AutoCharts

Autocharts

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.29 14:46

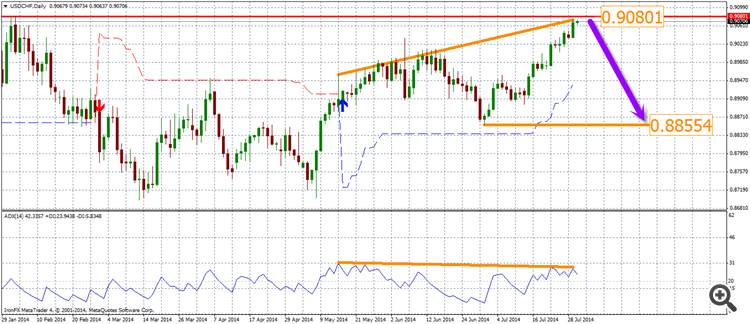

Should price action for the USDCHF remain inside the 0.9020 to 0.9060 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9040

- Take Profit Zone: 0.8720 – 0.8760

- Stop Loss Level: 0.9180

Should price action for the USDCHF breakdown below 0.9020 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ Retracements in the trend; sell orders during rallies

- Take Profit Zone: 0.8720 – 0.8760

- Stop Loss Level: 0.9180

Should price action for the USDCHF breakout above 0.9060 the following trade set-up is recommended:

- Timeframe D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9070

- Take Profit Zone: 0.9180 – 0.9230

- Stop Loss Level: 0.9010

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 09:39

USD/CHF Daily Outlook[Click Here]

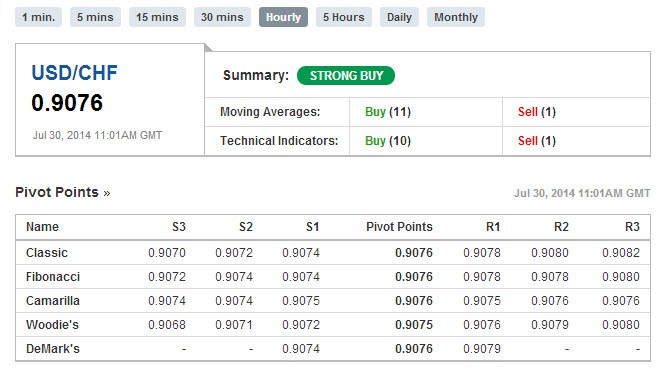

Daily Pivots: (S1) 0.9045; (P) 0.9059; (R1) 0.9082; More....

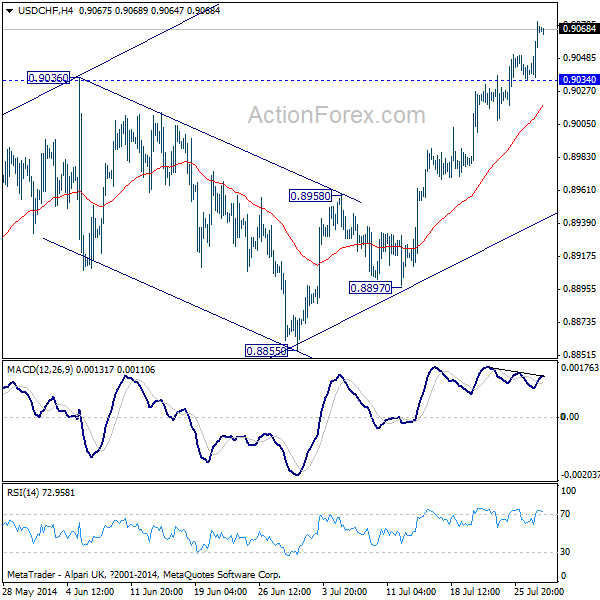

Intraday bias in USD/CHF remains on the upside. Current rally from 0.8698 is still in progress for 0.9156 key resistance. Break will indicate medium term reversal. On the downside, below 0.9034 minor support will turn bias neutral and bring retreat. But outlook will stay bullish as long as 0.8958 resistance turned support holds.

In the bigger picture, price actions from 0.9971 are viewed as a correction pattern. the break above 55 week EMA argues that it might be finished at 0.8698 already. Focus is back on 0.9156 resistance. Decisive break there should confirm this case and turn outlook bullish for a test on 0.9971 high. Meanwhile, break of 0.8855 near term support will dampen this bullish view and would extend the correction to 50% retracement of 0.7065 to 0.9971 at 0.8518 and below. In that case, we'll start to look for reversal signal below 0.8518 again.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 10:26

Swiss Franc Trading Above Its MA’s

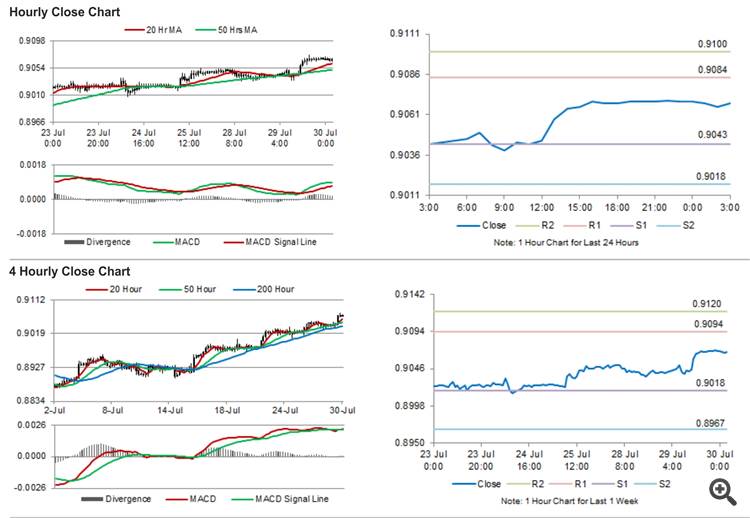

For the 24 hours to 23:00 GMT, the USD rose 0.31% against the CHF and closed at 0.9069.In the Asian session, at GMT0300, the pair is trading at 0.9068, with the USD trading marginally lower from yesterday’s close.

The pair is expected to find support at 0.9043, and a fall through could take it to the next support level of 0.9018. The pair is expected to find its first resistance at 0.9084, and a rise through could take it to the next resistance level of 0.91.

Investors are likely keeping an eye on Switzerland’s UBS Consumption and KOF Leading indicators, to be released in a few hours.

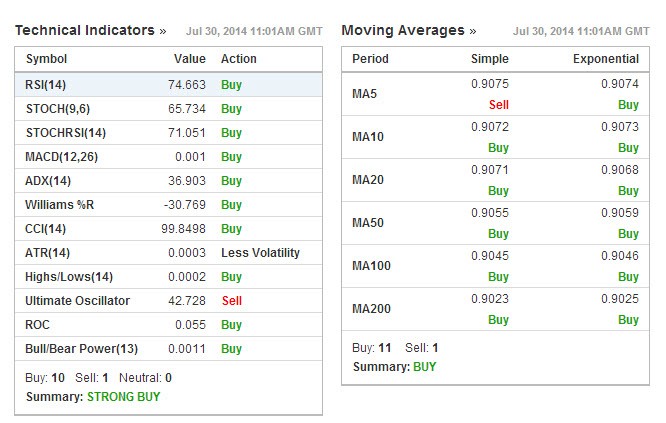

The currency pair is trading above its 20 Hr and 50 Hr moving averages.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

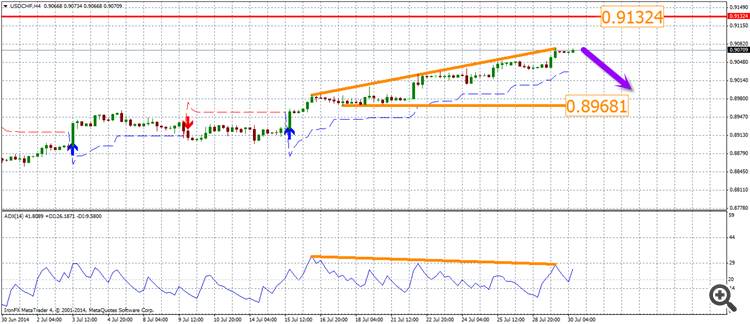

H4Time Frame

Bearish Divergence (ADX)