on codefx:

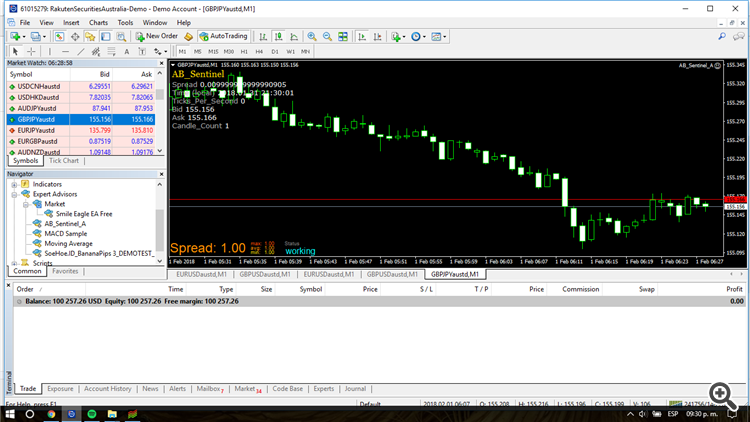

There are brokers with acceptable fixed spreads and no commisions. The commision is the real killer, not the spread, this is because it doesn't let you compound your winnings as you increase the lot size. Take a look at this: Hi All,

I was watching this GBP/JPY tick chart today while at work https://1forge.com/tick-chart/GBPJPY

I know it's hard with broker's spreads to profit on such a short time frame, but, I noticed some things.

- You can get a good idea of buy/sell pressure by paying attention to who is pushing who. For example, if the bid is pushing up again the ask, or visa versa, if the ask is pressing against the bid.

- I noticed, before a big move this morning on the AUD/CAD, the ask stayed below the bid for 5+ seconds, then retreated for 5 - 10 seconds, then the pair dropped significantly.

This brings me to my question: Have you guys found any useful/predictive data by watching a bid/ask tick chart?

1 pip should be enough for trend following (i know it is not a tick chart, but close enough). With 1 Min bars, you can develop a certain feeling on price action, just keep watching it... Catch those losers trying to buy when the trend is still down.

You could use the feed of a commisioned broker with floating spreads for that kind of trigger and enter on the one who doesn´t charge as much :) (just giving ideas).

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Hi All,

I was watching this GBP/JPY tick chart today while at work https://1forge.com/tick-chart/GBPJPY

I know it's hard with broker's spreads to profit on such a short time frame, but, I noticed some things.

This brings me to my question: Have you guys found any useful/predictive data by watching a bid/ask tick chart?