It's illogical? Same settings & same data but different results

- 2018.05.02

- www.mql5.com

https://www.mql5.com/en/forum/242204

I don't really know what's going on with mohanmad having variable results doing backtests on multiple timeframes with indicator as only minute chart? but crude/ticks using fractal analysis could change results if using ticks.

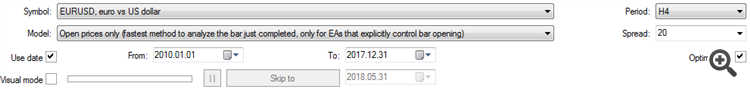

I am using open prices.

It's illogical to think that results can be the same or even predict future performance.

Check if the logic fires appropriately and if yes start doing real performance tests.

Therefore it should be called Meta-trader Time Waster?

What is illogical with using open prices over a set date range which doesn't change?

What is illogical about getting the same results from optimizations using the same settings?

What is strategy tester for if it cannot predict future performance using 99% tick data?

It's illogical to think that results can be the same or even predict future performance.

Check if the logic fires appropriately and if yes start doing real performance tests.

It's perfectly logic. Same inputs should produce same outputs.

If the outputs are not the same that's because the inputs are different.

EDIT: I realized the OP was talking about optimization (and not a backtest). An optimization using the genetic algorithm can perfectly lead to different results.

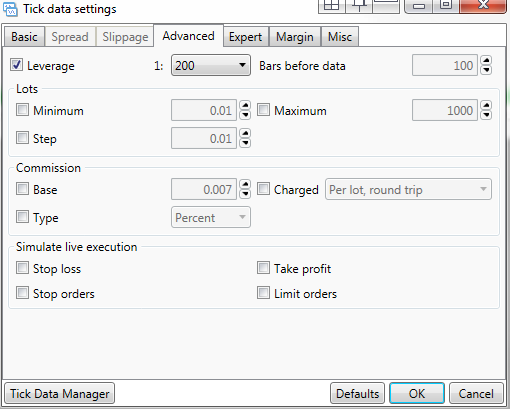

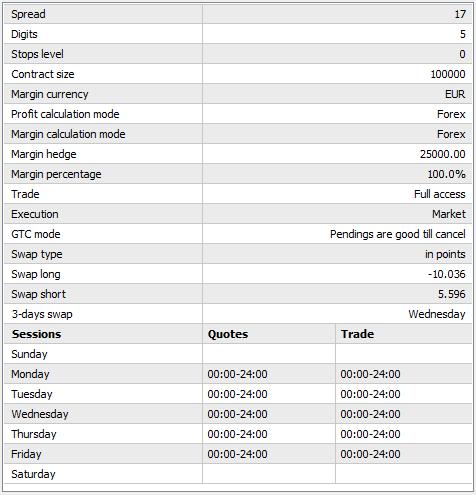

Are you the EA author ? Knowing more about the algo it embeds could help you/us understand - supposing you're using a fix spread and a fix slippage, it could be an explanation to your issue.

Are you the EA author ? Knowing more about the algo it embeds could help you/us understand - supposing you're using a fix spread and a fix slippage, it could be an explanation to your issue.

No, its an ex4, and it is a price/cost averaging system..

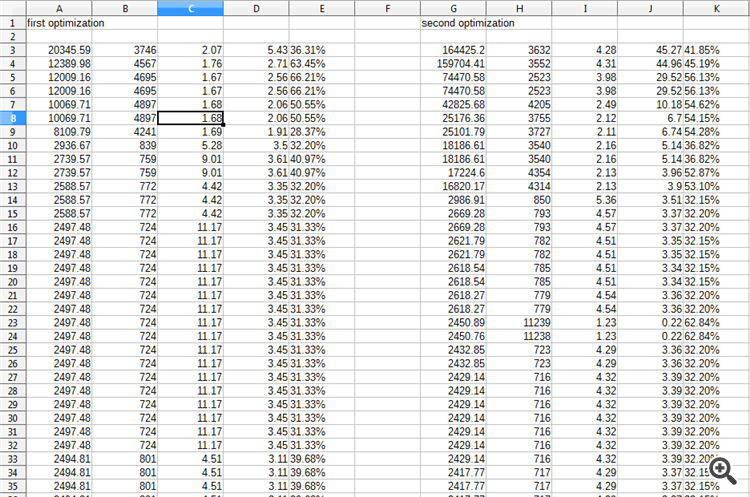

Here's an example of what I am seeing:

Not that I am defending the strategy as a open bar only strategy but it does have the option to use close prices but is false.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Seems the more you optimize with everything the same from the EA settings to Symbol, Time-frame, Date & Spread.

I have tried to duplicate what I found using open prices and it's not always the same.

Not to say that all the settings are not accurate as they are.

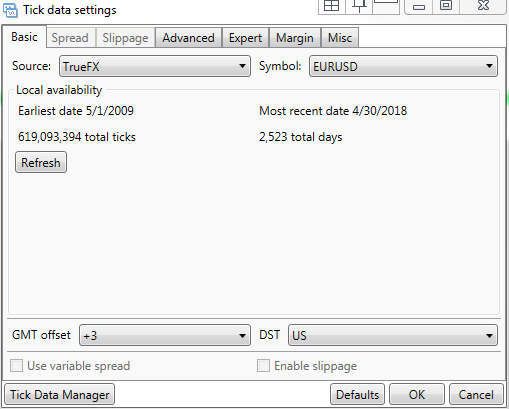

I am using Tick Data Manager and TrueFX 99% data.

Date range is 2010.01.01 to 2017.12.31