You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.06 09:58

Trading the News: European Central Bank (ECB) Interest Rate Decision (adapted from dailyfx article)

The EUR/USD may face another selloff in the days ahead should the European Central Bank (ECB) adopt a more dovish tone and offer additional monetary support to prop up the ailing economy.

What’s Expected:

Why Is This Event Important:

The ECB may take a more aggressive approach in expanding its balance-sheet amid the growing threat for deflation, but we may see a relief rally in the EUR/USD should the Governing Council merely make an attempt to buy more time.

Nevertheless, ECB President Mario Draghi may promote a wait-and-see approach as the central bank continues to assess the impact of the non-standard measures, and the Euro may face a more meaningful rebound in the days ahead if we see more of the same from the Governing Council’s October 2 meeting.

How To Trade This Event Risk

Bearish EUR Trade: Governing Council Shows Greater Willingness to Implement More Easing

- Need red, five-minute candle following the updated forward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: ECB Attempts to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

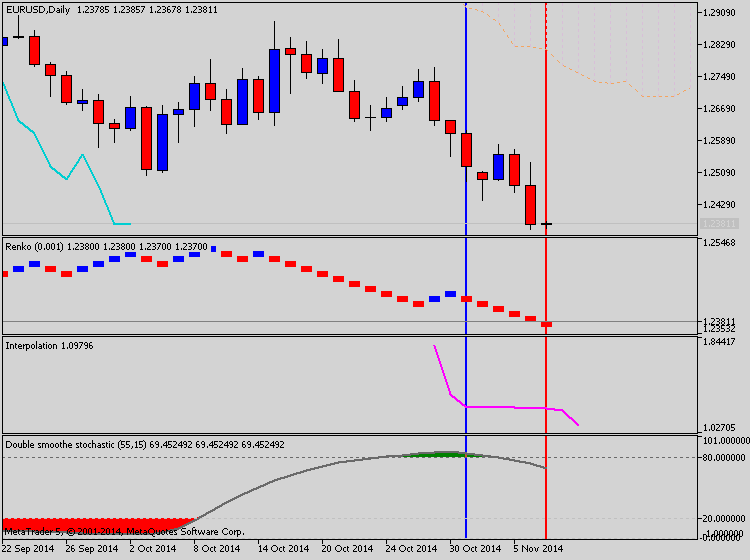

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Despite the range-bound price action in EUR/USD, the

long-term outlook remains bearish as the RSI retains the downward

momentum carried over from the previous year.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2620 (50.0% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2470 (78.6% expansion)

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.06 15:00

2014-11-06 13:30 GMT (or 14:30 MQ MT5 time) | [EUR - ECB Press Conference][EUR - ECB Press Conference] = The press conference is about an hour long and has 2 parts - first a prepared statement is read, then the conference is open to press questions. The questions often lead to unscripted answers that create heavy market volatility. The press conference is webcasted on the ECB website with a slight delay from real-time. It's the primary method the ECB uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, such as the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy

==========

"We will also soon start to purchase asset-backed securities. The programmes will last for at least two years. Together with the series of targeted longer-term refinancing operations to be conducted until June 2016, these asset purchases will have a sizeable impact on our balance sheet, which is expected to move towards the dimensions it had at the beginning of 2012.Our measures will enhance the functioning of the monetary policy transmission mechanism, support financing conditions in the euro area, facilitate credit provision to the real economy and generate positive spillovers to other markets. They will thereby further ease the monetary policy stance more broadly, support our forward guidance on the key ECB interest rates and reinforce the fact that there are significant and increasing differences in the monetary policy cycle between major advanced economies.

With the measures that have been put in place, monetary policy has responded to the outlook for low inflation, a weakening growth momentum and continued subdued monetary and credit dynamics. Our accommodative monetary policy stance will underpin the firm anchoring of medium to long-term inflation expectations, in line with our aim of achieving inflation rates below, but close to, 2%. As they work their way through to the economy, our monetary policy measures will together contribute to a return of inflation rates to levels closer to our aim.

However, looking ahead, and taking into account new information and analysis, the Governing Council will closely monitor and continuously assess the appropriateness of its monetary policy stance. Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate. The Governing Council has tasked ECB staff and the relevant Eurosystem committees with ensuring the timely preparation of further measures to be implemented, if needed."

==========

EURUSD M5: 126 pips price movement by EUR - ECB Press Conference news eventForum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.07 07:30

EUR/USD Drops to 1.2380 on Draghi’s Stimulus Pledge (based on marketpulse article)

The euro fell to a more than two-year low as European Central Bank President Mario Draghi deepened his commitment to stimulus and signaled policy makers are ready to implement additional measures if needed.

Europe’s shared currency dropped for the first time in six days versus the yen as Draghi told reporters in Frankfurt that the central bank’s bond-buying program will last at least two years and, together with targeted loans, move its balance sheet toward early-2012 levels. The pound weakened to a 14-month low as the Bank of England left interest rates unchanged. The dollar rose to its highest since April 2009 before jobs data tomorrow. Russia’s ruble slid.

“Draghi’s trying to prepare the market for what he sees as a very likely expanded program of quantitative easing, maybe not in size but in terms of the assets purchased,” said Collin Crownover, the head of currency management at State Street Global Advisors Inc. “The fall in the euro, while not massive in historical terms, has been pretty significant. I think we drift a little bit lower but I think we’ll struggle to touch $1.20 this year.”

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.07 12:21

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may generate a further decline in the EUR/USD as market participants anticipate a pickup in job growth.

What’s Expected:

Why Is This Event Important:

At the same time, Average Hourly Earnings are also expected to uptick to an annualized 2.1% from 2.0% in September, and stronger employment paired with growing wage pressures should heighten the bullish sentiment surrounding the greenback especially as the Federal Open Market Committee (FOMC) moves away from its easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFPs Exceed Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job/Wage Growth Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

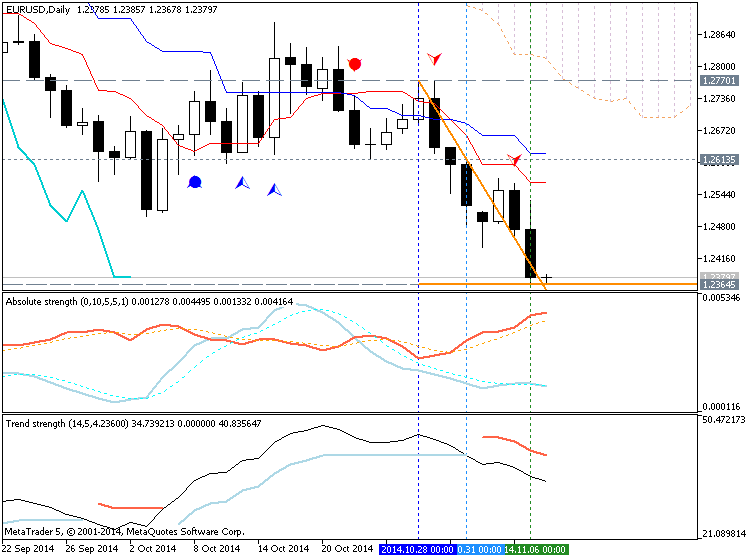

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will continue to look for lower highs/lows as the RSI retains the bearish momentum carried over from the end of 2013.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2625 (61.8% expansion)

- Interim Support: 1.2290 (100% expansion) to 1.2320 (38.2% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

September 2014 U.S. Non-Farm Payrolls

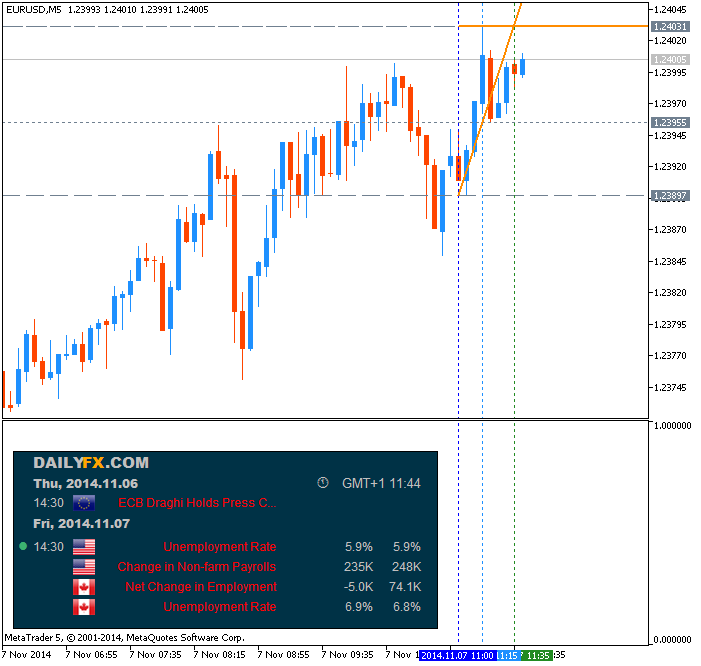

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.11.07

EURUSD M5: 83 pips pips range price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.08 09:35

Trading Video: Next EURUSD, USDJPY and SPX Moves Require Greater Conviction (based on dailyfx article)