John Bollinger Webinar on Bollinger Bands® and Japanese Candlesticks

In this hour long webinar John Bollinger teaches the basics of Bollinger Bands and then discusses candlestick charts and how Bollinger Bands can be combined with Japanese candlesticks to provide more powerful analysis.

Strategy Video: EURUSD Break or Reversal at 1.4000 is Investor vs ECB

- After a heavy round of US and Eurozone event risk, EURUSD is important resistance once again

- Capital inflows and a diminishing ECB balance sheet are keeping the Euro slowly rising

After a weak showing from 1Q US GDP and a rebound in Eurozone inflation, EURUSD was pushed back up to the top of April's range. This recent move, however, doesn't properly encompass the fundamental, technical and market conditions factors behind this benchmark pair. Nor does it properly reflect its trade potential. The bullish inclination for EURUSD is well founded in investment capital seeking out higher returns in the Eurozone - another 'risk on' factor. Yet, the 1.4000-1.3900 region carries a technical prominence and the ECB's ire. A large scale confrontation is playing out, and we discuss its trading potential in today's Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 10:40

DAX forecast for the week of May 5, 2014, Technical AnalysisThe DAX as you can see rose during the majority of the week, but did find enough resistance in the form of the €9600 level to push the market back down a little bit. We believe that this congestion should send the market higher eventually though, and that pullbacks will be buying opportunities as the DAX has been wildly bullish over the last couple of years. With that being the case, we are buyers above €9700, and most certainly above €9800 as it would open the doors to the €10,000 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 11:29

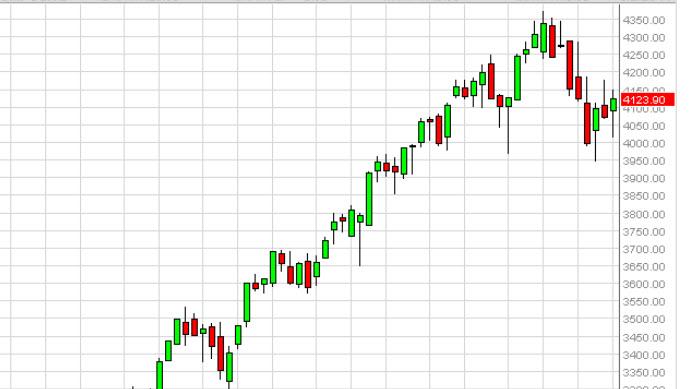

NASDAQ forecast for the week of May 5, 2014, Technical AnalysisThe NASDAQ fell during the bulk of the week, but found enough support near the 4000 level in order to form a hammer, which of course shows that the market does in fact have plenty of buyers below. With that, a break above the top of the shooting star from the previous week, or the 4200 level if you will, is a nice buying opportunity. We believe that there is a “floor” in this market at the 4000 level, and as a result we are bullish still. On a move above the 4200 level, we think of this market originally will try to get to the 4350 level, and then ultimately the 4500 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 12:20

MIB forecast for the week of May 5, 2014, Technical AnalysisThe MIB rose during the bulk of the week, but found the 22,000 level to be a bit too resistive to continue. This is the second week in a row that we have found resistance in this general vicinity, so we think that we may be heading into a bit of a consolidation move now, but we certainly think that this market remains bullish overall. That being said, we get above the 22,200 level, we are buyers as it would show continued strength. However, we fully anticipate sideways action in the short term.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 12:47

IBEX forecast for the week of May 5, 2014, Technical AnalysisThe IBEX initially fell during the week, but found enough support near the €10,250 level to turn things back around and head towards the €10,500 level. The fact that the market touch the top of the shooting star suggests that the market is going to try to breakout to the upside, and we believe that the IBEX should continue to be one of the better performers in Europe as the Spanish index always gets a lot of “hot money” flowing into it. With that, we are bullish and look at buying on dips, and a break above the top of the range for the week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 12:54

CAC forecast for the week of May 5, 2014, Technical AnalysisThe Parisian index rose during the week, but for the second week in a row found enough resistance near the €4500 level to form a shooting star. The fact that we have dual shooting stars at the €4500 level suggests that this market is in fact going to struggle to get above that area. However, the CAC has been a strong performer over the longer term, and with that we feel that the market will eventually breakout to the upside. On top of that, we feel that there will be enough momentum and inertia build job that once we finally get that break above 4500, this market should become wildly bullish again and perhaps head to the €5000 level.

Keep in mind that the market won’t make that move in one quick swipe, but ultimately we think that it will happen. On top of that, any pullback in this general vicinity should find plenty of buying areas, such as the €4400 level, the €4300 level, and most certainly the €4000 level. With that, we cannot sell this market as the Parisian index continues to be one of the more bullish out there. If you look at the recent action, you can see that we are in a little bit of an uptrend the channel, and that a pullback all the way to the 4300 level would be within the realm of possibility without breaking any type of momentum.

We believe in the European stock exchanges anyways, and with this market in particular, we have had one of the nicest uptrends over the last couple of years. Because of this, we believe that buying on the dips will continue to be the way to go going forward, and this move may offer just that type of setup. Of course, if we break above €4500 on a daily close, we think that’s strong enough as well as the market would continue to go much higher, ultimately touching the €5000 level as mentioned above. We have no scenario in which to sell this market right now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 13:33

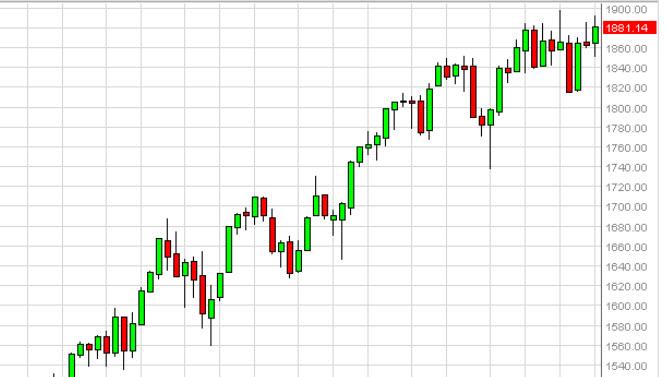

S&P 500 forecast for the week of May 5, 2014, Technical Analysis The S&P 500 initially fell during the week but found enough support below at the 1850 level to turn things back around. However, we have not broken above the 1900 level, a prerequisite for a buy-and-hold type of situation. On a daily close above that level, we are more than willing to buy this market as it should head directly to the 2000 level at that point in time. Pullbacks here should offer nice buying opportunities as we think the market will struggle to sell offer any real length of time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 13:38

FTSE forecast for the week of May 5, 2014, Technical Analysis The FTSE had a bullish week as we shot well above the 6700 level during the week, testing the 6850 area. This area has been resistance previously, so on a daily close above that area, we are buyers as we believe the FTSE will continue to go higher at that point. Pullbacks on short-term charts can be buying opportunities as well, recognizing that the area will more than likely take a bit of momentum to get through. Breaking out above that area is a sign that the market could head to 7000.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Trading and training video (from youtube for example) about forex and financial market in general.

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.