 MQ MT5 time) | [CAD - Gov Council Member Schembri Speech]

2014-11-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Industrial Production]

2014-11-13 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - NHPI]

2014-11-13 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-11-13 15:30 GMT (or 16:30 MQ MT5 time) | [CAD - BOC Review]

2014-11-13 20:05 GMT (or 21:05 MQ MT5 time) | [CAD - Gov Council Member Wilkins Speech]

2014-11-14 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

2014-11-14 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-11-14 14:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movementSUMMARY : bullish

TREND : ranging

Intraday Chart