Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.19 19:23

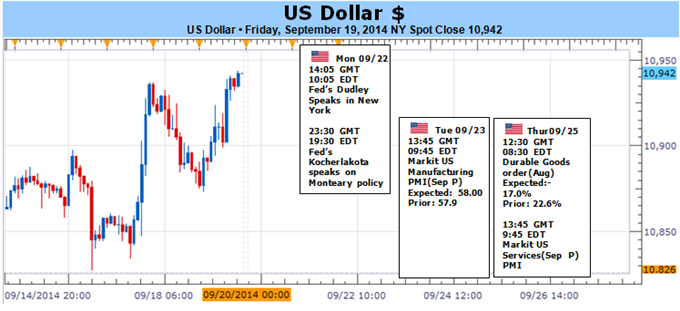

Weekly Outlook: 2014, September 21 - September 28G20 Meetings, Mario Draghi’s speech, German Ifo Business Climate, US New Home Sales, US Durable Goods Orders, US Unemployment Claims are the main highlights this week. Here is an outlook on the major events coming our way.

Last week Scotland voted NO on independence from the UK in the historic referendum. The NO campaign’s victory was more decisive than the opinion polls had suggested, leaving the 307-year union in place. UK’s Prime Minister David Cameron acknowledged the Scots’ demand to have more power in the UK legislation and form a new constitutional settlement for the entire UK. Markets reacted with relief, bank shares climbed sharply after the market opened. Sterling initially gained in reaction to the result, rising 0.3 % higher to $1.6442, but later fell back against the dollar. Will the UK economy speed up growth in the coming months?

- G20 Meetings: Sat-Sun. Finance ministers from the G20 countries gathered in Australia to discuss measures to improve economic growth in the Eurozone by an additional two per cent by 2018. Measures to fight black money and tax avoidance were also discussed in this forum. Last week’s meeting resolutions will initiate the next meeting at Brisbane in November.

- Mario Draghi speaks: Monday, 13:00. ECB President Mario Draghi is scheduled to testify before the European Parliament’s Economic and Monetary Committee, in Brussels. Draghi may talk about the need for investments alongside Governmental aid. Volatility is expected.

- German Ifo Business Climate: Wednesday, 8:00. German business sentiment declined for a fourth straight month in August down to 106.3 from 108 in July, amid concerns about the Ukraine crisis and the impact of sanctions imposed by the Eurozone against Russia. The value of German shipments to Russia plunged 15.5% to 15.3 billion euros in the first six months of the year, with major declines in car and machinery shipments. Exports also fell due to smaller orders from Russia. Economists expected a higher reading of 107.1. The lukewarm growth in the Euro area also contributed to the decline in German business sentiment. Another drop to 105.9 is expected now.

- US New Home Sales: Wednesday, 14:00. Sales of new single-family homes declined for a second straight month in July to a seasonally adjusted annual rate of 412,000, from 422,000 posted in the previous month. Nevertheless, the housing market is on a growth trend. Larger stock of properties and tame prices will help boost demand in the coming months. New homes sales data is considered volatile, despite the decline new home sales were up 12.3 from July last year. Sales of new single-family homes is expected to rise to 432,000.

- US Core Durable Goods Orders: Thursday, 12:30. U.S. durable goods orders surged in July by a seasonally adjusted 22.6%, after a revised gain of 2.7% in the previous month while core orders declined unexpectedly by 0.7% following a 1.9% increase in June. The mixed data confused markets. Commercial aircraft orders hit the roof with a 318% increase, after Boeing signed a record number of contracts for new jetliners in July. Cars and trucks sales went up 10.2%. However, core durable goods orders, excluding volatile transportation items, missing forecasts for a 0.5% gain. Core durable goods orders rose by 3% in June. U.S. durable goods orders is expected to plunge 17.7% while Core orders are predicted to rise 0.7%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits plunged unexpectedly last week to 280,000 from 316,000 in the prior week, indicating the lukewarm figures in August were a temporary relapse. Economists expected a small decline to 312,000. US economy has broad-based growth including the housing sector. The number of layoffs continue to fall. The four-week moving average declined by 4,750 to 299,500. The number of jobless claims is expected to reach 294,000 this week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.22 06:07

EUR/USD bears in full control - JPMorgan

EUR/USD bears remain in full control,

shooting for 1.2769/55/46 and potentially even for 1.2502, notes Thomas Anthonj, FX Strategist at JP Morgan.

Key Quotes

The

downtrend of the EUR opened additional downside before a bounce looks

to be due. Having decisively broken the potential base for a temporary

4th wave recovery at 1.2908 (wave 1 x 1.618) in EUR/USD the market

opened additional downside to the next potential base at 1.2769/55/46

(monthly trend/pivots)."

"A straight extension to the latter is

favored unless a break above 1.2996 (pivot) indicates that the 3rd wave

low is in place and wave 4 up to 1.3165 (minor 38.2 %) already on its

way.

"The latter would provide a good risk-reward to bet on the

missing 5th wave decline whereas breaks above 1.3165 and above 1.3274

(daily trend) would constitute a scale jump in favor of a broader 2nd or

b-wave rebound to 1.3413 (int. 50 %) and to 1.3701/19 (pivot/int. 76.4

%) at a later stage."

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.22 14:00

We expect the euro will fall to parity vs. the dollar by year-end 2017 (based on businessinsider article)

"The euro has weakened by 8% versus the US dollar since May," Goldman Sachs' David Kostin wrote in a new note to clients. "We expect the downward gravitational pull on the EURUSD will persist for the next several years until it trades at parity versus the dollar by year-end 2017. From a spot of 1.29, our economists forecast the euro will depreciate by 7% vs. the dollar during the next year (to 1.20) and fall by 22% to parity by 2017."

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.23 06:09

EURUSD Technical Analysis: Euro Aiming Below 1.28 Mark (based on dailyfx article)

- EUR/USD Technical Strategy: Short at 1.3644

- Support: 1.2783, 1.2718, 1.2653

- Resistance:1.2864, 1.2913, 1.2994

The Euro slid to the lowest level in nearly 15 months against the US Dollar,

with sellers now aiming below the 1.28 figure. Near-term support is at

1.2783, the 38.2% Fibonacci expansion, with a break beneath that on a

daily closing basis exposing the 50% level at 1.2718. Alternatively,

turn above the 23.6% Fib at 1.2864 clears the way for a challenge of the

14.6% expansion at 1.2913.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.23 09:35

2014-09-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]- past data is 46.9

- forecast data is 47.1

- actual data is 48.8 according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[EUR - French Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

French manufacturing PMI 48.8 vs. 47.0 forecast

France’s manufacturing PMI rose more-than-expected last month, preliminary data showed on Tuesday.

In a report, Markit Economics said that French manufacturing PMI rose to

a seasonally adjusted 48.8, from 46.9 in the prior month.

Analysts had expected French manufacturing PMI to rise to 47.0 last month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 13 pips price movement by EUR - French Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.20 18:22

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Neutral- Euro at risk as results from recent ECB actions cast doubt on future policy

- Volume figures nonetheless warn of EUR bounce, and positions confirm risk

The Euro tumbled to fresh lows versus the high-flying US Dollar on a week of bad news for Europe and much better developments out of the US. But why might the Euro/Dollar exchange rate be at risk of an important bounce?

Almost all traditional fundamental signals point to further Euro

weakness, and yet we see clear warning signs that such news and

sentiment may be overdone. Everyone is bearish at major market bottoms

and bullish at the tops, and that in itself is an important trigger

which favors some sort of Euro bounce. Beyond that, however, we see

technical reasons why the US Dollar rally may be overdone.

High FX market volatility continued to drive the safe-haven US

currency higher across the board as the combination of a US Federal

Reserve Meeting, key European Central Bank results, and the

highly-anticipated Scotland independence referendum fueled major moves.

Yet the week ahead promises far less foreseeable event risk, and our

forward-looking DailyFX 1-Week Volatility Index has pulled back sharply.

The US Dollar’s strong correlation to volatility leaves it at risk on

such a slowdown.

It’s possible but unlikely that the Euro sees strong reactions to

upcoming European Purchasing Managers Index (PMI) survey results, a

German IFO Business Climate report, and a late-week GfK Consumer

Confidence data release. Thus we’ll focus on how US Dollar traders

react to calmer markets; we suspect that the EURUSD could bounce as

sellers lose enthusiasm.

Recent FXCM Execution Desk numbers show that total Euro trading volume

slowed even as it tumbled to fresh lows. While momentum clearly favors

further losses, the slowdown acts as clear warning that markets may

soon capitulate.

And thus we’re left with somewhat of a dilemma: on the one hand we

believe that the Euro will remain in a downtrend, but too many signs

warn of a near-term price and sentiment extreme. We advise caution on

fresh EURUSD-short positions in the days ahead.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.24 09:49

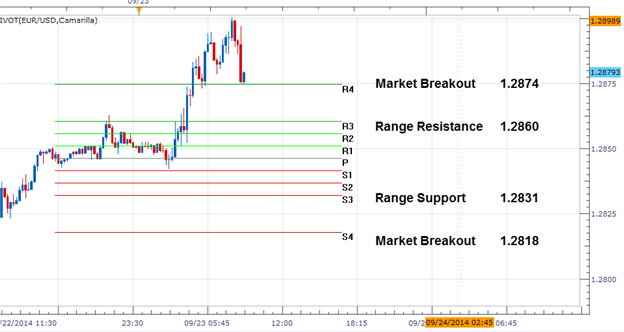

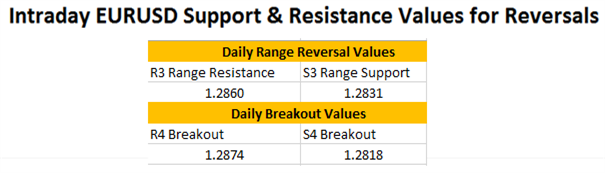

Technical Analysis: EURUSD Breakout (based on dailyfx article)

- EURUSD Breaks Resistance

- Breakout Signaled Above 1.2874

- Bearish Reversal Signaled Under 1.2860

As price with any breakout, there is always the potential for a price reversal. In the event of a false breakout, traders would first look for price to move back into range resistance located at the R3 pivot at a price of 1.2860. Once price has moved back into the trading range, reversal traders can look for price to potentially traverse the current 29 pip range back to support found at 1.2831. It should also be noted that price has the potential to break towards a lower low in the direction of the daily trend below the S4 pivot at 1.2818. In either scenario, this would indicate an end of bullish momentum drawing a conclusion to the present breakout environment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.24 17:23

Silver Breakdown Hints at USD Turning Point; EUR/USD, USD/CAD Not Done (based on dailyfx article)

- Silver/XAGUSD fall through support signals turning point.

- EURUSD may push lower again.

During August and early-September, the rise of US Treasury yields neatly

coincided with an already-bullish landscape for the US Dollar, proving

to be further fuel to the fire. Yet over the past two weeks, the

greenback has persisted as a top performer while long-end US yields have

come back in after their brief jump. See the brief video above for what the technical breakdown in Silver

means for the majors such as EURUSD and USDCAD over the coming days.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.25 15:51

2014-09-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]- past data is 22.6%

- forecast data is -17.7%

- actual data is -18.2% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

U.S. Durable Goods Orders Show Sharp Pullback In August

Reflecting volatility in commercial aircraft orders, the Commerce Department released a report on Thursday showing a sharp pullback in orders for manufactured durable goods in August following the substantial increase seen in July.

The report said durable goods orders tumbled by 18.2 percent in August after surging up by 22.5 percent in July. Economists had been expecting orders to plunge by about 18.0 percent.

Excluding orders for transportation equipment, durable goods orders actually rose by 0.7 percent in August compared to a 0.5 percent drop in July. The rebound matched economist estimates.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.26 06:29

EUR/USD Drops Below 1.27 on Divergent Outlooks

The euro hit a 22-month low against the dollar on Thursday on the prospect of diverging monetary policy between the Federal Reserve and the European Central Bank as rate differentials swing decisively in the greenback’s favor.

The common currency fell to $1.2730 on trading platform EBS, its lowest since November 2012, and was down 0.3 percent on the day. The dollar index hit a new four-year high. The latest drop came as yield differentials between US 10-year Treasuries and their German counterparts traded near 15-year highs, driving more investors to buy the dollar.

A recent batch of economic data has also highlighted the diverging economic outlook for the euro zone and the United States. While German business sentiment fell again in September to its lowest level in nearly 1-1/2 years, sales of new U.S. single-family homes surged in August to their highest level in more than six years.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish market condition ranging between 1.2995 resistance and 1.2834 support levels.

H4 price is on bearish for trying to break 1.2830 support level for the bearish to be continuing.

W1 price is on primary bearish with 1.2859 as the nearest support line which is already broken on open W1 bar.

If D1 price will break 1.2995 resistance level on close bar so we may see market rally or ranging within primary bearish.

If D1 price will break 1.2834 support level so the primary bearish will be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-09-22 13:00 GMT (or 15:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-09-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-09-22 14:05 GMT (or 16:05 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2014-09-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-09-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-09-23 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-09-23 08:30 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-09-23 13:20 GMT (or 15:20 MQ MT5 time) | [USD - FOMC Member Powell Speech]

2014-09-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Richmond Manufacturing Index]

2014-09-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-09-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-09-24 16:05 GMT (or 18:05 MQ MT5 time) | [USD - FOMC Member Mester Speech]

2014-09-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-09-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-09-26 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

2014-09-26 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-09-26 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart