Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.13 22:20

EUR/USD trading forecast for Monday

During Friday’s trading session EUR/USD traded within the range of 1.3863-1.3905 and closed at 1.3885.

Fundamental viewIndustrial production in the euro zone probably rose 0.2% in February from the previous month, according to the median analyst’ estimate. In January, industrial output unexpectedly declined 0.1%. Industrial production is an indicator of the business cycle that shows the activity and development in the industry as a whole, by measuring the change in volume for a certain period of time. Information on industrial production is raised through special studies for EU members, which are called Prodcom. They cover between 5000 and 6000 products. The index measures the percentage change from the previous month.

A larger than expected increase in the industrial output would heighten the appeal of the euro. The official report is due out at 09:00 GMT on Monday.

Meanwhile, retail sales in the United States probably increased 0.8% in March on a monthly basis, according to the median forecast by experts. In February sales rose 0.3%. The report on retail sales reflects the dollar value of merchandise sold within the retail trade by taking a sampling of companies, operating in the sector of selling physical end products to consumers. The retail sales report encompasses both fixed point-of-sale businesses and non-store retailers, such as mail catalogs and vending machines. US Census Bureau, which is a part of the Department of Commerce surveys about 5 000 companies of all sizes, from huge retailers such as Wal-Mart to independent small family firms.

US core retail sales (retail sales ex autos) probably rose 0.5% in March compared to a month ago, following a 0.3% increase in February. This indicator removes large ticket prices and historical seasonality of automobile sales.

The retail sales index is considered as a coincident indicator, thus, it reflects the current state of the economy. It is also considered a pre-inflationary indicator, which investors can use in order to reassess the probability of an interest rate hike or cut by the Federal Reserve Bank. In addition, this indicator provides key information regarding consumer spending trends. Consumer expenditures, on the other hand, account for almost two-thirds of nation’s total Gross Domestic Product. Therefore, a larger than expected increase in sales would heighten the appeal of US dollar. The official report is due out at 12:30 GMT on Monday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.12 18:27

Forex Weekly Outlook Apr. 14-18The US dollar had a terrible week, falling across the board. Can it stabilize now, or will the sell off continue? US retail sales, German ZEW Economic Sentiment, US Inflation data, Janet Yellen and US Haruhiko Kuroda speeches, Unemployment Claims and the Philly Fed Manufacturing Index are the highlights of this week. Here is an outlook on the main market movers coming our way.

The greenback took a big hit following the relatively dovish FOMC minutes release where forward guidance was forsaken for a promise of low rates after the bond buying program ends. Fed Chair Yellen also surprised markets by saying that bond buying will finish in 6 months. However, later that week, the Jobless claims release was a positive surprise, plunging 32,000 to 300,000 claims, the lowest level since December 2013, indicating the US job market is on a solid growth trend. Will the US economy continue its growth trend after the QE is over? In the euro-zone, weak inflation data from France was dismissed. Strong industrial data from the UK boosted the pound, upbeat Australian data energized the Aussie and the lack of action from the BOJ fueled the yen.

- US Retail sales: Monday, 13:30. U.S. retail sales expanded more than expected in February, after harsh weather conditions slowed activity in recent months. Retail sales edged up 0.3%, following a revised 0.6% decline in January. The reading was higher than the 0.2% rise anticipated. Meanwhile Core sales, excluding automobiles, gasoline, building materials and food services increased 0.3% after a 0.3% decline in the previous month. Analysts anticipate retail sales would improve further in the coming months. U.S. retail sales are expected to rise 0.8%, while core sales are predicted to gain 0.5%.

- UK inflation data: Tuesday, 9:30. The UK inflation rate fell to a four-year low of 1.7% in February, amid a sharp decline of 0.8% in petrol prices. This was the second consecutive reading falling below the BOE’s 2% inflation target. Prime Minister David Cameron noted that the figures support the government’s economic strategy to provide stability and security for hard-working people. But Labour’s Shadow Treasury Minister Catherine McKinnell said prices are still rising faster than wages badly affecting household consumption. CPI is expected to rise 1.6%.

- German ZEW Economic Sentiment: Tuesday, 10:00. Investor sentiment in Germany continued to decline in March, falling for the third consecutive month to 46.6 points, from 55.7 in February. The release came in below forecasts of a 52.8 points reading. The possible reasons for this weak reading could be, a softer outlook for emerging market activity, a strong euro and mounting deflation risks and tensions in the Ukraine. Investor climate is expected to reach 46.3.

- US Inflation data: Tuesday, 13:30. U.S. inflation stayed mild in February. Consumer Price Index inched 0.1% for the second month consecutive month after a drop in gasoline prices offset the largest rise in the cost of food in nearly 2-1/2 years. On a yearly base, consumer prices increased only 1.1%, weaker than the 1.6% rise in January. Meanwhile Core prices, excluding volatile energy and food components increased 0.1% for a third straight month and remained steady at 1.6% on a yearly base. However, the stable state of inflation is positive for business planning for hiring and capital spending. Both CPI and Core CPI are expected to gain 0.1%.

- Janet Yellen speaks: Tuesday, 13:45, Wednesday 17:15. Federal Reserve Chair Janet Yellen will speak in Stone Mountain and in New York. Yellen may speak about the recent improvement in the US job market as well as the ongoing tapering process, its duration and its effects on the US economy. Volatility is expected, especially after her previous important comment triggered a big USD rally.

- UK employment data: Wednesday, 9:30. The UK’ unemployment rate remained stable at 7.2% for the third consecutive month, however, the number of people claiming unemployment benefits declined more than expected, reaching 34,600, indicating the labor market continues to improve. The BoE revised its forward guidance policy, which linked interest rate decisions to the unemployment rate, since the rate fell unexpectedly towards the 7%, marking the start of rate hikes. The Bank hinted that the first rate hike will occur in the second quarter of 2015. UK number of unemployed is expected to decline by 30,200, while the unemployment rate is expected to remain 7.2%.

- US Building Permits: Wednesday, 13:30. The number of building permits surged in February to 1.018 million units from January’s total of 945,000. These four-month high topped analysts’ predictions for 970,000 units. Contrary to this release, U.S. housing starts declined by 0.2% in February a seasonally adjusted 907,000 units from January’s total of 909,000, disappointing expectations for an increase of 3.4% to 910,000 units. Nevertheless the rise in the number of permits ensures the continuation of growth in the housing industry. The number of building permits is expected to reach 1 million.

- Canadian rate decision: Wednesday, 15:00. The Bank of Canada was concerned about the soft inflation rate on its last meeting in March, despite the rise in consumer prices occurred in January. The bank noted that a rate change is possible in the next policy meeting however analysts do not expect a rate change until the third quarter of 2015. The rate report was nearly unchanged from January when Governor Stephen Poloz said the door was “slightly more open to a rate cut. Meanwhile, the Canadian dollar, dipped in value against its U.S. counterpart in recent months which may help to boost exports, business confidence and investment. Interest rates are expected to remain unchanged at 1.00%.

- Canadian inflation data: Thursday, 13:30. Canadian consumer prices edged up 0.8% in February, following a 0.3% rise in the previous month. The rise was better than the 0.6% predicted by analysts. However, on a yearly base, the index dropped to 1.1% from 1.5% in January. Canadian Core prices rose 0.7% while expected to reach 0.5%. The year-over-year core rate moderated to 1.2% from 1.4% in January. The sharp rise indicates that seasonal factors were involved. However, despite the recent increase, inflation remains rather tame. CPI is expected to edge up 0.4% and Core CPi is expected to increase by 0.3%.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits dropped sharply last week to the lowest level since December 2013, reaching 300,000, signaling a pick-up in the US job market. Positive weather and stronger growth boosted the labor market causing the 32,000 drop. This stronger than expected release will also contribute to the second quarter growth rate. Unemployment claims are expected to increase to 316,000.

- US Philly Fed Manufacturing Index: Thursday, 15:00. Manufacturing activity in the Philadelphia-region soared in March, reaching 9 points after posting minus 6.3 in February, easing concerns over the U.S. economic outlook. Analysts had forecasted the index to rise to 4.2 in March. The survey’s showed new orders, and shipments increased and recorded positive readings indicating growth trend is returning following weather-related weakness in February. Manufacturing activity is expected to improve further to 9.6 points.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.12 18:49

EUR/USD forecast for the week of April 14, 2014, Technical Analysis

The EUR/USD pair rose during the week, breaking above the 1.38 level

handily. However, we need to get above the 1.3950 level, and for that

matter the 1.40 level in order to feel comfortable enough to start

buying and holding onto the position. If we do that though, it would

break above a downtrend line from the monthly timeframe, which of course

would be a massive bullish sign in a market that has been actually in a

downtrend since the financial crisis began. Granted, we’ve had long

moves up and down, but if you look at the monthly charts, you will see

that we are in fact in a downtrend.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.14 15:26

2014-04-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

- past data is 0.7%

- forecast data is 0.8%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Retail Sales Jump 1.1% In March Amid Improved Weather

With Americans heading back to the stores after the unusually rough winter, the Commerce Department released a report on Monday showing that U.S. retail sales rose by more than expected in the month of March.

The report showed that retail sales jumped by 1.1 percent in March after climbing by an upwardly revised 0.7 percent in February.

Economists had expected sales to increase by about 0.9 percent compared to the 0.3 percent increase originally reported for the previous month.

Peter Boockvar, managing director at the Lindsey Group, said, "Retail sales in March showed a nice bounce back after the weather influenced previous months."

The stronger than expected retail sales growth was partly due to a notable increase in sales by motor vehicle and parts dealers, which surged up by 3.1 percent in March after climbing by 2.5 percent in February.

Excluding the increase in auto sales, retail sales still rose by 0.7 percent in March compared to economist estimates for an increase of 0.5 percent.

The report also showed a significant rebound in sales by building materials and supplies dealers, which rose by 1.8 percent in March after falling by 0.6 percent in February.

General merchandise stores and non-store retailers also saw strong sales growth, with sales rising by 1.9 percent and 1.7 percent, respectively.

On the other hand, the report said sales at electronic and appliance stores dropped by 1.6 percent. Sales at gas stations also fell by 1.3 percent.

Core retail sales, which exclude autos, gasoline, and building materials, increased by 0.8 percent in March compared to economist estimates for 0.5 percent growth.

"Bottom line, consumers clearly responded to the winter thaw and the sales gains m/o/m were pretty broad based," Boockvar said.

"With the upside to the core portion of the data, Q1 GDP estimates should go up by about .1-.2 but still may print below 2%," he added. "The sustainability of the sales gains, as opposed to just a onetime weather rebound, will now be the focus."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 17 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.13 17:03

EUR/USD weekly outlook: April 14 -18The dollar ended the week close to three-week lows against the euro on Friday as dovish Federal Reserve minutes tempered expectations that U.S. interest rates would rise sooner than had been anticipated.

EUR/USD ended Friday’s session at 1.3884, after touching session highs of 1.3905 earlier. The pair ended the week with gains of 1.04%, the largest weekly increase since September.

The pair is likely to find support at 1.3835, Thursday’s low and resistance at 1.3900.

The euro eased back from session highs against the dollar on Friday after data showed that U.S. producer prices rose 0.5% in March, the largest increase in nine months and ahead of expectations for a 0.1% increase.

A separate report showed that the University of Michigan’s U.S. consumer sentiment index rose to 82.6 this month, its highest level since July.

But the greenback remained under pressure after the minutes of the Fed’s March meeting indicated that an interest rate increase is unlikely to be warranted for some time.

The Fed’s March meeting minutes, released on Wednesday, showed that policymakers discussed whether to keep interest rates at record lows until inflation moves higher, and did not elaborate on a possible timeframe for when rates could start to rise.

Last month the U.S. central bank reduced the monthly pace of asset purchases by $10 billion, to $55 billion, and repeated it is likely to continue paring the program in “further measured steps.”

In mid-March Fed Chair Janet Yellen had indicated that interest rates could start to rise around six months after the end of the Fed’s bond purchasing program, suggesting a rate hike could occur in the early part of 2015.

The single currency continued to remain supported after comments by European Central Bank officials earlier in the week tempered expectations for quantitative easing.

ECB governing council member Yves Mersch said Monday there is no immediate risk of deflation in the euro zone and therefore no urgent need to implement large-scale bond purchases.

Separately, Bundesbank president Jens Weidmann said that monetary policy cannot solve the financial crisis, and urged euro zone political leaders to keep reforming their economies.

In the week ahead, market watchers will be focusing on speeches by Fed Chair Janet Yellen, as well as reports on U.S. retail sales and housing starts. Meanwhile, Germany is to release its ZEW economic sentiment index.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 14

- The euro zone is to release data on industrial production.

- The U.S. is to produce data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Later Tuesday, Fed Chair Janet Yellen is to speak.

- The euro zone is to release revised data on consumer price inflation.

- The U.S. is to produce reports on housing starts, building permits and industrial production.

- Later Wednesday, Fed Chair Janet Yellen is to speak at an event in New York.

- The euro zone is to publish data on the current account, while Germany is to produce data on producer price inflation.

- The U.S. is to publish data on initial jobless claims and a report on manufacturing activity in the Philadelphia region.

- Markets in Europe and the U.S. will be closed for the Good Friday holiday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.15 12:57

Forex Trading Video: EURUSD Drops and GBPUSD At-Risk On Monetary Policy Focus

- Markets wouldn't pick up the momentum for last week's strong risk aversion drive, but it isn't lost

- EURUSD gapped lower Monday as Draghi made a clear threat of stimulus due to the exchange rate

- GBPUSD traders ready for the release of UK and US inflation data to guide rate expectations

The strong risk aversion of the last two weeks was on a weak footing to

start this new trading period. In its absence, we find rate speculation

more than capable of taking its place. Responding to a very clear

threat, the Euro

dropped Monday against all of its major counterparts. Clearly unnerved

by the currency's strength, ECB President Draghi upgraded his threat to

forcibly drive the Euro down via monetary policy channels. Ahead, we

will see whether the US Dollar and Pound

will exploit the unfavorable position of their counterpart or join it

with important inflation readings. The risk theme is still in play, but

our attention must now be split with interest rate speculation. We look

at both drivers and their trade implications in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.15 13:02

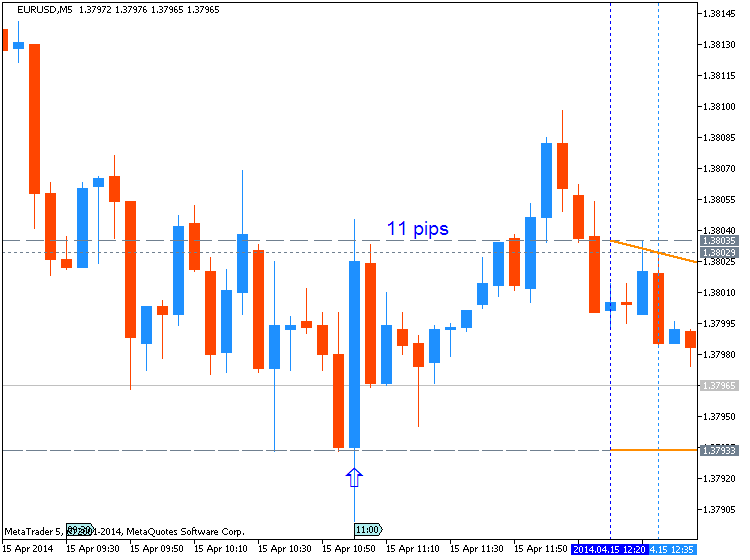

German ZEW falls to 43.2 points – EUR/USD pressured under 1.38

ZEW disappointed in the headline but surprised in the current situation component. The headline Economic Sentiment figure dropped to 43.2 points while the Current Situation actually improved to 59.5 points. The important German ZEW Economic Sentiment Index for April was expected to remain at similar levels to last month’s 46.6 points. The “Current Situation” sub component was predicted to remain around 51.3 points. The all European figure was expected to tick down from 61.5 points and it did: to 61.2 points. The German figure is of higher importance.

EUR/USD was pressured towards the release, trading just under 1.38.

It immediately fell to new lows of 1.3789, but recovered back to the

round number of 1.38. It seems unable to retake previous levels, but the

numbers are not too bad to trigger an extension of the fall.

2014-04-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment] :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.15 15:09

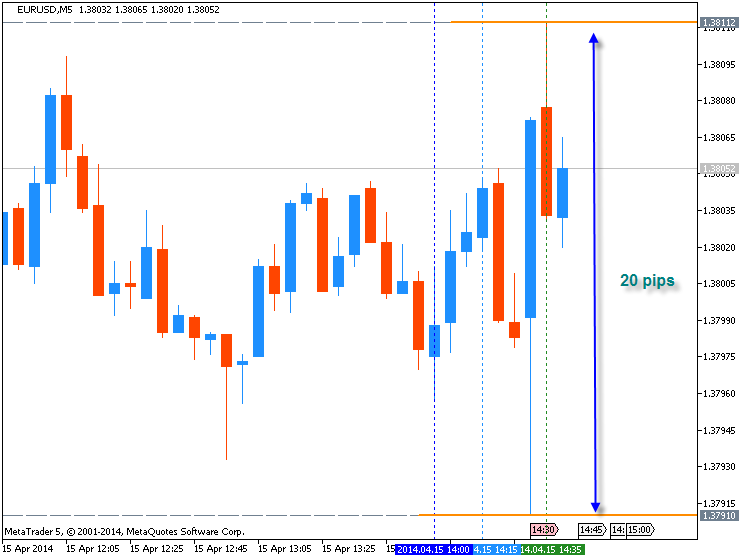

2014-04-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

- past data is 0.1%

- forecast data is 0.1%

- actual data is 0.2% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Prices Rise Slightly More Than Expected In March

Consumer prices in the U.S. rose by slightly more than expected in the month of March, according to a report released by the Labor Department on Tuesday, with the growth largely reflecting higher prices for shelter and food.

The Labor Department said its consumer price index rose by 0.2 percent in March after inching up by 0.1 percent in each of the two previous months. Economists had been expecting another 0.1 percent increase.

The core consumer price index, which excludes food and energy prices, also rose by 0.2 percent in March after ticking up by 0.1 percent for three straight months. Core prices had been expected to inch up by 0.1 percent once again.

EURUSD M5 : 20 pips price movement by USD - CPI news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

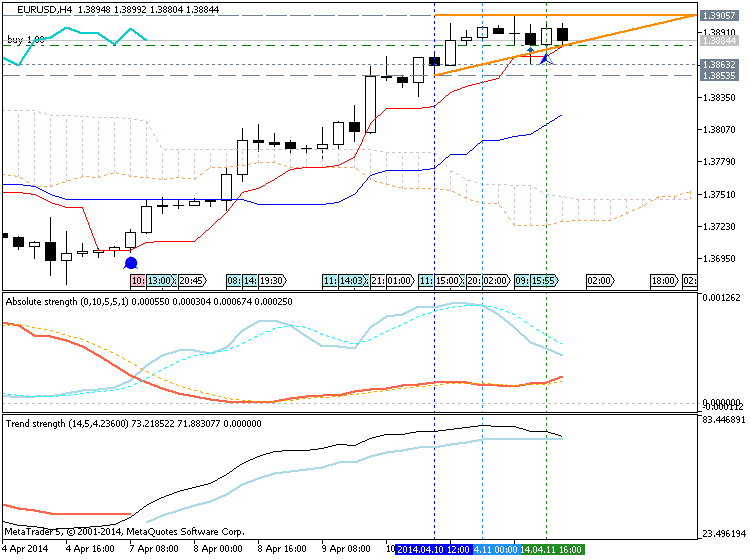

D1 price is on primary bullish trying to break 1.3898 resistance for bullish to be continuing. Chinkou Span line of Ichimoku indicator is moving along historical price to be ready to cross it from above to below for possible breakdown which will be correction within primary bullish.

H4 timeframe - flat with correction started on open bar.

W1 timeframe - the price is on ranging market condition within primary bullish trying to break 1.3966 resistance.

If D1 price will break 1.3898 resistance level on close bar so the bullish trend will be continuing.

If Chinkou Span line of Ichimoku indicator will cross historical price from above to below so we may see good correction within primary bullish

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-04-14 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Industrial Production]

2014-04-14 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-04-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Trade Balance]

2014-04-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2014-04-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-04-15 12:45 GMT (or 14:45 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-15 13:00 GMT (or 15:00 MQ MT5 time) | [USD - TIC Long-Term Purchases]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Industrial Production]

2014-04-16 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Retail Sales]

2014-04-16 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2014-04-16 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-04-16 16:15 GMT (or 18:15 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-17 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2014-04-17 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

2014-04-17 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : bullish

Intraday Chart