Getting Started with Moving Averages

- MVAs show the average price of a currency for a specific number of periods

- As price moves so will the indicator, giving clues about the current market

- Traders can filter a trading decision based on the position of price relative to a MVA

Simple Moving Averages (MVAs) consist of some of the most versatile and

widely used indicators in the market. Typically MVAs are used for

filtering the trend, support and resistance levels, as well as market

entries. Today we will continue our look at indicators by reviewing one

of these components to get you comfortable using MVAs in your trading

strategy. Let’s get started!

MVAs and the Trend

First you may be asking, “What is a moving average?” Moving averages are

simple technical tools that are designed to measure the average price

presented on a graph for a designated number of periods. For example the

200 period MVA is shown below. This means that the closing price has

been taken for the last 200 periods, added them together then finally

divided that sum out again by 200. Once this number has been

established, the average is printed on the graph as a frame of

reference.

Below we can see a USDCAD daily graph with price trending downward. You should notice as price trends downward, the MVA will begin moving lower as well. With price moving down faster than the 200 period MVA this is a strong signal that the market is declining.Likewise as price moves upward, the average will slowly move towards higher highs as well. Knowing this, we can now work the MVA into our trading.

Trading with a MVA Filter

Once a 200 period MVA has been added to your chart, you can easily

decipher whether you should be considering a buy or sell position. The

best trading environment for new buying positions would be in an uptrend

as price moves towards higher highs, while the currency pair stays

above the 200 MVA. The example below shows opportunities to buy the

EURUSD as it rallies above the average. Since the trend is up, at no

time should traders consider a sell based position!

This bias abruptly changes when prices move below the designated 200 period MVA. Since the price on this USDCAD daily chart is below the average traders should at no point consider new positions buying the pair. As price moves towards lower lows and stays below the average, only new sell positions should be considered. Now that you have filtered for the trend, you can focus your attention to timing new entries with the market!

Trading with MVAs

Filtering for the trend is just one of three key ways you can utilize the Moving Average in your trading!

Three Ways to Trade with Moving Averages

- Traders can use mathematical averaging to their advantage by employing the moving average.

- Moving averages can be used to initiate positions in the direction of the trend.

- Traders can incorporate multiple moving averages to fit in their strategy to accomplish specific goals.

Indicators can be tricky tools. Knowing which ones to use and how to use

them can be complicated enough; but finding out how to properly employ

an entire strategy in the right market environment can be the most

difficult question for traders to address.

The Moving Average is simply the last x period’s closing prices added

together, and divided by the number of observed periods (x). And it’s in

its simplicity lies its beauty. When prices are trending higher, the

moving average will reflect this by also moving higher. And when prices

are trending lower, these new lower prices will begin to be factored

into the moving average and it too will begin moving lower.

While this averaging effect brings on an element of lag, it also allows

the trader an ideal way of categorizing trends and trending conditions.

In this article, we’re going to discuss three different ways this

utilitarian indicator can be employed by the trader.

As a Trend-Filter

Because the moving average does such a great job of identifying the

trend, it can be readily used to offer traders a trend-side bias in

their strategies. So if price action is above a moving average, only

long positions are looked at while price action below the moving average

mandates that only short positions are taken.

For this trend-filtering effect, longer-term moving averages generally

work better as faster-period settings may be too active for the desired

filtering effect. The 200 Day Moving Average is a common example, which

is simply the last 200 day’s closing prices added together and divided

by 200.

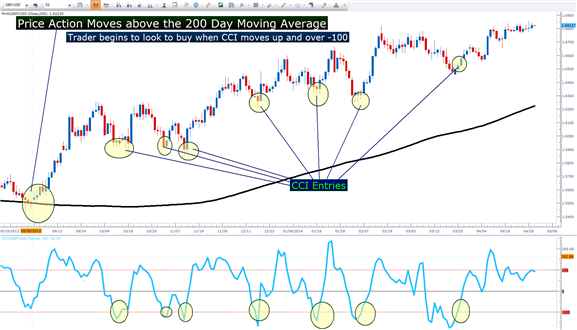

After a bias has been obtained and traders know which direction they

want to look to trade in a market, positions can be triggered in a

variety of ways. An oscillator such as RSI or CCI can help traders catch

retracements by identifying short-term overbought or oversold

situations.

In the picture below, we show an example of a CCI (Commodity Channel Index) Entry with the 200 day moving average as a trend filter.

As a trigger to initiate positions

Taking the idea of strategy development a step further, the logic of the

moving average can also be used to actually open new positions.

After all, if price action is showing a trending state just by residing

above a moving average, doesn’t logic dictate that the very action of

crossing that moving average can have trending connotations as well?

So traders can also use the price/moving average crossover as a trigger into new positions, as shown below.

The Moving Average can also be used to initiate positions in the direction of the trend

The downside to the moving average trigger is that choppy or trend-less

markets can invite sloppy entries as congested prices meander back and

forth around a specific MA. So it’s highly suggested to avoid using a

moving average trigger in isolation without any other filters or

limitations. Doing so could mean massive losses if markets congest or

range for prolonged periods of time.

As a Crossover Trigger

The third and final way that moving averages can be implemented is with

the moving average crossover. This is an extremely common way of

triggering trades, but has the undesired impact of being especially

‘laggy’ by introducing two different lagging indicators rather than just

one (as is the case of using the MA as a filter or a trigger

individually).

Common examples of moving average crossovers are the 20 and 50 period

crossovers, the 20 and 100 period crossover, the 20 and 200 period

crossover, and the 50 and 200 period crossover (commonly called ‘the

death cross’ when the 50 goes below the 200, or the ‘golden cross’ when

the 50 goes above the 200).

The 50 Day/200 Day Moving Average Crossover :

This can be taken a step further with multiple time frame analysis.

Traders can look to a longer-term chart to use a moving average filter

as we had outlined in the (1) part of this article, and then the

crossover can be used as a trigger in the direction of the trend on the

shorter time frame.

While no indicator is going to be perfect, these three methods show the

utility that can be brought to the table with the moving average, and

how easily traders can use this versatile tool to trigger trades ahead

and in front of very large, outsized moves in the market.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 09:41

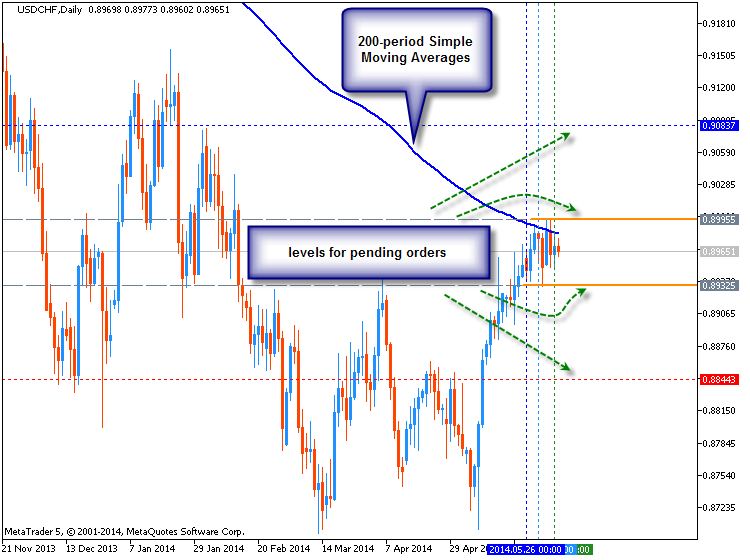

USDCHF Breakout Hindered by 200-Day Moving Average (adapted from dailyfx article)

- The USDCHF break has run into the 200 Day Moving Average.

- Potential buyers could enter upon a confirmed break above the 200 Day MA.

The 200-Day Simple Moving Average

The 200-Day Simple Moving Average is one of the most popular indicators

in the world. When price breaks through a 200 MA on a daily chart, it

can often be seen as a topic of conversation on financial news stations,

websites and newspapers.

It is primarily used to give traders and investors an overall sense of how strong or weak a currency pair is.

Typically, when a currency pair’s price falls below the 200 Day MA, it

is a sign of weakness with a potential for further price decline. And

when a currency pair’s price breaks above the 200 Day MA, it is a sign

of strength with a potential for further price increases.

The chart above shows the recent price action surrounding the 200 Day

MA. We see a large run up in price breaking through multiple resistance

levels until it met this powerful MA line. We have had 6 consecutive

days where price has temporarily broke through the 200 Day MA or price

has come within 10 pips of the line before retreating lower. So this

level is acting as strong resistance.

If price were to remain below the MA, it could propel it lower back into

the pair’s price channel. However, a breakout to the upside could add

yet another reason to buy the USDCHF. Until we witness a larger price

move, we are in a state of limbo.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The Moving Average Class:

Uses the idea of the classical moving average smoothing. The class can be used when you want to smooth out any array of type double without using the standard indicator.

The class sample requires the following:

An example of using the class is available in the indicator line.mq5

Author: Ekaterina Hinkel