Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.17 11:16

Forex Fundamentals - Weekly Outlook May 19-23Rate decision in Japan, inflation data in the UK and Canada, FOMC Meeting Minutes, Unemployment Claims, German Ifo Business Climate and US housing data are the main events on our list. Here is an outlook on the main market-movers for this week.

Last week, major US figures came out above expectations; Annual inflation reached 2%, as expected and the monthly CPI edged up to 0.3%. Meanwhile, the annual core inflation beat forecasts with a 1.8% reading. Furthermore, the sharp drop in the number of unemployment claims reaching a 7-year low of 297,000, reaffirms the strength of the US labor market. These positive signs support the Fed’s tapering plan, indicating the US economy is getting stronger and does no longer need QE. Will the US housing data also change for the better this week.

- UK inflation data: Tuesday, 8:30. UK inflation remained below the BOE’s 2.0% inflation target in March, reaching 1.6%, the lowest reading since October 2009. This reading was preceded by 1.7% in February. This was the sixth consecutive month of low inflation narrowing the gap between wage growth and the rise in prices contributing to business stability. UK inflation is expected to increase to 1.7%.

- Japan rate decision: Wednesday. Governor Haruhiko Kuroda maintained the BOJ’s monetary policy in April expressing confidence that the economy is advancing according to plan. However, many analysts believe the BOJ will have to ease policy in the near future to prevent a deflation trend. Kuroda told Prime Minister Shinzo Abe that he will adjust policy without hesitation in case the 2.0% inflation target may be jeopardized. No change is expected this time.

- US FOMC Meeting Minutes: Wednesday, 18:00. FOMC minutes released in April indicate the Fed’s intention of maintaining loose monetary policy for years to come. The FOMC welcomed the pickup in GDP growth registered after the weak first quarter affected by the cold weather. The members supported a low fed funds rate for as lonf as inflation remains below the 2% target. Tapering should continue and changes to guidance are possible. The FOMC expects that the economy will improve.

- UK GDP data: Thursday, 8:30. According to the NIESR estimates GDP edged up 1.0% in the second quarter after posting a 0.8% expansion rate in the first three months of 2014. The growth levels nearly equal the pre-financial crisis peak. NIERS forecasts a 2.9% growth rate in 2014. However, despite the pick-up, income per capita will need another three years to catch up with GDP expansion. GDP growth in the second quarter is expected to reach 0.8%.

- US Unemployment Claims: Thursday, 12:30.Initial claims for U.S. unemployment benefits hit a seven-year low of 297,000 claims last week, confirming the strong recovery in the US economy. Claims fell 24,000 from the preceding week, indicating stronger economic growth in the second quarter. Stronger labor market and rising inflation pressures give green light to the Fed’s ongoing tapering move. Jobless claims are expected to increase to 312,000.

- US Existing Home Sales: Thursday, 12:30. Second hand homes sales declined to their lowest level in more than 1-1/2 years in March, reaching an annual rate of 4.59 million units. However, sales were stronger than the 4.57 million forecasted by analysts, indicating that the negative trend in the housing market may be over. Supply increased as well as the number of first time buyers. Existing Home Sales are expected to rise to 4.71 million.

- German Ifo Business Climate: Friday, 8:00. German business climate index rose to 111.2 in March, following a revised 110.7 in February. The reading was stronger than the 110.5 points forecasted by analysts. The Ukraine crisis took less attention in the survey despite Barack Obama’s warnings of additional sanctions against Russia in case it fails to reach an agreement with Ukraine. German business climate is predicted to reach 111.

- US New Home Sales: Friday, 14:00. Sales of new U.S. homes plunged to their lowest level in eight months reaching a seasonally adjusted annual rate of 384,000 units in March. It was the second consecutive monthly drop indicating a slowdown in sales. Economists expected sales to increase to 455,000 saying the unexpected drop may be related to cold weather conditions. However, the weak demand increased the months’ supply of houses on the market to 6.0, the highest level since October 2011, from 5.0 months in February. New home sales are expected to reach 426,000.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.19 09:24

2014-05-19 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German Deutsche Bundesbank (Buba) President Weidmann Speech]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

Speech at a Symposium organized by Deutsche Bundesbank, in Frankfurt

==========

BUBA’s Weidmann says ECB will closely monitor FX moves when weighing policy decisions

Here we go, right on cue

- but it would be short sighted to look at one-dimensional fx rise without looking at stimulating effecto f lower bond yields

- targeting a weaker euro could prompt counter-reaction

- euro target rate could conflict with price stability

- but fx rate is relevant for monetary policy as it can influence price developments

- Eurozone countries must make their economies competitive

- Euro’s gains partly due to capital inflows

EURUSD a little higher at 1.3719 on the view that a weaker euro could prompt adverse impact so they will be careful on driving it lower.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 14 pips price movement by EUR - German Buba President Weidmann Speech news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.17 18:14

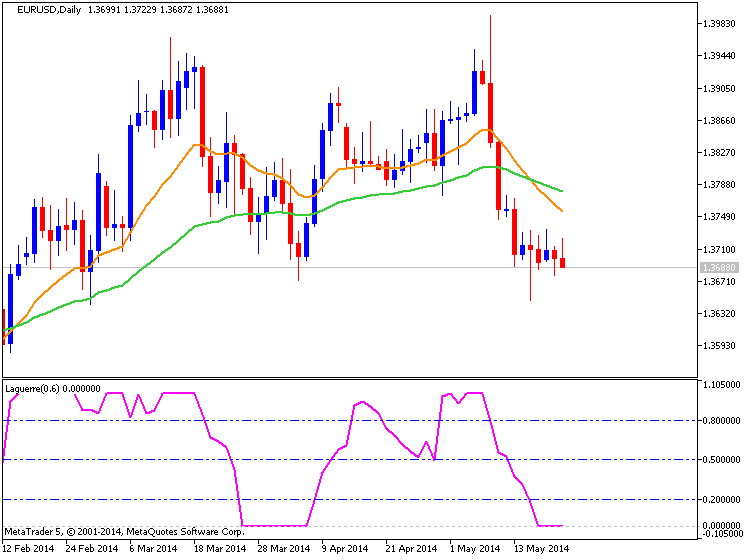

EUR/USD forecast for the week of May 19, 2014, Technical AnalysisThe EUR/USD pair fell during most of the week, but did manage to close right at the 1.37 handle, which is significant as it would has been both supportive and resistive recently. On top of that, there is an uptrend of sorts still being held by a line there, and as a result we feel that this market could continue to go higher. We may have just found the summer range – the area between the 1.37 level on the bottom, and the 1.40 level on the top.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.20 08:17

Euro Rallies against the Dollar, Ending Two-Week Run of Losses (based on Forexminute article)

The euro rose against the dollar, ending two weeks of losses as

investors awaited market data that points towards monetary easing in the

euro zone.

The euro advanced 0.1 percent to $1.3702, ending a run of losses of more

than 1 percent over the last two weeks. The shared currency advanced to

138.99 yen before edging lower to 138.77 yen, a three-month low.

The euro has been hurt by speculation that the European Central Bank may

ease its monetary policy when it meets in June. Commodity Futures

Trading Commission’s data that was released last Friday indicated that

there were 2,175 net short contracts on the common currency in the week

ended May 13, down from net long positions of 32,551 a week earlier,

reported Reuters.

"There seems to be so many reasons to short the euro," said Bart

Wakabayashi, a Tokyo-based head of forex at State Street Global Markets.

"The ECB seems to be the one [central bank] under the most pressure to

act the soonest."

The ECB is expected to roll out a raft of measures such as a reduction

in all interest rates and policy that seeks to increase lending to

small and mid-sized enterprises. Hence traders will be keenly

monitoring purchasing managers’ surveys of the euro zone that will be

released this week.

"Given the low euro zone inflation, interest will be on the

input/output price subcomponents of the PMIs," analysts at Commonwealth

Bank told clients.

The dollar index fell to 80.017, down from last week’s peak of 80.338

that it touched on Thursday. The dollar fell 0.1 percent to 101.44 yen,

which is close to 101.31 yen, a two-month low that it also hit last

Thursday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.18 17:19

EUR/USD Fundamentals - weekly outlook: May 19 - 23The euro slid lower against the dollar on Friday following the release of uneven U.S. data, as concerns over the strength of the recovery in the euro zone added to pressure on the European Central Bank to ease monetary policy.

EUR/USD was at 1.3693 late Friday, holding just above the two-and-a-half month low of 1.3647 struck in the previous session. For the week, the pair was down 0.45%.

The pair is likely to find support at 1.3647 and resistance at 1.3731, Thursday’s high.

The Commerce Department reported Friday that U.S. housing starts rose 13.2% last month, after a 2.0% increase in March.

It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was overshadowed by a report showing that consumer confidence in the U.S. deteriorated this month. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 in April. Analysts had expected a slight uptick to 84.5.

The single currency remained under pressure after weaker-than-expected data on euro zone first quarter growth on Thursday added to pressure on the ECB to ease monetary policy at its next meeting in June, in order to safeguard the recovery in the region.

The euro zone’s gross domestic product grew just 0.2% in the first quarter Eurostat reported, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

The French economy stagnated in the first three months of the year, while Italy, Portugal and the Netherlands all reported contractions.

Germany’s economy, the euro zone largest, outperformed in the first three months of the year, expanding 0.8%, beating expectations of 0.7%.

Also Thursday, Eurostat reported that the annual rate of inflation in the euro zone was unchanged at 0.7% in April, in line with forecasts. The inflation rate is still well below the ECB target of close to but just under 2%.

Meanwhile comments by a senior EBC official fuelled speculation that the bank is preparing to act at its next meeting in June to shore up the recovery in the currency bloc and stop inflation from falling too low.

In an interview with The Wall Street Journal, ECB Vice President Vitor Constancio said Thursday the central bank was open to more monetary easing and was determined to act swiftly if required.

EUR/JPY ended Friday’s session at 139.03, down 0.17% for the day, after falling to lows of 138.78 earlier in the session, the weakest since February 12.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

The euro zone is to publish what will be closely watched data on private sector activity on Thursday.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- Germany’s Bundesbank President Jens Weidmann is to speak at an event in Frankfurt; his comment will be closely watched. Later in the day the German central bank is to publish its monthly report.

- In the euro zone, Germany is to release data on producer price inflation.

- In the U.S., Federal Reserve Bank of Philadelphia Charles Plosser and Federal Reserve Bank of New York President William Dudley are to speak.

- The euro zone is to release data on the current account.

- Fed Chair Janet Yellen is to speak at an event in New York. Later Wednesday, the Fed is to publish the minutes of its latest meeting.

- The euro zone is to release data on manufacturing and service sector activity, while Germany and France are to release individual reports.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

- In the euro zone, the Ifo Institute is to publish data on German business climate.

- The U.S. is to round up the week with data on new homes sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.21 12:54

EUR/USD still immune for stock market volatility

On Tuesday, the eco calendar was again thin. In Europe, equities were unable to give trading on other markets a clear guidance. The euro remained slightly under pressure as were peripheral bonds. However, the key 1.3643 support stayed well out of reach. USD/JPY was initially slightly higher off Monday’s low but the a new selling wave of US equities after the close in Europe pushed the pair again lower in the 101.00 big figure. EUR/JPY tested again the key 138.55/70 support but a break didn’t succeed.

This morning, Asian

equities are mostly in the red except for China. However, the losses

are contained compared to the correction in the US. Yesterday evening,

Fed hawk Plosser repeated its assessment that rates may be raised sooner

rather than later. His comments might have caused some nervousness on

the US equity markets. However, they didn’t help the dollar. On the

contrary, USD/JPY is creeping back to this week’s low at 101.10. EUR/USD

is again not at all affected, not by the Fed comments and not by the

correction on the US and Asian equity markets. The BoJ as expected kept

its policy unchanged. There is no indication that the bank is preparing

for additional stimulus anytime soon. An optimistic tone from BOJ might

keep the yen well bid.

Later today, there are

again few eco data in the US and in Europe. Consumer confidence from the

European commission is expected to improve slightly from -8.6 to -8.3.

This report probably won’t be a game changer for EUR/USD trading. After a

chorus of ECB speakers recently, the focus turns to the Fed today. A

long series of Fed governors will speak and the Fed will publish the

minutes from the April meeting. Fed’s Yellen already elaborated on the

Fed decision in an appearance before the JEC of Congress earlier this

month. Even so, it will be interesting to see the thinking within the

Fed on the next steps to scale back policy stimulation. Indications that

this next step is coming closer might be slightly positive for the

dollar. Even so, currency trading will probably again be driven by technical considerations and by global sentiment on risk.

How will European markets react to the correction in the US yesterday?

Will intra-EMU spreads continue to widen? If so, it might at least

cement the topside of EUR/USD. The picture in the yen cross rates

remains very interesting, too. EUR/JPY is struggling to hold above a

first resistance (138.55/70 area). USD/JPY is testing the key

101.20/100.75 support. The process is going very slowly, but a break

below these levels would be highly significant and may also be a

negative for the euro. For now this is nothing more than an hypothesis.

After the May ECB press conference, we reinstalled a sell-on-upticks bias for EUR/USD ahead of the June ECB meeting.

Of course, the reasons for recent dollar weakness haven’t disappeared

all at once. So, the downside correction in EUR/USD will probably

develop in a gradual way. A first support at 1.3673/43 was tested last

week but no sustained break occurred. The next high profile level is the

1.3477 April correction low. We maintain a sell-on-upticks approach. A

break above 1.40 would suggest that the markets doubt the credibility of

the ECB commitment and thus warrants stop loss protection.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.22 09:57

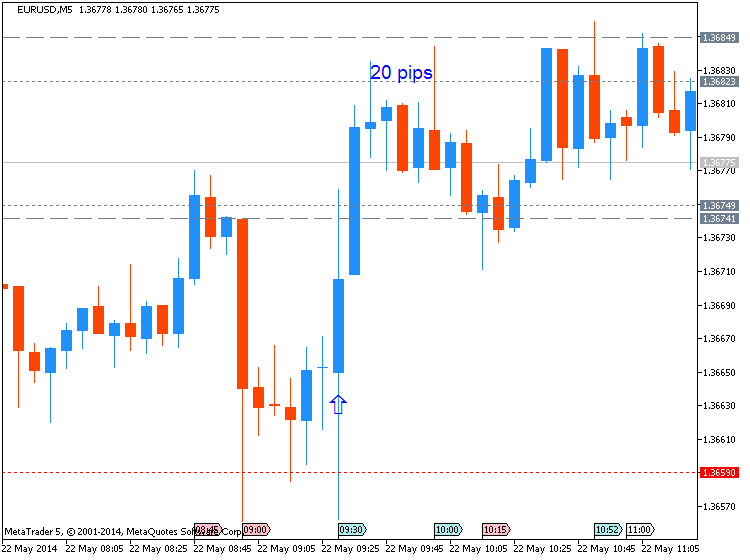

2014-05-22 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French PMI]

- past data is 51.2

- forecast data is 51.1

- actual data is 49.3 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

EUR French PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing/services industry

==========

French Private Sector Slips Into Contraction In May

The French private sector contracted for the first time in three months in May, flash survey data from Markit Economics showed Thursday.

The flash composite output index fell to 49.3 in May from 50.6 in April. The score below 50 indicates contraction in the sector.

The Purchasing Managers' Index for manufacturing declined more-than-expected to a 4-month low of 49.3 in May from 51.2 in April. The expected reading was 51.

Likewise, the services PMI dropped to 49.2 from 50.4 a month ago. Economists had forecast the score to remain at 50.4.

Lower output was recorded across the service and manufacturing sectors. New business received by French private sector firms decreased for the second month running in May.

Employment in the French private sector fell for a seventh consecutive month and the rate of job shedding was the sharpest since February.

Divergent price trends were signaled in May. Input price inflation across the French private sector accelerated to a four-month high, driven by a sharper increase in service providers' costs.

On the other hand, private sector output prices continued to fall, with the rate of decline accelerating to the sharpest in ten months.

"With GDP having stagnated in Q1, the PMI data so far suggest another disappointing performance in the second quarter," said Jack Kennedy, senior economist at Markit said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 18 pips price movement by EUR - French PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.22 12:55

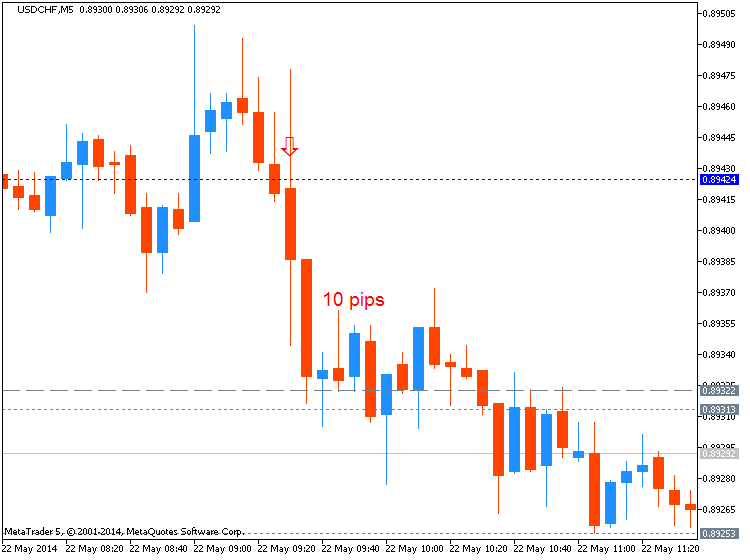

2014-05-22 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German PMI]

if actual > forecast = good for currency (for EUR in our case)

EUR - German PMI = level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - above 50.0 indicates industry expansion, below indicates contraction.

==========

German manufacturing PMI falls to 6-month low of 52.9 in May

Manufacturing activity in Germany expanded at the slowest rate in six months in May, dampening optimism over the health of the euro zone's largest economy, preliminary data showed on Thursday.

In a report, market research group Markit said that its preliminary German manufacturing purchasing managers' index fell to a seasonally adjusted 52.9 this month, down from a final reading of 54.1 in April. Analysts had expected the index to inch down to 54.0 in May.

Meanwhile, the preliminary services purchasing managers' index improved to a 35-month high of 56.4 this month, up from a reading of 54.7 in April. Analysts had expected the index to ease down to 54.5 in May.

A reading above 50.0 on the index indicates industry expansion, below indicates contraction.

Commenting on the report, Ollver Kolodselke, Economist at Markit said, "Survey data for the second quarter so far suggest that we should expect another period of solid growth of GDP."

Following the release of the data, the euro trimmed losses against the U.S. dollar, with EUR/USD shedding 0.07% to trade at 1.3676, compared to 1.3665 ahead of the data.

Meanwhile, European stock markets were higher after the open. Germany's DAX picked up 0.3%, the Euro Stoxx 50 rose 0.2%, France's CAC 40 eased up 0.1%, while London's FTSE 100 added 0.3%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.22 16:03

Price & Time: Approaching Key Levels, But EUR/USD Remains Vulnerable

Since reversing from the important cycle turn window that we highlighted at the start of the month the euro has come under steady downside pressure. On Wednesday, EUR/USD touched its lowest level in over three months before rebounding off the 3rd square root relationship of the year’s high at 1.3640 - which is also just above the widely watched 200-day moving average. Was this an important low in the euro? We don’t think so. With the next important turn window eyed around the end of the month/first week of June we suspect general weakness will persist at least until then before a meaningful recovery in the euro is seen (though some minor strength looks possible early next week). The bottom of the1-year standard deviation channel coincides with the 4th square root relationship of the year’s high near 1.3550 and this still looks like a reasonable downside objective. Unexpected aggressive strength over 1.3820 would suggest that the euro has bottomed ahead of schedule.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

newdigital, 2014.05.22 19:44

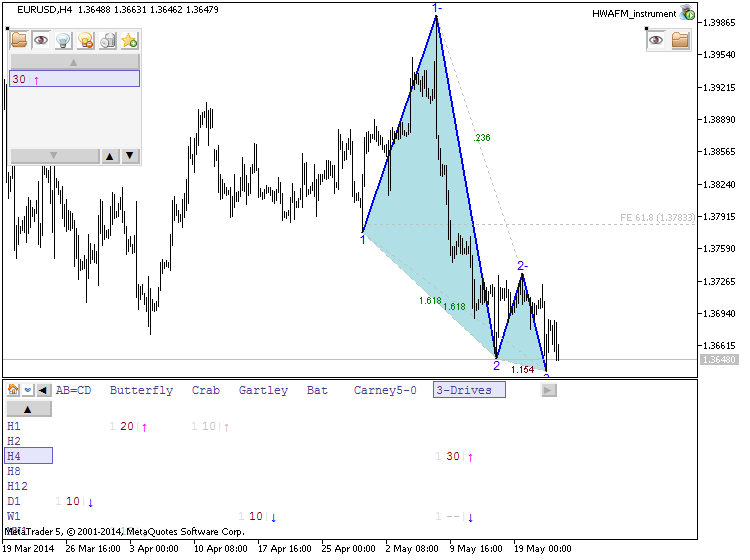

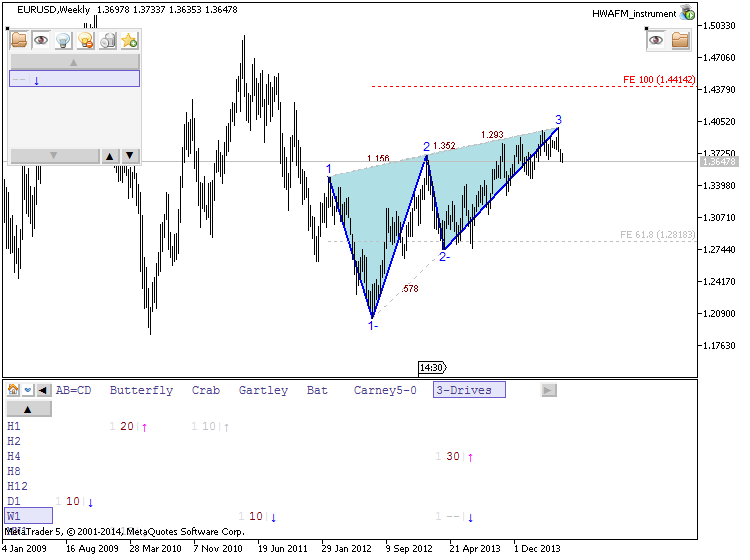

The Three Drives Pattern - Harmonic Ratios and Explanation

The charts were made by using free HWAFM tool for Metatrader 5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

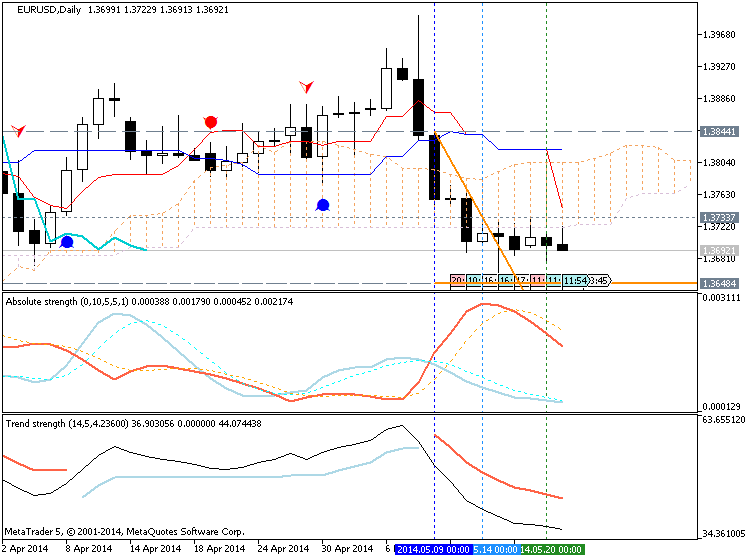

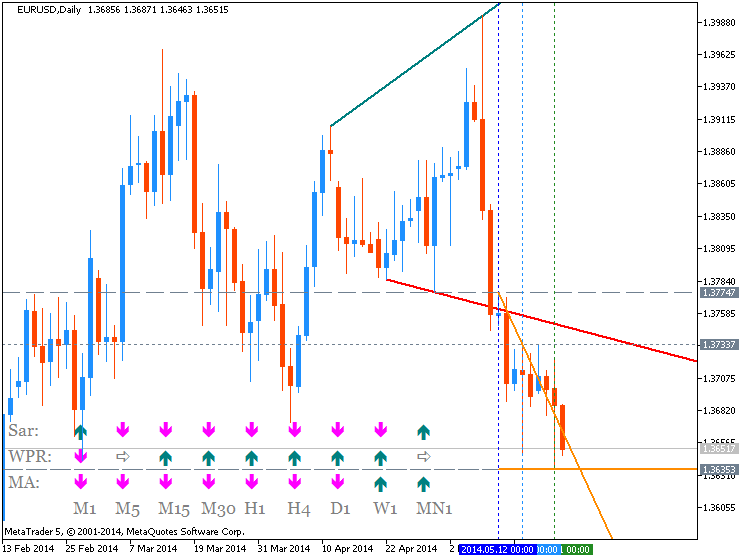

D1 price reversed from primary bullish to bearish market condition - price broke Ichimoku cloud in the end of last week moving along Sinkou Span B line.

H4 price was on triangle pattern breakdown with primary bearish and stopped near 1.3685 support level.

W1 price is on bullish correction with 1.3675 as the nearest support level.If D1 price will break 1.3648 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-05-19 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German Deutsche Bundesbank (Buba) President Weidmann Speech]

2014-05-20 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2014-05-20 16:30 GMT (or 18:30 MQ MT5 time) | [USD - FOMC Member Plosser Speech]

2014-05-20 17:00 GMT (or 19:00 MQ MT5 time) | [USD - FOMC Member Dudley Speech]

2014-05-21 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

2014-05-21 15:30 GMT (or 17:30 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-05-21 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-05-22 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-05-22 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French PMI]

2014-05-22 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German PMI]

2014-05-22 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - PMI]

2014-05-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-05-23 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German GDP]

2014-05-23 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-05-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : reversal

TREND : ranging

Intraday Chart