Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.25 10:39

Forex Weekly Outlook October 27-31German Ifo Business Climate, US Core Durable Goods Orders, CB Consumer Confidence, FOMC Statement and rate decision, US and Canadian GDP data, US Unemployment Claims, Fed Chair Yellen’s speech. These are a few of the larger events on our calendar for this week. Follow along as we explore the Forex market movers.

Last week, US data continued to surprise with a better than expected headline CPI rising 1.7% on a yearly base and 0.1% monthly in September while core CPI remained unchanged. Furthermore US unemployment claims increased to 283K but remained below 300,000 for a sixth straight week and he four-week moving average declined to its lowest level since May 2000. Will the strong US data continue despite the global slowdown trend?

- Eurozone German Ifo Business Climate: Monday, 9:00. German business climate index, based on a monthly survey of about 7,000 responders, declined in September to 104.7 from 106.3 posted in August. Economists expected a higher reading of 105.9. Sentiment worsened across the board amid the prolonged crisis in Ukraine impacting more than 6,000 German firms and the weak recovery in the Eurozone economy. Nevertheless, the German Bundesbank forecasted a positive end to the year despite the recent slowdown. German business sentiment is expected to reach 104.6 this time.

- US Core Durable Goods Orders: Tuesday, 12:30. US durable goods orders plunged in August due to volatility in aircraft orders. Orders dropped 18.2% after a strong rise of 22.6% in July. However the overall growth trend remained strong. Meantime, Core orders excluding transportation advanced by 0.7% in August after a 0.8% decline in the previous month. Core orders reflect the true trend, rising 17.2% in the three months to August. The rise in orders is also reflected by the constant improvement in the US job market with fewer layoffs and increase hiring. Durable goods orders are projected to gain 0.4% , while Core durable goods orders are expected to increase by 0.5%.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence worsened in September, falling to 86 from 93.4 in the prior month. Economists expected a milder decline to 92.2. The strong decline may be explained by less favorable assessments of the current job market condition. Consumers expected economic growth to stall in the following months ahead. The outlook index declined to 83.7 from a revised 93.1 reading, while the present conditions index fell to 89.4 from a revised 93.9.

- US FOMC Statement: Wednesday, 0:00. The Fed maintained interest rates and reduced its QE program by $10 billion as expected. The Federal Reserve made a hawkish statement that the period between the end of the QE program and the Fed’s first rate hike will take “Considerable time”. The Federal Reserve also released its latest Summary of Economic Projections, which shows stronger projections for rate hikes over the long run. Regarding the labor market, conditions have improved further. The Fed believes economic conditions are not sufficient for a rate hike.

- NZ rate decision: Wednesday, 20:00. The Reserve Bank of New Zealand kept the official cash rate at 3.5%. Governor Graeme Wheeler stated he won’t rush to raise rates as previously thought, since inflation remains contained. Wheeler also signaled a pause in the bank’s current tightening measures, indicating the bank needs to measure the impact of the four rate hikes this year. The policy statement projects slower inflation by the end of 2015. Rates are expected to remain unchanged at 3.5%.

- US GDP data: Thursday, 12:30. The third estimate of real gross domestic product release for the second quarter showed an annual rate expansion of 4.6%, following June’s estimate of 4.2%. The 4.6% growth in real GDP showed growing personal consumption, private inventory investment, exports, as well as local government spending. The gains were partially offset by a rise in imports, and a 0.9% decline in federal government expenditures. Personal consumption increased but the main growth force was fixed business investments expanding 9.7%. The BEA expected second quarter corporate profits increased $164.1 billion, compared to a $201.7 billion decrease in the first quarter. 3.1%

- US Unemployment Claims: Thursday, 12:30. The number of new claims for U.S. unemployment benefits rose by 17,000 last week to 283,000. Despite the rise, the number of claims remained below 300,000 for a sixth straight week, indicating the US job market continues to strengthen in spite of a global slowdown trend. The four-week moving average fell to its lowest level since May 2000. However, the slowdown trend in major countries is starting to impact the US manufacturing sector. The number of jobless claims is expected to decline to 277,000 this time.

- Janet Yellen speaks: Thursday, 13:00. Federal Reserve Chair Janet Yellen will speak in Washington DC. Yellen may address the rate hike issue amid continued U.S. economic growth and strengthening in the US labor market. Likewise the Fed Chair may discuss the global slowdown trend which may affect the US economy in the coming months.

- Japan rate decision: Friday. The Bank of Japan kept monetary policy unchanged at its October meeting. The Bank also unanimously decided to prolong its money market operations to raise the monetary base to an annual pace of between JPY 60 and 70 trillion and reach a 2.0% inflation rate. The central bank was more pessimistic regarding economic conditions, despite stating that the economy is continuing to recover moderately as a trend. Regarding global developments, the BOJ sees a downside risk in the pace of recovery in the US and the unclear state of the Eurozone economy.

- Canadian GDP: Friday, 12:30. Canada’s economy did now grow in July, from the previous month due to a slowdown in the mining, and oil and gas industries offset by a rise in manufacturing and the public sector. Mining, oil and gas industries contracted by 1.5% in July. Manufacturing expanded by 1% and the public sector by 0.5%. Economists expected a minor growth of 0.2%. This sluggish growth suggests the BOC will be on no hurry to raise rates anytime soon.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.27 19:46

2014-10-27 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Pending Home Sales]- past data is -1.0%

- forecast data is 1.1%

- actual data is 0.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Pending Home Sales] = Change in the number of homes under contract to be sold but still awaiting the closing transaction, excluding new construction.

==========

U.S. Pending Home Sales Show Modest Rebound In September

After reporting a notable pullback in U.S. pending home sales in the previous month, the National Association of Realtors released a report on Monday showing a modest rebound in pending sales in the month of September.

NAR said its pending home sales index inched up by 0.3 percent to 105.0 in September after falling by 1.0 percent to 104.7 in August. Economists had been expecting pending home sales to increase by about 0.5 percent.

A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale.

With the modest monthly increase, the pending home sales index is up by 1.0 percent compared to September of 2013, reflecting the first year-over-year increase in eleven months.

Lawrence Yun, NAR chief economist, said moderating price growth and sustained inventory levels are keeping conditions favorable for buyers.

"Housing supply for existing homes was up in September 6 percent from a year ago, which is preventing prices from rising at the accelerated clip seen earlier this year," Yun said. "Additionally, the current spectacularly low mortgage rates should help more buyers reach the market."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 37 pips price movement by USD - Pending Home Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.28 06:30

Strategy Video: Volatility Underpricing FOMC Risk Suggests Explosive Markets Ahead

- Implied (expected) volatility traditionally builds into high profile events

- Volatility measures for equities and FX are surprisingly tepid heading into the Oct 30 FOMC meeting

- Considering risk trends have been unseated and market forecasts are so dovish, the market looks unprepared

Heading into major event risk, we typically see expectations for

volatility and the cost of hedges rise. Yet, as we close in on

Wednesday's FOMC decision; we find the anticipation for market reaction

is surprisingly stoic. Not only are activity levels generally higher now

than they have been in past months; but the forecasts for the central

bank's bearings have grown increasingly extreme towards the dovish view -

at the same time the market grows increasingly aware of its dependency

on temporary global stimulus. This disparity in impending event and the

market's position reflects a similar type of mispricing to traditional

scenario analysis. Yet, here, the result is greater volatility.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.28 14:19

2014-10-28 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Durable Goods Orders]- past data is -18.4%

- forecast data is 0.4%

- actual data is -1.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods. t's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders;

==========

U.S. Durable Goods Orders Show Unexpected Decrease In September

New orders for U.S. manufactured durable goods unexpectedly showed a notable decrease in the month of September, according to a report released by the Commerce Department on Tuesday, with orders extending the steep drop seen in August.

The report said durable goods orders fell by 1.3 percent in September after plunging by 18.3 percent in August. The continued decrease came as a surprise to economists, who had expected orders to increase by about 0.5 percent.

Excluding orders for transportation equipment, durable goods orders fell by a more modest 0.2 percent in September compared to a 0.7 percent increase in the previous month. Economists had also expected ex-transportation orders to climb by 0.5 percent.

MetaTrader Trading Platform Screenshots

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.28 17:16

Forex technical trading (VIDEO): Keeping the EURUSD buyers in control (October 28th, 2014).

The EURUSD has been able to move higher in trading on Monday after

finding support above a low from November 2012, the 100 hour MA and the

38.2% of the move down from last week.|

Traders will be eyeing these levels in the new trading day, to see if

what was broken can remain broken – keeping the buyers in control.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.29 05:34

Video: EURUSD, GBPUSD and USDJPY Trade Potential on FOMC

- While the upcoming Fed decision is top billing, there is a lot of event risk moving forward

- Relative monetary policy and general 'risk trends' remain a key delineation of fundamental trading

- EURUSD, USDJPY and GBPUSD offer decisive trade opportunity for different outcomes and themes

If the FOMC

decision significantly alters the Dollar's position in the monetary

policy ranks, what pair is best positioned for the change? What trades

are primed for a significant 'risk' response to the central bank's

actions? The upcoming monetary policy decision holds significant sway

over both immediate volatility levels as well as big-picture fundamental

trends. Against a backdrop of surprisingly low volatility readings, a

tremendous rebound in equities and a stubborn US Dollar

position; there are heavy biases and plenty of opportunity. These

different facets position GBPUSD as a favored relative yield setup,

USDJPY as a key 'risk' trade and EURUSD a balance of both worlds. We

look discuss these pairs, the FOMC rate decision and other event risk

ahead in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.26 10:23

EUR/USD forecast for the week of October 27, 2014, Technical AnalysisThe EUR/USD pair initially tried to rally during the course of the week, but the 1.28 level offered enough resistance yet again to push the market back down and form a negative candle. That being the case, the market should continue to go much lower, perhaps testing the 1.25 level. That area, if we break through it will have a significant effect on this marketplace as it should push the Euro much lower. We have no interest in buying until we get above the 1.30 handle, as it would show a significant uptick in positive momentum.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.29 19:43

2014-10-29 18:00 GMT (or 19:00 MQ MT5 time) | [USD - Federal Funds Rate]- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

Federal Reserve calls end to QE3 - Full Text of the Fed’s Statement

The US Federal Reserve has announced the formal conclusion of its latest bond-buying program, commonly referred to as QE3, while reaffirming plans to hold interest rates at current levels for a "considerable time".

The US central bank said it would make a final $US15 billion taper to its quantitative easing program from next month, concluding a 10-month process that has seen it gradually reduce its bond buying from $US85 billion.

The widely expected move came at the end of a two-day meeting of the Fed’s policy-setting Federal Open Market Committee (FOMC), with market eyes now shifting to the central bank’s view on the US economy and outlook for rate hikes.

“The committee judges that there has been a substantial improvement in the outlook for the labour market since the inception of its current asset purchase program,” the Fed’s statement read.

“Moreover, the committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability.

“Accordingly, the committee decided to conclude its asset purchase program this month.”

“The committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 0.25 per cent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month,” the Fed advised.

“However, if incoming information indicates faster progress toward the committee's employment and inflation objectives than the committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated.

“Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.”

The Janet Yellen-led central bank noted that the US economy had expanded at a "moderate" pace since its last meeting in mid-September, while the underutilisation of labour resources was "gradually diminsihing" and long-term inflation expectations remained "stable".

==========

Here is the full text of the Federal Reserve’s policy statement.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 97 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.30 05:23

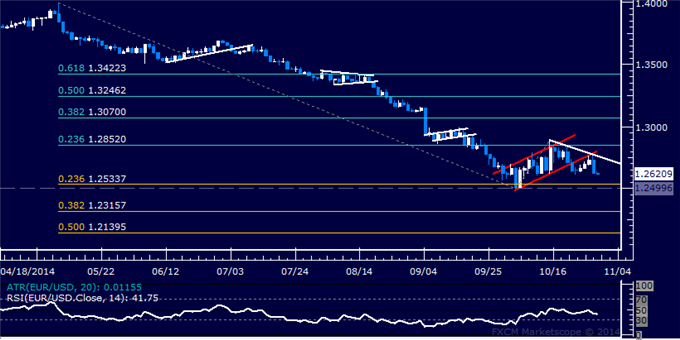

EUR/USD Technical Analysis: Short Trade Making Progress (based on dailyfx article)

- EUR/USD Technical Strategy: Short at 1.2710

- Support: 1.2500, 1.2316, 1.2140

- Resistance:1.2759, 1.2852, 1.3070

The Euro

looks to be resuming its down trend resumption following the completion

of a Flag chart formation. Near-term support is in the 1.2500-34 area,

marked by the October 3 low and the 23.6% Fibonacci expansion, with a

daily close below that exposing the 38.2% level at 1.2316.

Alternatively, a reversal above trend line resistance at 1.2759 opens

the door for a test of the 23.6% Fib retracement at 1.2852.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish ranging between 1.2613 support and 1.2886 resistance levels.

H4 price is on bearish ranging between 1.2630 support and 1.2695 resistance.

W1 price is on bearish with market rally just started for the second week from now with 1.2500 as a key support level.

MN price: bearish - Chinkou Span line is crossing the price on open bar together with 1.2571 support level which is ready to be broken on open bar too. If Chinkou Span line will break MN price from above to below on close monthly bar so we may see the bearish market condition for this pair for the next months of this and next year. I just hope it will not be start on this November.

If D1 price will break 1.2613 support level so the primary bearish will be continuing (good to open sell trade for example)

If D1 price will break 1.2886 resistance - we may see the secondary market rally inside primary bearish (good to counter-trend trading systems)

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-10-27 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-10-27 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-10-28 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-10-28 14:00 GMT (or 15:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-10-29 18:00 GMT (or 19:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-10-30 12:30 GMT (or 13:30 MQ MT5 time) | [USD - GDP]

2014-10-30 13:00 GMT (or 15:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-10-31 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-10-31 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PCE Price Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart