I personally do not have experience with that ... but I think that execution time is not related to ECN, STP, non-ECN.

- If ECN/STP so you (or your EA) is openning the trade, and after that only (by second action) the stop loss/take profit values will be added (by modifying the already existing trade).

- If standard so you can open the trade with tp/sl values by one action.

Some EA is having the following settings:

input bool ECN_ModeOn = false; // ECN Mode On/Off

- If ECN = true so EA will open the trade, and after that - this trade will be modified for stop loss/take profit values.

- If ECN = false so the trade may be opened with top loss/take profit.

- www.metatrader5.com

i read this subject write it

STP - Straight Through Processing

STP Forex brokers send orders directly from clients to the liquidity providers - banks or other brokers. Sometimes STP brokers have just one liquidity provider, other times several. The more the liquidity providers - and therefore liquidity in the system - the better the fills for the clients. The fact that traders have access to the real-time market quotes and can execute trades immediately without dealer intervention is what makes the platform STP.

ECN - Electronic Communications Network

ECN brokers pass on prices from multiple market participants, such as banks and market makers, as well as other traders connected to the ECN, and display the best bid/ask quotes on their trading platforms based on these prices. ECN Forex brokers additionally allow orders to interact with other orders. They provide a marketplace where all participants (banks, market makers and individual traders) interact inside the system and get the best offers for their trades available at that time. Unlike fixed spreads, often offered by market makers, ECNs spreads vary, depending on the pair’s trading activities. During very active trading periods, you can sometimes get no spread at all, particularly in very liquid currency pairs. These brokers make money by charging customers a fixed commission for each transaction. Authentic ECNs do not play any role in making or setting prices, therefore, the risks of price manipulation are reduced for retail traders. True ECN brokers display the Depth of the Market (DOM) showing order sizes in the system

what you opinion about that ?

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.07.01 06:59

Just something about ECN and STP - The Truth about Currenex Brokers :

===========

What is an ECN?

ECN is a term often used when referring to Currenex. ECN stands for

Electronic Communication Network and it eliminates the function of a

third party in the execution of orders. Without the intercession of a

third party, market participants of any size can interact directly for

Bid and Offer prices posted by other market participants. This leads to

greater transparency and narrower spreads. ARCHIPELAGO, purchased by

the NYSE in 2006, and ISLAND are two well known ECNs.

What is an ESP?

ESP™ means Executable Streaming Prices and is offered through the

Currenex system. Currenex connects to multiple sources of liquidity,

primarily banks, who offer "pools of liquidity". This expansiveness

from the multiple pools of liquidity, available through Currenex’s ESP,

provides better price discovery and narrower spreads for traders.

The prices that are offered via Currenex are executed directly within these various pools of liquidity. Whereas in the past, a trader would be required to obtain a Prime Brokerage relationship with one or more of the major liquidity providers which required a very high threshold and associated high expenses.

Not all Currenex Brokers are the same.

It is important to remember that a broker’s Currenex offering is only as good as the liquidity sources that are linked to the platform. The quantity and quality of liquidity sources can lead to dramatic differences in price spreads. For instance, a broker offering 1-2 banks versus a broker offering 8-10 banks will have a dramatic difference in pricing and liquidity.

What is STP?

STP, or Straight Through Processing, is a term commonly used among Forex

brokers.Many Forex brokers state they use "interbank pricing" but act

as a counter party to their customers’ trades. They take the other side

of the trade, going against the client’s best interest, and make money

on a client’s losing trade.

Conversely, a true STP setup passes the order in an automated way to all

liquidity sources. With a true STP broker, there is not the

possibility of any adversarial relationship between the broker and

client as the broker only generates revenue in the form of a commission

per trade rather than the dealing desk model of capturing client losses.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.07.01 07:19

Just next educational article about ECN and so on - Market Makers Vs. Electronic Communications Networks

===============

The foreign exchange market (forex or FX) is an unregulated global market in which trading does not occur on an exchange and does not have a physical address of doing business. Unlike equities, which are traded through exchanges worldwide, such as the New York Stock Exchange or the London Stock Exchange, foreign exchange transactions take place over-the-counter (OTC) between agreeable buyers and sellers from all over the world. This network of market participants is not centralized, therefore, the exchange rate of any currency pair at any one time can vary from one broker to another.

How Market Makers Work

Market makers "make" or set both the bid and the ask prices on their systems and display them publicly on their quote screens. They stand prepared to make transactions at these prices with their customers, who range from banks to retail forex traders. In doing this, market makers provide some liquidity to the market. As counterparties to each forex transaction in terms of pricing, market makers must take the opposite side of your trade. In other words, whenever you sell, they must buy from you, and vice versa.

The exchange rates that market makers set, are based on their own best interests. On paper, the way they generate profits for the company through their market-making activities, is with the spread that is charged to their customers. The spread is the difference between the bid and the ask price, and is often fixed by each market maker. Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers. As counterparties, many of them will then try to hedge, or cover, your order by passing it on to someone else. There are also times in which market makers may decide to hold your order and trade against you.

There are two main types of market makers: retail and institutional. Institutional market makers can be banks or other large corporations that usually offer a bid/ask quote to other banks, institutions, ECNs or even retail market makers. Retail market makers are usually companies dedicated to offering retail forex trading services to individual traders.

Pros:

- The trading platform usually comes with free charting software and news feeds. (For related reading, see Forex: Demo Before You Dive In.)

- Some of them have more user-friendly trading platforms.

- Currency price movements can be less volatile, compared to currency prices quoted on ECNs, although this can be a disadvantage to scalpers.

Cons:

- Market makers can present a clear conflict of interest in order execution, because they may trade against you.

- They may display worse bid/ask prices than what you could get from another market maker or ECN.

- It is possible for market makers to manipulate currency prices to run their customers' stops or not let customers' trades reach profit objectives. Market makers may also move their currency quotes 10 to 15 pips away from other market rates.

- A huge amount of slippage can occur when news is released. Market makers' quote display and order placing systems may also "freeze" during times of high market volatility.

- Many market makers frown on scalping practices and have a tendency to put scalpers on "manual execution," which means their orders may not get filled at the prices they want.

How ECNs Work

ECNs pass on prices from multiple market participants, such as banks and market makers, as well as other traders connected to the ECN, and display the best bid/ask quotes on their trading platforms based on these prices. ECN-type brokers also serve as counterparties to forex transactions, but they operate on a settlement, rather than pricing basis. Unlike fixed spreads, which are offered by some market makers, spreads of currency pairs vary on ECNs, depending on the pair's trading activities. During very active trading periods, you can sometimes get no ECN spread at all, particularly in very liquid currency pairs such as the majors (EUR/USD, USD/JPY, GBP/USD and USD/CHF) and some currency crosses.

Electronic networks make money by charging customers a fixed commission for each transaction. Authentic ECNs do not play any role in making or setting prices, therefore, the risks of price manipulation are reduced for retail traders. (For more insight, see Direct Access Trading Systems.)

Just like with market makers, there are also two main types of ECNs: retail and institutional. Institutional ECNs relay the best bid/ask from many institutional market makers such as banks, to other banks and institutions such as hedge funds or large corporations. Retail ECNs, on the other hand, offer quotes from a few banks and other traders on the ECN to the retail trader.

Pros:

- You can usually get better bid/ask prices because they are derived from several sources.

- It is possible to trade on prices that have very little or no spread at certain times.

- Genuine ECN brokers will not trade against you, as they will pass on your orders to a bank or another customer on the opposite side of the transaction.

- Prices may be more volatile, which will be better for scalping purposes.

- Since you are able to offer a price between the bid and ask, you can take on the role as a market maker to other traders on the ECN.

Cons:

- Many of them do not offer integrated charting and news feeds.

- Their trading platforms tend to be less user-friendly.

- It may be more difficult to calculate stop-loss and breakeven points in pips in advance, because of variable spreads between the bid and the ask prices.

- Traders have to pay commissions for each transaction.

The Bottom Line

The type of broker that you use can significantly impact your trading performance. If a broker does not execute your trades in a timely fashion at the price you want, what could have been a good trading opportunity can quickly turn into an unexpected loss; therefore, it is important that you carefully weigh the pros and cons of each broker before deciding which one to trade through.

Forex Broker Types - MM,NDD,STP,ECN

This is small 10 minute education video about the following: the difference between Forex Broker Types - MM,NDD,STP,ECN

can anyone explain to me why these indicators show as well as the chart it covers,WHY? Can I do something to change it? This my first of many charts I plan on seeing and I want them to be right... Suggestions??

It depends on indicator (how it was coded) and depends on the settings of your chart.

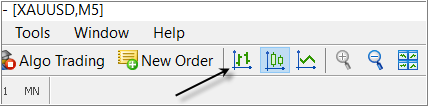

For example, you can click here on the chart -

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello ;

I read more subjects about execution By fast do orders between ECN and standard ?

So , i want know in Account Type ECN The orders Do fast and direct Fast From Type Standard ( Classic ) Or Not.

Or Standard Fast From ECN ?

I Dont Talk About Spread Or Commission , I Talk About Fast Do Orders Only

And how you Know Your answer By experience Or Read in anther articles

thank you