You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

That's what I'm doing ... 2 as a multiplier, but not fixed lots, risk for the first order is 1%

Hey, did any of you try to combine market hours with hedging? I mean see table below taken from babypips.com

Let's take GBPJPY pair for sake of example and use GMT as a reference.

What happens when we open the hedging trade when the Tokyo market is about to close while the London market is about to open (7.00 a.m to 8 a.m)?

Vuala!, we have a big percent chance of reversal. The market might be trending and moving forward but most of the time it will reverse during this transition.

So, the idea here is to monitor the behavior of the market by referring to this market hours and to make thing more convincing (dramatic sound..),

here is the performance of my latest hedging EA (i'm not selling anything, just try to show you that it have a potential, you can do better).

$50 account double in 10 days with a risk less than 20%. For me, after the account has doubled, I will stop trading for the following month.

If the drawdown achieves 20%, I will cut loss, close the EA but still in profit and stop trading for the following month, either way, I win.

Well, you should try it too and to be honest, it is fun doing this puzzle.

p/s: Again, please don't condemn my backtest results, I'm just want to show you the technique (based on market hours) is working.

Hey, did any of you try to combine market hours with hedging? I mean see table below taken from babypips.com

Let's take GBPJPY pair for sake of example and use GMT as a reference.

What happens when we open the hedging trade when the Tokyo market is about to close while the London market is about to open (7.00 a.m to 8 a.m)?

Vuala!, we have a big percent chance of reversal. The market might be trending and moving forward but most of the time it will reverse during this transition.

So, the idea here is to monitor the behavior of the market by referring to this market hours and to make thing more convincing (dramatic sound..),

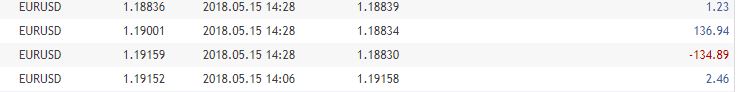

here is the performance of my latest hedging EA (i'm not selling anything, just try to show you that it have a potential, you can do better).

$50 account double in 10 days with a risk less than 20%. For me, after the account has doubled, I will stop trading for the following month.

If the drawdown achieves 20%, I will cut loss, close the EA but still in profit and stop trading for the following month, either way, I win.

Well, you should try it too and to be honest, it is fun doing this puzzle.

p/s: Again, please don't condemn my backtest results, I'm just want to show you the technique (based on market hours) is working.

Yep, absolutely Ahmad. This also should be considered.

That for example, it's highly smoothed since last one ! These 3 points are particularly interesting.

1. Hedge when loss, average as a martingale ?

2. This one is very interesting, you're closing the buy 0.01 used for entry when you reached 1 lot after many orders, right ?

3. I'm doubtful about that one, it generates profits but it desequilibrates the whole system, you get out of the hedging logic, i guess that when it remains 2 sells, you'll open the buy needed for to hedge these 2 short right ?

20% a year ... between the two yellow it is 20% rafael in 3 days !!!

Then I changed the setting to see how it performs, the vps will soon expire & i didn't work on the code since last monday, I just glanced and commented what was happening on but ... those losses you are seeing on the two side of the red line, are caused by the issue we talked of higher, and this is the same issue, each costing 2*10%, with the same solution and an expectation of 40% + approx 20% in approx 6 days once solved.

I can't stand imagining something else than solving the problem in a way or the other - that said, i'm not a robot.

I will wait for inspiration, and your n°2 seems to me the most interesting to explore.

Hi Icham, here are some explanations:

1. The lot size is the same. For example, the inital trade is 0.01 Buy. If it is at a loss, the EA will open 0.02 Buy OR Sell, depending on market conditions. On a trending market it is usually better to open a Hedge and on a ranging market it is usally better to use averaging.

2. Correct. Sometimes it is better to accept small losses to free our EA to handle newer trades, which has bigger lots and are more important that the old ones.

3. If you are using exclusively Hedge, it will unbalance your system. If you decide to go for my initial topic (use both Hedge and Averaging) it starts to make sense, because it does not need balance anymore, it just need to close trades in any order, in the most efficient way possible.

I agree that 20% a year is too low, but I decided a different approach:

Instead of making a profitable EA and then trying to make it stable, I decided to make a stable EA and now I am trying to improve it's profit.

Hey, did any of you try to combine market hours with hedging? I mean see table below taken from babypips.com

Let's take GBPJPY pair for sake of example and use GMT as a reference.

What happens when we open the hedging trade when the Tokyo market is about to close while the London market is about to open (7.00 a.m to 8 a.m)?

Vuala!, we have a big percent chance of reversal. The market might be trending and moving forward but most of the time it will reverse during this transition.

So, the idea here is to monitor the behavior of the market by referring to this market hours and to make thing more convincing (dramatic sound..),

here is the performance of my latest hedging EA (i'm not selling anything, just try to show you that it have a potential, you can do better).

$50 account double in 10 days with a risk less than 20%. For me, after the account has doubled, I will stop trading for the following month.

If the drawdown achieves 20%, I will cut loss, close the EA but still in profit and stop trading for the following month, either way, I win.

Well, you should try it too and to be honest, it is fun doing this puzzle.

p/s: Again, please don't condemn my backtest results, I'm just want to show you the technique (based on market hours) is working.

Hi Ahmad, I have actually made several EAs based on Market Hours, but never using hedge. Your results look good!

Since I started using renko charts, time does not matter that much...

No, no, that one... What it did today is good :

It didn't really increase and conformly to last change, it now accept to lose rather than place another order on a different criteria than hedging orders numbers or margin :

But that one is weird :

This EA is honestly not ready, it needs to go back in the garage and requires some work I'm unable to furnish by being bore, by having no idea etc ... That's how I work, and it often takes me more than one & only look to have a turnkey EA. I remind to those who may read, that for now it works only on metaquote demo server & tester, but one day ... maybe baby will be old !

edit : it won't do never ever again those loss peeks of 10% each ... i don't like this way of trading, knowing there's such peek, knowing it can happen anytime, and hope this will happen as rare as possible

Sometimes ...

Some other times ...

Then in term of Risk-Reward it's possible to implement a formula that would aim to recover those -80$ (screenshot) in the 10 following trades, because it's rare also. It is perfectly negligible to go from a 1% risk to a 2% risk the time it recovers last lost deal.edit : it won't do never ever again those loss peeks of 10% each ... i don't like this way of trading, knowing there's such peek, knowing it can happen anytime, and hope this will happen as rare as possible

That's exactly what I don't like about hedges and averaging systems. Once trades start to stack up, we either accept the risk and wait for it to recover (eventually reaching a margin call) or we cut losses once drawdown reachs a certain number (like 10% in your example).

What we must do is not allow the EA to reach such point. I already managed to do it using the independent trades closings, as I explained before (I am working on increasing the profit with minimal risk). I don't know what strategy you are using, but once we manage to find a way to overcome this problem, there's a good chance our EA will be (very) profitable.

That's exactly what I don't like about hedges and averaging systems. Once trades start to stack up, we either accept the risk and wait for it to recover (eventually reaching a margin call) or we cut losses once drawdown reachs a certain number (like 10% in your example).

What we must do is not allow the EA to reach such point. I already managed to do it using the independent trades closings, as I explained before (I am working on increasing the profit with minimal risk). I don't know what strategy you are using, but once we manage to find a way to overcome this problem, there's a good chance our EA will be (very) profitable.

Wow Raphael ! I didn't touch at this EA nor even the terminal since last monday. And just now, if you ask me I would say that by using random entries I'm gambling 50%/50% ; at any hedge orders I'm adding, I increase the probability to win but also the losable amount and I won't never ever be able to add hedge orders ad vitam eternam, I'll always be limited by my margin, I won't never ever reach 100% winning deals - and now now now, just now I would say that the solution could be called "risk reward".

Wow Raphael ! I didn't touch at this EA nor even the terminal since last monday. And just now, if you ask me I would say that by using random entries I'm gambling 50%/50% ; at any hedge orders I'm adding, I increase the probability to win but also the losable amount and I won't never ever be able to add hedge orders ad vitam eternam, I'll always be limited by my margin, I won't never ever reach 100% winning deals - and now now now, just now I would say that the solution could be called "risk reward".

Should change the focus on how you look at this.

Focus on making it through backtesting with the minimum amount of needed scale-up and still hit profit. In fact, make your profit 10- 20 pips only first. The reason is that closing the trades early will give you more entries attempts to blow the account. One it blows, repairs that scenario and then run again. Running this particular strategy based on profit if pointless is if you cant protect the account blowing.

Once you know the worse drawdown of a trade "cycle", then you can then scale up with a more reasonable profit. I suggest a Trailing SL, because setting profit too high could cause more entries. Or you may consider a break even rule after so many trades are triggered for the EA to only look to break even.

If this advise is helpful, i look forward to my free copy of the finished EA :)

Should change the focus on how you look at this.

Focus on making it through backtesting with the minimum amount of needed scale-up and still hit profit. In fact, make your profit 10- 20 pips only first. The reason is that closing the trades early will give you more entries attempts to blow the account. One it blows, repairs that scenario and then run again. Running this particular strategy based on profit if pointless is if you cant protect the account blowing.

Once you know the worse drawdown of a trade "cycle", then you can then scale up with a more reasonable profit. I suggest a Trailing SL, because setting profit too high could cause more entries. Or you may consider a break even rule after so many trades are triggered for the EA to only look to break even.

If this advise is helpful, i look forward to my free copy of the finished EA :)

Yes but you know I don't really need this EA it was to get busy because weather bad, for having fun and finally it became a corvee. So I don't really want to think about but ... there is of course a trail on the sample I tested last month and that's by the way what complicate any risk-reward use.

I didn't tried it with no trail, I was mostly interesting by scalping capabilities it shows and the last days on the signal aren't uncoherent, it's nor growthing highly nor ungrowthing highly, and it varies with market - I should have try it longer, but as I told it before, I just got bore to watch it especially since it's a metaquote demo account with exceptional conditions, by working on it wouldn't have necessarily work on broker.

So I just leave it aside and then one day maybe, I'll come over it again. Isn't it precisely the privilege to work for yourself ? No complaint of job, no complaint of delay :)