Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 08:13

Forex Fundamentals - Weekly Outlook May 12-16US Federal Budget Balance, retail sales, inflation and employment data, Philly Fed Manufacturing Index and Prelim UoM Consumer Sentiment are the main events on Forex calendar. Here is an outlook on the highlights of this week.

Last week, Fed Chair Janet Yellen testified before the US Congress repeating her speech made earlier before the Joint Economic Committee. Yellen noted the economy is on track for solid growth and that accommodative policy will continue as long as required. The Fed will normalize interest rates when the economy improves. Yellen believes US balance sheet will return to normal in 5 to 8 years. However, despite the positive tone, there were some troubled spots such as the Russia-Ukraine conflict and the recent setback in the housing market imposing on the ongoing economic recovery. Will the positive note continue in the coming weeks?

Let’s start,

- US Federal Budget Balance: Monday, 18:00. US budget debt narrowed more than expected in in March, reaching $36.9 billion, following $193.5 billion posted in February. Analysts expected a more modest decline to $76.5 billion. The overall trend is positive with a rise in receipts led by 11% fiscal year-to-date increase in corporate taxes and a 7 percent increase in individual taxes and the spending side is coming down including a 6% decline in defense spending. US Budget Balance is expected to reach a surplus of $112.6 billion.

- German ZEW Economic Sentiment: Tuesday, 9:00. German investor confidence continued to slide in April reaching 43.2 after posting 46.6 in March. Despite the strong recovery in the first quarter, the six month outlook survey revealed growing concerns about the Russia-Ukraine crisis and its possible effects on manufacturers and exporters in Germany. German investor confidence is expected to continue its downward trend towards 41.3.

- US retail sales: Tuesday, 12:30. U.S. retail sales surged to a 1-1/2 –year high of 1.1% in March indicating strong recovery in the US economy after a sluggish winter. The increase was evident in all sectors and followed a 0.7% gain in February. Meanwhile Core sales, excluding automobiles edged up 0.7%, the biggest rise in a year. These impressive figures raised new hopes for a boost in growth this year. U.S. retail sales are expected to climb 0.5%, while core sales are expected to increase 0.6%.

- UK employment data: Wednesday, 8:30. The number people claiming jobless benefits in March declined by 30,400 reaching to 1.14 million after a 37,000 drop in the previous month, indicating an ongoing improvement in Britain’s labor market. The unemployment rate also improved to 6.9% from 7.2% in February. Average earnings in the three months to February increased by 1.7% compared with a year earlier. Chancellor of the Exchequer, George Osborne, hailed the “strong jobs numbers” as further evidence that the coalition government’s economic plan is working. The number of jobless aid seekers are expected to decline further by 31,200 pushing the unemployment rate down to 6.8%.

- Mark Carney speaks: Wednesday, 9:30. Mark Carney, the Governor of the Bank of England will speak in a press conference, together with other MPC members, about the Inflation Report, in London. Carney stated in March that the Bank’s 2% inflation target became ‘dangerous distraction’ for the UK’s policymakers veiling the true progress made in the UK’s economy. Market volatility is expected.

- US PPI: Wednesday, 12:30. U.S. producer prices edged up 0.5% in March, posting their largest increase in nine months, amid a rise in the cost of food and trade services. The increase was well above market consensus following a 0.1% fall in February. The unexpected rise may be explained by weather related factors, but the wholesale inflation is expected to settle down in April. U.S. producer prices are expected to climb 0.2% this time.

- Haruhiko Kuroda speaks: Thursday, 4:25. BOJ Governor Haruhiko Kuroda will speak in Tokyo. Market volatility may occur.

- US inflation data: Thursday, 12:30. U.S. consumer prices increased slightly more than expected in March, rising 0.2% after a 0.1% climb in the previous month, suggesting inflation is back. In the 12 months through March, consumer prices rose 1.5% after increasing 1.1% over the 12 months through February. Meanwhile, core CPI, excluding volatile energy and food components, also edged up 0.2% in March after rising 0.1% in the prior month. The central bank is expected to end the QE bond purchases later this year. Domestic demand and the labor markets are improving but a rate hike is not expected before the second half of 2015. U.S. consumer prices are expected to increase by 0.3%, while core CPI is predicted to climb 0.2%.

- US Unemployment Claims: Thursday, 12:30. The number of new claims for unemployment aid filed last week fell 26,000 to 319,000, indicating the setback seen in the Easter holiday was temporary and the US job market is regaining its strength. Despite the drop in the number of applications. The four-week average increased by 4,500, to a seasonally adjusted 324,750 due to temporary layoffs around the Easter holiday but it is far better than the 343,000 average for 2013. Jobless claims is expected to rise to 321,000.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Factory activity in the U.S. mid-Atlantic region increased in April to 16.6 from 9.0 in March beating market forecast of a 9.6 reading. New orders edged up to 14.8, the highest level since October, from 5.7. The employment component improved to 6.9 from 1.7, but business conditions for the next six months fell to 26.6 from 35.4. Overall, the survey shows positive growth prospects for the US economy in the coming months. Factory activity in the Philadelphia area is anticipated to decline to13.9.

- Janet Yellen speaks: Thursday, 23:00. Federal Reserve Chair Janet Yellen will speak in Washington DC at the National Small Business Week. Yellen may talk about her latest testimony at the US congress. Market volatility is expected.

- US Building Permits: Friday, 12:30. US building permits fell by 2.4% in March reaching an annualized rate of 990,000.The reading suggests the pace of starts will increase further in the coming months. Single-family starts increased 0.2% compared to the previous year. Economists expect an acceleration in housing construction based on stronger household construction later this year and in 2015. US building permits are expected expand to an annualized rate of 1.01 million.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. Consumer confidence strengthened in April to the highest level since July, rising to 82.6 compared to 80 in March. Improvement in the US labor market contributed to this rise. The reading was better than the 81.2 projected by analysts. Increased employment opportunities and better wages will continue to lift consumer spending as well as consumer sentiment. Consumer confidence is expected to improve further to 84.7.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 15:24

EUR/USD forecast for the week of May 12, 2014, Technical AnalysisThe EUR/USD pair initially tried to rally to the 1.40 level, but as you can see turned everything back around and form a nasty looking resistive candle. The shape of the candle is somewhat like a shooting star, and as result it looks as if the market is ready to continue falling from here. The 1.37 level will be supportive, but we believe that the closing of the week at such lows in the range means that we will see continued bearish pressure, and as a result we aren’t looking to buy at all now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.11 17:13

EUR/USD weekly outlook: May 12 - 16The euro extended losses against the dollar into a second session on Friday, falling to a one-month low at the close, one day after the European Central Bank flagged possible monetary easing as soon as next month.

EUR/USD was at 1.3756 late Friday, the weakest level since April 8, down 0.60% on the day. For the week, the pair was off 0.85%.

The pair is likely to find support at 1.3695 and resistance at 1.3843, Friday’s high.

The euro fell from two-and-a-half year highs against the dollar on Thursday after ECB President Mario Draghi said the bank is “comfortable” with acting to shore up growth and stop inflation from falling too low at its next meeting in June.

The comments came after the ECB left rates on hold, as expected.

Draghi also said the strength of the euro was “a serious concern” and added that the bank would be closely monitoring exchange rate developments.

The single currency came under additional pressure after data on Friday showed that German exports fell 1.8% from a month earlier in March and the country posted a smaller-than-forecast trade surplus.

The euro dropped to two-month lows against the yen, with EUR/JPY at 140.09 late Friday, the weakest since March 4. The pair ended the week down 1.15%.

The U.S. dollar weakened against the other major currencies earlier in the week after Federal Reserve Chair Janet Yellen struck a dovish tone on the economy during testimony to the Joint Economic Committee of Congress.

Speaking Wednesday, Ms. Yellen said that a high degree of monetary accommodation remains warranted given the slack in the economy.

The Fed chief also said the bank expects economic growth to accelerate this year despite the slowdown in the first quarter but warned that the recent housing market slowdown "could prove more protracted than currently expected."

In the week ahead, investors will be looking ahead to preliminary data on first quarter growth in the euro zone, while the U.S. is to publish reports on retail sales, consumer prices and consumer sentiment.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 12

- The U.S. is to publish data on the federal budget balance.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The U.S. is to produce data on retail sales, as well as reports on import prices and business inventories.

- The euro zone is to produce data on industrial production.

- Later Wednesday, the U.S. is to release data on producer price inflation.

- The euro zone is to publish preliminary data on first quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth. The bloc is also to produce revised data on consumer inflation.

- The U.S. is to release data on initial jobless claims, consumer inflation and industrial production, as well as a report on manufacturing activity in the Philadelphia region.

- The U.S. is to round up the week with reports on building permits and housing starts, and a preliminary reading on consumer sentiment from the University of Michigan.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.13 11:16

2014-05-13 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - ZEW Economic Sentiment]

- past data is 61.2

- forecast data is 63.5

- actual data is 55.2 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

EUR - ZEW Economic Sentiment = Level of a diffusion index based on surveyed German institutional investors and analysts

==========

EUR/USD got its ZEW, and fell down

EUR/USD

opened the day at 1.3757, but since that time moved up by tiny steps

reaching 1.3770 right before the release, and posting 1.3746 right

after.

The first catalyst of Europe

The

pair showed timid moves higher on hopes for the stronger German data

which helped it to go above 1.3770 area just before the readings came

out. The Economic sentiment index showed downward moves from last

December when it posted multi-year high at 62. And this time the market

expected to see another decrease from 43.2 in April to 41.3. However,

the data came out at depressing 33.1 supporting the move of the pair to

1.3746 right after release, and making the market believe that Germany

has hard times with strong national currency damaging export activity.

The next target of the pair at 1.3717 support level.

What are today’s key EUR/USD levels?

Today's

central pivot point can be found at 1.3760, with support below at

1.3745, 1.3742 and 1.3717, with resistance above at 1.3773, 1.3788, and

1.3801. Hourly Moving Averages are bearish, with the 200SMA at 1.3862

and the daily 20EMA at 1.3832. Hourly RSI is bearish at 42.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

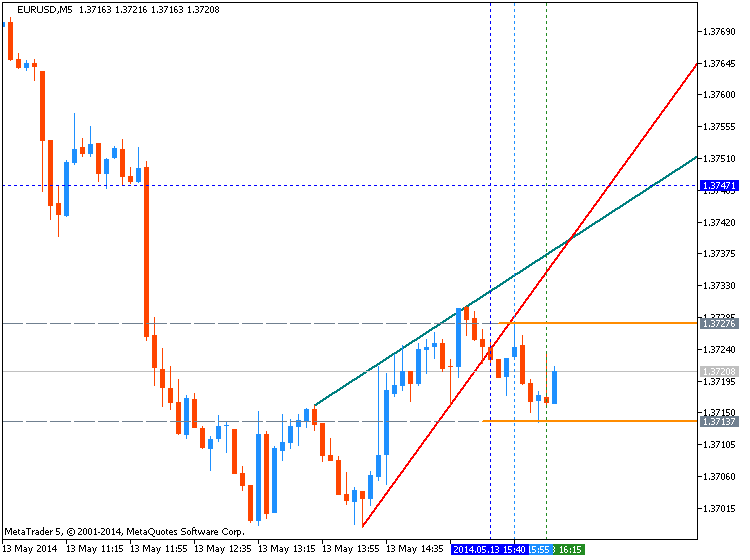

EURUSD M5 : 24 pips price movement by EUR - ZEW Economic Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.13 16:34

EUR/USD – Euro Weakens As German Economic Sentiment Slips

EUR/USD has softened on Tuesday, as the pair has finally broken out from its rangebound trading. In the European session, the pair has dipped close to the 1.37 line. The euro has reacted negatively to a dismal German ZEW Economic Sentiment, as the key indicator dropped to a 16-month low. Eurozone Economic Sentiment followed suit with a soft reading in April. In the US, today’s highlights are Core Retail Sales and Retail Sales. Strong numbers would point to increased consumer spending and could lift the dollar further against the euro.

The first Eurozone releases of the week were anything but impressive. German ZEW Economic Sentiment, a key indicator, weakened badly in April, dropping to 33.1 points. This was well off the estimate of 41.3 and its worst showing since December 2012. The Eurozone release followed suit, dropping to 55.2 points, compared to an estimate of 63.5 points. These indicators are based on a survey of institutional investors and analysts, and the weak numbers point to increasing concern about the Eurozone and German economies.

The ECB held its policy meeting last Thursday, and the euro took traders and investors on a wild ride in both directions. Mario Draghi took note of worrying inflation indicators, saying that food and energy prices, the strong euro and weak domestic demand were all factors in weak inflation which has engulfed the Eurozone. He then surprised the markets by adding that the Bank would be comfortable taking action in June, after re-examining inflation and growth forecasts in June. This is the clearest sign in months that the ECB is prepared to take action, and a reaction from the market was quick to follow, with the euro suffering sharp losses after coming within a few pips of the key 1.40 line. Draghi added that the ECB would continue to monitor exchange rates. Many analysts are of the view that the "line in the sand" for the ECB is the 1.40 level, and if the euro rebounds and moves above this line, it's more than likely that the ECB will take action to reign in the high-flying currency.

There were no surprises from Federal Reserve Chair Janet Yellen last week, who gave a cautious thumbs-up to the economic recovery in testimony before Congress. Yellen said that the US economy has improved, but noted two sore spots - the employment market and inflation which remains below the Fed's target of 2%. Yellen stated that she therefore expects that low interest rate levels will continue to stay low for a "considerable time". Yellen has stated previously that slack remains in the economy, and the Fed is expected to proceed carefully with future tapers to its QE scheme. Since December, the Fed has trimmed the asset-purchase program by almost half, cutting it to $45 billion each month.

EUR/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 1.3487 | 1.3585 | 1.3649 | 1.3786 | 1.3893 | 1.400 |

- EUR/USD has lost ground in Tuesday trade.

- 1.3649 is providing support to the pair. 1.3585 is stronger.

- On the upside, 1.3786 has some breathing room as the euro has given up some ground. This is followed by 1.3893.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3487 and 1.3346

- Above: 1.3786, 1.3893, 1.4000, 1.4149

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.14 09:00

2014-05-14 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French CPI]

- past data is 0.5%

- forecast data is 0.1%

- actual data is 0.0% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

EUR - French CPI = Change in the price of goods and services purchased by consumers

==========

France Consumer Price Index (EU norm) final (MoM) registered at 0%, missing expectations (0.1%) in AprilMetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 6 pips price movement by EUR - French CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.14 15:18

2014-05-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

- past data is 0.5%

- forecast data is 0.2%

- actual data is 0.6% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD PPI = Change in the price of finished goods and services sold by producers

==========

U.S. Producer Prices Rise More Than Expected In April

Producer prices rose by much more than anticipated in the month of April, according to a report released by the Labor Department on Wednesday, with the increase partly due to a sharp jump in food prices.

The Labor Department said its producer price index for final demand rose by 0.6 percent in April following a 0.5 percent increase in March. Economists had been expecting producer prices to edge up by about 0.2 percent.

Core producer prices, which exclude food and energy, also showed continued growth, climbing by 0.5 percent in April after rising by 0.6 percent in March. Core prices had been expected to rise by 0.2 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 14 pips price movement by USD - PPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.15 16:02

5 Things To Know About Euro-Zone GDP

There were a handful of clear messages in the raft of European first quarter GDP data released on Thursday. By and large they were disappointing, showing a struggle for growth across the euro zone, with Germany providing the sole ray of light. Here’s what’s to know.

1. Much of the euro zone is strugglingOf the 13 member states that have reported quarterly numbers, Italy, the Netherlands, Cyprus, Portugal, Estonia and Finland all registered contraction on the previous three months. Of the remaining five, the Greek economy continued to shrink on a year on year basis during the quarter. And the French economy was static, showing no growth on the final three months of 2013.

Apart from Germany’s, most of these numbers fell short of expectations. Overall the euro zone managed just a 0.2% expansion on the quarter and 0.9% on the year against consensus forecasts of a 1.1% increase on the year.

What’s more, prospects for the second quarter aren’t much better. The first quarter numbers were boosted by weather-related factors, argued Peter Vanden Houte, an economist at ING Bank. Second quarter data are likely to give back some of those gains. Meanwhile, recent survey evidence and industrial production figures across the region have been disappointing–even from Germany.

2. Low inflation, even outright deflation, are not antithetical to growth

For instance, Hungary’s inflation rate turned negative in April, contracting 0.1% on the year, yet the economy had a storming first quarter, expanding 1.1% on the previous three months and 3.2% on the year.

Ditto for Poland. Polish consumer price inflation rate has been declining steadily and was only just positive on the year in April–at 0.3%–but it too had a storming performance during the first quarter, expanding 3.5% on the year.

3. Look outside the euro zone

As well as Hungary and Poland, the U.K. economy performed well, expanding 0.8% on the quarter and 3.1% on the year. Lithuania and Romania expanded 2.9% and 3.8% on the year respectively, although their quarterly rates of growth slowed during the first three months of the year.

Of course there are exceptions. Bulgaria, the Czech Republic and Denmark, which are all outside of the single currency region, have been finding growth hard to come by.

And this particular strength across the European Union’s eastern fringes could yet prove to be short lived. It doesn’t seem the Ukrainian crisis had much of an effect on growth during the first quarter, but the impact could yet show up in second quarter data.

Both investors and ECB President Mario Draghi have recently cited the confrontation between Russia and Ukraine as a source of downside risk for European economies.

4. The ECB has plenty of justification to pull on its monetary levers

Euro-zone consumer prices rose just 0.7% on the year in April, far below the ECB’s target of slightly under 2%.

ECB Vice President Vitor Constancio reiterated the central bank’s determination “to act swiftly if required” in a speech on Thursday. Mr Draghi made the point that the central bank’s governing council was holding off acting until more data was available in June. The first-quarter GDP numbers will undoubtedly help to tilt the balance towards action.

And investors are expecting it. The euro fell to 11-week lows in the wake of Thursday’s data releases. Euro-zone sovereign bonds have continued to rally and Germany’s equity market has tested all-time highs on the view that the ECB will provide more liquidity.

5. Japan's example suggests ECB action alone might not be enough

With much of the single currency region struggling to generate escape velocity and even the German economy looking vulnerable, some economists doubt the central bank will be willing or able to provide the scale of policy action needed to get member economies back to sustainable long term growth.

Even though Germany’s policymakers have increasingly come round to the idea that the ECB needs to do more to help growth and forestall a slide into deflation, there are doubts about whether the ECB might be able to pursue wholesale asset purchases like those undertaken by the Bank of Japan, the Federal Reserve and the Bank of England did with their quantitative easing programs.

Other policy tools open to the ECB, such as another long term refinancing operation to shore up bank lending, are likely to be less effective. Especially in light of the fact that euro-zone fiscal policy by and large remains contractionary as governments aim to bring their deficits to back under treaty thresholds.

What’s more, if aging populations are a primary driver of deflation, as some economists think, the euro zone’s poor demographics will prove to be another huge hurdle for the central bank.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.15 16:48

2014-05-15 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

- past data is 16.6

- forecast data is 14.0

- actual data is 15.4 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD Philly Fed Manufacturing Index = Level of a diffusion index based on surveyed manufacturers in Philadelphia==========

Philly Fed Index Drops Less Than Expected In May

Activity in the Philadelphia-area manufacturing sector expanded for the third consecutive month in May, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday, although the index of activity in the sector fell compared to the previous month.

While the Philly Fed said its diffusion index of current general activity dipped to 15.4 in May from 16.6 in April, a positive reading still indicates growth in the regional manufacturing sector. Economists had expected the index to drop to a reading of 14.3.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 37 pips price movement by USD - Philly Fed Manufacturing Index news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

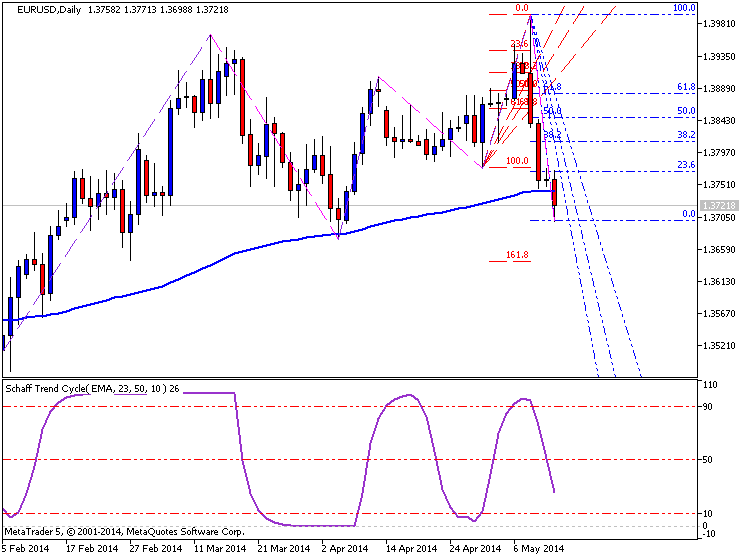

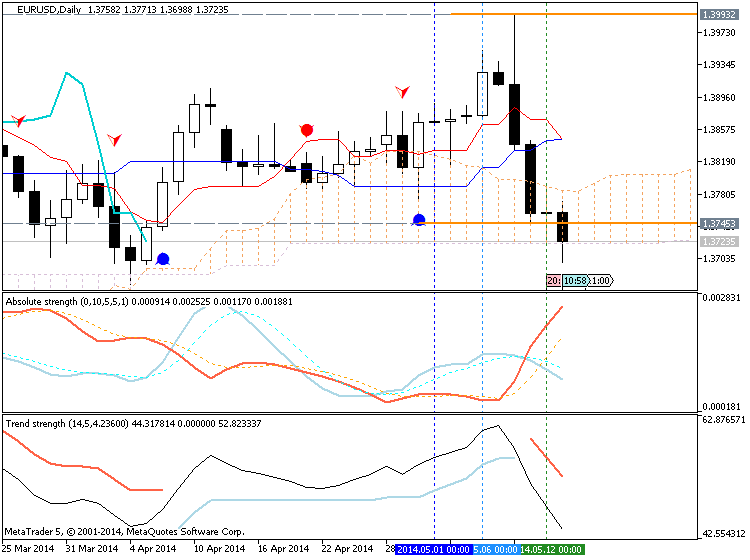

D1 price: Chinkou Span line of Ichimoku indicator is crossing the price on open bar for possible breakdown; and the price is crossed Sinkou Span A (one of the border of kumo) on open bar too for possible reversal from correction within primary to primary bearish on D1 timeframe.

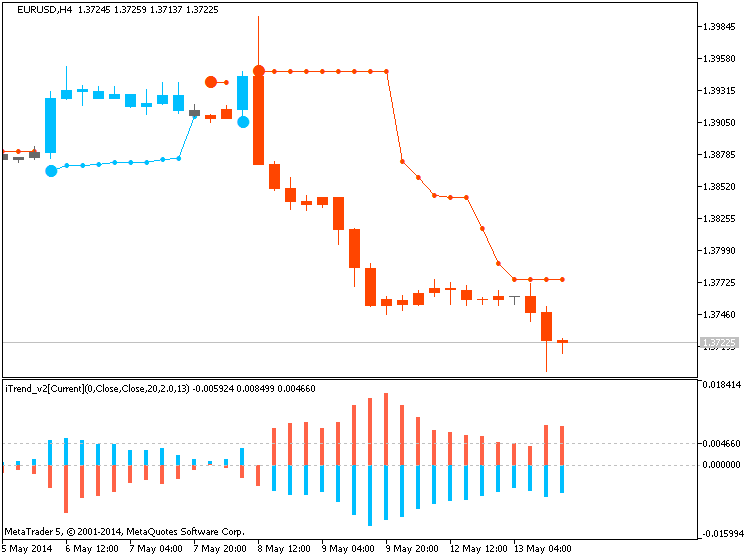

H4 price is on bearish with breaking 1.3752 resistance on open bar for now for the bearish to be continuing.

W1 price is on bullish correction with 1.3672 as nearest support level the way to correction to be continuing within bullish market condition.

If D1 price will break 1.3774 support so we may have the ranging market condition

If D1 price will break 1.3721 support level together with Chinkou Span line to be broken with historical price so we may see the fully reversal of price movement from bullish to bearish market condition on D1 timeframe.

If not so we may see the ranging market condition within primary bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-05-12 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

2014-05-13 05:30 GMT (or 07:30 MQ MT5 time) | [CNY - Industrial Production]

2014-05-13 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2014-05-13 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - ZEW Economic Sentiment]

2014-05-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-05-14 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Final CPI]

2014-05-14 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French CPI]

2014-05-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-05-15 05:30 GMT (or 07:30 MQ MT5 time) | [EUR - French GDP]

2014-05-15 05:30 GMT (or 07:30 MQ MT5 time) | [EUR - German GDP]

2014-05-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2014-05-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]

2014-05-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-05-15 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2014-05-15 23:00 GMT (or 01:00 MQ MT5 time) | [USD - Fed Chair Yellen Speaks]

2014-05-16 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Non-Farm Payrolls]

2014-05-16 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Trade Balance]

2014-05-12 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-05-16 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : reversal

TREND : correction

Intraday Chart