Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.09 14:33

Forex Weekly Outlook August 11-15German Economic Sentiment; UK employment data; Mark Carney’s speech and inflation report; US unemployment claims, PPI, consumer sentiment are the major topics in Forex calendar. Check out these events on our weekly outlook.

The US economy gained momentum last week with an excellent ISM Non-Manufacturing PMI release climbing to 58.7 from 56 points in June, indicating continued growth in the largest sector of the economy. The reading showed strong gains across the board. The employment component is up from 54.4 to 56 points and factory orders topped predictions with a 1.1% rise. Further good news came from the US labor market with a 14,000 drop in the number of new unemployment claims. Both readings reflect the strong growth trend in US economy.

- Eurozone German ZEW Economic Sentiment: Tuesday, 9:00. German analyst and investor climate continued to decline in July, falling to 27.1 points from June’s 29.8. Economists expected a higher reading of 28.9. Current conditions index also fell to 61.8 points from 67.7 in May, however still positive indicating a shift towards a domestically driven recovery in Germany. Nevertheless, the second quarter growth rate is expected to be lower than registered in the first quarter. This decline will also affect the Eurozone growth rate. German analyst and investor index is expected to plunge to 18.2.

- UK employment data: Wednesday, 8:30. The Unemployment rate in Britain fell to 6.5% from March to May, reaching following 6.6% in the previous three months. The number jobseeker’s fell by 36,300 to 1.04 million. Prime Minister David Cameron noted that the rate of employment matched the record level set in 2005, indicating stronger British economy. However wage growth is at its lowest since 2009, while excluding bonuses average wage increases are their lowest since 2001. If this trend continues it will have a negative effect on economic growth. The number of jobless Britons is forecasted to decline 29,700 and the unemployment rate is expected to drop to 6.4%.

- Mark Carney speaks: Wednesday, 9:30. Bank of England governor Mark Carney will hold a press conference in London about the inflation report. The Governor stated he was pleased with the rise in inflation, noting it came close to the BOE’s target of 2%. Market volatility is expected.

- US retail sales: Wednesday, 12:30. Retail sales in the U.S. advanced solidly in June. Core sales, excluding automobiles, gasoline, building materials and food services, edged up 0.6% following a revised 0.2% in May. Core sales are the best gauge for consumer spending component of gross domestic product. June’s gains indicate an upward trend in consumer spending in the second quarter. However retail sales gained only 0.2% in June after posting a 0.5% rise in May. Retail sales are expected to gain 0.2%, while core sales are predicted to edge up 0.4%.

- US Unemployment Claims: Thursday, 12:30. The number of US initial Jobless claims fell 14,000 last week to a seasonally adjusted 289,000. The reading was well below the 305,000 forecasted by analysts, indicating the US labor market continues to improve strengthening the US economy. The four-week average declined 4,000 to 293,500. That’s the lowest average since February 2006. The number of workers continues to grow as well as higher waged which will boost consumer spending in the coming months. The number of initial jobless claims is expected to reach 307,000 this time.

- UK GDP data: Friday, 8:30. Britain’s economy is expected to advance 0.8% in the second quarter matching the first estimate issued in July. The anticipated advance marches the UK economy to prerecession levels. The positive forecast indicates, recovery is back on track, but wage growth needs to rise in order to sustain long term recovery. The second GDP estimate is expec6ted to remain unchanged at 0.8% growth rate.

- US PPI: Friday, 12:30. U.S. producer prices edged up 0.4% in June amid rising gasoline costs, but overall inflation remained tame. Analysts expected a smaller rise of 0.2% as posted in the previous month. Gas prices jumped 6.4%, Steel costs edged up 3%. But prices declined for grains, cheese and rental cars to offset some of those increases. Nevertheless, inflation remains tame with in the Fed’s 2% target. Low inflation has enabled the Fed to pursue extraordinary measures to boost the economy but can drag down wages and spark a recession. U.S. producer prices are expected to rise 0.1%.

- US Prelim UoM Consumer Sentiment: Friday, 12:30. Consumer sentiment declined in July to 81.3 from 82.5 in June amid a fall in the consumer outlook index. Analysts expected the index to reach 83.5. Current economic conditions rose to 97.1 from 96.6, better than the 97.0 forecast. But consumer expectations plunged for a third straight month, to 71.1 from 73.5 below the 74.0 expected. Consumer sentiment is likely to improve to 82.7.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.11 12:00

AUDUSD for Monday, August 11, 2014 (based on seekingalpha article)

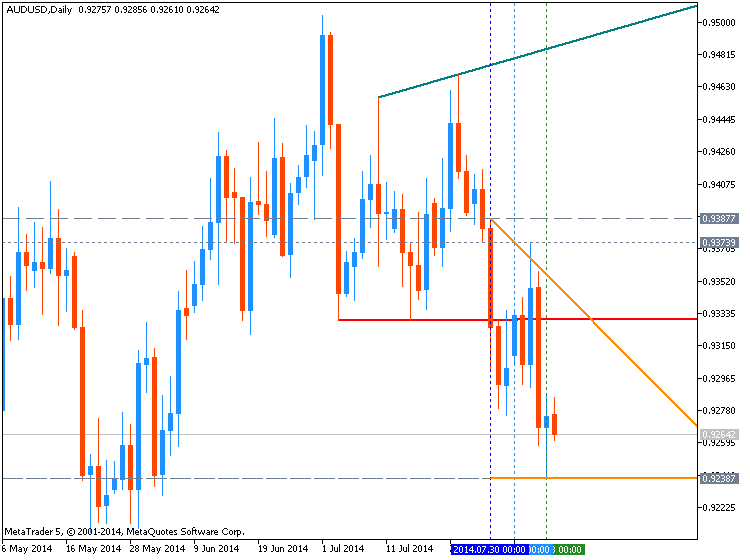

The Australian dollar is trading in a very small trading range between 0.9270 and 0.9280 after dropping so sharply in to finish out last week from above 0.9350 down to a two week low at 0.9240. In the middle of last week the Australian dollar surged higher to a one week high near 0.9375, before easing back and then falling sharply. It had done well of late to cling onto the 0.93 level after its sharp fall last week which saw it move from above 0.9400 down to a seven week low just below 0.9300, and in more recent days receive solid support there too. A couple of weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance. The Australian dollar reached a three week high just shy of 0.9480 a few weeks ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week.

Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 0.9260 | 0.9220 | 0.9100 | 0.9425 | 0.9500 | - |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.09 15:00

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Bearish- AUD/USD Extends Declines As Risk Aversion Saps Carry Demand

- Aussie Left Vulnerable As Rate Hikes Look Increasingly Distant

- Geopolitical Tensions May Pose A Short-Term Threat To The AUD

The Australian Dollar extended its recent declines over the past week

on the back of broad-based risk aversion and disappointing domestic

data. Heightened geopolitical turmoil sapped demand for the

high-yielding currency as traders flocked to the perceived safety of

the Yen and US Dollar. Additional pressure was put on the currency

following an unexpected jump in the local unemployment rate to a 12

year high.

Looking ahead, if we see tensions surrounding the Middle East or

Ukraine escalate, the Aussie could face further weakness in the

short-term. However, we have witnessed several flare-ups of

geopolitical tensions in recent months, which have failed to leave a

lasting impact on the currency. This suggests that if the swell settles

from the most recent storm of volatility, the currency may be afforded

some breathing room.

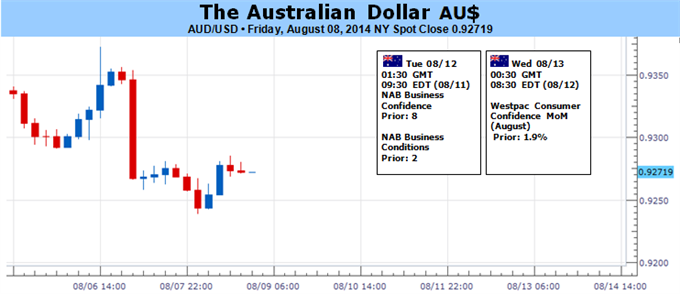

Consumer and business confidence figures are the only noteworthy

pieces of domestic data on the calendar over the coming week. The

leading indicators for the health of the local economy have reflected

some resilience in recent months, yet remain subdued. Another

lackluster set of readings would further reinforce the need for highly

accommodative RBA policy to remain in place.

Despite recent local data softening the Reserve Bank is likely to

retain its preference for a ‘period of stability’ for rates over the

near-term. Based on recent rhetoric from the Board it would take a

material deterioration in incoming economic indicators to re-open the

door to rate cuts. At the same time, policy tightening is likely to be

delayed. Indeed swaps-implied expectations for rates slipped back into

negative territory over the past week. This does little to raise the

carry appeal of the currency and leaves the Aussie in a precarious

position.

Upcoming Chinese Retail Sales and Industrial Production data will also

be on the radar for Aussie traders. Incoming data from the Asian giant

has been relatively positive on balance, which has eased concerns over

a deceleration in economic growth. If the next week’s figures continue

this recent trend it could ease some of the selling pressure facing

the AUD.

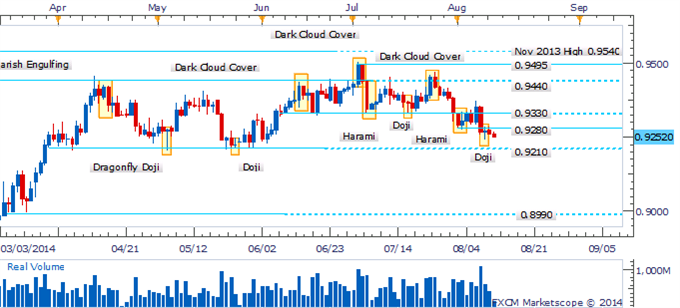

AUDUSD is drawing closer towards the 92 US cent handle, which has

been a line in the sand for the pair since late March. If broken, it

would set the stage for a sustained decline to the

psychologically-significant 0.9000 handle. Refer to the US Dollar outlook for insights into how the USD side of the equation may influence the pair.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.12 10:13

2014-08-12 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

- past data is 8

- forecast data is n/a

- actual data is 11 according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

Australia Business Confidence Climbs In July

An index measuring business confidence in Australia touched a four-year high in July, the latest survey from National Australia Bank revealed on Tuesday - showing a score of +11.

That's up from +8 in June.

The index for business conditions came in with a score of +2, rising from +2 in the previous month.

Among the individual components of the survey, home construction, retailing, sales, profitability and employment all showed improvement in July, the bank said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 19 pips price movement by AUD - NAB Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.12 15:37

AUDUSD Technical Analysis (based on dailyfx article)

- AUD/USD Technical Strategy: Pending Short

- Make-Or-Break Moment Ahead On Test Of Range-Bottom

- Lack of Reversal Signals Casts Doubt On A Recovery

The Australian Dollar has resumed its descent in recent trading with an absence of bullish reversal signals casting doubt on the potential for a recovery. This sets the Aussie up for a make-or-break moment as it drifts towards its range-bottom at 0.9210. A daily close below the nearby barrier would pave the way for a sustained decline to the 0.8990 mark.

Test of 0.9210 To Offer Make-Or-Break Moment:

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.13 06:21

2014-08-13 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

- past data is 1.9%

- forecast data is n/a

- actual data is 3.8% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 16 pips price movement by AUD - Westpac Consumer Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.10 18:14

AUD/USD weekly outlook: August 11 - 15The Australian dollar bounced off a nine-week low against its U.S. counterpart on Friday, as appetite for riskier assets strengthened after news reports that Russia ended military exercises on the Ukrainian border, easing concerns that an invasion could take place.

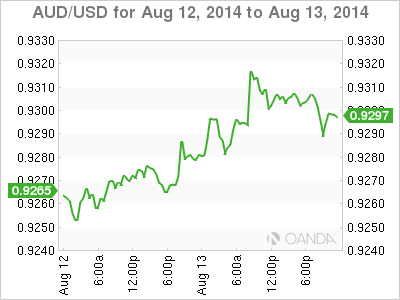

AUD/USD hit a daily low of 0.9239 on Friday, the pair’s weakest level since June 3, before subsequently consolidating at 0.9277 by close of trade, up 0.03% for the day but still 0.39% lower for the week.

The pair is likely to find support at 0.9228, the low from June 3 and resistance at 0.9356, the high from August 7.

Fears over hostilities between Russia and Ukraine eased on Friday after Russia’s defense ministry said it had concluded military exercises it was holding close to the border with Ukraine.

NATO warned earlier in the week that Russia massed around 20,000 combat-ready troops on Ukraine's border in preparation for a possible ground invasion.

Meanwhile, U.S. President Barack Obama authorized air strikes in Iraq to halt a Sunni insurgency there and to protect Iraqi civilians from the uprising as well as U.S. personnel in the country.

The Australian dollar sold off on Thursday after a poor employment report revived expectation that the Reserve Bank of Australia may cut interest rates again from the current record low.

Official data showed that the number of employed people in Australia fell by 300 in July, confounding expectations for an increase of 12,000. June's figure was revised down to a 14,900 gain from a previously estimated 15,900 rise.

The report also showed that Australia's unemployment rate rose to 6.4% last month, from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged in July.

On Tuesday, the RBA left its benchmark interest rate unchanged at a record low 2.50% and reiterated that it expects borrowing costs to remain low for an extended period of time.

Commenting on the decision, RBA Governor Glenn Stevens said "the most prudent course is likely to be a period of stability in interest rates."

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the Australian dollar in the week ending August 5.

Net longs totaled 33,300 contracts, down from net longs of 39,606 in the preceding week.

In the week ahead, investors will continue to monitor geopolitical risk, while a U.S. report on July retail sales will also be in focus for further clues about the strength of the economy and the timing of future interest rate hikes.

Tuesday, August 12

- Australia is to release reports on business confidence and house prices.

- Australia is to publish data on consumer sentiment and the wage price index.

- China is to release a report on industrial production. The Asian nation is Australia’s largest trade partner.

- The U.S. is to publish data on retail sales and business inventories.

- The U.S. is to release the weekly report on initial jobless claims.

- The U.S. is to round up the week with reports on manufacturing activity in New York state and industrial output, as well as preliminary data on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.13 15:12

2014-08-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.2%

- actual data is 0.0% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

U.S. Retail Sales Unexpectedly Flat In July

Retail sales in the U.S. unexpectedly came in unchanged in the month of July, according to a report released by the Commerce Department on Wednesday.

The Commerce Department said retail sales were virtually unchanged in July after edging up by 0.2 percent in June. Economists had been expecting another 0.2 percent increase.

Excluding a modest drop in auto sales, retail sales inched up by 0.1 percent in July compared to a 0.4 percent increase in the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 26 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.14 06:44

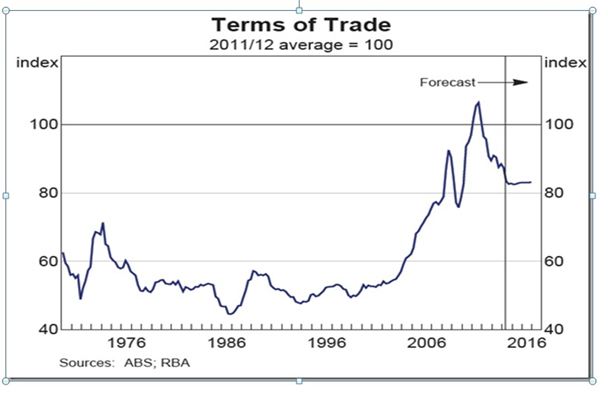

Structural changes in the Australian economy pose a risk for AUDUSD (based on tradingfloor article)

- Aussie economy shifting from away from mining based

- AUDUSD has risen from 87c to 95c despite RBA's best efforts

- Interest rate differentials should drive AUDUSD

A chart showing the long term history of the terms of trade is shown

below. The move up in the last decade was spectacular, peaking in

2010/2011 in line with the top in commodity prices. It’s no coincidence

that AUDUSD also reached its high at 1.1080 in July 2011 and, in

sympathy with the terms of trade, has been declining ever since.

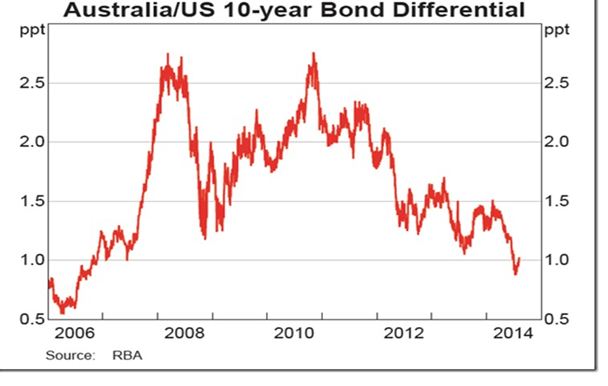

Another factor that kicked in around the same time the terms of trade were peaking was a decline in the interest rate differential in favour of the AUD. The global “reach for yield” after the introduction of quantitative easing in the US, has seen the spread between Australian and US bond yields decline from 250 to 100 basis points. Almost 70 percent of Australian government bonds outstanding are held by offshore investors.

The RBA has kept its policy interest rate at a record low of 2.50 percent for the last year, trying to encourage the non-mining economy to fill the gap being left by the fading resources boom. The central bank seems unconcerned that one of the areas this is showing up is in dwelling investment, spurred on by a strong housing market. This is because there is little evidence of domestic inflationary pressures in the rest of the economy and conditions in the labour market remain subdued with low wage growth, spare capacity and an elevated unemployment rate. This restraint on domestic costs has helped to offset the effects of the depreciation in the exchange rate over the last couple of years. Even so, the Consumers Price Index is up at the upper limit of the RBA’s target range of 2 to 3 percent. However, the RBA expects the counteracting forces of subdued domestic costs and a lower currency will mean inflation remains consistent with its target range.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.14 14:23

Aussie Posts Gains as US Retail Sales Soften (adapted from marketpulse article)

Australian data has enjoyed a strong week. On Wednesday, Westpac Consumer Sentiment climbed 0.8%, its strongest gain since October 2012. Stronger consumer confidence often translates into increased consumer spending, a key component for economic growth. Wage Price Index, an important gauge of inflationary pressure, dropped to 0.6%, short of the estimate of 0.8%. Earlier in the week, NAB Business Confidence and HPI posted strong gains.

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 0.9020 | 0.9119 | 0.9229 | 0.9361 | 0.9446 | 0.9617 |

- AUD/USD has posted gains in the Asian and European sessions. The pair is steady early in the North American session.

- On the downside, 0.9229 has some breathing room following gains by the Australian dollar.

- 0.9361 is an immediate resistance line. 0.9446 is next.

- Current range: 0.9229 to 0.9361

Further levels in both directions:

- Below: 0.9229, 0.9119, 0.9020 and 0.8916

- Above: 0.9361, 0.9446, 0.9617 and 0.9757

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on ranging market condition within primary bearish.

W1 price is located inside Ichimoku cloud above Sinkou Span A line which is indicating the secondary ranging correction within primary bullish.

H4 price is ranging between 0.9238 support and 0.9286 resistance levels with primary bearish.

If D1 price will break 0.9258 support level on close bar so the primary bearish will be continuing.

If not so we may see ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-08-11 07:15 GMT (or 09:15 MQ MT5 time) | [USD - FOMC Member Fischer Speaks]

2014-08-12 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2014-08-13 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2014-08-13 05:30 GMT (or 07:30 MQ MT5 time) | [CNY - Industrial Production]

2014-08-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-08-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-08-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart