Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.08 10:30

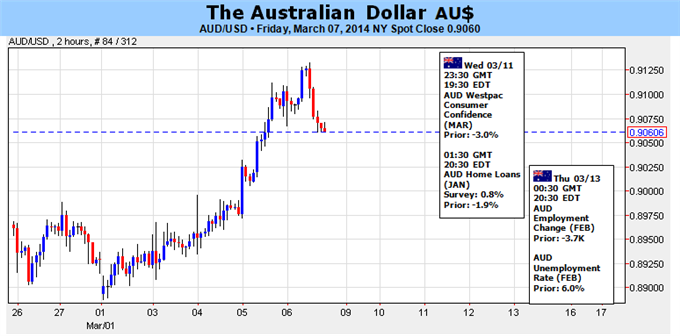

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- Upbeat Jobs Data May Reinforce Positive Shift in the RBA Policy Outlook

- Fading Doubts About Fed “Taper” Continuity May Undermine the Aussie

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.09 13:46

Forex Fundamentals - Weekly outlook: March 10 - 14

The dollar rose to six-week highs against the yen on Friday and pulled

back from two-and-a-half year lows against the euro after data showed

that the U.S. jobs report for February came in ahead of expectations.

Monday, March 10

- Japan is to release data on the current account, as well as revised data on fourth quarter economic growth.

- In the euro zone, France is to produce data on industrial production.

- Switzerland is to publish data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- Australia is to produce private sector data on business confidence.

- The Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- In the euro zone, Germany is to release data on the trade balance, the difference in value between imports and exports.

- The U.K. is to publish data on manufacturing production. Meanwhile, Bank of England Governor Mark Carney and several monetary policy committee members are to testify on inflation and the economic outlook before Parliament's Treasury Committee.

- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Japan is to publish its BSI manufacturing index and a report on tertiary industry activity.

- The U.K. is to produce data on the trade balance.

- The euro zone is to release data on industrial production.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- Japan is to publish data on core machinery orders. Elsewhere, China is to produce data on industrial production and fixed asset investment.

- Australia is to publish data on the change in the number of people employed and the unemployment rate, as well as a private sector report on inflation expectations.

- RBNZ Governor Graeme Wheeler is to testify before the Finance and Expenditure Select Committee, in Wellington.

- The ECB is to publish its monthly bulletin, which looks at current and future economic conditions from the bank’s perspective.

- The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

- The BoJ is to publish monetary policy meeting minutes, which contain valuable insights into economic conditions from the bank’s point of view.

- Switzerland is to release data on producer price inflation.

- The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.09 16:04

AUD/USD Fundamentals - weekly outlook: March 10 - 14The Australian dollar fell from a three-month against its U.S. counterpart on Friday, after Reserve Bank Governor Glenn Stevens said the exchange rate is "high by historical standards".

Tuesday, March 11

- Australia is to produce private sector data on business confidence.

- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Australia is to publish data on the change in the number of people employed and the unemployment rate, as well as a private sector report on inflation expectations.

- The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

- The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.11 07:14

2013-03-11 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - NAB Business Confidence]

- past data is 8

- forecast data is n/a

- actual data is 7 according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Business Conditions Plummet - NAB

Indexes monitoring business conditions and business confidence in Australia declined in February, the latest survey from National Australia Bank revealed on Tuesday.

The reading for business conditions fell to 0 from an upwardly revised 5 in January (originally 4), while business confidence dipped to 7 from the upwardly revised 9 (originally 8) in the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 28 pips price movement by AUD - NAB Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.12 05:51

2013-03-12 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

- past data is -3.3%

- forecast data is -0.5%

- actual data is 0.0% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Home Loans Flat In January

The total number of home loans in Australia was roughly unchanged on month in January, the Australian Bureau of Statistics said on Wednesday, standing at 51,054.

That was shy of forecasts for an increase of 0.5 percent following the downwardly revised 3.3 percent contraction in December (originally down 1.9 percent).

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 9 pips price movement by AUD - Home Loans news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.13 07:04

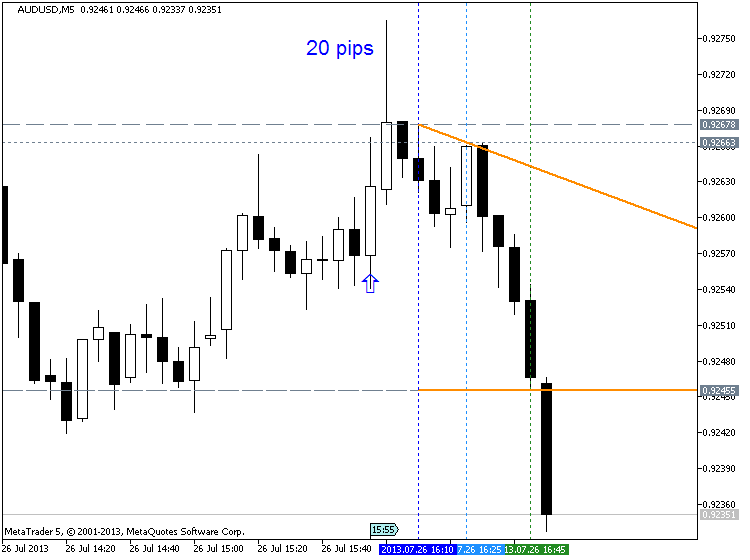

2013-03-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Employment Change]

- past data is 18.0K

- forecast data is 18.0K

- actual data is 47.3K according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Unemployment Rate Steady At 6.0%

Australia posted a seasonally adjusted unemployment rate of 6.0 percent in February, the Australian Bureau of Statistics said on Thursday - in line with expectations and unchanged from the January reading.

The Australian economy gained 47,300 jobs in February to 11,530,800 - blowing away expectations for a gain of 15,000 following the loss of 3,700 jobs in the previous month.

Full-time employment increased by 80,500 to 8,049,900 and part-time employment decreased by 33,300 to 3,480,900.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 61 pips price movement by AUD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.13 10:02

2013-03-13 05:45 GMT (or 06:45 MQ MT5 time) | [CNY - Industrial Production]

- past data is 9.7%

- forecast data is 9.5%

- actual data is 8.6% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

Weak Data Signal China SlowdownChina's industrial production, retail sales and fixed investment grew less than expected in the first two months of 2014, underscoring the moderate slowdown in the region as measures to clamp down credit suppressed investment.

Industrial production increased 8.6 percent year-on-year in the January to February period, the National Bureau of Statistics said Thursday. Production was forecast to grow 9.5 percent, following a 9.7 percent rise in December.

Another report from the statistical office showed that retail sales grew by a double-digit 11.8 percent year-on-year during the two months, which was weaker than the 13.5 percent increase forecast by economists.

Further, urban fixed asset investment during January to February increased 17.9 percent from the last year, which was also slower than expectations for 19.4 percent.

The government targets 17.5 percent fixed asset investment growth for the whole of 2014, after it advanced 19.6 percent in 2013.

Nonetheless, economic data in January and February are usually distorted by the Lunar New Year holiday.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 20 pips price movement by CNY - Industrial Production news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.13 08:16

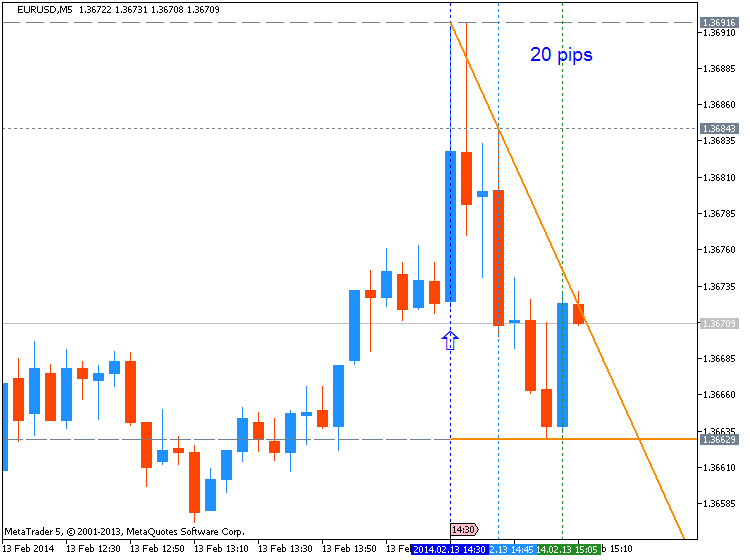

Trading the News: U.S. Retail Sales (based on dailyfx article)

- U.S. Retail Sales to Increase for First Time in Three-Months

- Household Spending Rose 10 Months in 2013

What’s Expected:

Time of release: 03/13/2014 12:30 GMT, 8:30 EDT

Primary Pair Impact: EURUSD

Expected: 0.2%

Previous: -0.4%

Forecast: -0.2% to 0.4%

Why Is This Event Important:

With the Federal Open Market Committee (FOMC) widely expected to discuss

another $10B taper at the March 19 meeting, a pickup in private sector

consumption may put increased pressure on the central bank to normalize

monetary policy sooner rather than later, but we may see Fed Chair Janet

Yellen preserve the zero-interest rate policy (ZIRP) for an extended

period of time in an effort to curtail the ongoing slack in the real

economy.

How To Trade This Event Risk

Bullish USD Trade: Household Spending Increases 0.2% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The Release

- Remains Upward Trending Channel While Preserving March Opening Range (1.3914)

- Bullish RSI Momentum Continues to Favor Further Advances

- Interim Resistance: 1.3800 (100.0% expansion) to 1.3830 (61.8% retracement)

- Interim Support: 1.3450 (38.2% retracement) to 1.3460 (50.0% expansion)

January 2014 U.S. Retail Sales :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 8 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.14 08:49

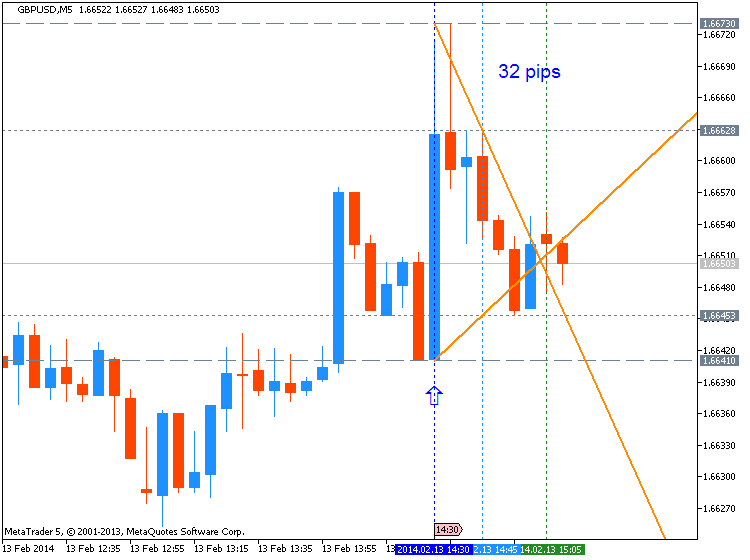

Trading the News: USD - Michigan Consumer Sentiment (based on dailyfx article)- U. of Michigan Confidence to Improve for Second Consecutive Month

- Has Held Above 80 for the Last Three-Month; High of 85.1 in 2013

A further pickup in the U. of Michigan Confidence survey may prop up the

U.S. dollar ahead of the Fed’s March 19 meeting as it raises the

prospects for a stronger recovery in 2014.

What’s Expected:

Time of release: 03/14/2014 13:55 GMT, 9:55 EDT

Primary Pair Impact: EURUSD

Expected: 82.0

Previous: 81.6

Forecast: 80.0 to 83.0

Why Is This Event Important:

Indeed, positive developments coming out of the U.S. economy may heighten bets of seeing another $10B reduction in the asset-purchase program, but an unexpected decline in household sentiment may drag on interest rate expectations as Fed Chair Janet Yellen pledges to retain the zero-interest rate policy even after achieving the 6.5% threshold for unemployment.

How To Trade This Event Risk

Bullish USD Trade: Consumer Confidence Climbs to 82.0 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The Release

- Stalls at Trendline Support, 61.8% Fib Expansion- Higher High in Place?

- Break of Bullish RSI Momentum to Highlight Near-Term Correction

- Interim Resistance: 1.3960-70 (61.8% expansion)

- Interim Support: 1.3600 Pivot to 1.3620 (23.6 retracement)

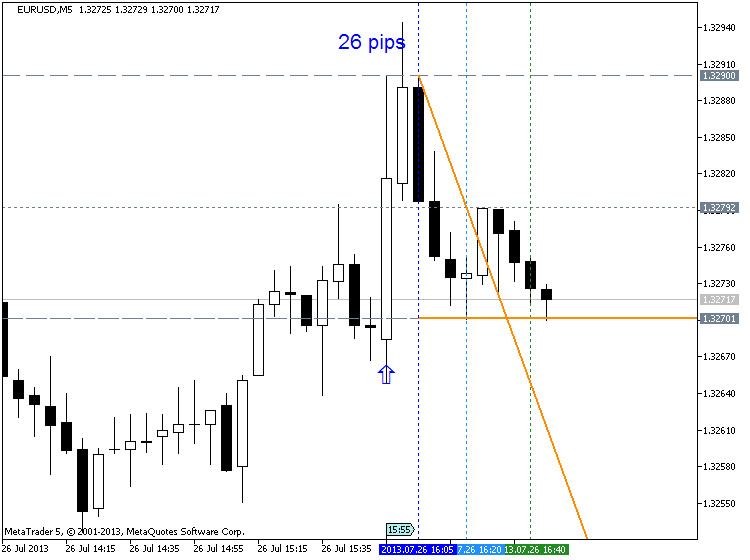

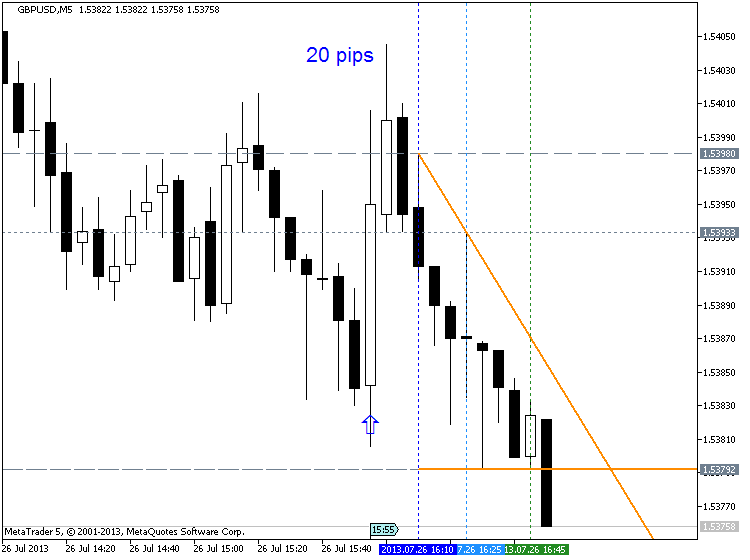

Previous USD - Michigan Consumer Sentiment :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 26 pips price movement by USD - Michigan Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is on primary bullish on D1 timeframe trying to break 0.9112 resistance level. But the price is located to be very close to Ichimoku cloud for possible ranging market condition within primary bullish for possible correction on D1 timeframe.

W1 timeframe: bearish ranging between 0.9085 resistance and 0.8659 support levels.

H4 timeframe: the correction is started, and price is breaking 0.9061 and 0.9046 levels from above to below.

If the price will break 0.9112 resistance on D1 close bar so the primary bullish will be continuing (good to open buy trade).If not so we may see the ranging market condition within Ichimoku cloud/kumo.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2013-03-11 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2013-03-11 22:30 GMT (or 23:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2013-03-12 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

2013-03-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Unemployment Rate]

2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Industrial Production]

2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Retail Sales]

2013-03-13 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Retail Sales]

2013-03-14 12:30 GMT (or 13:30 MQ MT5 time) | [USD - PPI]

2013-03-14 13:55 GMT (or 14:55 MQ MT5 time) | [USD - Michigan Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart