- Trading Signals and Copy Trading

- How to Subscribe to a Signal - Trading Signals and Copy Trading

- How to copy deals of successful traders in MetaTrader 5

2. You can use Calculator of the Signals (to calculate everything 'automatically' based on any pre-selected signal for example) - for MT5.

On the other case - use the following calculation/information -

------------

How to change the volume/lot size (many posts)https://www.mql5.com/en/forum/11714

------------

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.09.13 11:50

And this small thread as well (with answers) -

signal provider has minimal volume 0.01, subscriber has 0.10 - how to change minimal volume ????The question of how exactly the Subscriber's deposit will participate in trading via Signals service is one of the most critical ones. When solving this issue, we followed the already mentioned principle - providing maximum protection for each participant. As a result, we can offer a secure solution for Subscribers.

When enabling signals in the terminal and subscribing to one of them, Subscribers should select what part of the deposit is to be used when following the signals. There was an alternative solution of setting the ratio between Subscriber's and Provider's position volumes. But such a system could not guarantee the security of the Subscriber's deposit. For example, suppose that Provider's deposit is 30 000$, while Subscriber's one is 10 000$ and the ratio of 1:1 has been selected. In that case, the Signals Provider may just wait out temporary drawdown having a large volume order, while the Subscriber may lose all the funds with all his or her positions closed by Stop Out. The situation may get even worse if the Provider's balance suddenly changes (top up or withdraw), while previously specified volumes ratio remains intact.

To avoid such cases, we have decided to implement the system of percentage-based allocation of the part of a deposit, which is to be used in trading via the Signals service. This system is quite complicated as it considers deposit currencies, their conversion and leverages.

Let's consider a specific example of using the volumes management system:

- Provider: balance 15 000 USD, leverage 1:100

- Subscriber1: balance 40 000 EUR, leverage 1:200, deposit load percentage 50%

- Subscriber2: balance 5 000 EUR, leverage 1:50, deposit load percentage 35%

- EURUSD exchange rate = 1.2700

Calculation of Provider's and Subscriber's position volumes ratio:

- Balances ratio considering specified part of the deposit in percentage terms:

Subscriber1: (40 000 * 0,5) / 15 000 = 1,3333 (133.33%)

Subscriber2: (5 000 * 0,35) / 15 000 = 0,1166 (11.66%) - After considering the leverages:

Subscriber1: the leverage of Subscriber1 (1:200) is greater than Provider's one (1:100), thus correction on leverages is not performed

Subscriber2: 0,1166 * (50 / 100) = 0,0583 (5.83%) - After considering currency rates of the deposits at the moment of calculation:

Subscriber1: 1,3333 * 1,2700 = 1,6933 (169.33%)

Subscriber2: 0,0583 * 1,2700 = 0,0741 (7.41%) - Total percentage value after the rounding (performed using a multistep algorithm):

Subscriber1: 160% or 1.6 ratio

Subscriber2: 7% or 0.07 ratio

Thus under the given conditions, Provider's deal with volume of 1 lot will be copied:

- to Subscriber1 account in amount of 160% - volume of 1.6 lots

- to Subscriber2 account in amount of 7% - volume of 0.07 lots

Be careful not to confuse the percentage value of the used part of the deposit and the actual ratio of position volumes. The trading terminal allows setting the part of the deposit in percentage value. This value is used to calculate the ratio of position volumes. This data is always fixed in the log and is shown in the following way:

Subscriber1:

2012.11.12 13:33:23 Signal '1277190': percentage for volume conversion selected according to the ratio of balances and leverages, new value 160%

2012.11.12 13:27:55 Signal '1277190': signal provider has balance 15 000.00 USD, leverage 1:100; subscriber has balance 40 000.00 EUR, leverage 1:200

2012.11.12 13:27:54 Signal '1277190': money management: use 50% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

Subscriber2:

2012.11.12 13:33:23 Signal '1277191': percentage for volume conversion selected according to the ratio of balances and leverages, new value 7%

2012.11.12 13:27:55 Signal '1277191': signal provider has balance 15 000.00 USD, leverage 1:50; subscriber has balance 5 000.00 EUR, leverage 1:50

2012.11.12 13:27:54 Signal '1277191': money management: use 35% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

---------------

- 2013.04.18

- www.mql5.com

...

You can subscribe to one signal only. It means: one signal per account. And it is not recommended to use the other EA on this account.

And this is from the FAQ -

Why manual trading leads to problems with copying of signals (accounts out of sync)? Why I cannot simultaneously subscribe to a signal and trade on one account?

Manual intervention in trading on account subscribed to a signal, prevents correct copying of Provider's signals and complicates the analysis of signal copying results.

- Subscription to a signal means that you completely rely on Provider's trading strategy. Positions and pending orders created by you or any other signal are not part of the current Provider's trading strategy.

- The volume of copied trade operations is calculated based on the value of account balance. Subscriber's positions opened manually or by any other signal increase the deposit load and may also prevent signal copying due to insufficient free margin or lead to Margin Call.

- The netting position accounting system allows you to have only one position for one symbol at the same time. If Subscriber's and Provider's accounts have open positions for the same symbols, signal copying can lead to a reverse of the final position or to a significant change in its volume.

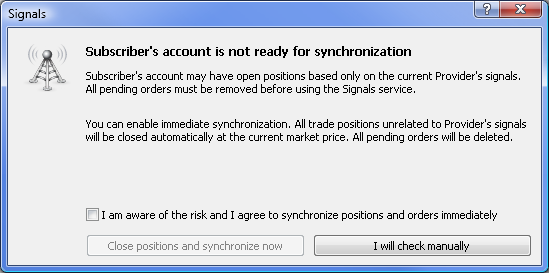

Should the synchronization reveal any inconsistencies, i.e. positions different from those of the Provider or any pending orders set, a standard pop-up window will appear to prompt you for permission to synchronize.

- www.metatrader5.com

and finally -

----------------

Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide - the article

Hi there

Sergey covered it almost all, I can only add that in order to figure out the minimum balance for copying a signal (if that is not suggested by the signal provider), you have to check the signal's balance and the minimum trade size that it opens.

If for instance the signal has a balance of $1000 and opens 0.02 lot trades, your minimum balance could be $550 or more, in order to open 0.01 lot trades.

If you use $200-$300 in that example, you will still open 0.01 trades (because there aren't smaller trades) but you will have double the risk of the signal, so in case the signal reaches 40% drawdown, you will go 80%, since you have double the risk.

So, make your own search about it or contact us for any help you need.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use