You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.12 08:04

Technical Analysis: AUDUSD & NZDUSD trade similarly for different reasons

The NZDUSD made new lows on the back of comments from RBNZ’s Wheeler who said that the currency was overvalued and that rates would stay on hold until 1Q of 2015. Meanwhile in Australia, the AUDUSD made it’s new move lows despite much stronger employment statistics that had the market questioning the seasonals.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.17 11:37

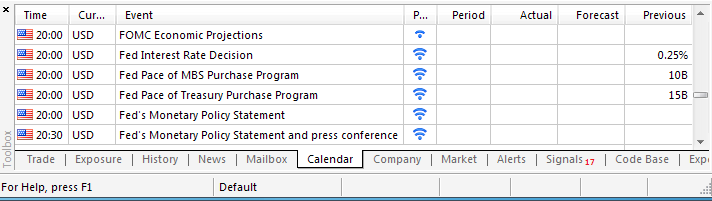

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision (based on dailyfx article)

The Federal Open Market Committee (FOMC) interest rate decision may spur a bearish reaction in the dollar (bullish EUR/USD) if the central bank remains reluctant to move away from the zero-interest rate policy (ZIRP).

What’s Expected:

Why Is This Event Important:

Even though the Fed is widely expected to conclude its asset-purchase program at the October 29 meeting, we would need a more hawkish twist to the forward-guidance for monetary policy to favor further USD strength.

The dollar may come under pressure should we get more of the same from the Fed, and the greenback may face a larger correction over the remainder of the month should Chair Janet Yellen see greater scope to retain the highly accommodative policy stance for an extended period of time.

Nevertheless, sticky inflation paired with the uptick in wage growth may spur a greater dissent within the committee and push the FOMC to lay out a more detailed exit strategy as the central bank looks to move away from its easing cycle.

How To Trade This Event Risk

Bearish USD Trade: FOMC Remains Reluctant to Normalize Monetary Policy

- Need green, five-minute candle following the policy statement to consider a long EUR/USD position

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish USD Trade: Policy Statement Shows Larger Dissent & Shift Away from ZIRP- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Risks Larger Topside Correction as the Relative Strength Index (RSI) Threatens Bearish Momentum

- Interim Resistance: 1.2990 (23.6% retracement) to 1.3025 (23.6% expansion)

- Interim Support: 1.2858 (Monthly low) to 1.2870 (50.% expansion)

Impact that the FOMC rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

EURUSD M5 : 32 pips price movement by USD - Federal Funds Rate news event:

The Federal Open Market Committee (FOMC) voted to reduce its asset-purchase pace to $25B from $35B in July amid the sharp economic rebound in the second quarter. However, the Fed also highlighted the significant underutilization of labor resources and reiterated that it is appropriate to maintain the current fed fund rate for a considerable period of time even after the quantitative easing program ends. The Fed’s dovish tone dragged on the greenback, with EUR/USD climbing above 1.3400, but we saw limited follow-through behind the initial reaction as the pair ended the day at 1.3395.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.18 10:56

EUR/USD Vulnerable to Hawkish Fed- Outlook May Hinge on T-LTRO (based on dailyfx yotube channel)

The EUR/USD may look beyond the FOMC policy meeting to break out of the rate as the ECB implements the targeted long-term refinancing operation (T-LTRO).

=============

2014-09-18 09:15 GMT (or 11:15 MQ MT5 time) | [EUR - Targeted LTRO]

[EUR - Targeted LTRO] = Total value of money the ECB will create and use to loan to Eurozone banks. It provides liquidity to banks which usually leads to lower long-term interest rates and stimulates growth.

LTRO = Long Term Refinancing Option

==========Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.20 06:12

Video: Dollar, S&P 500 and Volatility Trends

FX traders have traded through a mine field of fundamental event risk. After the FOMC meet, Scotland 'No' vote and ECB stimulus injection; what trends prevail? Are there new bearings or are their lasting currents that are set to retake the reins moving forward? In this weekend Trading Video, we gauge the impact of this past week's fundamental developments and discuss how it can shape the currency and capital markets moving forward.

Introduction to the Central Bank Gold Agreement

This video explores the Central Bank Gold Agreement, and its role in current international monetary policy.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.24 17:23

Silver Breakdown Hints at USD Turning Point; EUR/USD, USD/CAD Not Done (based on dailyfx article)

During August and early-September, the rise of US Treasury yields neatly coincided with an already-bullish landscape for the US Dollar, proving to be further fuel to the fire. Yet over the past two weeks, the greenback has persisted as a top performer while long-end US yields have come back in after their brief jump. See the brief video above for what the technical breakdown in Silver means for the majors such as EURUSD and USDCAD over the coming days.

Traders: Millions By The Minute - Season 1 - Episode 1

Traders: Millions By The Minute takes a look at the fast and fiercely competitive world of financial traders and talks to the men and women who play the markets in London, New York, Chicago and Amsterdam.

Manhattan hedge fund manager Karen believes that money is power, and making it is fun, as she juggles two sets of twins, a busy social calendar and her $200 million fund.

Bob has spent more than three decades yelling out his trades and jostling for position on Chicago’s cattle futures trading floor, but now he thinks it may be time wean himself off his “trading addiction”.

London day traders Will and Piers use their expertise to train others in the art of making money from tiny moves in the markets. But they warn their new trainees it’s going to be far harder to master the psychological and emotional skills needed for trading than the technicalities.

Traders: Millions By The Minute - Season 1 - Episode 2

This is really great movie - it is about British men and women who play financial markets from their kitchens and bedrooms. Mother-of-three Jane squeezes currency trading in-between the school run and her work as a nurse, and is hoping to raise capital by selling her 10 Bengal kittens. Justyn and Akil are both convinced that trading will be their ticket to a lavish lifestyle, and Rene gave up a successful career as an antiques dealer for a new existence as a trader.

Episode 2.

Jane is not like the normal professional City trader as she also does the school run and works as a nurse. Justyn and Akil are ambitious and believe that trading will be their ticket to a lavish lifestyle.Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

newdigital, 2014.04.28 19:36

John Bollinger Webinar on Bollinger Bands® and Japanese Candlesticks

In this hour long webinar John Bollinger teaches the basics of Bollinger Bands and then discusses candlestick charts and how Bollinger Bands can be combined with Japanese candlesticks to provide more powerful analysis.