Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.17 11:16

Forex Fundamentals - Weekly Outlook May 19-23Rate decision in Japan, inflation data in the UK and Canada, FOMC Meeting Minutes, Unemployment Claims, German Ifo Business Climate and US housing data are the main events on our list. Here is an outlook on the main market-movers for this week.

Last week, major US figures came out above expectations; Annual inflation reached 2%, as expected and the monthly CPI edged up to 0.3%. Meanwhile, the annual core inflation beat forecasts with a 1.8% reading. Furthermore, the sharp drop in the number of unemployment claims reaching a 7-year low of 297,000, reaffirms the strength of the US labor market. These positive signs support the Fed’s tapering plan, indicating the US economy is getting stronger and does no longer need QE. Will the US housing data also change for the better this week.

- UK inflation data: Tuesday, 8:30. UK inflation remained below the BOE’s 2.0% inflation target in March, reaching 1.6%, the lowest reading since October 2009. This reading was preceded by 1.7% in February. This was the sixth consecutive month of low inflation narrowing the gap between wage growth and the rise in prices contributing to business stability. UK inflation is expected to increase to 1.7%.

- Japan rate decision: Wednesday. Governor Haruhiko Kuroda maintained the BOJ’s monetary policy in April expressing confidence that the economy is advancing according to plan. However, many analysts believe the BOJ will have to ease policy in the near future to prevent a deflation trend. Kuroda told Prime Minister Shinzo Abe that he will adjust policy without hesitation in case the 2.0% inflation target may be jeopardized. No change is expected this time.

- US FOMC Meeting Minutes: Wednesday, 18:00. FOMC minutes released in April indicate the Fed’s intention of maintaining loose monetary policy for years to come. The FOMC welcomed the pickup in GDP growth registered after the weak first quarter affected by the cold weather. The members supported a low fed funds rate for as lonf as inflation remains below the 2% target. Tapering should continue and changes to guidance are possible. The FOMC expects that the economy will improve.

- UK GDP data: Thursday, 8:30. According to the NIESR estimates GDP edged up 1.0% in the second quarter after posting a 0.8% expansion rate in the first three months of 2014. The growth levels nearly equal the pre-financial crisis peak. NIERS forecasts a 2.9% growth rate in 2014. However, despite the pick-up, income per capita will need another three years to catch up with GDP expansion. GDP growth in the second quarter is expected to reach 0.8%.

- US Unemployment Claims: Thursday, 12:30.Initial claims for U.S. unemployment benefits hit a seven-year low of 297,000 claims last week, confirming the strong recovery in the US economy. Claims fell 24,000 from the preceding week, indicating stronger economic growth in the second quarter. Stronger labor market and rising inflation pressures give green light to the Fed’s ongoing tapering move. Jobless claims are expected to increase to 312,000.

- US Existing Home Sales: Thursday, 12:30. Second hand homes sales declined to their lowest level in more than 1-1/2 years in March, reaching an annual rate of 4.59 million units. However, sales were stronger than the 4.57 million forecasted by analysts, indicating that the negative trend in the housing market may be over. Supply increased as well as the number of first time buyers. Existing Home Sales are expected to rise to 4.71 million.

- German Ifo Business Climate: Friday, 8:00. German business climate index rose to 111.2 in March, following a revised 110.7 in February. The reading was stronger than the 110.5 points forecasted by analysts. The Ukraine crisis took less attention in the survey despite Barack Obama’s warnings of additional sanctions against Russia in case it fails to reach an agreement with Ukraine. German business climate is predicted to reach 111.

- US New Home Sales: Friday, 14:00. Sales of new U.S. homes plunged to their lowest level in eight months reaching a seasonally adjusted annual rate of 384,000 units in March. It was the second consecutive monthly drop indicating a slowdown in sales. Economists expected sales to increase to 455,000 saying the unexpected drop may be related to cold weather conditions. However, the weak demand increased the months’ supply of houses on the market to 6.0, the highest level since October 2011, from 5.0 months in February. New home sales are expected to reach 426,000.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.17 18:09

USD/CAD forecast for the week of May 19, 2014, Technical AnalysisThe USD/CAD pair initially tried to rally during the week, but as you can see we ended up falling. We rest right on the 1.0850 handle, an area of significant support. That being the case, we feel that a break down below here will more than likely send this market looking for the 1.07 level first, and then the 1.06 level where we would expect a significant amount of support. Any supportive candle down there, we would be more than willing to start buying. In the meantime though, it does look like this pair is probably going to see more weakness.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.18 14:32

USD/CAD Fundamentals - weekly outlook: May 19 - 23The U.S. dollar was lower against the Canadian dollar late Friday following the release of upbeat U.S. housing sector data, which offset a report pointing to a deterioration in U.S. consumer sentiment.

USD/CAD ended Friday’s session at 1.0863, down 0.17% for the day. For the week, the pair lost 0.32%.

Investor sentiment was boosted after the Commerce Department reported that U.S. housing starts jumped 13.2% in April, after a 2.0% increase in March.

It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was offset by a report showing that U.S. consumer confidence deteriorated in May. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 the month before. Analysts had expected a slight uptick to 84.5.

Earlier in the week risk appetite was hit by concerns over the outlook for global growth after data showed that the euro zone economy grew less strongly than forecast in the first three months of the year.

The euro zone’s gross domestic product grew just 0.2% in the first quarter, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

In Canada, data on Friday showed that foreigners reduced their holdings in Canadian securities in March, while Canadian investors purchased foreign securities at the fastest pace in 16 months.

Statistics Canada said foreign investors sold a net C$1.23 billion in Canadian securities, while Canadian investors acquired C$7.88 billion in foreign securities, the largest investment abroad since November 2012.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

Canadian data on retail sales and consumer prices will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- Markets in Canada are to remain closed for a national holiday.

- Canada is to publish data on wholesale sales.

- In the U.S., Federal Reserve Bank of Philadelphia Charles Plosser and Federal Reserve Bank of New York President William Dudley are to speak.

- Fed Chair Janet Yellen is to speak at an event in New York.

- Later Wednesday, the Fed is to publish the minutes of its May meeting.

- Canada is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

- Canada is to publish data on consumer price inflation, which accounts for the majority of overall inflation.

- The U.S. is to round up the week with data on new homes sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.21 16:20

USD/CAD eases up to 1-week high before Fed minutes

The U.S. dollar eased up to one-week highs against the Canadian dollar on Wednesday as investors awaited the minutes of the Federal Reserve’s latest meeting later in the session for fresh insight into when U.S. borrowing costs might rise.

USD/CAD touched highs of 1.0918, the most since May 14 and was last up 0.09% to 1.0914.

The pair was likely to find support at 1.0870, Tuesday’s low and resistance at 1.0959.

Investors were turning their attention to of the minutes from the Fed’s latest monetary policy meeting for insight on the central bank's view of the economy.

Recent U.S. economic reports indicating that the recovery remains uneven have weighed on U.S. Treasury yields, pressuring the dollar.

On Tuesday, New York Fed President William Dudley reiterated the central bank’s dovish stance, saying the pace of rate hikes was likely to be “slow”.

Market participants were also looking ahead to Canadian data on retail sales due for release on Thursday and a report on consumer inflation on Friday.

Elsewhere, the loonie, as the Canadian dollar is also known, was higher against the euro, with EUR/CAD down 0.18% to 1.4915.

The

euro remained under pressure amid expectations that the European

Central Bank will ease monetary policy at its next meeting in June and

after data last week showing that the euro zone economy grew at a slower

than forecast rate in the first quarter.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.22 10:08

2014-05-22 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

- past data is 48.1

- forecast data is 48.1

- actual data is 49.7 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

CNY - HSBC Manufacturing PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry

==========

China Manufacturing PMI Jumps To 49.7 - HSBC

An index monitoring manufacturing activity in China came in with a score of 49.7 in May, the latest flash estimate from HSBC and Markit Economics revealed on Thursday.

That topped forecasts for a score of 48.3 and was up sharply from 48.1 in April - and while it does remain below the line of 50 that separates expansion from contraction, the May reading represents a five-month high.

"The improvement was broad-based with both new orders and new export orders back in expansionary territory. Disinflationary pressures also eased over the month and output prices increased for the first time since November 2013," said HSBC Chief Economist, China & Co- Head of Asian Economic Research Hongbin Qu.

Among the individual components of the survey, the index for manufacturing output came in at 50.3 - up from 47.9 in April to a four-month high.

The index for new orders swung to expansion from contraction a month earlier - as did new export orders, output prices, stocks of purchases and quantity of purchases.

Backlogs of work continued to contract, but at a slower pace - as did input prices. The employment index declined at a faster pace, while stocks of finished goods turned to contraction after expanding last month.

Suppliers' delivery times lengthened in May after showing no change in the previous month.

"The employment index fell further to 47.3, which implies that this month's uptick in sentiment has not yet filtered through to the labor market. Some tentative signs of stabilization are emerging, partly as a result of the recent mini-stimulus measures and lower borrowing costs. But downside risks to growth remain, particularly as the property market continues to cool. We think more policy easing is needed to put a floor under growth in the coming months," Hongbin said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

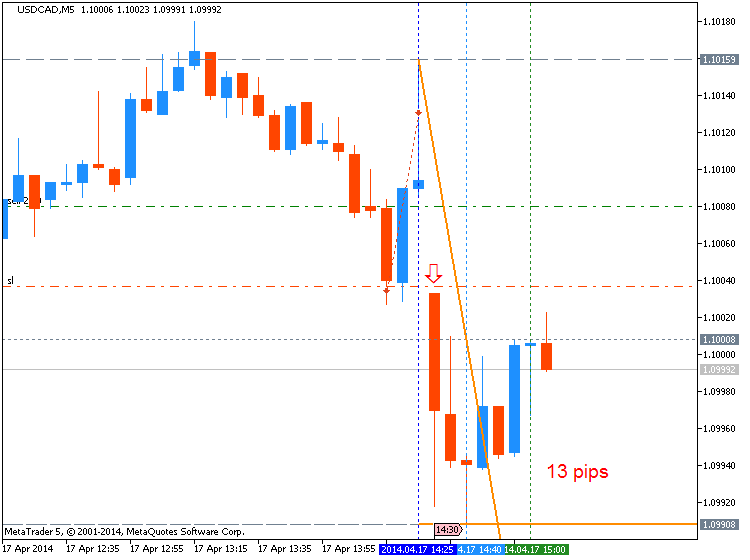

USDCAD M5 : 11 pips price movement by CNY - HSBC Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.23 10:14

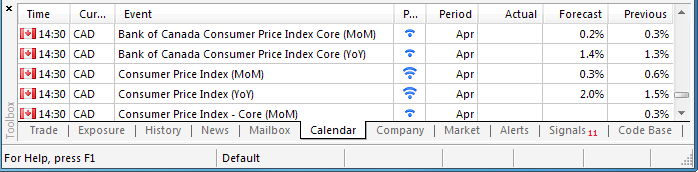

Trading the News: Canada Consumer Price Index (based on dailyfx article)

- Canada Consumer Price Reading of 2.0% Will Mark Highest Price Since April 2012.

- Core Rate of Inflation to Increase for Third Time in 2014.

A sharp rebound in Canada’s Consumer Price Index (CPI) may generate a

larger pullback in the USD/CAD as the pair struggles to push back above

former support around 1.0930-40.

What’s Expected:

Why Is This Event Important:

Despite the dovish tone for monetary policy, heightening price pressures may limit the Bank of Canada’s (BoC) scope to further embark on its easing cycle, and the bearish momentum in the USD/CAD may get carried into June should the data print prop up interest rate expectations.

The ongoing recovery in private sector activity paired with the resilience in the housing market may spur a meaningful rebound in the CPI, and a stronger-than-expected inflation print may heighten the appeal of the Canadian dollar as it dampens expectations for a rate cut.

However, firms may continue to offer discounted price amid the persistent weakness in the labor market along with the slowdown in private sector, and a dismal release may instill a more bullish outlook for the USD/CAD as it appears to be carving a higher-low in May.

How To Trade This Event Risk

Bullish CAD Trade: Headline Inflation Climbs 2.0% or Greater

- Need red, five-minute candle after the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in reverse

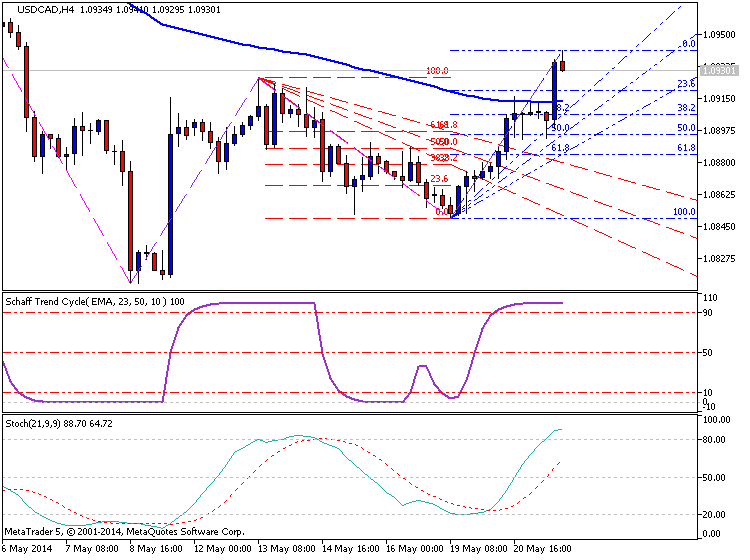

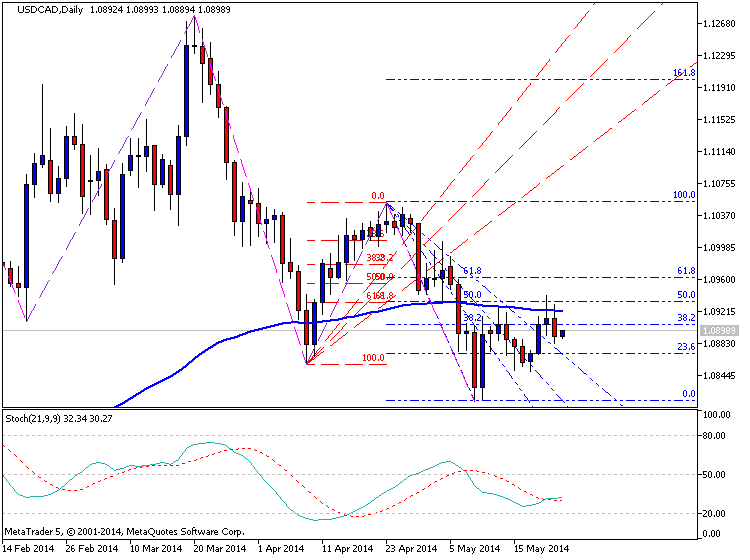

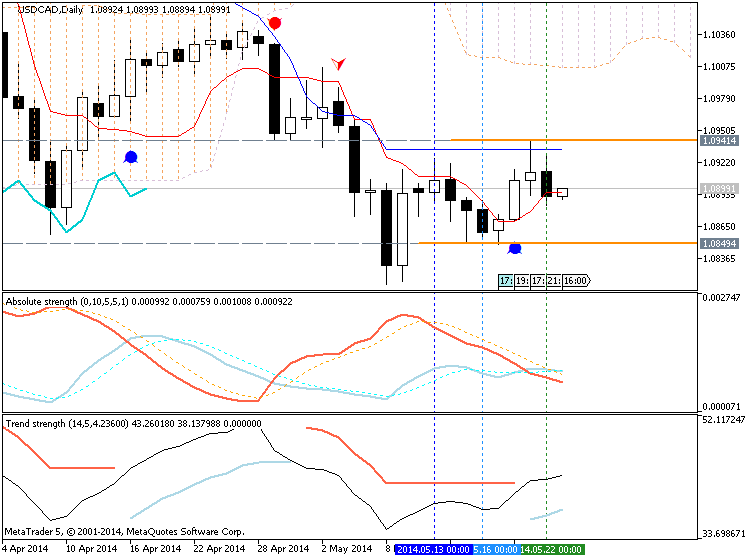

USD/CAD Daily

- Need Break of Bearish RSI Momentum to Favor Topside Targets

- Interim Resistance: 1.1000 (1.618% expansion) to 1.1020 (23.6% retracement)

- Interim Support: 1.0850 (61.8% retracement) to 1.0870 (100% expansion)

| Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| MAR 2014 |

04/17/2014 12:30 GMT | 1.4% | 1.5% | -12 | flat |

March 2014 Canada Net Change in Employment

USDCAD : 13 pips price movement by CAD - CPI news event

The Canadian Dollar strengthened against the greenback following better

than expect CPI for March. The print came in at a tenth of a percent

higher, but CAD strength was quickly retraced by the end of the day.

Although on a technical basis we may have set a USDCAD low, it may take

weak CAD data and inflation coming in on the downside to prompt

fundamental CAD selling.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 24 pips price movement by CAD - CPI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

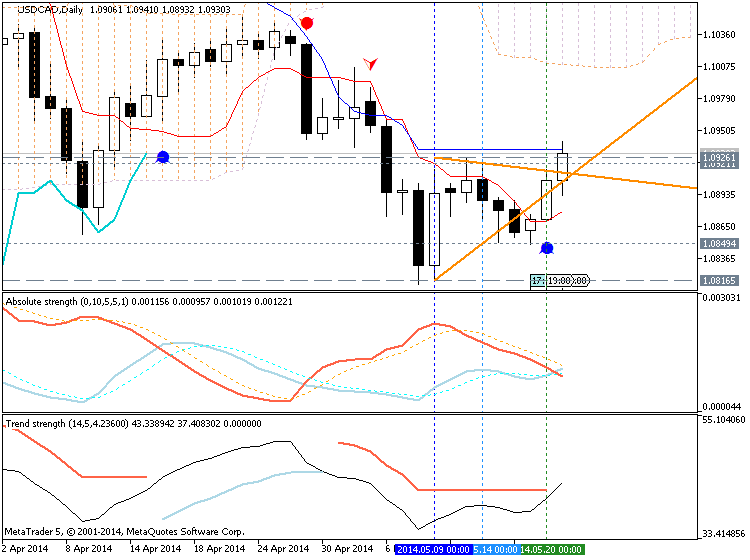

D1 price is on primary bearish market condition trying to break 1.0814 support level from above to below.

H4 price broke triangle pattern for breakdown with primary bearish too.

W1 price is on correction within primary bullish for breaking 1.0814 support level.If D1 price will break 1.0814 support from above to below on close bar so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish on D1 timeframe.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-05-20 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Wholesale Sales]

2014-05-20 16:30 GMT (or 18:30 MQ MT5 time) | [USD - FOMC Member Plosser Speech]

2014-05-20 17:00 GMT (or 19:00 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2014-05-21 15:30 GMT (or 17:30 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-05-21 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-05-22 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-05-22 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Retail Sales]

2014-05-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-05-23 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - CPI]

2014-05-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart