Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.24 10:57

Forex Weekly Outlook May 26-30The dollar and the pound enjoyed a positive week and the euro continued to grind lower. European Parliamentary Elections, US Durable Goods Orders, Consumer Confidence, GDP figures form the US and Canada as well as US employment data are the main market movers this week.

The FOMC meeting release failed to bring surprises. The main focus was on normalizing monetary policy after the Fed finishes its asset purchase tapering. The Fed expects growth will continue to accelerate in 2014 despite the unexpected softness in the first quarter attributed to bad weather conditions. The euro was pressured lower once again, through a combination of unimpressive data and more talk from the ECB regarding an imminent rate hike. In the UK, mostly positive data kept the pound bid, and cable still has a shot on 1.70. The Aussie showed weakness despite a positive surprise from China. Where will currencies go in the last week of this turbulent month?

- European Parliamentary Elections: The European Parliament elections takes place every five years. This time 751 MEPs will be elected and the voters will have more of a say in the appointment of the next Commission president. According to recent surveys, only 37 percent of Europeans believe their voice counts in Brussels. Policymakers in Brussels are trying to democratize the election process, and for the first time, the election results will be linked to the selection of the European Commission president. The major risk is that Euro-skeptic parties from the right will gain ground, thus undermining the decision making processes in the union.

- US Durable Goods Orders: Tuesday, 12:30. Orders for long lasting U.S. manufactured goods increased more than expected in March, jumping 2.6%, higher than the 2.1% rise estimated, while Core orders edged up 2.0%, beating forecasts of a 0.6% increase. Capital spending plans increased significantly indicating a pickup in growth in the second quarter. This report correlates with other manufacturing data indicating expansion. Durable goods orders are expected to decline by 0.5%, while core orders are expected to rise 0.2% this time.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence came below market consensus in April reaching 82.3 from 83.9 in the previous month. Analysts expected a slightly stronger reading of 82.9. Consumers assessed current business and employment conditions less favorably than in March, however the short-term outlook remained strong. Consumer confidence is expected to rise to 83.2.

- Haruhiko Kuroda speaks: Wednesday, 0:00. BOE Governor Haruhiko Kuroda will speak in Tokyo. Kuroda stated last month that consumer inflation may exceed the central bank’s projection in the fiscal year that ended in March. BOE Governor is confident that Japan’s economy is progressing in line with the banks forecasts. Kuroda may explain the BOJ’s decision of maintaining monetary policy. Market volatility is expected.

- US GDP (second release): Thursday, 12:30. The preliminary estimate of GDP growth for the first quarter of 2014 showed a weak growth rate of 0.1% dragged down by lower demand and unusually harsh weather conditions. Nevertheless, consumer spending increased 3.0% in the first three quarters. With weather conditions back to normal, housing and corporate investment should rebound sharply. GDP growth estimate for the first quarter is expected to show a 0.6% contraction and this could weigh on the dollar.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits edged up by 28,000 last week to 329,000, but still remaining at low levels suggesting a steady pace of hiring. The four-week average declined 1,000 to 322,500 indicating an increase in job openings. The pickup in hiring may help boost economic growth for the rest of 2014. Jobless claims are expected to reach 321,000 this time.

- US Pending Home Sales: Thursday, 14:00. Contracts to buy existing U.S. homes edged up in March by 3.4% following a 0.8% contraction in the prior month. The reading was well above expectations for a 1.0% rise. This was the first good sign in nine months that the housing market is recuperating. The strong reading suggest that the housing market will continue to support growth in the US economy. Pending home sales are expected to rise further by 1.1%.

- Canadian GDP: Friday, 12:30. The Canadian economy expanded by 0.2% in February after a 0.5% growth in January. The reading came in line with market forecast, indicating a modest recovery from the 0.4% contraction in December. However estimate for the first quarter growth stand at 1.7%-to 1.9%. February’s growth is credited to the mining and oil and gas industries. The agriculture and forestry sector contracted 1.5%. Manufacturing rose 0.6% after increasing 1.6% in January, and goods production climbed 0.5%. GDP for March is expected to reach 0.1%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.24 17:00

NZD/USD forecast for the week of May 26, 2014, Technical AnalysisThe NZD/USD pair fell during the bulk of the week, but seemed to stall right around the 0.8550 level. There is a significant amount of support below at the 0.85 handle as well, so quite frankly we don’t really see an opportunity to sell this market. That being the case, we are waiting for some type of supportive candle just below current levels in order to start buying again. Ultimately, watch risk appetite in general as it typically will push the New Zealand dollar around in a positive correlation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.25 15:15

NZD/USD Fundamentals - weekly outlook: May 26 - 30The New Zealand dollar fell to a three-week low against its U.S. counterpart on Friday, amid indications that the U.S. economy is shaking off the effect of a weather-related slowdown over the winter.

NZD/USD hit 0.8531 on Friday, the pair’s lowest since April 29, before subsequently consolidating at 0.8553 by close of trade, down 0.15% for the day and 0.93% lower for the week.

The pair is likely to find support at 0.8531, the low from May 23 and resistance at 0.8587, the high from May 22.

The Commerce Department reported Friday that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of decline.

Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

The upbeat data underlined the view that the U.S. economy was regaining traction after being slowed by unusually cold temperatures during the winter months.

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the New Zealand dollar in the week ending May 20.

Net longs totaled 17,594 contracts as of last week, compared to net longs of 19,340 contracts in the previous week.

In the week ahead, U.S. markets will remain closed on Monday for the Memorial Day holiday. Revised data on U.S. first quarter growth and reports on U.S. consumer confidence will be in focus.

Monday, May 26

- New Zealand is to publish data on the trade balance, the difference in value between imports and exports.

- Markets in the U.S. will remain closed for the Memorial Day holiday

- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

- New Zealand is to release private sector data on business confidence.

- The U.S. is to release revised data on first quarter GDP, as well as the weekly government report on initial jobless claims and data on pending home sales.

- New Zealand is to release data on building consents.

- The U.S. is to round up the week with a report on personal income and expenditure and revised data from the University of Michigan on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 06:21

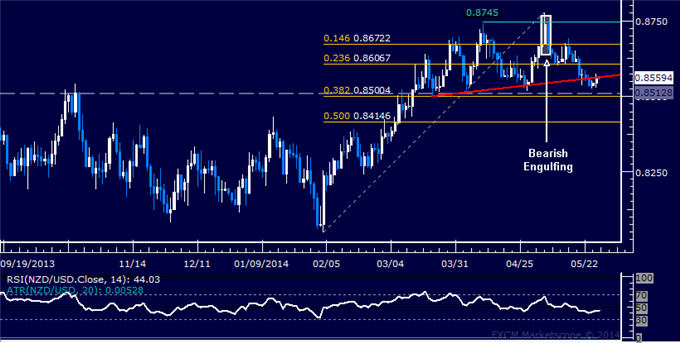

NZD/USD Technical Analysis – Focus Remain on 0.85 Figure

- NZD/USD Technical Strategy: Flat

- Support: 0.8500-13 (38.2% Fib ret., Oct 22 close), 0.8415 (50% Fib ret.)

- Resistance: 0.8562 (trend line), 0.8607 (23.6% Fib ret.

The New Zealand Dollar declined against its US counterpart as expected after prices formed a Bearish Engulfing candlestick pattern. A break below rising trend line set from late March has exposed the 0.8500-13 area, marked by the 38.2% Fibonacci retracement and the October 22 close. A further push below that aims for the 50% level at 0.8415. The trend line – now at 0.8562 – has been recast as resistance, with a turn back above that eyeing the 23.6% Fib at 0.8607.

The 0.85 figure has acted as formidable horizontal support over the past two months and we will opt to wait for that level to be broken as a signal of downside conviction before entering short. In the meantime, we remain flat.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 07:28

2014-05-28 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Business Confidence]

- past data is 64.8

- forecast data is n/a

- actual data is 53.5 according to the latest press release

if actual > forecast = good for currency (for NZD in our case)

NZD - ANZ Business Confidence = Level of a diffusion index based on surveyed manufacturers, builders, retailers, agricultural firms, and service providers

==========

New Zealand Business Confidence Continues To Fall In May

New Zealand business confidence eased in May although the outlook on general business prospects remained positive, results of a survey by ANZ Bank showed Wednesday.

The balance of business confidence slipped 11 points from the previous month's score to 53.5 in May. This is also 17 points below February's peak.

The slide in confidence can be attributed to higher interest rates, fall in commodity prices, high NZ dollar and leveled out house prices, the survey showed. However, though confidence in all sub-sectors eased in May, the levels of confidence remained well above average.

Activity expectations of firms regarding their own business fell to 53 points from 51 points in April, still remaining close to double the long-term average. Expected profitability fell for the third consecutive month, but at 31, the situation still augurs well for investment and employment.

Thirty percent of businesses are expected to hire more staff over the year, the same score as in the previous month. Investment intentions, though remaining higher than average, fell to 23 in May from 30 in April. Export intentions dropped to 25, leveling with October 2013.

Residential construction activity is expected to rise by 63 percent and construction activity by 59 percent, with the confidence indices rising to 63.2 and 58.8, respectively, in May.

The survey showed that the composite growth indicator signals a potential 5.7 percent growth in economy.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 24 pips price movement by NZD - ANZ Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 15:32

2014-05-28 12:55 GMT (or 14:55 MQ MT5 time) | [USD - Redbook index]

- past data is 1.0%

- forecast data is n/a

- actual data is 0.7% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD - Redbook index = The Johnson Redbook Index, released by Redbook Research Inc., is a sales-weighted of year-over-year same-store sales growth in a sample of large US general merchandise retailers representing about 9.000 stores. By dollar value, the index represents over 80% of the equivalent "official" retail sales series collected and published by the US Department of Commerce.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 10 pips price movement by USD - Redbook index news event

NZD/ USD technically bullish. Multiple analysis wise bullish. Here is a hourly chart. I am 7 years of experienced. Target profit : 0.8611

Both of Fundamental and Technical analysis wise bullish. Price will up. Because of technically oversold and bullish . Also, older and future NZD fundanetal is very good.And NZD current rate about 3.00%. Average of nzd is very strong at the moment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.29 20:49

The NZD/USD broke

broke below 0.8470 and fell quickly to 0.8450 reaching the lowest price

since March 12. The Kiwi is falling sharply across the board.

After

bottoming the NZD/USD rebounded slightly and currently trades at

0.8468, down 0.29% for the day so far. The pair is falling for the

second day in a row, accumulating a decline of a hundred pips.

NZD/USD technical outlook

The

pair weakened earlier after being unable to hold above 0.8700 and

accelerated to the downside after breaking short term support levels.

Now headed toward the second daily close in a row below 0.8500, the

outlook remains bearish.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.30 06:26

2014-05-29 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Building Consents]

- past data is 9.2%

- forecast data is n/a

- actual data is 1.5% according to the latest press release

if actual > forecast = good for currency (for NZD in our case)

[NZD - Building Consents] = Change in the number of new building approvals issued

==========

New Zealand Building Permits Rise 1.5%

The total number of building permits issued in New Zealand was up a seasonally adjusted 1.5 percent on month in April, Statistics New Zealand said on Friday - standing at 2,082.

That beat forecasts for a decline of 3.5 percent following the 8.3 percent jump in March.

Excluding apartments, the number of permits dropped 5.2 percent to 1,650.

The unadjusted value of building work consented in April was NZ$1.140 billion. This consisted of NZ$739 million of residential work and NZ$401 million of non-residential work.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 11 pips price movement by NZD - Building Consents news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.30 14:52

2014-05-30 12:30 GMT (or 14:00 MQ MT5 time) | [USD - Personal Consumption Expenditure]

- past data is 0.2%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - Personal Consumption Expenditure] = Change in the price of goods and services purchased by consumers, excluding food and energy

==========

U.S. Personal Spending Shows Unexpected Decrease In April

While the Commerce Department released a report on Friday showing that U.S. personal income rose in line with economist estimates in the month of April, the report also showed an unexpected drop in personal spending for the month.

The report showed that personal income rose by 0.3 percent in April following a 0.5 percent increase in March. The increase marked the fourth straight month of growth and matched expectations.

On the other hand, the Commerce Department said personal spending edged down by 0.1 percent in April after surging up by 1.0 percent in March. The modest decrease surprised economists, who had expected spending to rise by 0.2 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 5 pips price movement by USD - Personal Consumption Expenditure news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

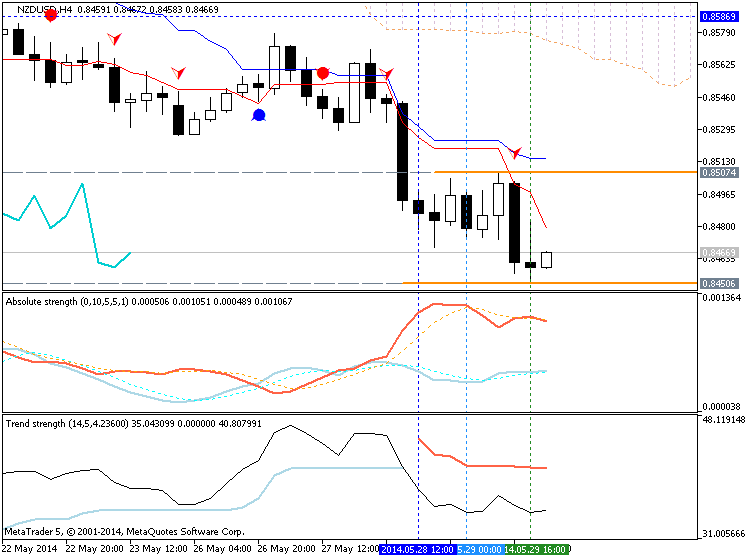

D1 price is located inside Ichimoku cloud/kumo for ranging bearish market condition trying to break 0.8536 support level for the bearish to be continuing.

H4 price is on bearish ranging between 0.8530 support and 0.8577 resistance levels.

W1 price is on correction within primary bullish with ranging between 0.8513 support and 0.8779 resistance.If D1 price will break 0.8536 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2014-05-25 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Trade Balance]

2014-05-27 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-05-27 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2014-05-28 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Business Confidence]

2014-05-29 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-05-29 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-05-29 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Building Consents]

2014-05-30 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart