Auticharts

| EUR/JPY Intraday: the upside prevails. |

| Pivot: 136.6 Our preference: Long positions above 136.6 with targets @ 137.35 & 137.6 in extension. Alternative scenario: Below 136.6 look for further downside with 136.35 & 136 as targets. Comment: The pair is trading within a bullish channel. |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.29 13:22

Well ... I found it your sources :) You are just copy-pasting without source link ...

-------------

- All external content should be uploaded to this one thread only: Press review

- if you want to use external content to any of your thread - use "to pocket" feature:

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 09:49

EUR/JPY Daily Outlook

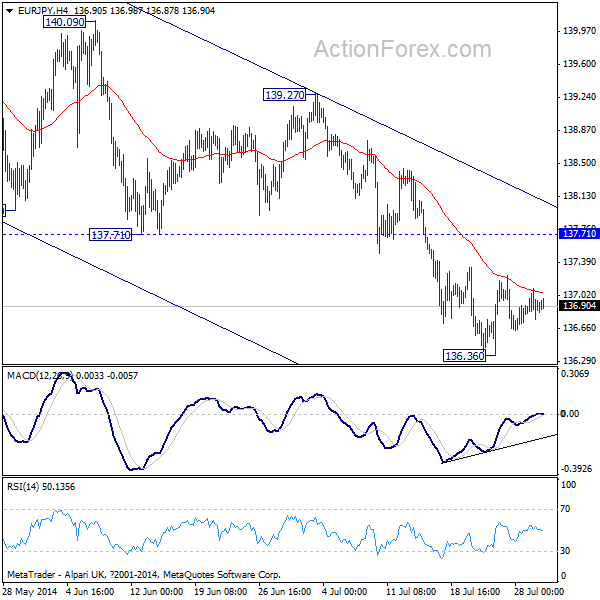

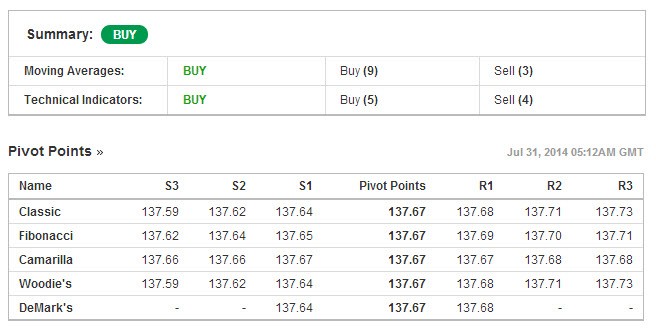

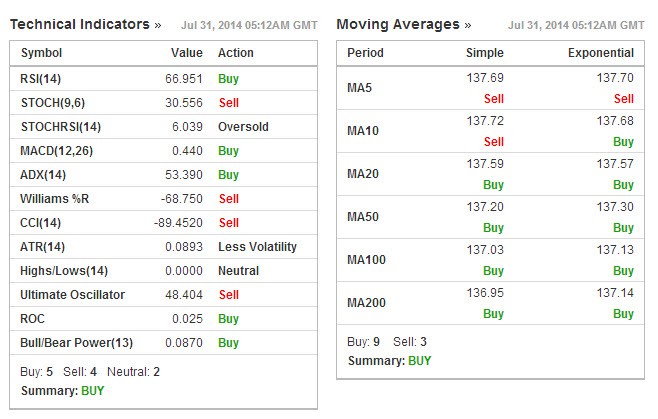

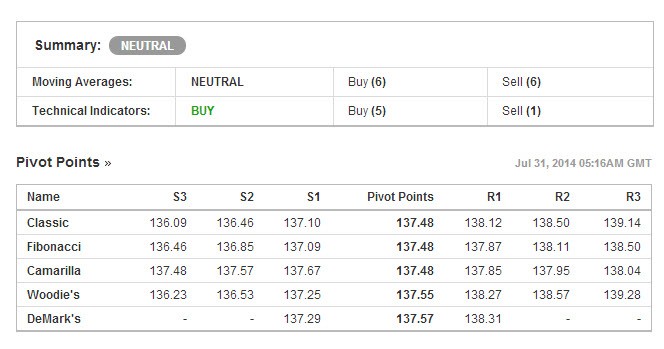

Daily Pivots: (S1) 136.70; (P) 136.81; (R1) 136.98; More...

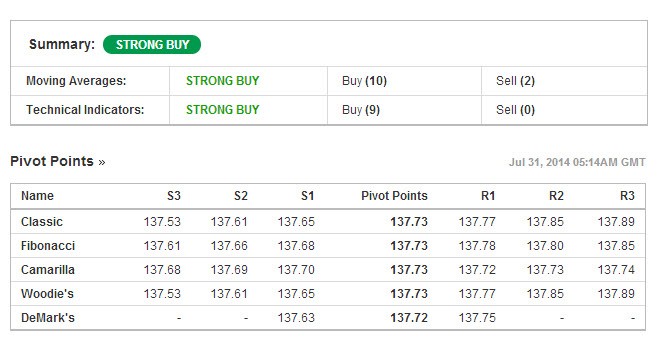

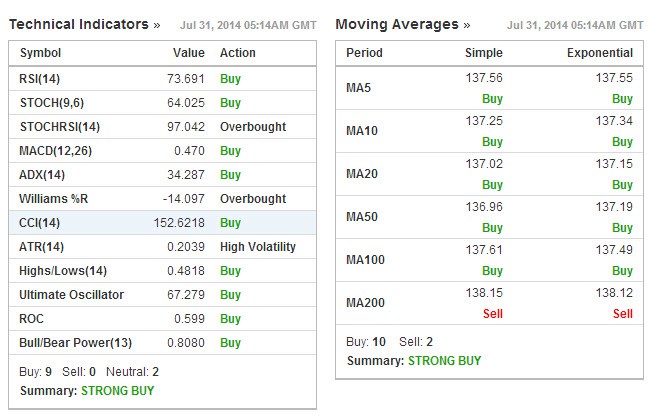

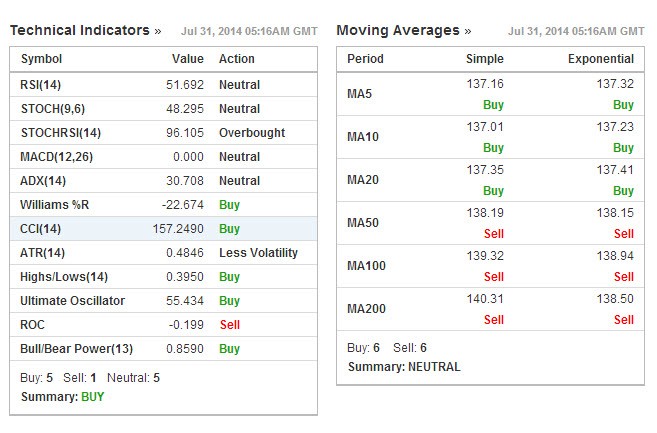

EUR/JPY continues to stay in consolidation above 136.36 and intraday bias remains neutral. As long as 137.71 resistance holds, deeper decline is still expected in the cross. It's now in the third leg of the pattern from 145.68 and should target 136.22 support. However, break of 137.71 resistance would be the first sign of near term reversal and wold turn bias back to the upside for 139.27 resistance for confirmation.

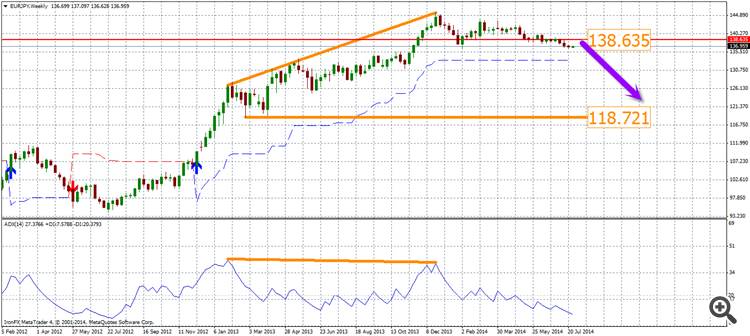

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in weekly MACD. However, EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Our preference: Long positions above 136.35 with targets @ 136.95 & 137.35 in extension.

Alternative scenario: Below 136.35 look for further downside with 136 & 135.6 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.