Simply ... if you have 1.000 $ deposit at your account, you can trade up to 1.000.000 $ with 1:1000 leverage ... or 100.000 $ with 1:100 leverage.

As you see, not in real life, the banks are so generous and good in FX market.

They want you to be rich as quickly as possible.

So ... they are allowing you to trade up to 1.000.000 $ if you put 1.000 $ in cash in their hands.

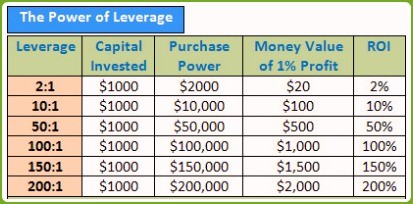

See illustrations below

Lets assume an investment or capital of $1000 with a leverage of 1:1000, the resultant effect would be (Capital x Leverage = Position Size); i.e. ($1000 x 1000 = $1,000,000)

Lets say the change in value (BUY or SELL) of a currency after trading was +0.0010 i.e. 10 pips or points. Then the profit made on a 1:1000 leverage = +0.0010 x leverage (1000) = $1000 Profit

Balance in account = Profit + Capital = $2000

Do forget it can go both ways, both of the above examples show winning and doubling you're money, the flip-side in these examples is losing the trade which is all your money

If you're just starting go with the lower leverages and don't ever risk more that 1-2% of you total balance on one trade

Hey brothers,

I have a question that is always in my mind, what does the leverage do?

Like what is the difference between 1000:1 or 500:1 leverage ?

Regards

It kills you :)

Risk depends on your initial stop loss, lot size, and the value of the pair.

- In code (MT4):

- You place the stop where it needs to be - where the reason for the trade is no longer valid. E.g. trading a support bounce the stop goes below the support.

- Account Balance * percent/100 = RISK = OrderLots * (|OrderOpenPrice - OrderStopLoss| * DeltaPerLot + CommissionPerLot) (Note OOP-OSL includes the SPREAD, and DeltaPerLot is usually around $10/pip but it takes account of the exchange rates of the pair vs. your account currency.)

-

Do NOT use TickValue by itself - DeltaPerLot

and verify that MODE_TICKVALUE is returning a value in your deposit

currency, as promised by the documentation, or whether it is returning a value

in the instrument's base currency.

MODE_TICKVALUE is not reliable on non-fx instruments with many brokers. - You must normalize lots properly and check against min and max.

- You must also check FreeMargin to avoid stop out

- Use a GUI EA like mine (for MT4): Indicators: 'Money Manager Graphic Tool' indicator by 'takycard' Forum - Page 6

About Mr Margin Call -

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.07.25 14:25

Margin Call: What Happens When A Margin Call Takes Place and How to Avoid (adapted from the article)

To understand the cause of a margin call is the first step. The second and more beneficial step is learning understanding how to stay far away from a potential margin call. The short answer as to understand what causes a margin call is simple, you’ve run out of usable margin.

The second and promised more beneficial step is to understand what depletes your usable margin and stay away from those activities. In risk of oversimplifying the causes, here are the top causes for margin calls which you should avoid like the plague (presented in no specific order):

- Holding on to a losing trade too long which depletes Usable Margin

- Overleveraging your account combined with the 1st reason

- An underfunded account which will force you to over trade with too little usable margin

What Happens When A Margin Call Takes Place?

When a margin call takes place, you are liquidated or closed out of your trades. The purpose is two-fold: you no longer have the money in your account to hold the losing positions and the broker is now on the line for your losses which is equally bad for the broker.

How to Avoid Margin Calls

Leverage is often and fittingly referred to as a double-edged sword. The purpose of that statement is that the larger leverage you use to hold a trade greater than some large multiple of your account, the less usable margin you have to absorb any losses. The sword only cuts deeper if an over-leveraged trade goes against you as the gains can quickly deplete your account and when your usable margin % hits, zero, you will receive a margin call. This only gives further credence to the reason of using protective stops while cutting your losses as short as possible.

Something about the leverage -

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video

Sergey Golubev, 2018.07.25 14:20

Video Lesson: How to Trade - The Leverage

One of the great things about the forex market for individual traders and one of the reasons we are starting with the forex market as our first market specific course is the availability of real time demo accounts. Unlike the equities and futures markets where one must pay the exchanges to get access to real time data, most forex brokers not only provide free real time quotes and charts but they also give you access to the same platform that their live traders trade on and the ability to trade there with virtual cash. This is a nice perk especially for beginner traders, as it allows them to get to know the market and the logistics of placing trades in a real time environment but without risking any real money.

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

- For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

Remember, a 25% loss requires a 33% return to get back to break even. If a 25% loss in a fast moving market is difficult enough to overcome, imagine how challenging it would be to overcome a 25% loss in a slow moving market. Therefore, de-emphasize each trade and think of the next trade simply as the first of ten trades rather than the next homerun.

You can reduce the emphasis by implementing less than 10x effective leverage. Effective leverage is simply taking the total notional trade size and dividing it by your account size. The result will indicate how many times you have your equity levered. According to our research, we recommend implementing less than ten times effective leverage.

Incorporating smaller trade sizes and less leverage will alleviate the stress of having to produce a profitable trade. As a result, you’ll be more likely to let the trade develop and let the trade evolve in the way the patterns indicate.

With 1:1, anything you "buy/sell" has to be with the full amount.

For example buying one lot of EURUSD requires 100000 EUR (approximately 107446 USD at current rates), not to mention the extra capital needed to hold your position open as it goes against you $10 for every pip.

So how much starting balance are you assigning in your back-test?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hey brothers,

I have a question that is always in my mind, what does the leverage do?

Like what is the difference between 1000:1 or 500:1 leverage ?

Regards