Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.30 06:48

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

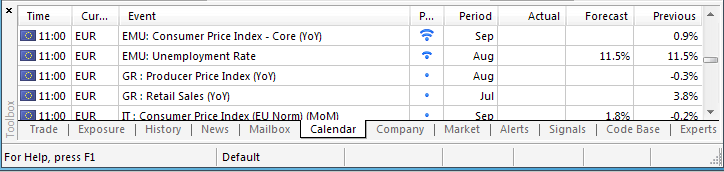

- Euro-Zone Consumer Price Index (CPI) to Mark the Slowest Pace of Growth Since October 2009.

- Core Inflation to Hold Steady at 0.9% for Second Straight Month.

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may prompt fresh monthly lows in the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to implement more non-standard measures.

What’s Expected:

Why Is This Event Important:

The ECB may continue to push monetary policy into uncharted territory as the Governing Council struggles to achieve its one and only mandate to deliver price stability, and the bearish sentiment surrounding the Euro may gather pace throughout the remainder of the year amid the weakening outlook for growth and inflation.

The persistent slack in the real economy may paint a weakened outlook for price growth, and a dismal CPI print may generate a bearish reaction in the EUR/USD should the report highlight a greater threat for deflation.

However, the unprecedented steps taken by the ECB may help to mitigate the downside risk for inflation, and a better-than-expected release may generate a more meaningful rebound in the Euro as it curbs bets of seeing a new wave of monetary support.

How To Trade This Event Risk

Bearish EUR Trade: Headline & Core CPI Highlight Greater Threat for Deflation

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

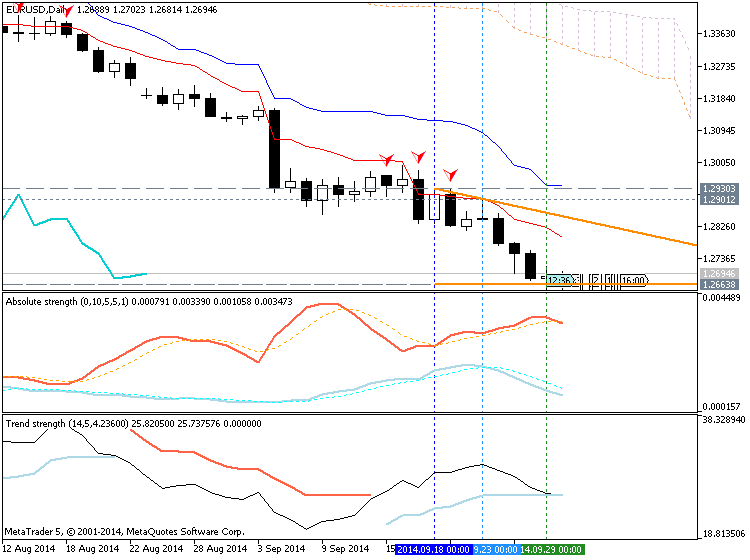

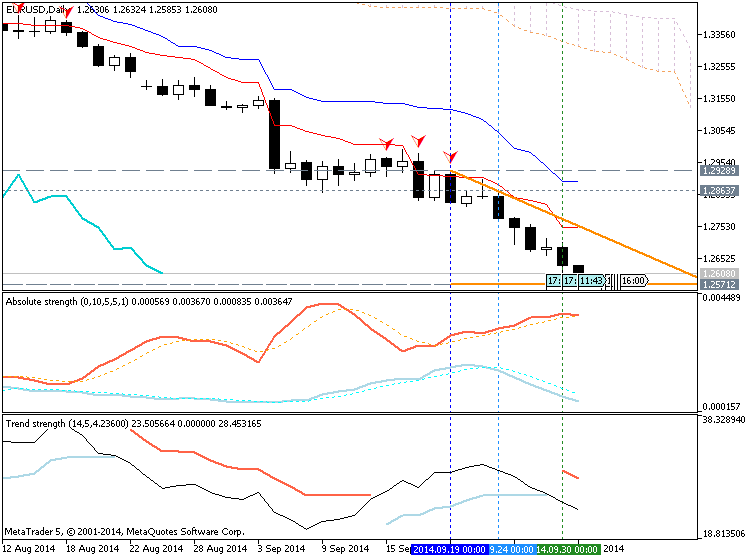

EUR/USD Daily

- Downside targets remain favored as RSI retains bearish momentum & pushes deeper into oversold territory

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2590 (100% expansion) to 1.2600 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 | 08/29/2014 9:00 GMT | 0.3% | 0.3% | -44 |

August 2014 Euro-Zone Consumer Price Index (CPI)

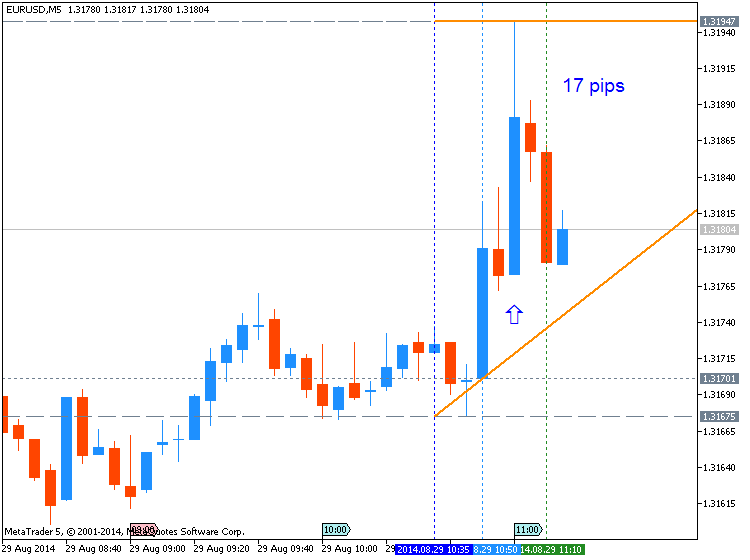

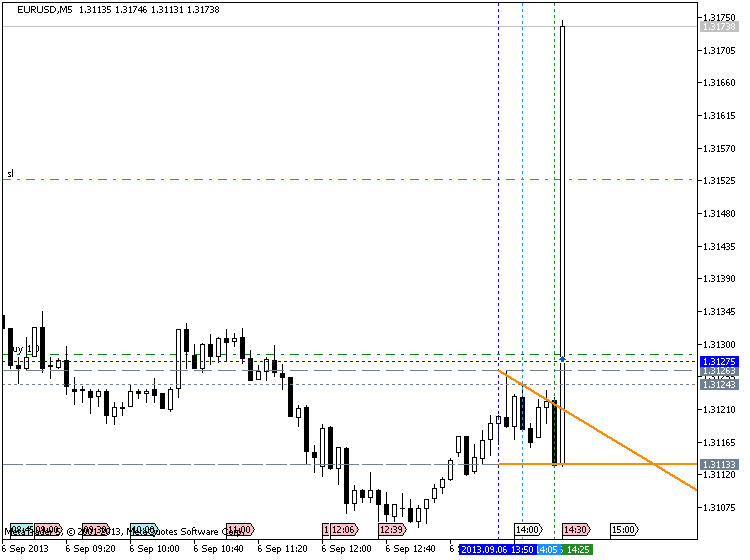

EURUSD M5 : 17 pips price movement by EUR - CPI news event:

The Euro-Zone’s annualized Consumer Price Index (CPI) continued the downward trend and slipped to a 5-year low of 0.3% from 0.4% the month prior, while the core inflation rate unexpectedly rose 0.9% during the same period amid forecasts for a 0.8% print. The ongoing weakness in price growth may put increased pressure on the European Central Bank (ECB) to implement its own quantitative easing program amid the growing threat for deflation. Nevertheless, the initial reaction in the EUR/USD was short-lived as the pair consolidated around 1.3182 following the release, but the euro-dollar came under increased pressure during the North American trade as it ended the day at 1.3133.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 68 pips price movement by EUR - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2014

newdigital, 2014.03.03 16:19

Boosting RSI with the Modified Inverse Fisher Transform (MIFT) - Part 1

Upside price action can be in sharp contrast to what is experienced to the downside. "The market goes down like an elevator but up like an escalator," as prices tend to fall faster than they rise. At the same time, technical indicators, such as the well-known Relative Strength Index (RSI), treat rising prices the same as falling prices. Adjusting the indicator distribution with the Modified Inverse Fisher Transform (MIFT) helps to account for those differences and provides new trading applications. This paper will introduce the TSLabs: Modified Inverse Fisher Transform custom indicator with practical examples to explore and apply in trading.

=======

The article : Applying The Fisher Transform and Inverse Fisher Transform to Markets Analysis in MetaTrader 5

=======

Indicators from MT5 CodeBase :

=======

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.09.01 21:06

This my post? red dotted lines are for possible sell stop trade, blue dotted lines are are possible buy stop ...

=============

Anyway - I just copied some latest summary from this thread :

=============

Market Condition Evaluation

story/thread was started from here/different thread

================================

Market condition

- the theory with examples (primary trend, secondary trend) - read staring from this post till this one

- Summary about market condition theory is on this post

- Practical examples about every market condition case by indicators: starting from this page till this one

- trendstrength_v2 indicator is here,

- AbsoluteStrength indicator new version is here

- AbsoluteStrength indicator old version is on this post

AbsoluteStrengthMarket indicator is here to download.

good feature in Metatrader 5: moving stop loss/take profit by mouse on the chart (video about howto) - Market condition setup (indicators and template) is here

================================

3 Stoch MaFibo trading system for M5 and M1 timeframe

- trading examples

- template to download

- explanation how to trade and more explanation here

- how to install

- 2stochm_v4 EA is on this post.

================================

PriceChannel ColorPar Ichi system.

================================

MaksiGen trading system

- indicator to download

- some explanation about the system in general how to use

- Trading examples with MT5 statement, more trading is here.

- Paramon trading system iis on this post; How to trade the system - manual trading with live examples - read this page.

================================

Merrill's patterns are on this page.

================================

Divergence - how to use, explanation and where to read about.

================================

Scalp_net trading system

- template/indicators and how to use are on this comment.

- scalp_net_v132_tf EA is on this post with optimization results/settings for EURUSD M5 timeframe

- possible settings #1 for this EA for EURUSD M5 timeframe with backtesting results is on this post.

================================

MTF systems

more to follow ...

================================

MA Channel Stochastic system is here.

================================

Ichimoku

- The theory of the signals

- Ichimoku alert indicator with arrows

- Ichimoku alert indicator improved : warning alert mode was fixed and autosettings feature was added

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2014

newdigital, 2014.03.04 10:58

How should I choose my trade strategy?Case shows slides about what strategies to use in high and low implied volatility situations. Her and Tom talk about how the market conditions affect the types of plays she makes.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.30 16:49

Next EUR/USD Leg Lower Begins; Trade Opportunities in EUR/AUD, EUR/GBP

- EURUSD cracks weekly low and tumbles below $1.2600.

- New EURGBP trade on the table.

- EURUSD has been on a major losing streak since mid-August.

Euro-Zone economic data came out roundly weaker than expected today, and the aftershocks have been felt throughout EUR-complex. The depth of impact stemming from the disappointing preliminary September Euro-Zone CPI may have to do with expectations for the core: +0.9% y/y was expected when +0.7% y/y was delivered. The scope of disinflation widens.

Over the next few months, Euro-Zone CPI may start to bottom. For starters, if it takes three to nine months for changes in interest rates and exchange rates to impact an economy, then the EURUSD peak in early-May is a good watermark to look back at; the window for peak drag on CPI by FX is just about now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.01 05:48

EUR/USD Downside Targets in Focus- Gold Eyes Key $1,179 Support

- EUR/USD Downside Targets in Focus Ahead of ECB Policy Meeting.

- Gold Eyes Key $1,179 Support as Bearish RSI Momentum Remains in Play.

- EUR/USD marks fresh monthly low of 1.2569 as Euro-Zone Consumer Price Index (CPI) narrows to 0.3%, while core inflation unexpectedly slips to 0.7% from 0.9%.

- Downside objectives remain favored ahead of the European Central Bank (ECB) policy meeting as the Relative Strength Index (RSI) retains bearish momentum & pushes deeper into oversold territory.

Is it really possible to outperform the Stock Market? The answer is a definite YES. In order to achieve this outperformance, it is necessary to use a top-down approach to identifying stocks that are outperforming both the index and the sector.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.01 12:34

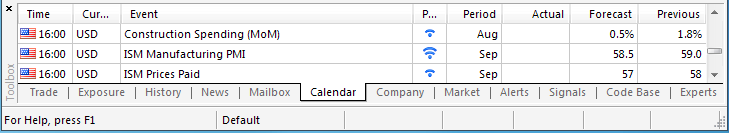

Trading the News: U.S. ISM Manufacturing (based on dailyfx article)

- U.S. ISM Manufacturing Survey Expected to Fall Back from Highest Reading Since March 2011.

- Even Though Employment Component Narrowed in August, Still Marked the Second-Highest Print for 2014.

A downtick in the ISM Manufacturing survey may generate a bearish dollar reaction (bullish EUR/USD) should the data print dampen the outlook for growth and inflation.

What’s Expected:

Why Is This Event Important:

At the same time, we will need to keep a close eye on the employment component as the highly anticipated Non-Farm Payrolls (NFP) report is expected to show the U.S. economy adding another 217K jobs in September, and a material downward revision in the key metrics may undermine the bullish sentiment surrounding the greenback as it drags on interest rate expectations.

The dollar may face a near-term correction should the ongoing slack in the real economy spur a marked slowdown in manufacturing, and a dismal ISM print may prompt the Fed to further delay its normalization cycle as Chair Janet Yellen remains reluctant to move away from the zero-interest rate policy (ZIRP).

Nevertheless, the resilience in private sector consumption may foster another unexpected uptick in the manufacturing survey, and a better-than-expected release may heighten the bullish sentiment surrounding the dollar as it raises the Fed’s scope to implement a rate hike sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: ISM Survey Narrows to 58.5 or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

EUR/USD Daily

- Remains vulnerable to a further decline as near-term bearish RSI momentum remains in play

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 | 9/02/2014 14:00 GMT | 57.0 | 59.0 | -4 | -2 |

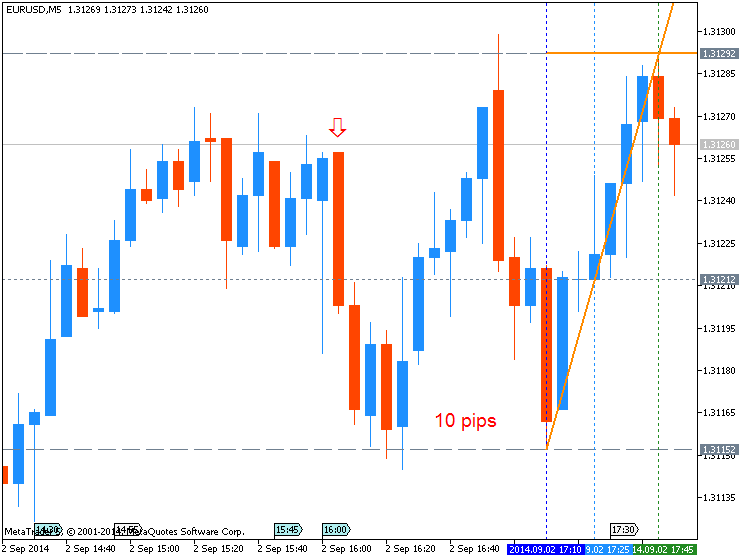

August 2014 U.S. ISM Manufacturing

EURUSD M5 : 10 pips price movement by USD - ISM Manufacturing PMI news event:

Manufacturing activity in the U.S. unexpectedly picked up in August as the ISM survey rose to 59.0 from July’s 57.1 print; reaching the highest level since March 2011. The expansion was fueled by a surge in orders for plastics and metals, and highlights the scope for a stronger U.S. recovery in the second half of the year. The market reaction to the positive ISM print was limited and short-lived as the EUR/USD chopped around 1.3128, with the pair closing the day at 1.3122.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.19 07:43

01: NON FARM PAYROLL (Part 1) - ECONOMIC REPORTS FOR ALL MARKETSThis is the 1st video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this and the next lesson, we cover the Employment Situation Report, also known as Non Farm Payroll.

============

Non-farm Payrolls (metatrader5.com)Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

- Release Frequency: monthly.

- Release Schedule: 08:30 EST, the first Friday of the month.

- Source: Bureau of Labor Statistics, U.S. Department of Labor.

============

FF forum economic calendar :

- Source : Bureau of Labor Statistics

- Measures : Change in the number of employed people during the previous month, excluding the farming industry

- Usual Effect : Actual > Forecast = Good for currency

- Frequency : Released monthly, usually on the first Friday after the month ends

- Why Traders Care : Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

- Also Called : Non-Farm Payrolls, NFP, Employment Change

============

mql5 forum thread : Non-Farm Employment Strategy

============

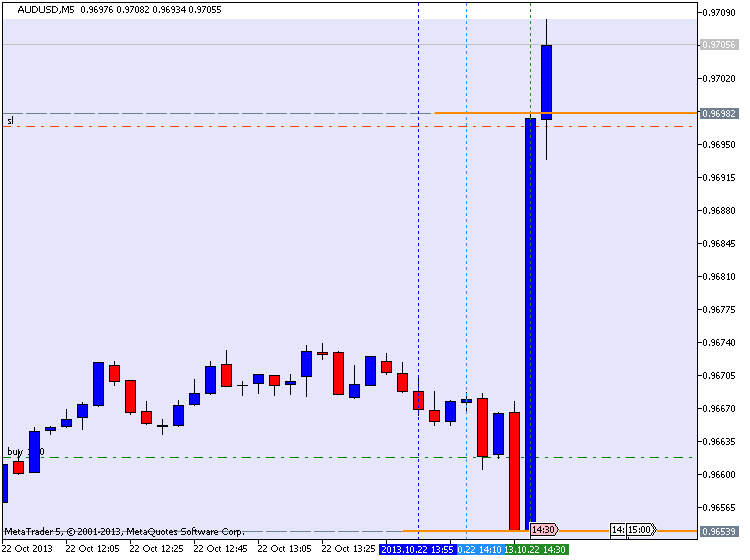

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

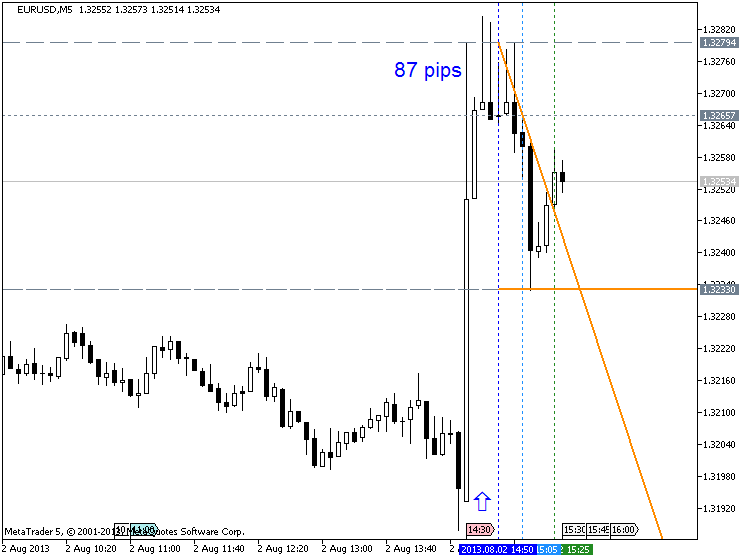

EURUSD M5 : 87 pips price movement by NFP news event :

NZDUSD M5 : 37 pips price movement by USD - Non-Farm Employment Change :

Trading EURUSD during NFP :

==================

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.23 12:58

02: NON FARM PAYROLL (Part 2)- ECONOMIC REPORTS FOR ALL MARKETS

This is the second part of video lesson about nfp. The first part of the lesson is on this post :

============

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.04 12:25

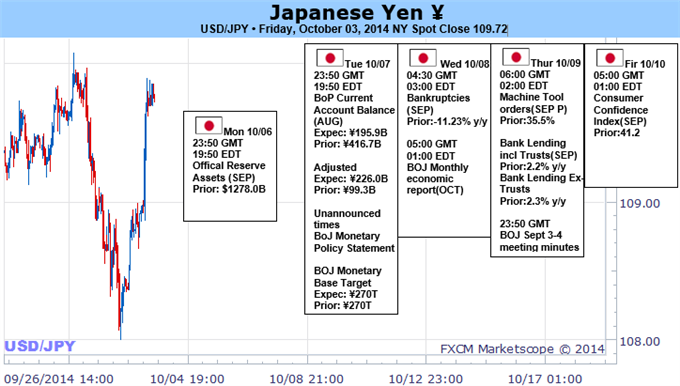

USDJPY Fundamentals (based on dailyfx article)

The Japanese Yen fell to fresh post-financial crisis lows versus the surging US Dollar, but a clear slowdown the USDJPY rally warns that it’s near an end. When might we buy?

The difficulty in trading the USDJPY is clear: recent data shows that the trade is extremely crowded, and a sharp correction is possible if not likely. Yet the US Dollar continues to defy our expectations and is plowing higher across the board. We’ll need to wait for signs of concrete turnaround before getting short USDJPY.

An upcoming Bank of Japan Monetary Policy Meeting and Decision dominate event risk for the Japanese Yen in the week ahead, while clear USD outperformance keeps focus on a number of important US data releases. See the full video for our take on what to expect, but in sum: we are likely biding our time and keeping a very close eye on whether the USDJPY breaks above ¥110.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.