Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.15 17:18

Forex Fundamentals - Weekly outlook: June 16 - 20The dollar ended Friday’s session flat against a basket of other major currencies as escalating tensions in Iraq underpinned safe haven demand for the greenback, offsetting an unexpected decline in U.S. consumer confidence.

Concerns over the ongoing Sunni insurgency in Iraq hit market sentiment on Friday, after insurgents took control of the Iraqi cities Mosul and Tikrit, fuelling fears over the impact of reduced oil supply on global growth.

The escalating violence in Iraq overshadowed a report showing that U.S. consumer sentiment unexpectedly deteriorated in June.

The preliminary reading of the University of Michigan's consumer sentiment index for June came in at 81.2, down from 81.9 in May, missing expectations for an uptick to 83.0.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, was flat at 80.75 late Friday.

The dollar was higher against the yen, with USD/JPY up 0.28% to 101.99 late Friday. For the week, the pair was down 0.49%.

The euro edged lower against the dollar, with EUR/USD dipping 0.08% to 1.3541 at the close, not far from the four-month trough of 1.3502 reached on June 5. For the week, the pair lost 0.38%.

The single currency has weakened broadly since the European Central Bank cut rates to record lows earlier this month, in order to combat the threat of persistently low inflation in the euro area.

Elsewhere, the pound ended the week close to five year highs against the dollar after Bank of England Governor Mark Carney said Thursday that U.K. interest rates could rise sooner than investors expect.

GBP/USD was up 0.24% to 1.6968 late Friday, after rising as high as 1.6990 earlier in the session, the most in almost five years. The pair ended the week with gains of 0.99%.

Sterling rose to one-and-a-half year highs against the broadly weaker euro, with EUR/GBP down 0.30% to 0.7981 late Friday, extending the week’s losses to 1.32%.

The New Zealand dollar turned lower on Friday amid increased safe haven demand, with NZD/USD slipping 0.26% to 0.8663.

The pair rallied to a one month high of 0.8699 Thursday after the Reserve Bank raised its benchmark interest rate to a five-year high of 3.25% and indicated that borrowing costs would rise again as strong economic growth fuels inflation pressures.

In the week ahead, investors will be focusing on the outcome of Wednesday’s Federal Reserve policy meeting, while Monday’s preliminary report on euro zone inflation will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 16

- The euro zone is to release preliminary data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to publish a report on foreign securities purchases.

- The U.S. is to produce data on industrial production and manufacturing activity in the Empire State.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- Switzerland is to release data on producer price inflation, while the U.K. is to release data on consumer price inflation.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Later Tuesday, the U.S. is to produce data on housing starts, building permits and consumer prices.

- New Zealand is to release data on the current account, while Australia is to publish an index of leading economic indicators.

- The Bank of Japan is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective. Japan is also to release data on the trade balance.

- The BoE is to publish the minutes of its latest policy setting meeting.

- The ZEW Institute is to publish a report on economic expectations in Switzerland, a leading indicator of economic health.

- Canada is to produce data on wholesale sales.

- Later Wednesday, the Federal Reserve is to announce its federal funds rate and publish its rate statement. The announcement is to be followed by a press conference with Fed Chair Janet Yellen.

- New Zealand is to publish data on gross domestic product, the broadest indicator of economic activity and the leading measure of the economy’s health.

- The Swiss National Bank is to announce its libor rate. The bank is also to publish its quarterly monetary policy assessment and hold a press conference.

- The U.K. is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The Eurogroup of euro area finance ministers are to hold meeting in Brussels.

- The U.S. is to publish the weekly report on initial jobless claims as well as a report on manufacturing activity in the Philadelphia region.

- Germany is to publish data on producer price inflation.

- BoJ Governor Haruhiko Kuroda is to speak at an event in Tokyo; his comments will be closely watched.

- The euro zone is to release data on the current account, while the euro area’s Economic and Financial Affairs Council is to hold meetings in Brussels.

- The U.K. is to release data on public sector net borrowing.

- Canada is to round up the week with data on consumer inflation and retail sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.13 21:41

Forex Fundamentals Weekly Outlook June 16-20The dollar and the euro were on the back foot in the past week. The focus is now on the Fed decision and the UK inflation data. In addition, the Philly Fed Manufacturing Index and inflation figures will be of interest. Here are the main events on our FX calendar. Here is an outlook on the market-movers for the coming week. A jump in US job openings underpinned the US dollar. While this figure is lagging, it closely watched by the Federal Reserve. However, other figures from the US, such as retail sales, were mediocre. The UK enjoyed encouraging employment figures that lift the prospects of an early rate hike, and Carney indeed explicitly said that a rate hike make come sooner than later, sending the pound jumping up.. In Europe, the lower bond yields and the implementation of the negative deposit rate weighed on the common currency. Another currency that stood out is the kiwi that leaped up: the RBNZ hiked the rate and did not signal a pause.

- UK inflation data: Tuesday, 8:30. Annual inflation in the UK edged up to 1.8% in April, rising for the first time in almost a year, following 1.6% in the previous month. The main cause for this rise was higher travel and energy prices. Analysts expected a smaller climb of 0.1%. However rising inflation ignites new fears that the standard of living will decline due to falling wages. CPI is expected to slide to an annual level of 1.7%. The RPI is predicted to remain at 2.5% and Core CPI to slide to 1.7%.

- German ZEW Economic Sentiment: Tuesday, 9:00. German economic sentiment plunged in May by 10.1 points, to 33.1, hitting the lowest level since January 2013. The Ukraine crisis was the probable cause for this fall starting effect economic activity, especially in the eastern part of the country. Economists expected a 2.2 points fall to 41.3 in May. A rise to 35.2 points is expected now. The all-European figure is also expected to advance to 59.6 points.

- US Building Permits: Tuesday, 12:30. U.S. building permits soared in April to their highest level in nearly six years, reaching 1.08 million-unit pace. The sharp rise offered hope that the recent sluggishness in the housing market may be over. The 90,000 rise surprised analysts expecting a 1.01 million-unit pace. A similar level of 1.07 million is estimated now. Housing starts carry expectations of dropping from 1.07 to 1.04 million.

- US inflation data: Tuesday, 12:30. U.S. Consumer Price Index increased 0.3% in April after posting a 0.2% gain in March, as food prices edged up for a fourth consecutive month and the cost of gasoline climbed. The reading was consistent with analysts’ forecast. In the 12 months through April, CPI gained 2.0% after a 1.5% rise in March, the biggest increase since July last year. Meanwhile, core inflation, excluding food and energy prices, rose 0.2% above predictions of a 0.1% rise and following a 0.2% rate in the previous month. US inflation remains in Goldilocks territory. Both CPI and Core CPI are expected to rise 0.2% m/m.

- UK MPC Meeting Minutes: Wednesday, 8:30. After Carney lifted the pound with his rate hike comment, it will be very interesting to see if one or more members already voted for a rate hike in June’s no-change decision. Up to now, Carney enjoyed unanimous support behind his policy, and that is what is expected now. A non-unanimous vote could push the pound even higher.

- US rate decision: Wednesday, 18:00, press conference at 18:30. The Fed is expected to taper bond buys for the 5th time, to $35 billion / month. Recent data from the US has been positive and showed growth in jobs as well as in other sectors after the terrible first quarter. Markets will likely focus on the fresh economic projections, especially those concerning the potential date of a rate hike. The previous decision was not accompanied by a press conference, and it passed quite quietly. This was not the case in March, when Yellen said that a rate hike could come within 6 months of the end of QE and stirred markets. Was it a slip in her first appearance or did she sow the initial seed for a rate hike in early 2015? Every word she says now will be scrutinized and could cause a significant market stir. Given the recent improvement, we can expect a more hawkish approach. If the hints are subtle, a full response to the FOMC statement and the press conference can only be expected in the following sessions. Contrary to April’s decision, this one could have a long lasting impact on markets.

- NZ GDP: Wednesday, 22:45. Economic growth in New Zealand continued to grow in the last quarter of 2013, rising 0.9% from a 1.2% expansion in the third quarter. Analysts expected a higher rise of 1.0% in the 4th quarter. Manufacturing and wholesale trade were the main contributors to the rise in output. On an annualized rate, GDP expanded 3.1% in the December quarter, in line with forecasts. A growth rate of 1.2% is expected now.

- Switzerland rate decision: Thursday, 7:30. The Swiss National Bank kept rates unchanged at 0.25% but was more optimistic on future growth prospects. The bank reiterated its commitment to defend the 1.20 per euro limit with unlimited interventions and stood ready to take further measures if necessary. The SNB said economic activity in Switzerland should improve from the first quarter of 2014 confirming a 2.0% growth this year.

- US Unemployment Claims: Thursday, 12:30. Recent trends in jobless claims have been positive, with a gradual convergence towards the 300K level. While the drops have never been steady, the US job market seems to be going in the right direction. A figure of under 300K will certainly be dollar positive, but after the recent rise to 317K, a similar value of 316K is predicted.

- US Philly Fed Manufacturing Index: Thursday, 14:00. US manufacturing barometer in the Philadelphia area declined less than expected in April, reaching 15.4 after rising to 16.6 points in March. The Philly Fed’s general conditions index reaching 15.4 in May was nearly as strong as April’s 16.6. This report, together with Empire State, reaffirms the strength of the US manufacturing sector. A small slide to 14.3 points is on the cards.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.16 10:10

2014-06-16 03:20 GMT (or 05:20 MQ MT5 time) | [AUD - RBA Assist Gov Kent Speech]

Unemployment Rate To Remain Elevated In Coming Years - RBA's Kent

Labour demand has improved over the recent months after the slowdown in labour demand and supply in the recent past, although the jobless rate is expected to remain elevated in the coming years, Christopher Kent, Assistant Governor of the Reserve Bank of Australia, said on Monday in his address on Labour Market Developments.

In the previous year, demand for labour was affected by the decline in mining investment, decline in trade, high level of exchange rates and weak growth of public demand.

The labour supply was affected as a consequence of a discouraging effect from the decline in demand and also due to ageing population, he said.

Kent noted that wages declined steadily due to the labour demand-supply weakness.

"The decline in wage growth has contributed, at the margins, to a turnaround in the real exchange rate and helped cushion the effect of slower growth of domestic demand on employment growth. It has also helped to contain domestic cost pressures thereby offsetting the effect of the lower exchange rate on consumer prices" Kent said.

While noting that the demand for labour has improved over recent months, with some of that reflecting a 'catch-up' after a period of weak employment growth last year, Kent said some forward-looking indicators are higher than they have been, though they are still at levels consistent with only moderate employment growth in the next few months. The Assistant Governor added that the central bank's latest forecasts are for employment growth to pick up gradually over the next two years.

The unemployment rate, though forecast to remain high in the upcoming years, is expected to decline later in 2015 when GDP growth is expected to pick up, he added.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.14 16:07

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- Minutes from June’s RBA Rate Decision May Reveal Dovish Overtones

- Upbeat FOMC Outcome May Dent Aussie’s Perceived Yield Advantage

The Australian Dollar managed a strong showing last week, rising to a

two-month high just below the 0.95 figure against its US counterpart.

The advance tracked an improvement in monetary policy expectations,

with a Credit Suisse gauge tracking the priced-in 12 month outlook

rising to the highest level since mid-May. High-profile event risk on

the domestic and the external fronts in the week ahead threatens to

undermine the rally however.

The spotlight initially falls on minutes from June’s RBA policy meeting. The policy announcement struck a familiar tone,

arguing for a period of stability in interest rates. With that in

mind, traders will look to the text of the minutes for added color,

attempting to gauge how long the standstill is likely to last and the

direction that policy is likely to take thereafter.

Minutes from a likewise status-quo flat rate decision in May proved telling,

revealing a dovish lean in the Bank’s posture and sending the Aussie

lower. Australian economic data dramatically deteriorated relative to

expectations between the May and June meetings (according to data from

Citigroup), warning that a similar dynamic may play out again.

Later in the week, the focus returns to the Federal Reserve the rate-setting FOMC committee convenes for its policy meeting.

This outing takes on particular significance in that it will be

accompanied by the release of an updated set of policymakers’ economic

forecasts as well as a press conference from Fed Chair Janet Yellen. As

we’ve discussed previously, the fate of the Fed’s effort to

“taper” QE asset purchases with an eye to end the program this year –

paving the way for interest rate hikes – has been a formative catalyst

for the markets this year.

US economic news-flow has broadly improved relative to consensus

forecasts since early April but a string of disappointing releases over

the past three weeks have rekindled doubts about the strength of the

recovery from a dismal performance in the first quarter.

Indeed, the US Dollar has come under renewed selling pressure as traders

scaled back bets on swift Fed policy normalization, putting the

greenback’s multi-year uptrend in jeopardy. For their part, FOMC

officials have adamantly maintained that the first quarter was a

hiccup in an otherwise supportive environment. If that sentiment is

reflected in an upgraded set of economic forecasts and/or an upbeat

Yellen presser this dynamic may be overturned, undermining the Aussie’s

perceived yield advantage and sending it lower anew.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.17 08:30

2014-06-17 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA Minutes: Policy Stance Continues To Be Appropriate

Members of the monetary policy board of the Reserve Bank of Australia felt that the current level of stimulus in the Australian economy continues to be appropriate, minutes from the central bank's June 3 meeting revealed on Tuesday.

The board members also said that economic growth is expected to remain slightly below trend, while inflation figures to remain within the target range of 2 to 3 percent.

"Global and domestic economic conditions overall were little changed from the previous meeting. Growth of Australia's major trading partners remained consistent with the earlier outlook, with growth early in 2014 around its long-run average," the minutes said.

At the meeting, the board kept the nation's benchmark interest rate unchanged at 2.50 percent, in line with expectations; the rate has been unchanged since last August.

The RBA has reduced the cash rate by a cumulative 225 basis points since November 2011 to help the economy sustain the economic growth in view of fading support from the mining boom.

"The expectation of substantial falls in mining investment, below-average growth of public demand and non-mining investment remaining subdued for a time implied that the pace of growth was likely to be a little below trend over the rest of this year and into the next, before gradually increasing," the minutes said.

The government estimates real GDP to continue growing below trend at 2.5 percent in 2014-15, before accelerating to near-trend growth of 3 percent in 2015-16.

The board said continued accommodative monetary policy should provide support to demand, and help growth to strengthen over time.

In the board's judgment, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target.

On the currency, the bank said the exchange rate remains high by historical standards, particularly given the further decline in commodity prices.

"Given this outlook for the economy and the significant degree of monetary stimulus already in place to support economic activity, the Board judged that the current accommodative stance of policy was likely to be appropriate for some time yet," the minutes said.

Also on Tuesday, the Australian Bureau of Statistics said that the total number of new motor vehicle sales in Australia was up a seasonally adjusted 0.3 percent on month in May, standing at 92,410. That follows the flat reading in April.

By category, sales of other vehicles climbed 3.4 percent on month and sales of sports utility vehicles jumped 1.8 percent, while sales of passenger vehicles fell 2.0 percent.

By region, Victoria saw the largest increase (3.5 percent) followed by South Australia (1.3 percent) and the Australian Capital Territory (0.8 percent). The Northern Territory had the largest decline in sales (19.2 percent) followed by Queensland and Tasmania with 2.1 percent each.

On a yearly basis, sales declined 2.0 percent after falling 1.9 percent in the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 22 pips price movement by AUD - RBA Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.17 15:00

2014-06-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

- past data is 0.3%

- forecast data is 0.2%

- actual data is 0.4% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

U.S. Consumer Prices Rise More Than Expected In May

Consumer prices rose by more than expected in the month of May, according to a report released by the Labor Department on Tuesday, with the increase reflecting broad-based price growth.

The Labor Department said its consumer price index rose by 0.4 percent in May after climbing by 0.3 percent in April. Economists had expected the index to edge up by about 0.2 percent.

Core consumer prices, which exclude food and energy prices, increased by 0.3 percent in May after rising by 0.2 percent in the previous month. Core prices had also been expected to tick up by 0.2 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 30 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.15 17:22

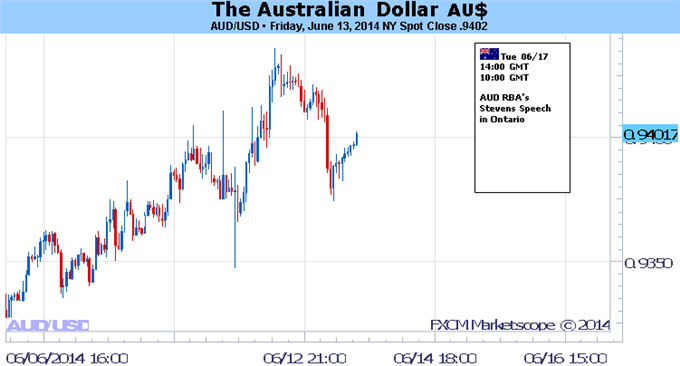

AUD/USD Fundamentals - weekly outlook: June 16 - 20The Australian dollar fell from a nine-week high against its U.S. counterpart on Friday, as concerns over escalating violence in Iraq dampened demand for riskier assets.

AUD/USD hit 0.9436 on Thursday, the pair’s highest since April 10, before subsequently consolidating at 0.9402 by close of trade on Friday, down 0.26% for the day but 0.72% higher for the week.

The pair is likely to find support at 0.9347, the low from June 12 and resistance at 0.9436, the high from June 12.

Concerns over the ongoing Sunni insurgency in Iraq hit market sentiment on Friday, amid fears over the impact of reduced oil supply on global growth.

The escalating violence in Iraq overshadowed a report showing that U.S. consumer sentiment unexpectedly deteriorated in June.

The preliminary reading of the University of Michigan's consumer sentiment index for June came in at 81.2, down from 81.9 in May, missing expectations for an uptick to 83.0.

The report came one day after data showed that U.S. retail sales rose less than expected in May, but the previous month was revised higher.

The Commerce Department said Thursday that U.S. retail sales rose 0.3% in May, falling short of expectations for a 0.6% gain. However, retail sales for April were revised up to a 0.5% gain from a previously reported increase of 0.1%.

Meanwhile, in Australia, official data released Thursday showed that the number of employed people in Australia declined by 4,800 in May, compared to expectations for a 10,000 rise.

Australia's unemployment rate remained unchanged at 5.8% last month, confounding expectations for an uptick to 5.9%.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the Australian dollar in the week ending June 10.

Net longs totaled 28,247 contracts, compared to net longs of 21,527 in the preceding week.

In the week ahead, investors will be focusing on the outcome of Wednesday’s Federal Reserve policy meeting, while the Reserve Bank of Australia will release the minutes of its most-recent policy meeting.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Friday, as there are no relevant events on this day.

Monday, June 16

- The U.S. is to produce data on industrial production and manufacturing activity in the Empire State.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- Later Tuesday, the U.S. is to produce data on housing starts, building permits and consumer prices.

- Australia is to publish an index of leading economic indicators.

- Later Wednesday, the Federal Reserve is to announce its federal funds rate and publish its rate statement. The announcement is to be followed by a press conference with Fed Chair Janet Yellen.

- The U.S. is to publish the weekly report on initial jobless claims as well as a report on manufacturing activity in the Philadelphia region.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.18 08:07

2014-06-18 00:00 GMT (or 02:00 MQ MT5 time) | [AUD - CB Leading Index]

- past data is 0.0%

- forecast data is n/a

- actual data is -0.1% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - CB Leading Index] = Change in the level of a composite index based on 7 economic indicators. This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously

==========

Australia Leading Index Dips 0.1% In May - Conference Board

A leading economic index for Australia eased 0.1 percent in April, the latest survey from the Conference Board revealed on Wednesday.

The headline figure follows the upwardly revised 0.2 percent increase in March (originally flat) and the 0.5 percent gain in February.

Among the individual components of the survey, building approvals and rural good exports were down, while the sales to inventories ratio, yield spread, money supply, gross operating surplus and share prices all were higher.

The Conference Board LEI for Australia has been on an upward trend since the middle of 2009, although its six-month growth rate has moderated in recent months.

The six-month growth rate of the leading economic index was 2.5 percent (about a 5.0 percent annual rate) from October 2013 to April 2014, higher than its growth of 1.1 percent (about a 2.3 percent annual rate) for the previous six months. The strengths among the leading indicators still outweigh the weaknesses, the board said, with six out of seven components advancing over the past six months.

The coincident index added 0.2 percent in April following the revised 0.3 percent gain in March and the 0.4 percent increase in February.

All four of its components continued to advance over the last six months. With April's gain, the coincident economic index grew by 1.6 percent (about a 3.3 percent annual rate) in the six-month period through April 2014 - significantly higher than the 0.2 percent (about a 0.5 percent annual rate) in the previous six months.

Meanwhile, real GDP increased at a 4.5 percent annual rate in the first quarter of 2014, an improvement from 3.2 percent (annual rate) in the fourth quarter of 2013.

Taken together, the current behavior of the composite indexes suggests that economic expansion will continue in the near term.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 6 pips price movement by AUD - CB Leading Index news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.18 14:29

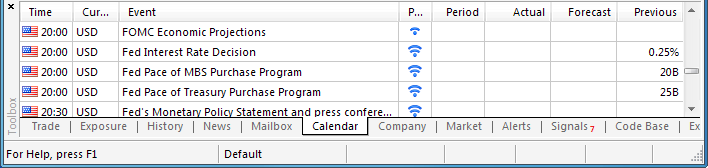

Trading the News: Federal Open Market Committee Meeting and Federal Funds Rate (based on dailyfx article)

- Federal Open Market Committee (FOMC) to Reduce QE by Another $10B.

- Fed Chair Janet Yellen to Hold Press Conference at 18:30 GMT.

Despite expectations for another $10B reduction in the Federal Open

Market Committee’s (FOMC) asset-purchase program, the central bank’s

updated forecasts (growth, inflation & interest rate) may have a

greater impact in driving the U.S. dollar as market participants weigh

the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Indeed, there’s limited scope of seeing a material shift in the Fed’s

policy outlook as Chair Janet Yellen remains reluctant to normalize

monetary policy, and the interest rate decision may spur a bearish

dollar reaction (bullish EUR/USD) should we get more of the same from

the central bank.

Sticky inflation paired with the ongoing improvement in the labor market

may encourage the FOMC to soft its dovish tone for monetary policy, and

the fresh developments coming out of the central bank may generate a bullish outlook for the dollar should we see a greater dissent within the committee.

However, the slowdown in the housing market along with the dismal 1Q GDP

reading may push the FOMC to lower its fundamental projections for the

U.S. economy, and the updated forecasts may heighten the bearish

sentiment surrounding the greenback should the calculations drag on

interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: FOMC Cuts Another $10B & Shows Greater Willingness to Normalize

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors a long dollar trade, short EUR/USD with two separate position

- Place stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in opposite direction

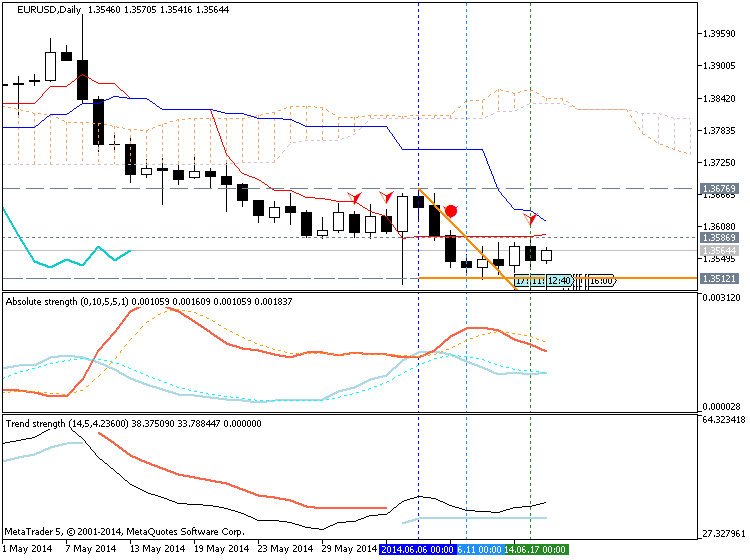

EUR/USD Daily

- Sideways Price Action in Focus as EUR/USD Holds Monthly Range

- Interim Resistance: 1.3650 (78.6% expansion) to 1.3670 (61.8% retracement)

- Interim Support: 1.3490 (50.0% retracement to 1.3500 Pivot

| Period | Data Released | Estimate | Actual | Pips Change 1 Hour post event | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| APR 2014 | 04/30/2014 18:00 GMT | 0.25% | 0.25% | +9 | +2 |

2013-09-18 18:00 GMT (or 20:00 MQ MT5 time| [USD - Federal Funds Rate] :

As expected, the Federal Reserve cut its asset purchase program by $10B in April leaving the total monthly purchase total to $45B per month, but pledged to keep rates on stay on hold for a considerable period of time even after its quantitative-easing (QE) program comes to an end. The relatively dovish tone for monetary policy dragged on the greenback, with the EUR/USD spiking to a high of 1.3875, but the market reaction was short-loved as the pair ended the day at 1.3864.

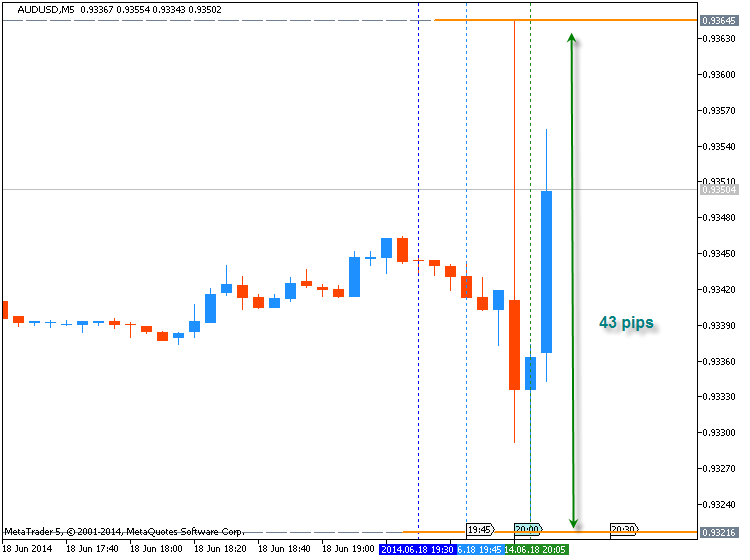

AUDUSD M5 : 43 pips range price movement by USD - Federal Funds Rate news event:

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.19 11:14

AUD/USD edges higher after Fed statement (based on investing article)

The Australian dollar edged higher against its U.S. counterpart on Thursday, as demand for the greenback weakened after the Federal Reserve indicated that interest rates will remain low for a considerable time after the bank’s asset purchase program ends.

AUD/USD hit 0.9419 during late Asian trade, the pair's highest since June 13; the pair subsequently consolidated at 0.9423, adding 0.19%.

The pair was likely to find support at 0.9323, Wednesday's low and resistance at 0.9461, the high of April 10.

At the conclusion of its two-day meeting on Wednesday, the Fed cut its bond purchases by another $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed also lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter. The central bank still acknowledged a broad improvement in the labor market.

The Fed said it expects the federal-funds rate, currently close to zero, to reach 1.2% by the end of next year and 2.5% by the end of 2016, a slightly faster rate of tightening than formerly expected.

The Aussie was higher against the New Zealand dollar, with AUD/NZD rising 0.26% to 1.0799.

Also Thursday, official data showed that New Zealand's gross domestic product rose by 1% in the first quarter, compared to expectations for an expansion of 1.2%. For the fourth quarter of 2013, New Zealand's GDP was revised up to an expansion of 1% from a previously estimated growth rate of 0.9%.

Later in the day, the U.S. was to publish the weekly report on initial jobless claims as well as a report on manufacturing activity in the Philadelphia region.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bullish market condition stopped by 0.9437 resistance for the bullish to be continuing.

H4 price is on bullish ranging between 0.9374 support and 0.9437 resistance levels..

W1 price is on breakout:

If D1 price will break 0.9437 resistance level so the primary bullish will be continuing.

If not so we may see the ranging market condition or correction within bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-06-16 03:20 GMT (or 05:20 MQ MT5 time) | [AUD - RBA Assist Gov Kent Speech]

2014-06-17 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Meeting Minutes]

2014-06-17 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - New Motor Vehicle Sales]

2014-06-17 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Foreign Direct Investment]

2014-06-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-06-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-06-17 14:00 GMT (or 16:00 MQ MT5 time) | [AUD - RBA's Governor Glenn Stevens Speech]

2014-06-18 00:00 GMT (or 02:00 MQ MT5 time) | [AUD - CB Leading Index]

2014-06-18 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-06-19 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Bulletin]

2014-06-19 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart