Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.26 09:05

Forex Weekly Outlook Apr 28 – May 2Currencies drifted sideways in the post Easter week, and now we have a very busy week with top tier events. The all important inflation release from the euro-zone, GDP in the US and the UK, the FOMC meeting, the buildup to to Friday’s Non-Farm Payrolls and other events all promise lots of action Here is an outlook on the market-movers for this week.

The week after Easter provided some interesting developments. This time, US data was quite mixed: durable goods orders climbed nicely, but jobless claims disappointed and new home sales plunged. Will the skies clear in the upcoming week? In the euro-zone, Draghi tried to play down the euro once again, with diminishing success. He might be forced to act soon. One extreme action would be buying gold with printed euros. A central bank that is acting, but in the other way, is the RBNZ: a second rate hike in New Zealand certainly supported the kiwi. Its neighbor, the Aussie, was falling after weak inflation data. The pound remains near 4 year highs.

- US Pending Home Sales: Monday, 14:00. Signed contracts to purchase existing homes fell 0.8% in February, declining for the eighth straight month, indicating the housing sector goes through a rough patch. Pending home sales fell 0.2% in January. Analysts expected the index to rise 0.1% this time. The cold winter probably played a role in discouraging prospective buyers. Pending home sales are expected to rise by 1.0% this time.

- UK GDP: Tuesday, 8:30. Britain’s economic recovery weakened slightly in the final quarter of 2013, with a 0.7% growth rate, following 0.8% in the third quarter. The service sector was the main locomotive of GDP growth. Manufacturing grew 0.9%, though construction suffered a 0.3% fall in output. However, wage growth increased less than price inflation, indicating smaller income. However, GDP growth in 2013 was the highest since 2007 with a 1.9% expansion rate. Britain’s estimated GDP for the first quarter of 2014 is expected to be 0.9%.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence edged up in March to its highest in more than six years posting 82.3 points following an upwardly revised 78.3 in February. Economists expected a mild improvement to 78.7. Consumers expect the economy to continue improving with a pick-up in growth in the coming months. However labor market assessment was more pessimistic in March. Consumers also anticipated larger price increases, with expectations for inflation in the coming 12 months. Consumer confidence is expected to edge up further to 82.9.

- Japan rate decision: Wednesday. The Bank of Japan left its monetary policy unchanged in April in line with market forecast, Governor Haruhiko Kuroda said on at the press conference following the rate statement that the BOJ may decide on additional monetary easing to boost the economy, although Prime Minister Shinzo Abe, did not ask for any additional measures by the BOJ to achieve the goal of an annual 2 % rise in consumer prices by fiscal 2015. Kuroda noted that the economy is in a growth trend but is still needs to attain the inflation goal and beat deflation risks. No change in rates is expected despite the weaker than expected inflation numbers from Tokyo for April.

- Euro-zone CPI Flash Estimate: Wednesday, 9:00. Annual consumer inflation in the Euro area member states was 0.5%, lower than the 0.7% posted in February and the lowest since 2009. Economists predicted a 0.6% inflation rate. This was the sixth month of low inflation defined by the ECB as the “danger zone” of below 1%. Mario Draghi suggested that the bank will take bold action should the outlook deteriorate. Inflation is expected to gain momentum with a 0.8% reading, in part due to the shift in date of Easter, from March in 2013 to April this year. Inflation below 0.5% could force the ECB to act.

- US ADP Non-Farm Payrolls: Wednesday, 12:15. The ADP report of job creation in March edged up to 191,000 from 178,000 posted in February, suggesting that the downside trend in the last few months has ended. Goods-producing sector employment increased by 28,000 jobs in March, but the main gains came from the construction industry which added 20,000 jobs over the month; compared to an average of 16,000 during the prior three months. Manufacturers added 5,000 jobs in March, the same as February. Service-providing employment rose by 164,000 jobs in March, up from the upwardly revised 153,000 in February. ADP early jobs gain report is expected to reach 212,000.

- Canadian GDP: Wednesday, 12:30. The Canadian economy rebounded in January with a growth rate of 0.5% from a weather-related contraction of 0.5% in December. Production rose by 1.0%, led by a boost in manufacturing, mining, construction, and oil and gas extraction. Services climbed 0.3% with gains in most sectors. According to forecasts, the yearly growth rate should go beyond 2%. The Canadian economy is expected to show a 0.2% expansion rate in February.

- US Advance GDP: Wednesday, 12:30. The US economy expanded at an annual rate of 2.6% in the last quarter of 2013, despite the government shutdown and the debt ceiling ordeal. The pace of growth weakened from 4.1% in the third quarter but still indicated US gross domestic product increased quite strongly in the last half of 2013, a pace unseen since 2003. A weak first half of the year impeded growth to 1.9% for all of 2013, down from 2.8% in 2012. The fourth-quarter enjoyed healthy gains in consumer spending, personal consumption rose by an annual rate of 3.3%, the strongest pace in three years. The GDP news were good for investors. US stock markets rose after several days of losses. Early estimates of GDP growth forecast a 1.1% rise in the first quarter of 2014 due to the effects of the cold winter.

- US FOMC Statement: Wednesday, 18:00. In the last FOMC statement released in March Federal Reserve Chair Janet Yellen raised the possibility of an earlier- than-anticipated increase in interest rates. The Fed is likely to taper bond buys for the fourth time to $45 billion / month, continuing the current policy. After Yellen dropped the forward guidance in her first decision, no other policy changes are likely. The focus could be on how the Fed sees the economy. If it expresses worries about the winter slowdown, the dollar could slide, and if it is upbeat on a spring bounce, the dollar could rise. The data is mixed, so the Fed might adopt a cautious approach. The bigger fireworks will probably wait for June, when the data will be clearer and a press conference accompanies the decision. For the upcoming decision, the GDP release made earlier on the same day could “steal the show”..

- Janet Yellen speaks: Thursday, 12:30. Federal Reserve Chair Janet Yellen will speak in Washington DC at the Independent Community Bankers of America’s Annual Policy Summit. She may talk about the growth trend in the US economy and may refer to her statement regarding the rate hike expected in 2015. Market volatility is expected.

- US Unemployment Claims: Thursday, 12:30.The number of Americans filing initial applications for unemployment benefits jumped by 24,000 last week to 329.000 due to temporary layoffs in the week before Easter. Economists expected a milder rise to 309,000. However the US economy is on a growth trend and the average of applications is declining. A year ago, claims stood at 343,000 indicating this year, employers hold back layoffs and increase hiring. The number of unemployment claims is expected to decline to 317,000.

- US ISM Manufacturing PMI: Thursday, 14:00. The U.S. manufacturing sector registered a mild pick-up in March compared to February, reaching 53.7. However the climb in production indicates that the U.S. economy is strengthening after the cold winter. Economists expected PMI to increase to 54.2. Overall, surveyed purchasing managers were optimistic regarding current economic conditions reporting a rise in demand. U.S. manufacturing sector is expected to continue its recovery with a reading of 54.3.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US job market continued to progress in March gaining 192,000 jobs after a 197,000 addition in the previous month. Private employment exceeded the pre-recession peak for the first time, indicating a growth trend in the US economy and supporting the Fed’s decision to continue tapering. Economists expected a higher reading of 199,000. Meanwhile, Unemployment rate remains unchanged at 6.7% however, a half-million Americans started looking for work last month, and most of them found jobs. The rise indicates that hiring increased. The US labor market is expected to expand by 211,000 jobs while the unemployment rate is predicted to decline to 6.6%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.27 06:19

EUR/USD forecast for the week of April 28, 2014, Technical AnalysisFor the second week in a row, the EUR/USD pair fell, but bounced enough to form a small hammer. With that being the case, we believe that this market will continue to grind sideways, and as a result this market looks as if it is not ready to do anything at the moment. Because of this, we are not interested in a longer-term trade in the EUR/USD pair, but do recognize that there is a potential uptrend line coming soon, so buying is possible, but not at this moment in time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.29 07:29

EUR/USD mocks at Draghi's efforts and set sights at 1.3880 resistance

EUR/USD is climbing higher in Asia as the pair moved to 1.3861 after opening at 1.3849

Risk vs. inflation

EUR/USD

lived through a volatile session on Monday as the pair slumped to

intraday lows early in Asia on the back of further Russia- Ukraine

crisis escalation, but reversed losses and pushed to 1.3878 when the

European players joined the game. Ironically, German Import Price Index

came out lower than expected (-0.6% m/m, -3.3% y/y against forecasted

-0.1% m\m, -2.7% y/y), increasing chances that today’s CPI will fail to

meet expectations and put more pressure on ECB. Though markets seemed to

look the other way. Today the European session starts with German ПАЛ

Consumer Confidence index that is expected to stay unchanged at 8.5 in

April. Strong figures might support EUR and push it yesterday’s high at

1.3878, though the investor are more likely to be focused on CPI data

published later during the day. April y\y figure is expected to climb to

1.3% from 0.9% in March, but negative surprises are possible. If the

data fails to live up to expectations EUR/USD may dip to 1.3820 and then

to the key support level of 1.3800.

What are today’s key EUR/USD levels?

Today's

central pivot point can be found at 1.3848, with support below at

1.3817, 1.3782 and 1.3751, with resistance above at 1.3883, 1.3914, and

1.3949. Hourly Moving Averages are bullish, with the 200SMA at 1.3824

and the daily 20EMA neutral at 1.3816. Hourly RSI is bullish at 53.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.29 12:35

EUR/USD drops to 1.3850 on EMU data

The single currency is now reverting the early upside, dragging the EUR/USD back to the 1.3850 area after softer EMU releases.

EUR/USD deflates on data

The pair is now giving

away some gains after EMU’s M3 Money Supply expanded below estimates at

an annual pace of 1.1% during March vs. 1.4% forecasted and February’s

1.3%. Private Loans followed suit, contracting 2.2% in a year to March,

missing forecasts for a 2.1% contraction. Previous releases showed the

German Consumer Confidence gauged by the Gfk Survey matching estimates

at 8.5 for the month of May. “Looking at the latest money and credit

growth data there remains a compelling case for further monetary easing

by the ECB. However, with inflation expected to bounce this month and

economic activity continuing to recover, we suspect that the ECB will

stick to its strategy of verbal intervention at next week’s press

conference and refrain from taking further policy action”, commented

Martin van Vliet, Analyst at ING Bank NV.

EUR/USD levels to watch

As

of writing the pair is up 0.05% at 1.3858 with the next resistance at

1.3880 (high Apr.28) ahead of 1.3906 (high Apr.11) and then 1.3925 (high

Mar.19). On the flip side a breakdown of 1.3832 (daily cloud top) would

aim for 1.3824 (10-d MA) and finally 1.3815 (low Apr.28).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.29 15:20

2014-04-29 12:00 GMT (or 14:00 MQ MT5 time) | [EUR - German CPI]

- past data is 0.9%

- forecast data is 1.3%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Germany HICP Inflation Accelerates Less Than Expected

Germany's EU measure of inflation accelerated for the first time in five months in April, but the figure came in below economists' expectations.

The harmonized index of consumer prices rose 1.1 percent annually in April, following a 0.9 percent gain in March, preliminary figures from Destatis showed Tuesday.

Economists had forecast an inflation figure of 1.3 percent. The March inflation was the lowest since June 2010, when the rate was 0.8 percent.

Month-on-month, the HICP dropped 0.3 percent in April. Economists had expected a 0.1 percent decline.

The overall consumer price index climbed 1.3 percent in April, which was faster than the 1 percent rise in the previous month. Economists were looking for an inflation figure of 1.4 percent. Consumer prices fell 0.2 percent from the previous month, while economists had forecast a 0.1 percent drop.

Destatis is set to release the final inflation numbers for April on May 14.

April inflation figures for Eurozone are due to be released on Wednesday. In March, Euro area headline inflation fell to a worrying 52-month low of 0.5 percent, way out of the ECB's target of "below, but close to 2 percent'.

Yesterday, European Central Bank Vice President Vitor Constancio said the bank does not have any target in mind for April inflation. He also asserted that a single figure alone cannot prompt a policy change.

The bank is set to hold the next rate-setting session on May 8.

The central bank has several instruments at its disposal and it will use them if there is a need, Constancio reiterated.

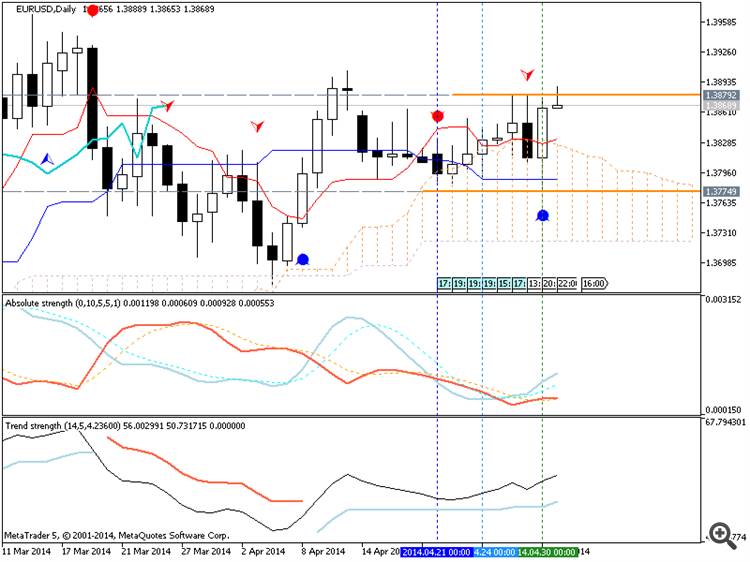

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 45 pips price movement by EUR - German CPI news event

If D1 price will break 1.3784 support level on close bar so the price will be inside Ichimoku cloud/kumo for ranging market condition.

If

D1 price will break 1.3864 resistance level from below to above so the

primary bullish will be continuing (good to open buy trade).

- Recommendation for short: n/a

- Recommendation

to go long: watch D1 price for breaking 1.3864 resistance level on close bar

- Trading Summary: ranging

Resistance level for today asnd tomorrow is 1.3879 instead of 1.3864 (just for information) :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.01 16:36

EUR/USD Fundamental Analysis May 2, 2014 Forecast

The EUR/USD is trading at 1.3880 inching higher on Thursday having ridden out two days of worse than expected news on Eurozone inflation and the US economy that have not fundamentally altered perceptions of the policy outlook in either. The US dollar weakened on disappointing GDP numbers and seemed to ignore the continuing tapering by the Federal Reserve.

This year’s dominant trend on major currency markets is the euro’s continued strength in the face of a steady reining in of US monetary policy stimulus and expectations the European Central Bank would be forced at some stage to do the opposite. A number of analysts had predicted low euro zone inflation on Wednesday, following lower than forecast figures out of Germany a day earlier, might be enough to turn the single currency significantly weaker.

Policymakers at the euro zone’s central bank have talked aggressively about their willingness to take action to head off a debilitating cycle of falling prices and demand, and as such have outright opposed any further gains for the euro.

But they face substantial barriers to delivering the sort of decisive policy action that would weaken the currency at a time when capital is flooding back into the euro zone’s peripheral economies and stock markets.

FxEmpire provides in-depth analysis for each currency and commodity we review. Fundamental analysis is provided in three components. We provide a detailed monthly analysis and forecast at the beginning of each month. Then we provide more up to the data analysis and information in our weekly reports.

Economic Data May 1, 2014 actual v. forecast

Cur. | Event | Actual | Forecast | Previous |

|---|---|---|---|---|

| China – Labor Day | |||

AUD | AIG Manufacturing Index | 44.8 |

| 47.9 |

CNY | Chinese Manufacturing PMI | 50.4 | 50.5 | 50.3 |

GBP | Nationwide HPI (YoY) | 10.9% | 10.0% | 9.5% |

GBP | Nationwide HPI (MoM) | 1.2% | 0.7% | 0.5% |

GBP | Manufacturing PMI | 57.3 | 55.4 | 55.8 |

USD | Core PCE Price Index (MoM) |

| 0.2% | 0.1% |

USD | Fed Chair Yellen Speaks |

|

|

|

USD | Initial Jobless Claims |

| 319K | 329K |

USD | ISM Manufacturing PMI |

| 54.3 | 53.7 |

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

newdigital, 2014.05.01 16:39

Strategy Video: EURUSD Break or Reversal at 1.4000 is Investor vs ECB

- After a heavy round of US and Eurozone event risk, EURUSD is important resistance once again

- Capital inflows and a diminishing ECB balance sheet are keeping the Euro slowly rising

After a weak showing from 1Q US GDP and a rebound in Eurozone inflation, EURUSD was pushed back up to the top of April's range. This recent move, however, doesn't properly encompass the fundamental, technical and market conditions factors behind this benchmark pair. Nor does it properly reflect its trade potential. The bullish inclination for EURUSD is well founded in investment capital seeking out higher returns in the Eurozone - another 'risk on' factor. Yet, the 1.4000-1.3900 region carries a technical prominence and the ECB's ire. A large scale confrontation is playing out, and we discuss its trading potential in today's Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.02 09:25

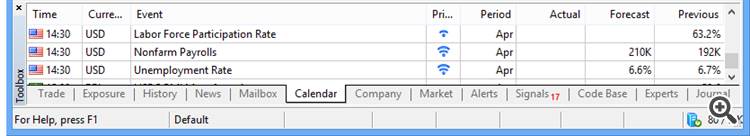

EURUSD Forex Signals: Trading the Non-Farm Payrolls Report

EUR/USD forex signals show that the pair is trading inside a symmetrical triangle on its 4-hour time frame as traders can’t quite establish a clear direction on the pair. Price is testing the top of the triangle around the 1.3875 levels but stochastic is reflecting selling pressure.

A selloff from its current levels could take the pair back to the bottom of the triangle at the 1.3775 area. Consolidation around the current levels could be seen for the most part of the day as traders await the results of the non-farm payrolls report for April.

EURUSD Forex SignalsRecall that the US dollar reacts to fundamentals during this release, as a strong jobs figure tends to support the currency while a weak reading leads to a selloff. The past report has printed a bleak result but there could be a stronger showing this time around. The consensus is at a 216K rise in employment, which could push the jobless rate down to 6.6% from 6.7%.

In this case, EUR/USD might selloff to the bottom of the triangle and an even stronger figure could lead to a breakdown. Take note that the chart pattern is roughly 300 pips in height, which suggests that the resulting selloff could be of the same size.

The fundamental bias for the EUR/USD pair is still to the downside, given the divergence in monetary policy plans of the Fed and the European Central Bank. Keep in mind that the ECB will make its policy announcement next week and that officials are already considering negative deposit rates or further easing measures. Meanwhile, the FOMC statement earlier this week turned out to be relatively upbeat as the Fed decided to push through with its taper and give optimistic comments on the US economic recovery.

If the NFP turns out to be a downside surprise though, EUR/USD forex signals might indicate a strong upside break from the triangle resistance and rally until the previous highs near the 1.4000 major psychological level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.02 11:27

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

- U.S. Non-Farm Payrolls (NFP) to Increase 215K- Largest Rise Since November (274K).

- Unemployment Rate to Narrow to 6.6%- Lowest Since January.

The U.S. Non-Farm Payrolls (NFP) report may spark a bullish reaction in the dollar (bearish EUR/USD)

as the economy is expected to add another 215K jobs in in April, while

the jobless is projected to narrow to 6.6% from 6.7% the month prior.

What’s Expected:

Why Is This Event Important:

A pickup in job growth paired with a further decline in unemployment may put increased pressure on the Federal Open Market Committee (FOMC) to normalize monetary policy sooner rather than later, but the data may do little to alter the Fed’s policy outlook as Chair Janet Yellen remains reluctant to move away from the zero-interest rate policy (ZIRP).

The ongoing strength in private sector consumption paired with the uptick in business sentiment may prompt a sharp rise in job growth, and a better-than-expected print may generate a near-term pullback in the EUR/USD as it raises the fundamental outlook for the U.S. economy.

However, rising input prices paired with the persistent slack in the

real economy may push businesses to scale back on hiring, and a dismal

NFP print may heighten the bearish sentiment surrounding the reserve

currency as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: NFPs Advance 215K+; Unemployment Slips to 6.6%

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

EUR/USD Daily

- Risks Larger Breakout as RSI Fails to Preserve Bearish Momentum

- Interim Resistance: 1.3960-70 (61.8 expansion)

- Interim Support: 1.3650 (78.6% expansion) to 1.3660 (61.8 retracement)

March 2014 U.S. Non-Farm Payrolls

EURUSD M5 : 37 pips range price movement by USD - Non-Farm Employment Change news event :

At the March Non-Farm Payrolls release we saw a print of 192K vs. 200K estimates and the figure, largely in line, caused little follow through in the EUR/USD pair. Following chop on both sides, we the week slightly higher. On Wednesday we saw ADP Employment Change figures for April come in slightly above estimates at 220K vs. 2010K expected. This will be the last major event risk for the week a key for monthly opening ranges.

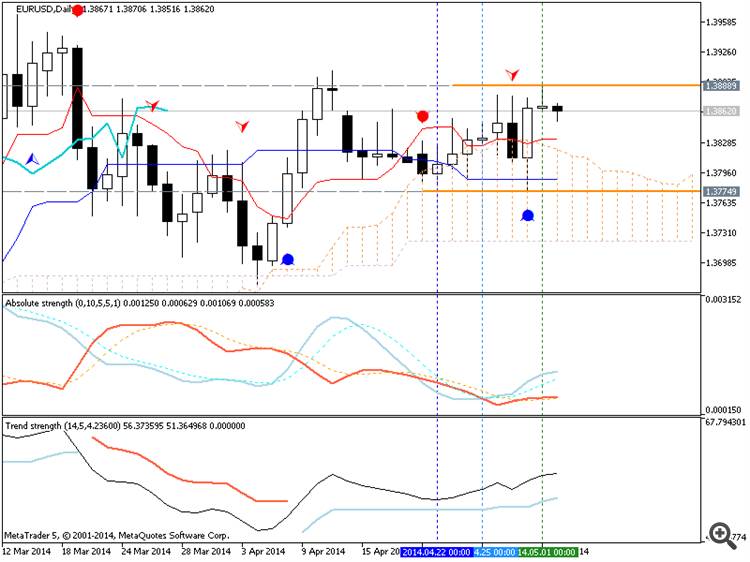

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 48 pips by USD - NFP news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price was going along Sinkou Span A line which is virtual border between primary bullish and primary bearish for D1/H4 timeframes. Chinkou Span line crossed the prifce but on horizantal way which is indicating flat within primary bullish.

If D1 price will break 1.3784 support level on close bar so the price will be inside Ichimoku cloud/kumo for ranging market condition.If D1 price will break 1.3864 resistance level from below to above so the primary bullish will be continuing (good to open buy trade).

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-04-28 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-04-29 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

2014-04-29 14:00 GMT (or 16:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-04-30 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Consumer Spending]

2014-04-30 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-04-30 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-04-30 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-04-30 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-05-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-05-01 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Fed Chair Yellen Speaks]

2014-05-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-05-02 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart