- Fundamental Analysis is also important in forex trading!

- What do you think the reason of your losses in forex ?

- Anyone trade the news?

So, let's start ...

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.02.15 06:58

Trader Styles and Flavors (based on dailyfx article)

Technical vs. Fundamental

Technical analysis is the art of studying past price behavior and

attempting to anticipate price moves in the future. These are traders

that focus solely on price charts and often times incorporate indicators

and tools to assist them. They look at price action, support and

resistance levels, and chart patterns to create trading strategies that

hopefully will turn a profit.

Fundamental analysis looks at the underlying economic conditions

of each currency. Traders will turn to the Economic Calendar and Central

Bank Announcements. They attempt to predict where price might be headed

based on interest rates, jobless claims, treasury yields and more. This

can be done by looking at patterns in past economic news releases or by

understanding a country’s economic situation.

Short-Term vs. Medium-Term vs. Long-Term

Deciding what time frame we should use is mostly decided by how much

time you have to devote to the market on a day-to-day basis. The more

time you have each day to trade, the smaller the time frame you could

trade, but the choice is ultimately yours.

Short-Term trading generally means placing trades with the intention of closing out the position within the same day, also referred to as

“Day Trading” or “Scalping” if trades are opened and closed very

rapidly. Due to the speed at which trades are opened and closed,

short-term traders use small time-frame charts (Hourly, 30min, 15min,

5min, 1min).

Medium-Term trades or “Swing Trades” typically are left open for a

few hours up to a few days. Common time frames used for this type of

trading are Daily, 4-hour and hourly charts.

Long-Term trading involves keeping trades open for days, weeks,

months and possibly years. Weekly and Daily charts are popular choices

for long term traders. If you are a part-time trader, it might be

suitable to begin by trading long term trades that require less of your

time.

Discretionary vs. Automated

Discretionary trading means a trader is opening and closing

trades by using their own discretion. They can use any of the trading

styles listed above to create a strategy and then implement that

strategy by placing each individual trade.

The first challenge is creating a winning strategy to follow, but the

second (and possibly more difficult) challenge is diligently following

the strategy through thick and thin. The psychology of trading can wreak

havoc on an otherwise profitable strategy if you break your own rules

during crunch time.

Automated trading or algorithmic trading requires the same time

and dedication to create a trading strategy as a discretionary trader,

but then the trader automates the actual trading process. In other

words, computer software opens and closes the trades on its own without

needing the trader’s assistance. This has three main benefits. First, it

saves the trader quite a bit of time since they no longer have to

monitor the market as closely to input trades. Second, it takes the

emotions out of trading by letting a computer open and close trades on

your behalf. This means you are following your strategy to the letter

and are not able to deviate. And third, automated strategies can trade

24 hours a day, 5 days a week giving your account the ability to take

advantage of any opportunity that comes its way no matter the time of

day.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.18 13:02

News is different from forecast, and forecast is different from technical analysis.

This is how I understand it:

------

Forecasts. You are following some system which is 'black box' for you and can not be disclosed in public. You just believe in this unknown system/person/trader/coder which is making forecast for you. Forecasts are made with no any alternatives, for example: "buy EUR/USD at 1.2440 now/tomorrow at 10 am etc."

It is similar with weather forecast (no one is responsible for false signal for example). There are free forecasts and commercial forecasts.

Technical analysis. The person is using indicators or/and price action to make a technical analysis describing the market condition in the past together with price movement explanation to the future on alternative ways. For example: "if the price breaks this level to above so ...., alternative - if the price will cross this level to below so ...".

In this case - technical analysis is acting as the science which everybody can repeat in MT4/MT5, and you are always having the choice about what to do (to buy, or to sell, or to do nothing).

There are free technical analysis and commercial technical analysis.

There are some websites and sources which are publishing the articles with the word 'Forecast' (dailyfx.com and investing.com for example) but if you look at those articles so you will understand that it is the technical analysis only.

Analysts (the persons who are providing the technical analysis) consider the forecasts/forecasters as the forex scam (so, basicly they do not like each other).

We do not have forecasts on this part of the forum because it will be consider as an advertisement with commercial promotion anyway (technical analysis and forecasts can not be on the same subforums because of the differences between them: technical analysis is the science, and forecast is commercial or promotional service.

------

I mean - if someone will post some link to the website with the forex forecast/trading signals and so on (and if it will be real forecast without technical analysis) so this your thread will be deleted sorry.

Traders analyze any financial market including the forex market in one of 3 ways:

1. Through Fundamental Analysis

2. Through Technical Analysis

3. Through a Combination of fundamental and technical analysis

While which method a trader chooses is ultimately up to them and their trading personality, it is my opinion that a trader who at least has an understanding of both technical and fundamental analysis is in a better overall position to trade profitably, than someone who focuses on only one school of thought.

To help understand this lets say that I am a trader who studies technical analysis and believes that at least in the short term, which is the time frame that I trade on, that technicals are all that matter. Next lets say that I am looking at a chart of the EUR/USD at 8:20 AM on the first Friday of the month, and my technicals are telling me that the trade is a good buy.

If I focused purely on technical analysis then I would probably enter that position not knowing that at 8:30 AM I may be in for a surprise that I was not expecting. As those of you who have been through module 8 of my basics of trading course know, at 8:30 AM on the first Friday of the month Non Farm Payrolls (NFP's) are released, which historically has been one of the most market moving fundamental releases in the forex market.

While I am not saying that a trader who trades on technicals should not take a trade that looks good to them from a technical standpoint because of weak fundamentals, what I think this shows is that technical traders who at least have an understanding of fundamentals have the ability to decide whether or not they should factor in a specific piece of fundamental information or no. In my opinion this gives them a big leg up on technical traders who dismiss fundamentals altogether.

Now lets say that I am a trader who trades a carry trade strategy which trades based off of a model I built to forecast interest rates based on fundamental news releases. Next lets say that my model generates a buy signal at 1.4700 which I have included on the chart on your screen. Would my trading not be better served if I at least knew that there was a major head and shoulders top in place, so technically the market is very weak here?

As with our technical analysis example what I am not saying is that a trader who trades on fundamentals should not take a trade that they feel is good from a fundamental standpoint when the market is weak from a technical standpoint. What I am saying however is that fundamental traders who at least have a basic understanding of technical analysis have the ability to decide this for themselves. In my opinion this gives them a big leg up on fundamental traders who dismiss technicals altogether.

As you have probably realized if you have been following my courses, they are designed to give traders a knowledge of both fundamental and technical analysis because I believe a knowledge of both puts traders in the best position to learn to trade profitably. I also believe that you can't really make a decision if you are going to trade based mainly off of technicals, fundamentals, or a combination of the two unless you have a sound understanding of the basics of both fundamental and technical analysis.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.03.04 07:35

What is a Fundamental? (based on dailyfx article)

- Fundamentals tack economic changes

- Traders want to buy the currency with strong fundamentals

- Check the economic calendar for upcoming events

Trade analysis is normally grouped into two categories, Technical and Fundamental. Normally when developing a trading strategy, traders will choose one or even a combination of both forms of analysis when developing a trading plan. While its always important to know and understand key technical levels, it is also good to know what is fundamentally driving market price.

What is a Fundamental

So what is a market fundamental? A market fundamental is a piece of

specific data or event that causes money to flow either in or out of an

underlying asset. As a trader we attempt to find the strongest currency

and pair it with a weaker one. This means when trading a fundamental

strategy, we will be looking for a series of data points that makes one

more attractive than the other.

Knowing this, traders should be factoring in things such as employment data, inflation, interest rates and even political turmoil before buying a particular currency. If the underlying fundamental data is improving or getting stronger we have found a candidate currency to buy relative to another with poor performance.

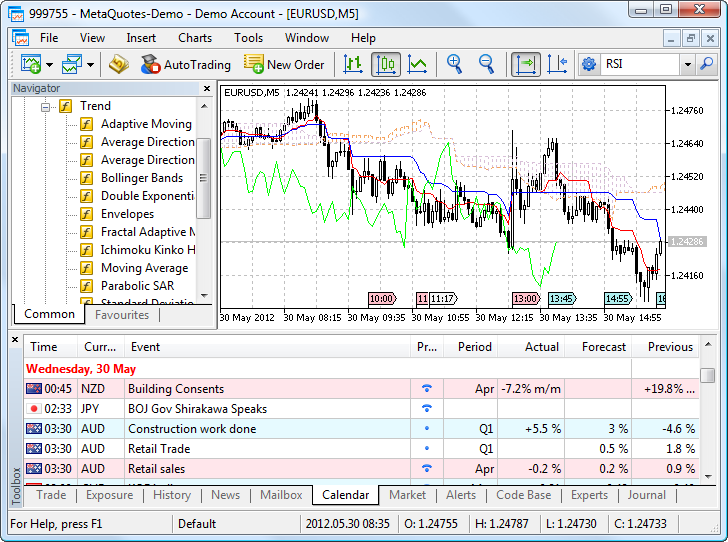

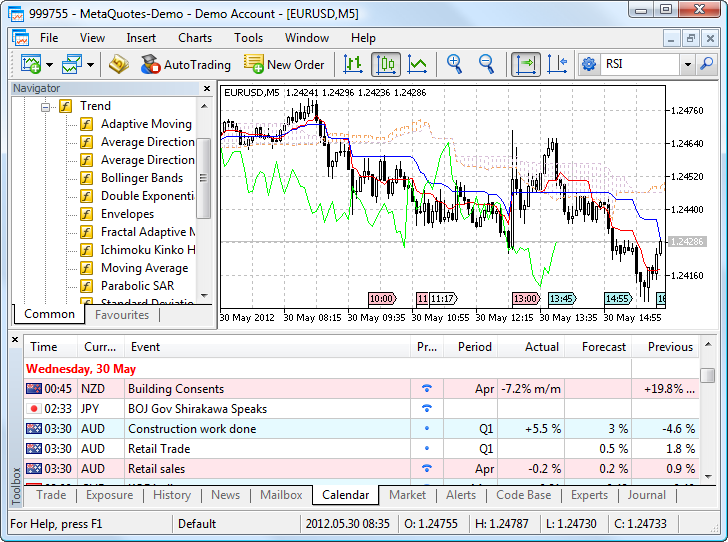

Economic Calendar

So now that you are a little more familiar with what a fundamental is,

now we need to find all this data so we can make an educated trading

decision. Every good fundamental trader should have access to an

economic calendar. This is where we can see which data points are being

released from week to week.

Traders should keep an eye on the calendar at all times, as data hits or misses expectations this will ultimately change our fundamental outlook on a currency.

Which Events to Track

The final question is which events we should follow. This is a fair

question, because there is a slew of economic data released each week!

To help make things easier, the high importance events have been marked

on the economic calendar as high priority/impact. These are the events

that our normally monitored by policy makers such as central banks and

have the ability to immediately influence market price. While these

events are certainly important, just watching events such as this week’s

employment figures for the US may not give us an overall opinion of the

market.

The key to trading fundamentals is to combine a variety of data points

to then make an educated trading decision. As we continue our study of

fundamentals we will take a look at the main influences on an economy

and how they can mold our trading opinion.

Watch the Market

As a fundamental trader, it is important to know how different events affect the valuation of a currency. This will allow you to monitor, track and trade currencies in real time.

=============

Related article : Building an Automatic News Trader

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.03.15 11:58

The Forex Guide to Fundamentals, Part 1: What is a Fundamental? (based on dailyfx article)

- Fundamentals tack economic changes

- Traders want to buy the currency with strong fundamentals

- Check the economic calendar for upcoming events

What is a Fundamental

So what is a market fundamental? A market fundamental is a piece of specific data or event that causes money to flow either in or out of an underlying asset. As a trader we attempt to find the strongest currency and pair it with a weaker one. This means when trading a fundamental strategy, we will be looking for a series of data points that makes one more attractive than the other.

Knowing this, traders should be factoring in things such as employment data, inflation, interest rates and even political turmoil before buying a particular currency. If the underlying fundamental data is improving or getting stronger we have found a candidate currency to buy relative to another with poor performance.

Economic Calendar

So now that you are a little more familiar with what a fundamental is, now we need to find all this data so we can make an educated trading decision. Every good fundamental trader should have access to an economic calendar. This is where we can see which data points are being released from week to week.

Traders should keep an eye on the calendar at all times, as data hits or misses expectations this will ultimately change our fundamental outlook on a currency.

Which Events to Track

The final question is which events we should follow. This is a fair question, because there is a slew of economic data released each week! To help make things easier, the high importance events have been marked on the economic calendar as high priority/impact. These are the events that our normally monitored by policy makers such as central banks and have the ability to immediately influence market price. While these events are certainly important, just watching events such as this week’s employment figures for the US may not give us an overall opinion of the market.

Watch the Market

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.02.15 06:58

Trader Styles and Flavors (based on dailyfx article)

Technical vs. Fundamental

Technical analysis is the art of studying past price behavior and

attempting to anticipate price moves in the future. These are traders

that focus solely on price charts and often times incorporate indicators

and tools to assist them. They look at price action, support and

resistance levels, and chart patterns to create trading strategies that

hopefully will turn a profit.

Fundamental analysis looks at the underlying economic conditions

of each currency. Traders will turn to the Economic Calendar and Central

Bank Announcements. They attempt to predict where price might be headed

based on interest rates, jobless claims, treasury yields and more. This

can be done by looking at patterns in past economic news releases or by

understanding a country’s economic situation.

Short-Term vs. Medium-Term vs. Long-Term

Deciding what time frame we should use is mostly decided by how much

time you have to devote to the market on a day-to-day basis. The more

time you have each day to trade, the smaller the time frame you could

trade, but the choice is ultimately yours.

Short-Term trading generally means placing trades with the intention of closing out the position within the same day, also referred to as

“Day Trading” or “Scalping” if trades are opened and closed very

rapidly. Due to the speed at which trades are opened and closed,

short-term traders use small time-frame charts (Hourly, 30min, 15min,

5min, 1min).

Medium-Term trades or “Swing Trades” typically are left open for a

few hours up to a few days. Common time frames used for this type of

trading are Daily, 4-hour and hourly charts.

Long-Term trading involves keeping trades open for days, weeks,

months and possibly years. Weekly and Daily charts are popular choices

for long term traders. If you are a part-time trader, it might be

suitable to begin by trading long term trades that require less of your

time.

Discretionary vs. Automated

Discretionary trading means a trader is opening and closing

trades by using their own discretion. They can use any of the trading

styles listed above to create a strategy and then implement that

strategy by placing each individual trade.

The first challenge is creating a winning strategy to follow, but the

second (and possibly more difficult) challenge is diligently following

the strategy through thick and thin. The psychology of trading can wreak

havoc on an otherwise profitable strategy if you break your own rules

during crunch time.

Automated trading or algorithmic trading requires the same time

and dedication to create a trading strategy as a discretionary trader,

but then the trader automates the actual trading process. In other

words, computer software opens and closes the trades on its own without

needing the trader’s assistance. This has three main benefits. First, it

saves the trader quite a bit of time since they no longer have to

monitor the market as closely to input trades. Second, it takes the

emotions out of trading by letting a computer open and close trades on

your behalf. This means you are following your strategy to the letter

and are not able to deviate. And third, automated strategies can trade

24 hours a day, 5 days a week giving your account the ability to take

advantage of any opportunity that comes its way no matter the time of

day.

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2013.09.01 21:06

This my post? red dotted lines are for possible sell stop trade, blue dotted lines are are possible buy stop ...

=============

Anyway - I just copied some latest summary from this thread :

=============

Market Condition Evaluation

story/thread was started from here/different thread

================================

The beginning:

- Market condition indicators/tools thread

- MaksiGen Trading system (light Paramon): many variations of the system - the thread

- How to use Support and Resistance Effectively - educational thread

- Market condition and EAs thread

- Trend indicators thread

- Forex Market Conditions, a graphic depiction - the thread

- Evaluation of the market condition using six SMA indicators thread

- Multi-indics indicators thread

- Candle time tools thread

================================

Market condition

- the theory with examples (primary trend, secondary trend) - read staring from this post till this one

- Summary about market condition theory is on this post

- Practical examples about every market condition case by indicators: starting from this page till this one

- trendstrength_v2 indicator is here,

- AbsoluteStrength indicator new version is here

- AbsoluteStrength indicator old version is on this post

- AbsoluteStrengthMarket indicator is here to download.

- good feature in Metatrader 5: moving stop loss/take profit by mouse on the chart (video about howto)

- predictions are very different thing from technical/fundamental analytsis the post with explanation

- Technical vs. Fundamental; Short-Term vs. Medium-Term vs. Long-Term; Discretionary vs. Automated - the post

- Market condition setup (indicators and template) is here

================================

3 Stoch MaFibo trading system for M5 and M1 timeframe

- trading examples

- template to download

- explanation how to trade and more explanation here

- how to install

- 2stochm_v4 EA is on this post.

================================

PriceChannel ColorPar Ichi system.

================================

MaksiGen trading system

- indicator to download

- some explanation about the system in general how to use

- Trading examples with MT5 statement, more trading is here.

- Paramon trading system iis on this post; How to trade the system - manual trading with live examples - read this page.

================================

Merrill's patterns are on this page.

================================

Divergence - how to use, explanation and where to read about.

================================

Scalp_net trading system

- template/indicators and how to use are on this comment.

- scalp_net_v132_tf EA is on this post with optimization results/settings for EURUSD M5 timeframe

- possible settings #1 for this EA for EURUSD M5 timeframe with backtesting results is on this post.

================================

MTF systems

more to follow ...

================================

MA Channel Stochastic system is here.

================================

Ichimoku

The beginning

After

- The theory of the signals

- Ichimoku alert indicator with arrows

- Ichimoku alert indicator improved : warning alert mode was fixed and autosettings feature was added

Please, can someone simply teach me the difference between fundamental analysis and technical analysis and how i can analyse by myself. i will learn quickly with all your responses here. thank you

If you need more information (or need someone who will teach you for something) - go to Freelance service.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use