You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Here I want to raise a topic "if a trading strategy fails, why the opposite of the trading strategy also fail??

I have some code to do trading, certainly most of them loss money. Just curious, I reverse all the trading direction buy/sell and SL/TP, the exact opposite of the trading strategy also fail.

Could anyone explain this interesting trading process?

It is a open-mind free discussing. Any ideas are welcome!

If that happens, it means when to open the position is not good.

Some of reasons for that may be:

The market is in a sideways, going sideways, SL is too small,

or resistance and support (for multi timeframes) are not taken into account.

Here I want to raise a topic "if a trading strategy fails, why the opposite of the trading strategy also fail??

I have some code to do trading, certainly most of them loss money. Just curious, I reverse all the trading direction buy/sell and SL/TP, the exact opposite of the trading strategy also fail.

Could anyone explain this interesting trading process?

It is a open-mind free discussing. Any ideas are welcome!

My understanding is that, if the failure of the strategy is due to the wrong trading direction, certainly we reverse the direction will improve the performance. However, if the failure i due to other factor, simply reversing the direction cannot help..

Hi Ning Liu,

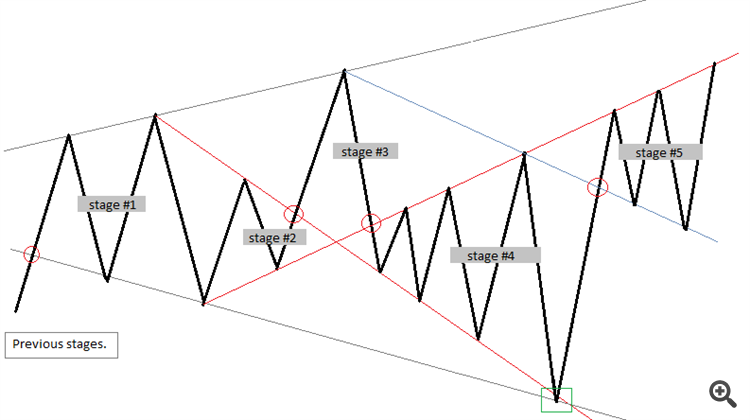

Let's figure out this stage on chart pattern.

Your stop-loss would often be triggered on the stages above.

You need to figure it out EA can handle the risky patterns of price movement on its stage.

You really need master coder to complete the mission well.

Good luck,

have a nice weekend.

Here I want to raise a topic "if a trading strategy fails, why the opposite of the trading strategy also fail??

I have some code to do trading, certainly most of them loss money. Just curious, I reverse all the trading direction buy/sell and SL/TP, the exact opposite of the trading strategy also fail.

Could anyone explain this interesting trading process?

It is a open-mind free discussing. Any ideas are welcome!

Hi Ning Liu,

Let's figure out this stage on chart pattern.

Your stop-loss would often be triggered on the stages above.

You need to figure it out EA can handle the risky patterns of price movement on its stage.

You really need master coder to complete the mission well.

Good luck,

have a nice weekend.

Not realy, this refer to side movement. If i use large SL and small TP, either way will end with profit trade.

Here I want to raise a topic "if a trading strategy fails, why the opposite of the trading strategy also fail??

I have some code to do trading, certainly most of them loss money.

Just curious, I reverse all the trading direction buy/sell and SL/TP, the exact opposite of the trading strategy also fail.

Could anyone explain this interesting trading process?

You said that and you can do what you want :)

Discussion for trading strategy will create more than millions words.

So, you can use anything that suit for you.

Good luck

Here I want to raise a topic "if a trading strategy fails, why the opposite of the trading strategy also fail??

I have some code to do trading, certainly most of them loss money. Just curious, I reverse all the trading direction buy/sell and SL/TP, the exact opposite of the trading strategy also fail.

Could anyone explain this interesting trading process?

It is a open-mind free discussing. Any ideas are welcome!

The reason is that a trade is comprised from direction plus take profit and stop loss. If you have a statistical random strategy (50/50) and you set the tp/sl so as the tp is two times closer then the sl, then you will get many small wins but half of that number losses but each loss is twice as large then a win.

You have given answer to the question, I believe.