You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.10 08:52

2014-07-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

if actual > forecast = good for currency (for AUD in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month. Export demand and currency demand are directly linked because foreigners usually buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

Acro Expand : Customs General Administration of China (CGAC).

==========

China trade gains momentum, but recovery patchyune exports grew 7.2% year-on-year, a touch above the 7% posted in May, but it fell short of the 10.4% that the market was hoping for. Imports rose 5.5%, improving from a dip of 1.6%, just slightly under the Bloomberg consensus forecast of 6%.

This led to China’s June trade surplus narrowing to $31.6 billion from $35.92 billion in May, and below consensus estimates of $36.9 billion.

On the news, AUD/USD dipped over 0.2% and found some support at the 0.9397 level.

There’s a bit of optimism with China’s customs office expecting exports growth to accelerate in the third quarter. Imports could also pick up based on improving signs of manufacturing and service activities over the past two months.

Still, there are concerns that the recovery has been patchy, particularly with the soft property sector and worries that the earnings season underway might turn out to be disappointing.

There is also some expectation that the government will have to do more to jumpstart the recovery with further stimulus measures to meet its 7.5% growth target. That argument got some backing when China’s June’s CPI was released yesterday, which came in at 2.3% year-on-year. This was down from 2.5% in the previous month and under the 2.4% market forecast.

China’s exports growth will also hinge on the recovery of other key economies especially the Euro Zone. The global outlook became a bit more uncertain after the International Monetary Fund warned earlier this week that global investment spending was still lacklustre.

We’ll get a better picture next week with the release of China’s Q2 GDP on Wednesday 16 July. This will perhaps be the clearest indication so far on how well China’s mini-stimulus measures have helped and how much more is needed since their roll-out back in April. The market consensus forecast for Q2 GDP is 7.4% growth, unchanged from Q1 which was the slowest in six quarters.

Indonesia will also be keenly watching China’s recovery story. Regardless who wins the election, the new president will take over a slowing economy with weakening fundamentals. With economic reforms a long term process, Indonesia’s outlook and policy decisions in the interim could hinge closely on China’s demand for commodities.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.10 22:27

USD Continues to Carve Lower-Highs; Broader EUR/USD Range in Focus

EUR/USD:

AUD/USD:

Reserve Bank of Australia (RBA) Minutes, which are due out next week, may trigger another decline in the AUD/USD should the central bank continue to toughen its verbal intervention.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.11 14:00

Forex: Daily EUR/JPY, EUR/USD Stochs, MACD Point to Sells: Friday, July 11, 2014

The Evolution of Trading

Learning to trade successfully is a journey. One that never ends. In this weeks video I look at the natural evolution that traders I've worked with (including myself) tend to make. I also walk you through my though process on a structure based trade providing advice on how to interpret price action by reading the "language of the markets."

Forum on trading, automated trading systems and testing trading strategies

Indicators: AMA_STL_HTF

newdigital, 2014.07.13 12:00

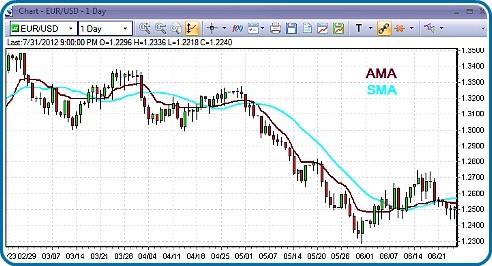

Adaptive Moving Average

Adaptive moving average (AMA), as the name suggests is an adaptation of moving average. It is designed to adapt according to the dynamic market as needed.

----

Simple moving average (SMA) and its cousins weighted moving averages (WMA) and exponential moving averages (EMA) all work fantastic when the market is trending. However when the market is range bound they pick up a lot of market noise generating a lot of premature signals. Moreover, they are all inherently lagging in nature.

In a quest to remedy shortcomings of moving averages, Perry J. Kaufmann, first introduced adaptive moving average in his book The Smarter Trading: Improving Performance in Changing Markets.

20-Day-SMA & AMA In Action:

Prior to Mr. Kaufmann's introduction of AMA, traders employed combination of more than a single moving average such as The Double Crossover Method and The Triple Crossover Method.

The reasons behind employing multiple combination of moving averages are based on the following facts:

So the genius in Kaufmann's AMA was a system smart enough to vary its speed according to a combination of market direction and speed.

In another words, when the market is trending, AMA speeds up along with the trend. When the market is range bound and does nothing AMA slows down.

Thus it righteously earns the name "adaptive" as it self adjusts to market direction and speed.

Kaufmann's AMA achieves sense of market direction and speed by incoporating the efficiency ratio.

Adaptive Moving Average Trading RulesFollowing are the trading rules for the Adaptive Moving Average:

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.13 16:03

NZD/USD forecast for the week of July 14, 2014, Technical AnalysisThe NZD/USD pair broke above the 0.88 level during the previous week, suggesting that a break out was in the process of happening. If we can break above the top of the range for the week, we believe that this market will continue to head towards the 0.90 level. That level is the next resistance barrier that we can see on the longer-term charts, so therefore that’s where the market should head towards. We see a significant amount of support below as well, so really it’s not likely we find an opportunity to sell.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.13 16:04

EUR/USD forecast for the week of July 14, 2014, Technical AnalysisThe EUR/USD pair tried to rally during the course of the week, but as you can see gave back quite a bit of the gains in order to form a shooting star. Nonetheless, the market seems to be stuck between the 1.35 level as support, and the 1.37 level as resistance. The resistance above should extend all the way from 1.37 to the 1.3750 level. Ultimately though, if we can break out of that range, we should continue to make a longer-term move. If it’s to the upside, we go to the 1.40 level, but to the downside below the 1.35 level, we would head to the 1.33 region.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.14 14:47

EUR/USD Pinned as EUR/JPY Pivots from June Swing; USD/CAD Emerges

If there was ever a week that could transpire a series of events flush in Euro negativity, last week failed to live up to the billing. A revival of Euro-Zone debt crisis fears made its way through bond and equity markets, June US labor market data clobbered expectations, and the June FOMC minutes showed a Fed more eager to wind down its QE3 program.

Nevertheless, EURUSD finished higher on the week, highlighting the drag low volatility conditions have placed on meaningful follow through in some of the major currency pairs.

So while we continue to monitor EURJPY and EURUSD as their daily charts highlight sell signals in various indicators, there is a admittedly a lack of momentum. The current rangebound states could be the default setting without a more substantial catalyst.

Elsewhere the two non-EUR pairs we're looking at are GBPCHF and USDCAD. Whereas GBPCHF is experiencing a slight pullback amid the EUR rebound, the nature of the Slow Stochastics and MACD indicators thus far offers no reason to think that the uptrend from mid-March is threatened, as the nature of the indicators and price action is still intact.

See the video above for a technical discussion on EURJPY, EURUSD, and GBPCHF, as well as notes on the recent USDCAD buying opportunity at long-term support.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.15 06:40

Strategy Video: Dollar, Pound and S&P 500 Probability vs Impact through Event Risk

In a dense round of event risk through the immediate future, there are scenarios where the headlines can prove exceptionally market moving...or barely tipping the needle. Expectations build up behind certain themes and markets to minimize the impact of likely outcomes and amplify the reaction to the less likely. In today's Strategy Video, we revisit this scenario analysis between 'potential' and 'probability' for Fed Chairwoman Janet Yellen's testimony, UK CPI and the general lean of a busy docket against the Dollar, Pound and S&P 500.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.16 08:46

NZ Dollar Falls on CPI Miss, Aussie Dollar Down After China GDP Data

The New Zealand Dollar underperformed in overnight trade, sliding as much as 0.7 percent on average against its leading counterparts. The move followed softer-than-expected CPI figures for the second quarter. The baseline year-on-year inflation rate registered at 1.6 percent, falling short of consensus forecasts calling for a 1.8 percent result. That seemingly undermined RBNZ rate hike expectations, with the slide in the Kiwi tracking a parallel move lower in the New Zealand’s benchmark 10-year bond yield.

The Australian Dollar likewise traded lower, losing as much as 0.24 percent against the majors. Curiously, the move followed an upbeat set of Chinese GDP figures. Output grew 2.0 percent in the second quarter, topping bets calling for a 1.8 percent increase. Supportive Chinese data might have been expected to boost the Aussie considering the East Asian giant is Australia’s top trading partner, meaning firming performance there bodes for the latter country’s pivotal export sector.

The newswires chalked up this apparent disparity to concerns that the Chinese economy’s recovery was unsustainable, suggesting seemingly sharp credit expansion rather than hard growth is behind the rosy headline GDP reading. Fading stimulus expansion bets were likewise cited, with investors apparently worried that the second-quarter data set will discourage further expansionary policy. Needless to say, it is all but impossible to tell with absolute certainty why the markets were unimpressed and the Aussie fell. In any case, we remain short AUDUSD.

June’s UK Jobless Claims figures headline the economic calendar in European hours. Expectations call for a 27,000 drop in new applications for unemployment benefits, which would mark the smallest drawdown in 13 months. Absent a dramatic deviation from expectations, the outcome may pass with little fanfare considering its relatively limited implications for BOE monetary policy bets and thereby for the British Pound. Meanwhile, technical positioning warns GBPUSD may be carving out a top below the 1.72 figure.

The spotlight then shifts to US policy concerns as Fed Chair Janet Yellen testifies before Congress for a second day, this time appearing before the House of Representatives having talked to the Senate yesterday. The central bank chief’s prepared remarks are likely to sound familiar and offer little impetus for volatility. The Q&A session that follows might produce some fireworks if lawmakers manage to squeeze out anything about the likely timing of interest rate hikes however, prompting a response from the US Dollar.

Asia Session

GMT

CCY

EVENT

ACT

EXP

PREV

22:45

NZD

Consumer Prices Index (QoQ) (2Q)

0.3%

0.4%

0.3%

0:30

AUD

Westpac Leading Index (MoM) (JUN)

0.1%

-

0.1%

2:00

CNY

GDP (QoQ) (2Q)

2.0%

1.8%

1.5%

2:00

CNY

GDP (YoY) (2Q)

7.5%

7.4%

7.4%

2:00

CNY

GDP YTD (YoY) (2Q)

7.4%

7.4%

7.4%

2:00

CNY

Retail Sales (YoY) (JUN)

12.4%

12.5%

12.5%

2:00

CNY

Retail Sales YTD (YoY) (JUN)

12.1%

12.2%

12.1%

2:00

CNY

Industrial Production (YoY) (JUN)

9.2%

9.0%

8.8%

2:00

CNY

Industrial Production YTD (YoY) (JUN)

8.8%

8.8%

8.7%

2:00

CNY

Fixed Assets Ex Rural YTD (YoY) (JUN)

17.3%

17.2%

17.2%

European Session

8:30

GBP

Jobless Claims Change (JUN)

-27.0K

-27.4K

High

8:30

GBP

Claimant Count Rate (JUN)

3.1%

3.2%

Medium

8:30

GBP

ILO Unemployment Rate (3Mths) (MAY)

6.5%

6.6%

Medium

8:30

GBP

Employment Change (3M/3M) (MAY)

243K

345K

Low

8:30

GBP

Avg Weekly Earnings (3M/(YoY) (MAY)

0.5%

0.7%

Low

8:30

GBP

Weekly Earnings ex Bonus (3M/(YoY) (MAY)

0.8%

0.9%

Low

9:00

EUR

Euro-Zone Trade Balance (€) (MAY)

16.5B

15.7B

Low

9:00

EUR

Euro-Zone Trade Balance s.a. (€) (MAY)

16.0B

15.8B

Low

9:00

CHF

ZEW Survey (Expectations) (JUL)

-

4.8

Medium

Critical Levels

EURUSD

1.3454

1.3520

1.3544

1.3586

1.3610

1.3652

1.3718

GBPUSD

1.6868

1.7000

1.7072

1.7132

1.7204

1.7264

1.7396