Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 10:19

Forex Weekly Outlook May 5-9A very busy week ended with a drama around the Non-Farm Payrolls and left some uncertainty about the next market moves. The list of events for the coming week includes: US ISM Non-Manufacturing PMI, Trade Balance, Janet Yellen’s testimony, and rate decisions in Australia, the UK and the Eurozone, with the latter promising a lot of action. Here is an outlook on the main market-movers awaiting usr this week.

European inflation numbers came out worse than expected, but is it enough for action from the ECB? Draghi’s headache is probably worsening. In the US, we can see a distinction between the weak GDP in Q1, and the promising data from Q2. Is the bounce strong enough? The Fed acknowledged the gap and in any case, continued tapering for the fourth time. The Non Farm Payrolls provided a great show: the US gained 288K jobs and this certainly boosted the US dollar. However, within an hour, the tables turned and the greenback lost its shine. Is volatility making a comeback?

- US ISM Non-Manufacturing PMI: Monday, 14:00. The US service sector rebounded mildly in March reading 53.1 after a sharp drop to 51.6 in February. Economists expected a slightly higher reading of 53.5% in March. The employment index registered the biggest climb rising 6.1 points to 53.6, from 47.5 in February. Furthermore, other components such as new orders and export orders increased, indicating the US economy continues to expand. US service sector is expected to advance further to 54.3.

- Australian rate decision: Tuesday, 4:30. The Reserve bank of Australia decided to maintain its cash rate at 2.5% in light of stronger than expected job figures as well as a climb in domestic demand and improvement in household finance. Furthermore, the ABS reported a surge in retail sales, rising 1.2% in January, beating market consensus. No change in rates is expected this time.

- US Trade Balance: Tuesday, 12:30 The U.S. trade deficit increased in February to $42.3 billion, reaching its highest level in five months due to lower demand for American exports. U.S. exports plunged 1.1% to $190.4 billion as sales of commercial aircraft, computers and farm goods fell. Imports climbed 0.4% to $232.7 billion, mainly autos and clothing. The increase in deficit caused some economists to reduce their estimate for overall economic growth for the January-March quarter. However analysts believe deficit will shrink this year with the help of exports. The U.S. trade deficit is expected to narrow to $40.1 billion.

- NZ employment data: Tuesday, 22:45. The jobless rate in New Zealand edged down to 6.0% in the fourth quarter of 2013 from 6.2% in the third quarter, in line with market forecast. New Zealand’s job market expanded by 1.1% in the final quarter of 2013, exceeding forecasts for a 0.6% increase. On a yearly basis, employment picked up 3.0%, far better than the 2.4% estimated. The employment rate reached 64.7 % with 2,297,000 people in the work force. The participation rate reached 68.9%, beating expectations for 68.6 %. New Zealand’s job market is expected to advance by 0.7% in the first quarter, while the unemployment rate is predicted to decline to 5.8%.

- Janet Yellen speaks: Wednesday, 14:00. Federal Reserve Chair Janet Yellen will speak in Washington D.C. before the Joint Economic Committee of Congress. The question and answer session may provide info about important monetary policy issues. Market volatility is expected. It will be interesting to hear her view on more tapering in light of the fourth such move and the recent jobs report.

- Australian employment data: Thursday, 1:30. The Australian unemployment rate edged down to a four-month low of 5.8% in March, following 6.1% in February. An addition of 18,100 jobs in March and 48,200 in February, helped lower the rate, suggesting a growth trend in the Australian economy. Full-time positions fell 22,100 in the month and part-time employment was up 40,200. However, the federal employment minister, Eric Abetz, cautioned against reading too much into one month’s numbers because of a decline in the labor force participation rate. Australian job market is expected to add 9,600 jobs while the unemployment rate is expected to reach 5.9%.

- UK rate decision: Thursday, 11:00. The Bank of England kept its key interest rate unchanged at a record low of 0.50%, amid a continuous growth trend in Britain’s economy. The bank also maintained the stimulus program of 375 billion pounds, in government bonds that it has purchased over the past five years. The BOE is not expected to change rates until next year according to analysts. GDP increased 0.8% in the first quarter of 2014. Growth in the first quarter is expected to reach 0.9% with lower unemployment and increased economic activity. The Bank of England is expected to maintain rates and monetary policy.

- Eurozone rate decision: Thursday, 11:45, press conference at 12:30. The ECB could cut the main lending rate by 0.10% and leave the deposit rate at 0% in an attempt to lower the value of the euro without using the heavier tools. Draghi’s dilemma is becoming a big headache. He would prefer to have a lower value of the euro against both the dollar and the Chinese yuan without having to take action. It worked amazingly well with the OMT. However, even his stronger and more explicit verbal interventions to lower the exchange rate are having a diminishing effect. The excellent US NFP was not enough to do the job for Draghi. More words without action could damage his credibility. Inflation is low and well below the 2% target, but not below 0.5% – a level that would probably force the ECB to act. With core inflation standing at 1%, it will be hard for Draghi to convince his German colleagues to use the “nuclear option” of setting a negative deposit rate. Regarding QE, it is quite complicated in the euro-zone and probably left as the last option. Cutting only the main lending rate has a very marginal effect on the EZ economies, but still shows that the ECB can act and not only talk. With such a move, Draghi can hope for a lower exchange rate and leave the other, bigger tools as big bazookas and nothing else.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits increased last week to 344,000 from 330,000 in the previous week. The reading was higher than the 317,000 anticipated by analysts. However this rise may be attributed to seasonal adjustment issues caused by the Easter holiday. Analysts believe that the real measure of claims is much lower. Another good sign is the ADP non-farm employment change report released a day before showing a rise of 220,000 jobs in April following 209,000 in the previous month. US Jobless claims is expected to rise by 328,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s labor market expanded by 42,900 in March driven by jobs for Canadian youths aged 15 to 24. This rise helped push down the unemployment rate by 0.1% to 6.9%, beating forecast of 7.0%. The majority of job addition is part-time. Employment in health care and social assistance edged up, while the agriculture sector continued to shrink. Canada’s labor market is expected to expand by 21,400 jobs, while the unemployment rate is expected to remain at 6.9%.

- US JOLTS Job Openings: Friday, 14:00. The JOLT Job Openings jumped to a 6 year high in February, reaching 4.17 million. This rise indicates a growth trend in the US economy as employers hire more people due to meet rising consumer demand. However, the quit rate remained unchanged at 1.7% a higher quit rate means employees are confident that they can find a new jobs. Chair Yellen, cited these indicators as important indicators for the Job market strength. The JOLT Job Openings is expected to reach 4.21 million.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 10:34

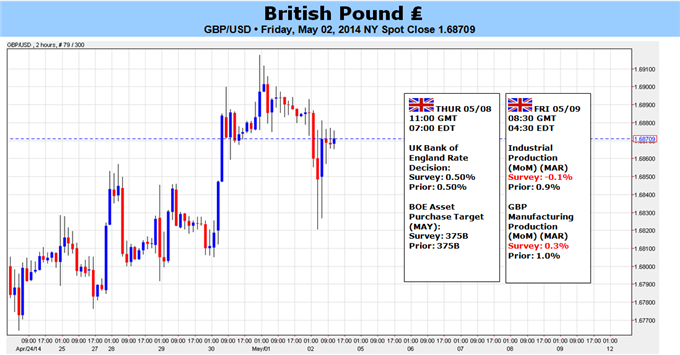

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: Neutral- Cable closed at a five-year high this past week on the back of a robust UK GDP reading – quite the contrast to the US

- A BoE rate decision this week is likely to hold less influence that a range of economic data releases that can weigh rate forecasts

The pound has finished out an impressive month and week. Through April, the currency has advanced against all of its major counterparts.

In the past week alone, progress was more restrained; but the

perception was just as robust. The clear standout for the pound is

GBPUSD (often called ‘Cable’) with a move through 1.6850 that has

pushed it to a near five-year high. Having cleared yet another

technical boundary on a 10-month climb backed by enviably growth rates

and burgeoning rate expectations, is this currency bound to overtake

1.7000 to open up a much bigger bull run?

A medium-term outlook for the sterling must rely more on fundamentals

and less on mere technical momentum. Speculative appetite certainly

plays a dominant role in both bearing and conviction (momentum), but

underlying financial market conditions have sapped the drive from all

assets and pairs – including Cable. In seeking out the primary sparks

for the British currency, this is one of the few majors that doesn’t

simply await its cue from general risk trends. With a historically low

benchmark rate that is in the middle of the pack between the US and

Australian dollars, there is neither carry nor funding labels attached

to the pound. However, as speculation for a rate hike regime from the

Bank of England gains further traction; this may prove the fastest

horse in a slow race.

Amongst the majors, the BoE is perceived as the most hawkish policy authority behind the RBNZ

(which has already hiked rates twice). This hawkishness derives from

the impressive reversal in the UK’s economic health last summer and the

group’s simultaneous shift away from threatening further stimulus

program upgrades. As everything in the FX market is relative – this has

presented a particularly stark contrast to the likes of the Fed, ECB

and BoJ who maintain an expansionary policy.

Yet, it is important to recognize that the foundation of the pound’s

strength is built on expectations rather than current conditions. Gilt

yields and swaps show expectations for an opening rate hike from the

BoE well ahead of its US counterpart. Having priced in that forecast,

though, the burden is now on maintaining that optimism. Projecting a

move ahead of the central bank’s own timetable requires a consistent

stream of favorable data to persuade the MPC (Monetary Policy

Committee) to capitulate. Given the current bearings on rate

expectations, it is far more difficult to advance the timetable (a

bullish factor) and far easier to postpone it through data.

This focus leverages the potential impact UK data can have on rate

forecast and therefore the pound. The most obvious release this week is

the BoE rate decision. However, this is likely to prove uneventful.

When the central bank does not change its policy, they do not release a

statement detailing their reasoning. That said, there are plenty of

key indicators that will hit the areas of the economy.

For general economic forecast, Tuesday’s Composite PMI and Friday’s NIESR GDP Estimate for April offer the broadest scope.

Yet, particular industry updates may prove more convincing.

Manufacturing production for business activity, the RICS home sector

reading and construction output for housing, and the trade figure for

the external support. During each release, we should keep a leery eye on

GBPUSD and the 10-year UK bond yield.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 15:56

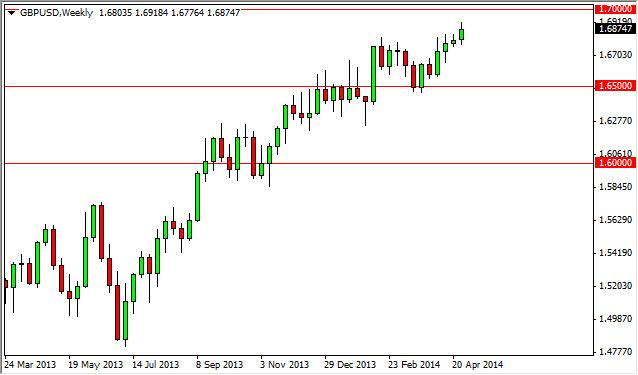

GBP/USD forecast for the week of May 5, 2014, Technical Analysis

The GBP/USD pair initially fell during the week, but turned back around

to form a positive candle. We have broken out and up to the 1.65 level,

but that area offered enough resistance to push the market back down.

With that, we feel that the market will eventually go to the 1.70

handle, an area that should be significant resistance. Going forward, we

do think that the market will break above there, and we believe that

the 1.65 level is the “floor” in this market. We are “buy only.”

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.06 10:47

2014-05-06 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

- past data is 54.0

- forecast data is 54.4

- actual data is 56.5 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

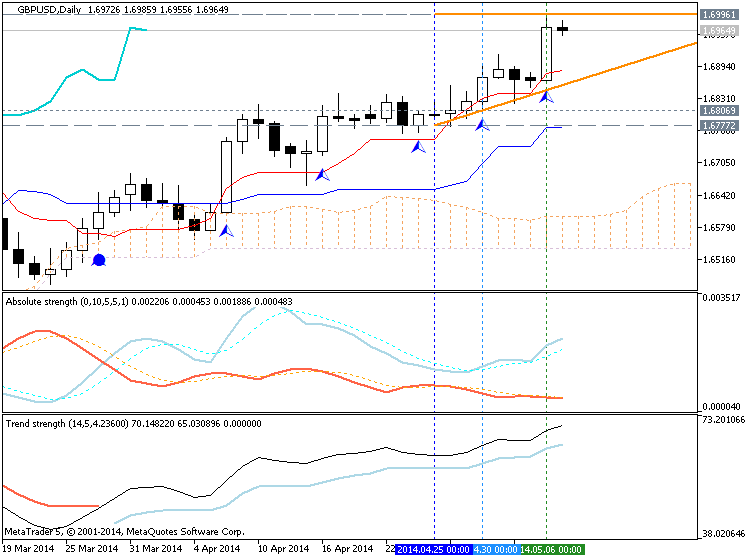

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 29 pips price movement by EUR - Spanish Services PMI news event

If D1 price will break 1.6762 support level on close bar - we will see the secondary correction or ranging within primary bullish market condition.

If

D1 price will break 1.6919 resistance from below to above so the

primary bullish will be continuing (good to open buy trade).

- Recommendation for short: watch D1 price for breaking 1.6762 support level on close bar

- Recommendation

to go long: watch D1 price for breaking 1.6919 resistance level from below to above on close bar

- Trading Summary: bullish

D1 price broke 1.6919 resistance so we can see the bullish trend to be continuing (look at the chart below). If some trader opened buy stop pending order at 1.6919 in Monday morning so it should be 77 pips in profit for now (by equity open trades with 4 digit pips).

Next resistance for D1 timeframe is 1.6996

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.08 07:30

2014-05-08 02:19 GMT (or 04:19 MQ MT5 time) | [CNY - Trade Balance]

- past data is 7.7B

- forecast data is 13.9B

- actual data is 18.5B according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China Has $18.5 Billion Trade Surplus In April

China saw a merchandise trade surplus of $18.5 billion in April, the Customs Office said on Thursday.

That topped forecasts for a surplus of $13.9 billion following the $7.7 billion surplus in March.

Exports were up 0.9 percent on year - also beating expectations for a decline of 1.7 percent following the 6.6 percent fall in the previous month.

Imports added an annual 0.8 percent versus expectations for a contraction of 2.3 percent after tumbling 11.3 percent a month earlier.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 13 pips price movement by CNY - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

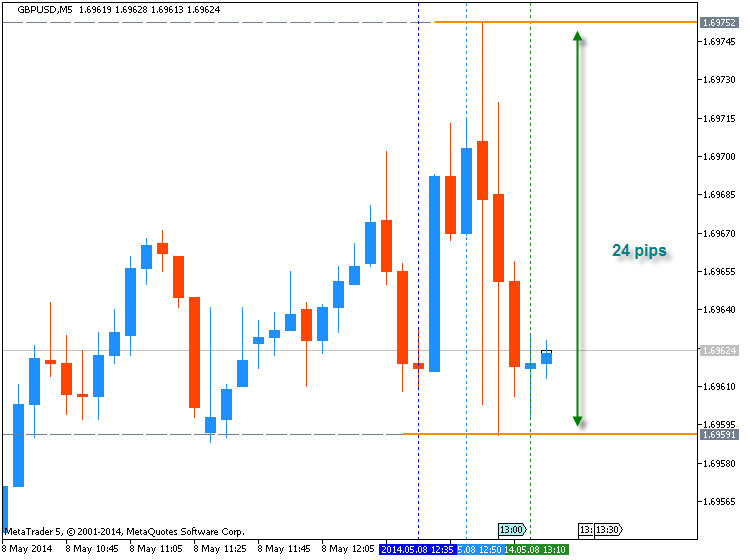

newdigital, 2014.05.08 13:15

2014-05-08 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

Bank Of England Maintains Key Rate; QE At GBP 375 Bln

The Bank of England retained its interest rate at a historic-low and the size of quantitative easing at GBP 375 billion as widely expected.

The nine-member Monetary Policy Committee led by Mark Carney voted to keep the key bank rate unchanged at 0.50 percent. The rate has been at the current 0.50 percent since March 2009.

The panel also decided to maintain the asset purchase programme at GBP 375 billion. The previous change in asset purchases was in July 2012, when it was raised by GBP 50 billion.

The bank first launched quantitative easing in March 2009 with an initial value of GBP 75 billion.

In August last year, the bank pledged not to hike the interest rate until the unemployment rate falls to 7 percent. The jobless rate slid to 6.9 percent in three months to February to a five-year low.

As the unemployment started falling faster than estimated, the BoE widened the scope of its forward guidance this February, and assured markets that interest rates will not be raised before the second quarter of 2015.

GBPUSD M5 : 24 pips range price movement by GBP - Official Bank Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.08 14:59

2014-05-08 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

- past data is 344K

- forecast data is 325K

- actual data is 319K according to the latest press release

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Weekly Jobless Claims Pull Back More Than Expected

After reporting an unexpected increase in first-time claims for U.S. unemployment benefits in the previous week, the Labor Department released a report on Thursday showing that initial jobless claims pulled back by more than expected in the week ended May 3rd.

The Labor Department said initial jobless claims fell to 319,000, a decrease of 26,000 from the previous week's revised level of 345,000. Economists had expected jobless claims to drop to 325,000 from the 344,000 originally reported for the previous week.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 25 pips price movement by USD - Unemployment Claims news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.08 19:51

GBP/USD holds steady after U.S. data

The pound held steady against the U.S. dollar on Thursday, hovering near five-year highs after the release of upbeat U.S. jobless claims data and as the Bank of England kept monetary policy on hold.

GBP/USD hit 1.6974 during U.S. morning trade, the session high; the pair subsequently consolidated at 1.6955, easing up 0.01%.

Cable was likely to find support at 1.6866, the low of May 6 and resistance at 1.6996, the high of May 6 and an almost five-year high.

The U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending May 3 fell by 26,000 to 319,000 from the previous week’s revised total of 345,000. Analysts had expected jobless claims to fall by 20,000 to 325,000 last week.

Earlier Thursday, The BoE’s Monetary Policy Committee voted to keep interest rates on hold at their current record low of 0.5%. The bank also made no change in its quantitative easing program, which remains at £375 billion.

The BoE will publish the minutes of this month’s meeting on Wednesday, May 21.

Expectations for a U.K. rate hike in the early part of next year have propelled sterling to multi-year highs against the dollar, after a recent string of strong economic reports indicated that the recovery is deepening.

Early last week BoE Governor Mark Carney said the U.K. recovery is starting to broaden, but added that the bank still sees plenty of slack in the labor market.

Data released earlier Thursday showed that U.K. house prices fell 0.2% last month, mortgage lender Halifax reported, and rose 8.5% in the three months to April, compared to the same period a year earlier, slowing from an increase of 8.5% in the three months to March.

Sterling was higher against the euro, with EUR/GBP shedding 0.40% to 0.8172.

Also Thursday, the European Central Bank held its benchmark interest rate at a record low 0.25%, in line with expectations.

Speaking at the ECB’s post-policy meeting press conference, Mario Draghi said that the central bank will continue to monitor developments closely and will consider all instruments available to support growth. He added that ECB is ready to act swiftly if further easing is needed.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bullish market condition trying to break 1.6919 resistance for bullish to be continuing.

H4 price is ranging between 1.6912 resistance and 1.6821 support levels within primary bullish.

W1 price is on bullish crossing 1.6841 resistance on open bar.

If D1 price will break 1.6762 support level on close bar - we will see the secondary correction or ranging within primary bullish market condition.If D1 price will break 1.6919 resistance from below to above so the primary bullish will be continuing (good to open buy trade).

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2014-05-05 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-05-05 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-05-06 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2014-05-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-05-07 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-05-08 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

2014-05-09 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-05-09 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2014-05-09 14:00 GMT (or 16:00 MQ MT5 time) | [GBP - NIESR GDP Estimate]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart