Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.06 06:58

Will the EURUSD continue to fall?

Technical Analysis (October 6, 2014). The EURUSD tumbled to support

after better than expected Non-Farm Payroll. Will the trend continue in

trading this week?

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.04 08:09

Forex Weekly Outlook October 6-10Rate decision in Japan and the UK, Employment data in Australia and Canada, US FOMC Meeting Minutes, US Unemployment Claims, Mario Draghi’s speech are the major market movers on FX calendar week. Here is an outlook on the top events coming our way.

Last week, US labor market top release showed a sharp gain of 248K new jobs in September, posting the lowest unemployment rate since 2008. These excellent figures reaffirm the strength in the US economy. The low job addition in August is regarded as a “blip” in the recovering labor market. The unemployment rate also surprised markets, falling to 5.9% from 6.1% in August and may prompt the Federal Reserve to raise rates sooner than estimated.

- Japan rate decision: Monday. The Bank of Japan (BOJ) maintained its monetary policy on its last meeting in September despite signs of weaker growth. The central bank kept its pledge to increase base money by 60-70 trillion yen, mostly in Japanese government bonds. It was suggested to turn the central bank’s 2 percent inflation target a medium-to-long-term goal was denied by an 8-1 vote. The BOJ expects the moderate recovery will continue since domestic demand remains strong. Inflation is improving but is still way behind the 2% inflation target, projected to reach this goal in 2016, rather than next year.

- Australian rate decision: Tuesday, 3:30. The RBA kept the cash rate on hold for the thirteenth consecutive month in line with market forecast, amid positive financial conditions. Inflation remains within the Central Bank’s 2-3 per cent target. Volatility in many financial prices remains low. These positive signs suggest the next rate hike will occur only in mid-2015. The number of loan applications in the housing market grew rapidly with a 40% rise in the number of loans for new properties and a 15% increase in construction loans.

- US FOMC Meeting Minutes: Wednesday, 18:00. The Fed minutes released in August showed that the economy is acting in accordance with the Fed goals of unemployment and inflation. The unemployment rate declined, but many FOMC participants suggested labor market slack as suggested by sluggish wage rates. Inflation is expected to remain around the 2% target. The FOMC will raise rates in case the economy continues to expand. Overall, the Fed is expected to increase rates sooner than earlier believed.

- Australian employment data: Wednesday, 0:30. Australia’s unemployment rate declined to 6.1% in August from a 12-year high of 6.4% in July. This unexpected decline occurred due to a large addition of 121,000 jobs that month after a 4,000 contraction in July. Economists expected the unemployment rate to decline to 6.3 with a job addition of 15,200. The Reserve Bank governor, Glenn Stevens, noted unemployment is still high, but a rate cut is not expected on the coming months. The economy is expected to add 29,600 new jobs while the unemployment rate is expected to rise to 6.2%.

- UK rate decision: Thursday, 11:00. The Bank of England has left UK interest rates at a record low of 0.5% in September, living the Bank’s economic stimulus program at £375 billion. Interest rates were unchanged for five years but are expected to rise early next year due to a growth trend in the UK economy. Nevertheless, Bank governor Mark Carney has stated that any rate rises would be small and gradual. Economists believe a rate hike will hurt households and businesses since wage growth is slow.

- US Unemployment Claims: Thursday, 12:30. The number of new claims for U.S. unemployment benefits declined by 8,000 last week to a seasonally adjusted 287,000, pushing down the total number of beneficiaries to the lowest level in more than eight years. The four-week average fell 4,250 to 294,750. The upward trend in economic activity means fewer layoffs as employers expect continued economic growth. Based off the four-week average for jobless claims, monthly job growth should be close 250,000. The number of new claims is expected to rise to 291,000.

- Mario Draghi speaks: Thursday, 15:00. ECB President Mario Draghi is scheduled to speak at the Brookings Institution, in Washington DC. He may discuss the recently declared ECB bond buying program and his goal to stimulate bank to lend more to European companies and consumers.

- Canadian employment data: Friday, 12:30. The Canadian job market contracted by 11,000 positions in August following a 41,700 addition in July, but the unemployment rate remained unchanged at 7%. Economists expected a job growth of 10,000. Declines were registered both full-time and part-time positions. The number of private sector employees decreased in August, while self-employment rose. The Canadian job market is expected to shed 11,000 jobs this time, while the unemployment rate is predicted to remain unchanged at 7%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.07 07:14

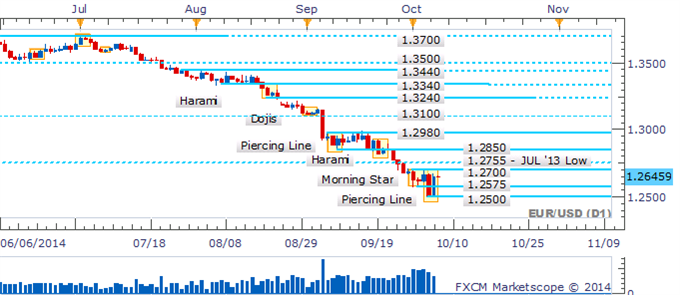

EUR/USD Technical Analysis: Floor Set at 1.25 Threshold?

- EUR/USD Technical Strategy: Short at 1.3644

- Support: 1.2500, 1.2377, 1.2278

- Resistance:1.2703, 1.2777, 1.2848

The Euro may be readying a rebound against the US Dollar

after prices put in a bullish Piercing Line candlestick pattern. A

daily close above support-turned-resistance at 1.2703, the November 2012

bottom, exposes the March 2013 floor at 1.2777. Alternatively, a drop

below the 23.6% Fib expansion at 1.2500 clears the way for a challenge

of the 38.2% level at 1.2377.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.07 16:31

EUR/USD Scope For Recovery May Be Limited In Spite Of A Piercing Line (based on dailyfx article)

- EUR/USD Technical Strategy: Sidelines Preferred

- Piercing Line Pattern Awaits Confirmation Near 2014 Low

- Dojis On H4 Suggested Fading Downside Momentum

EUR/USD’s recent rebound has yielded a Piercing Line formation, yet some skepticism over a recovery is warranted. The pattern requires a successive up-day in order to be validated and to suggest a base may have formed. This may prove a difficult feat given the sustained presence of a downtrend and the sellers still sitting nearby at the 1.2700 handle. Further, the Euro’s path lower over recent months has been littered with reversal signals that have failed to catalyze a recovery.

EUR/USD’s intraday recovery was preceded by a parade of Doji formations.

The candlesticks suggested hesitation by the bears to lead the pair

lower at the critical 1.2500 barrier. While an absence of reversal

signals leaves some doubt over a correction, the context on the daily

warns that scope for further gains may be limited.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.08 06:57

EURUSD and USDJPY - One Risks Correction, The Other Reversal

Normally, the media and market participants are hyping the risk of reversal or volatility. It seems they under-appreciate it today. Both the US Dollar and equity indexes are standing on the edge of important technical levels - a break from the greenbacks three-month trend and the floor of a S&P 500 channel that stretches back to the beginning of 2013. Symbolic breaks for either of these two can tip large fundamental imbalances to trigger deeper trends. What is the potential this pressure represents? Which faces the larger unwind? Why does the USDJPY appeal through more scenarios while the medium-term EURUSD outlook is bearish even if the greenback slips? We discuss these topics in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.09 07:03

EUR/USD Technical Analysis: Profits Booked on Short Position (based on dailyfx article)

The Euro recovered against US Dollar as expected

after putting in a bullish Piercing Line candlestick pattern. A daily

close above support-turned-resistance at 1.2777, the March 2013 bottom,

exposes the 38.2% Fibonacci retracement at 1.2848. Alternatively, a turn

below the 1.2703-15 area marked by the November 2012 floor and the

23.6% Fib clears the way for a challenge of trend line

resistance-turned-support at 1.2673.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.09 09:10

2014-10-09 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Trade Balance]- past data is -5.5B

- forecast data is -5.5B

- actual data is -5.8B according to the latest press release

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - French Trade Balance] = Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5 : 25 pips price movement by EUR - French Trade Balance news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish market condition for trying to break 1.2571 support level.

H4 price is on bearish as well after good breakdown of the price movement - if the price will break 1.2500 psychological level so this breakdown will be continuing (good to open sell trade).

W1 price is on bearish - 1.2676 support level was broken on close bar.

MN price: bearish - Chinkou Span line crossed the price on open bar together with 1.2571 support level to be broken on open bar too.

If D1 price will break 1.2571 support level so the primary bearish will be continuing.

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-10-06 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Factory Orders]

2014-10-07 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Industrial Production]

2014-10-07 17:20 GMT (or 19:20 MQ MT5 time) | [USD - FOMC Member Kocherlakota Speech]

2014-10-07 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2014-10-08 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-10-08 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-10-09 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

2014-10-09 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Trade Balance]

2014-10-09 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-10-09 15:00 GMT (or 17:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-10-10 13:00 GMT (or 15:00 MQ MT5 time) | [USD - FOMC Member Plosser Speech]

2014-10-10 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : bearish

Intraday Chart