| USD/JPY Intraday: bullish bias above 101.65. |

| Pivot: 101.65 Our preference: Long positions above 101.65 with targets @ 102 & 102.15 in extension. Alternative scenario: Below 101.65 look for further downside with 101.4 & 101.15 as targets. Comment: The pair is rebounding above its support. |

Autocharts

| USD/JPY Intraday: bullish bias above 101.65. |

| Pivot: 101.65 Our preference: Long positions above 101.65 with targets @ 102 & 102.15 in extension. Alternative scenario: Below 101.65 look for further downside with 101.4 & 101.15 as targets. Comment: The pair stands above its support. |

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 09:59

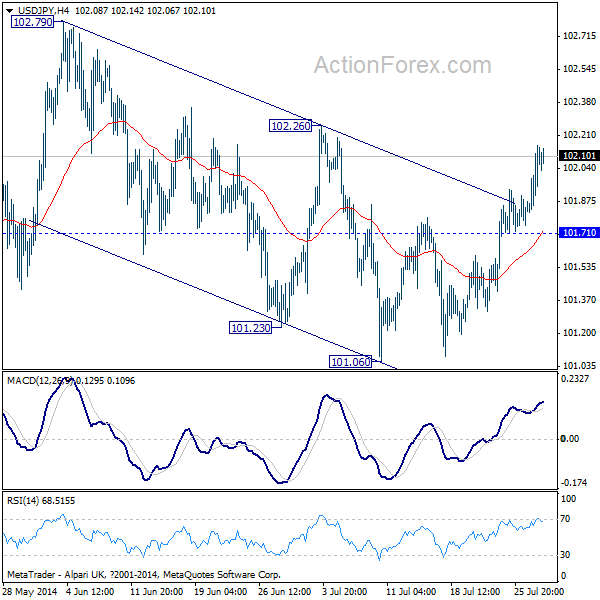

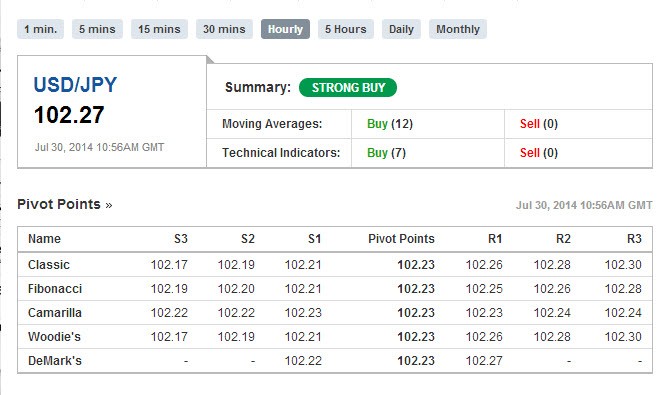

USD/JPY Daily Outlook

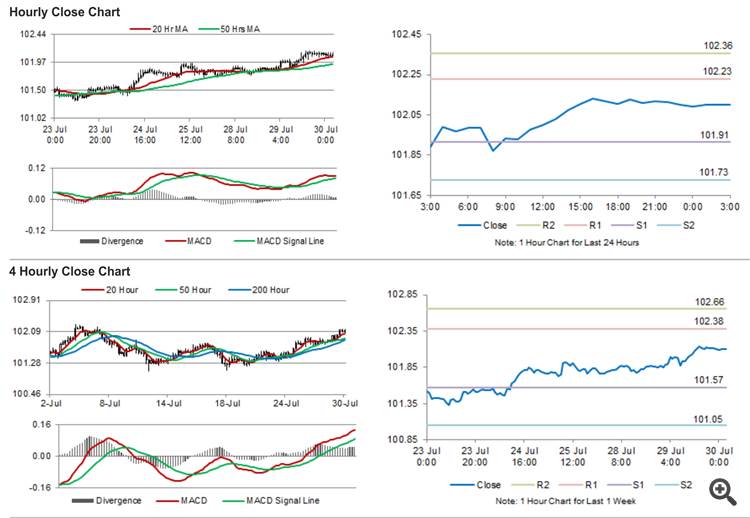

Daily Pivots: (S1) 101.90; (P) 102.03; (R1) 102.23; More...

Intraday bias in USD?JPY remains on the upside for 102.26 resistance. As noted before, the choppy fall from 102.79 has completed at 101.06 already. Break of 102.26 will confirm this bullish case and target 102.79 resistance and above. Overall, the pair is still bounded in the sideway pattern from 100.75 and we'd expect more sideway trading ahead. On the downside, below 101.71 minor support will turn bias back to the downside.

In the bigger picture, at this point, there is no confirmation of medium term reversal yet even though bearish divergence condition was clear in weekly MACD. Attention remains on 100.61 key support level and decisive break there will confirm the bearish case. In that case, deeper decline should be seen back to 38.2% retracement o 75.56 to 105.41 at 94.00. In case of another rise, we'll focus on reversal as it approaches 50% retracement of 147.68 to 75.56 at 111.62.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.30 10:29

Japanese Industrial Production Fell Sharply In June

For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 102.10 following upbeat US consumer confidence data.

In the Asian session, at GMT0300, the pair is trading at 102.10, with the USD trading flat from yesterday’s close.

In the economic news, Japan’s industrial production shrank 3.3%, on a monthly basis in June, after witnessing a 0.7% rise in the previous month. Meanwhile, the small business confidence index in Japan rose to a level of 48.7 in July, compared to a reading of 47.3 in the prior month.

The pair is expected to find support at 101.91, and a fall through could take it to the next support level of 101.73. The pair is expected to find its first resistance at 102.23, and a rise through could take it to the next resistance level of 102.36.

Amid a lack of economic releases from Japan today, investors would shift their attention to the release of Japanese housing starts data, to be out tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

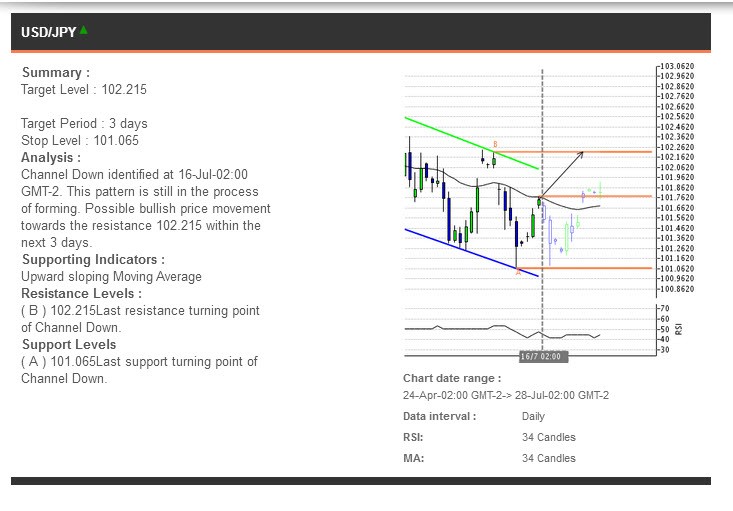

Summary :

Target Level : 102.215

Target Period : 2 days

Stop Level : 101.065

Analysis :

Channel Down identified at 16-Jul-02:00 GMT-2. This pattern is still in the process of forming. Possible bullish price movement towards the resistance 102.215 within the next 2 days.

Supporting Indicators :

Upward sloping Moving Average

Resistance Levels :

( B ) 102.215Last resistance turning point of Channel Down.

Support Levels

( A ) 101.065Last support turning point of Channel Down.