Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video August 2014

newdigital, 2014.08.24 15:43

Black Wednesday - a documentary about the crash of the pound sterling in 1992Strategy Video: ECB Strategy for EURUSD and Euro Crosses

- The ECB rate decision (11:45 GMT) and Draghi conference (12:30 GMT) on Thursday are top event risk

- Expectations for more easing build alongside forecasts for volatility - the highest since the June meet

- EURUSD may not present the best opportunity amongst Euro crosses on a hawkish or dovish outcome

In a crowded week for scheduled event risk, the ECB rate decision tops

my list for potential market impact. Not because the central bank will

introduce a new wave of easing. Rather, whether the policy authority

increases accommodation or stays its hand; a large segment will be

caught off gaurd and have to readjust. In other words, this event is

likely to be market moving and/or develop trends regardless of its

outcome. In today's Strategy Video we discuss what to look for from this

event and which Euro-based pairs may be best suited to different

scenarios.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.19 07:43

01: NON FARM PAYROLL (Part 1) - ECONOMIC REPORTS FOR ALL MARKETSThis is the 1st video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this and the next lesson, we cover the Employment Situation Report, also known as Non Farm Payroll.

============

Non-farm Payrolls (metatrader5.com)Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

- Release Frequency: monthly.

- Release Schedule: 08:30 EST, the first Friday of the month.

- Source: Bureau of Labor Statistics, U.S. Department of Labor.

============

FF forum economic calendar :

- Source : Bureau of Labor Statistics

- Measures : Change in the number of employed people during the previous month, excluding the farming industry

- Usual Effect : Actual > Forecast = Good for currency

- Frequency : Released monthly, usually on the first Friday after the month ends

- Why Traders Care : Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

- Also Called : Non-Farm Payrolls, NFP, Employment Change

============

mql5 forum thread : Non-Farm Employment Strategy

============

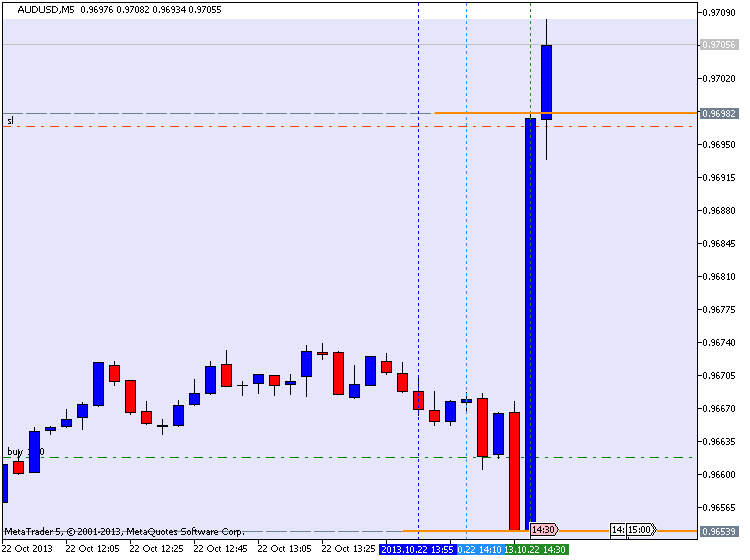

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

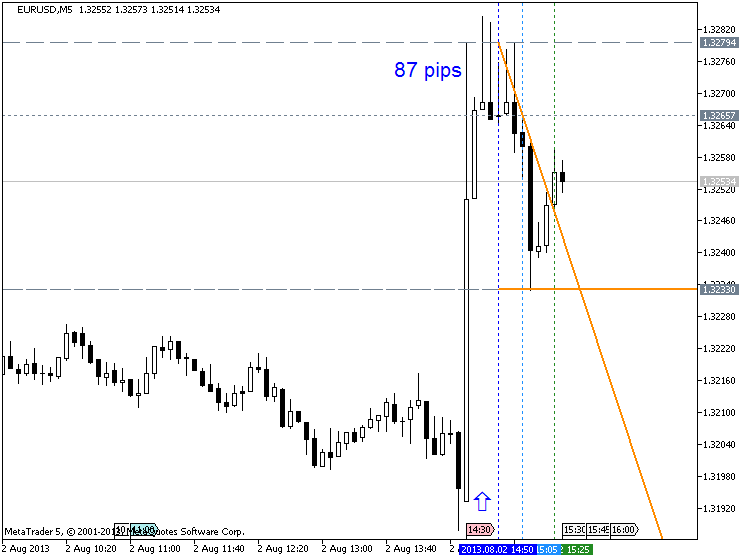

EURUSD M5 : 87 pips price movement by NFP news event :

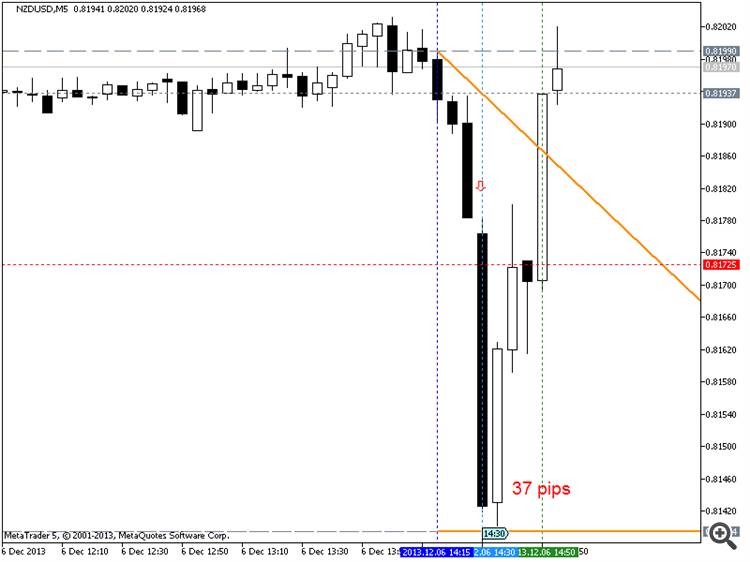

NZDUSD M5 : 37 pips price movement by USD - Non-Farm Employment Change :

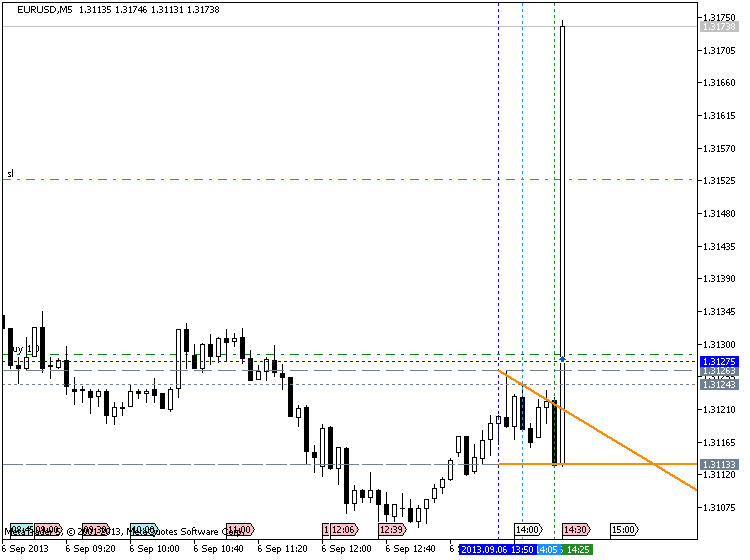

Trading EURUSD during NFP :

==================

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.23 12:58

02: NON FARM PAYROLL (Part 2)- ECONOMIC REPORTS FOR ALL MARKETS

This is the second part of video lesson about nfp. The first part of the lesson is on this post :

============

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.07 06:03

Trading Video: Can the Dollar Sustain its Rally and the S&P 500 its Quiet? (based on dailyfx article)

- Despite a boom of volatility in FX markets, sentiment trends and the S&P 500 remain troubling stoic

- The most impressive trend lately may also prove the most overdone in the short-term - the Dollar's rally

- If there is shift in risk or greenback favor, there are plenty of opportunities; but USDJPY would hit both

Though it falls short of the S&P 500's maturity, the US Dollar's

rally these past two months stands out as one of the financial market's

top themes. An eight-week rally for the USDollar

matches its longest run in 15 years, but the performance is all the

more remarkable for the fundamental drivers backing its progress. Rather

than find its footing through a 'flight to safety' or meaningful

upgrade in policy forecasts, the greenback has drawn strength through

its counterparts' difficulties. The culmination of unique issues for the

Euro, Pound and Yen

make for an effective lever; but it is also one that lacks for

endurance. With equity markets pulsating 'extreme complacency' and the

dollar stretched, we look at market conditions and potential setups for

the week ahead in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.10 07:24

Trading Video: FX Volatility Surge Puts Dollar and S&P 500 on Alert

- FX volatility levels swell - is it a precursor to a deeper shift in sentiment market-wide?

- EURUSD, GBPUSD and USDJPY maintain trend but curb progress

- Top event risk rests with an active Pound in BoE testimony and Kiwi on an RBNZ rate decision

Ichimoku Can Show Oversold and Overbought Levels

Here's Ichimoku compared to some other famous indicators when it adds up to showing oversold and overbought levels. Ichimoku does it all once you train yourself to see everything. No need to ad more decision makers to your chart to increase the ambiguity. Ichimoku is all you need!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.10 12:14

2014-09-10 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]- past data is 3.8%

- forecast data is n/a

- actual data is -4.6% according to the latest press release

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Bad time for Australia. Share market falls as consumer confidence drops

The Australian share market has suffered its worst fall in more than a month, with investors influenced by losses on Wall Street and an unexpected fall in consumer confidence.

All sectors fell but finance companies managed to post the slimmest losses.

The NAB and ANZ bank fell by 0.4 per cent and 0.25 per cent respectively, while the Commonwealth closed steady. Westpac gained 0.4 per cent.

The All Ordinaries index and the ASX200 both fell 34 points or 0.6 per cent to close at 5,574.

The mining sector was one of the hardest hit; BHP Billiton dropped 0.8 per cent and Rio Tinto 0.4 per cent, as the benchmark Chinese iron ore price softened a touch more overnight Tuesday.

Atlas Iron dropped 4.2 per cent and Fortescue Metals Group fell 2.7 per cent, but gold miner Newcrest gained 1.25 per cent.

The Westpac Melbourne Institute Consumer Confidence index fell sharply and unexpectedly in its latest reading, erasing the gains it had made over the previous three months.

The index is now 4.6 points lower at 94, with any reading below 100 indicating that pessimists outnumber optimists.

The

Australian dollar was also hurt by the confidence index and continued

its slide on speculation that US interest rates will begin increasing

before those domestically.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Trading and training video (from youtube for example) about forex and financial market in general.

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.