Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.08 10:34

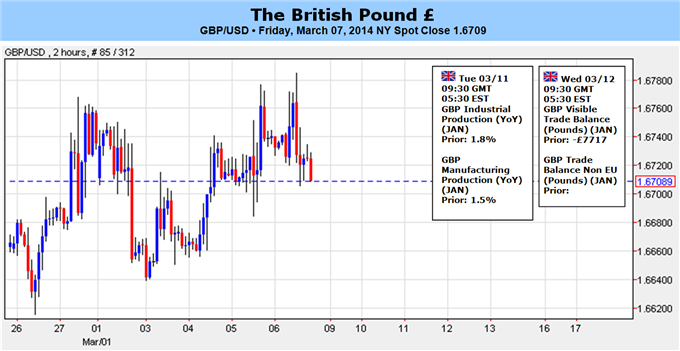

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for the British Pound: Bullish

- Cable in Consolidation Mode

- British Pound Bypasses BoE, Moves on to Inflation Forecast Update

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.10 09:12

2013-03-10 07:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Industrial Production]

- past data is -0.6%

- forecast data is 0.6%

- actual data is -0.2% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

French Industrial Production Unexpectedly Slips Into Contraction

France's industrial production fell back into contraction in January, contrary to economist's forecast for a marked increase, latest data revealed Monday.

Industrial production edged down 0.1 percent year-on-year in January, reversing increases of 0.3 percent and 1.5 percent logged in December and November respectively, statistical office Insee said. Economists were looking for 1.3 percent expansion for January.

Sequentially, industrial production decreased 0.2 percent in the beginning of the year, after falling 0.6 percent in December. Expectations were for a 0.5 percent gain.

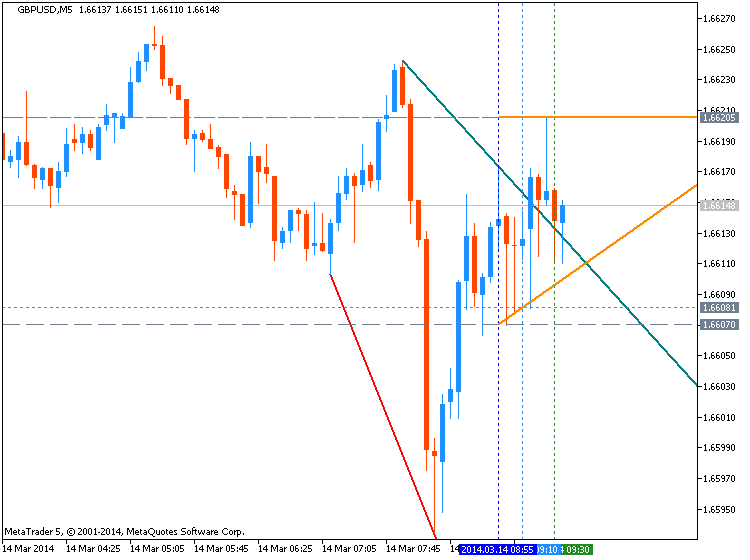

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 41 pips price movement by EUR - French Industrial Production news event

The U.S. economy added 175,000 jobs in February, the Labor Department reported, well above expectations for 149,000 new jobs. The unemployment rate ticked up to 6.7% from 6.6% in January, as more people joined the workforce. The jobs report eased concerns over soft U.S. employment and other economic data seen in the past few months. The strong figure indicated that the Federal Reserve is likely to continue to scale back its stimulus program, which has weighed on the value of the dollar.

Demand for sterling continued to be underpinned after business survey data earlier in the week indicated that the economic recovery in the U.K. is continuing. A report on Monday showed that the manufacturing activity expanded in February, while the pace of jobs growth in the sector reached a 33-month high. Meanwhile data on Wednesday showed that activity in the U.K. service sector slowed slightly in February, but growth remained robust.

The upbeat data reinforced the view that the Bank of England will raise interest rates as soon as next year. The BoE left U.K. interest rates unchanged at their record low of 0.5% on Thursday, and also left its quantitative easing program steady at 375 billion pounds.

Elsewhere, sterling fell to one-month lows against the broadly stronger euro on Friday, with EUR/GBP ending Friday’s session at 0.8301, up 0.26%. The euro added to the previous session’s strong gains after a report from the European Central Bank showed that banks in the euro area are set to repay a large portion of its emergency three-year loans next week.

The common currency strengthened across the board on Thursday as expectations for further monetary easing by the ECB dimmed after the bank refrained from tightening policy, saying economic conditions did not support such a move. In the week ahead, U.S. data on retail sales and consumer sentiment will be closely watched, while BoE Governor Mark Carney’s testimony on the inflation outlook will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Monday, as there are no relevant events on this day.

Tuesday, March 11

The U.K. is to publish data on manufacturing production. Meanwhile, BoE Governor Mark Carney and several monetary policy committee members are to testify on inflation and the economic outlook before Parliament's Treasury Committee.

Wednesday, March 12

The U.K. is to produce data on the trade balance, the difference in value between imports and exports.

Thursday, March 13

The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

Friday, March 14

The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

Source: investingdotcom

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.09 13:46

Forex Fundamentals - Weekly outlook: March 10 - 14

The dollar rose to six-week highs against the yen on Friday and pulled

back from two-and-a-half year lows against the euro after data showed

that the U.S. jobs report for February came in ahead of expectations.

Monday, March 10

- Japan is to release data on the current account, as well as revised data on fourth quarter economic growth.

- In the euro zone, France is to produce data on industrial production.

- Switzerland is to publish data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- Australia is to produce private sector data on business confidence.

- The Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- In the euro zone, Germany is to release data on the trade balance, the difference in value between imports and exports.

- The U.K. is to publish data on manufacturing production. Meanwhile, Bank of England Governor Mark Carney and several monetary policy committee members are to testify on inflation and the economic outlook before Parliament's Treasury Committee.

- Australia is to release private sector data on consumer sentiment, as well as official data on home loans.

- Japan is to publish its BSI manufacturing index and a report on tertiary industry activity.

- The U.K. is to produce data on the trade balance.

- The euro zone is to release data on industrial production.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- Japan is to publish data on core machinery orders. Elsewhere, China is to produce data on industrial production and fixed asset investment.

- Australia is to publish data on the change in the number of people employed and the unemployment rate, as well as a private sector report on inflation expectations.

- RBNZ Governor Graeme Wheeler is to testify before the Finance and Expenditure Select Committee, in Wellington.

- The ECB is to publish its monthly bulletin, which looks at current and future economic conditions from the bank’s perspective.

- The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

- The BoJ is to publish monetary policy meeting minutes, which contain valuable insights into economic conditions from the bank’s point of view.

- Switzerland is to release data on producer price inflation.

- The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.09 16:58

GBP/USD Fundamentals - weekly outlook: March 10 - 14The pound moved lower against the dollar on Friday after data showed that the U.S. employment report for February was stronger than forecast, bolstering the outlook for the economic recovery.

Tuesday, March 11

- The U.K. is to publish data on manufacturing production. Meanwhile, BoE Governor Mark Carney and several monetary policy committee members are to testify on inflation and the economic outlook before Parliament's Treasury Committee.

- The U.K. is to produce data on the trade balance, the difference in value between imports and exports.

- The U.S. is to release data on retail sales and import prices, in addition to the weekly government report on initial jobless claims.

- The U.S. is to round up the week with data on producer price inflation and preliminary data from the University of Michigan on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.11 10:51

2013-03-11 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

- past data is 0.4%

- forecast data is 0.3%

- actual data is 0.4% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Industrial Output Growth Slows More Than Forecast

U.K. industrial production growth slowed more than expected in January, while manufacturing output growth remained stable compared to December, official data showed Tuesday.

Industrial output edged up 0.1 percent from December, the Office for National Statistics reported. Output was forecast to expand 0.2 percent, following December's 0.5 percent rise.

Manufacturing output grew 0.4 percent as seen in December and stayed above the 0.3 percent rise forecast by economists.

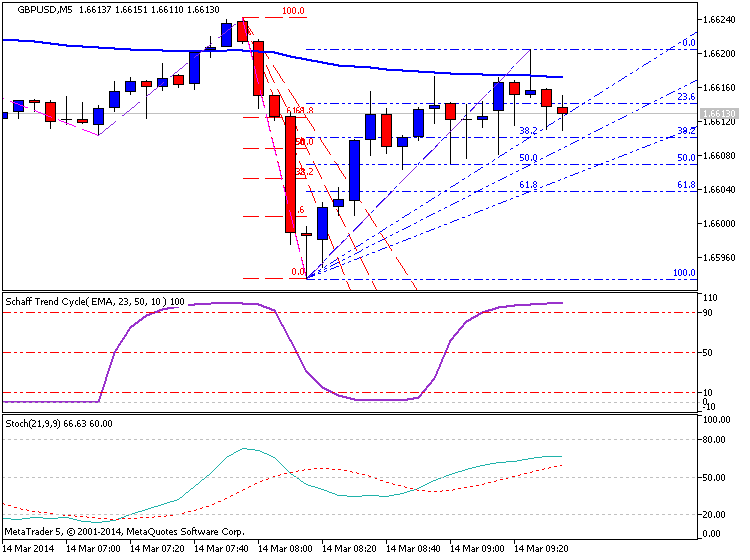

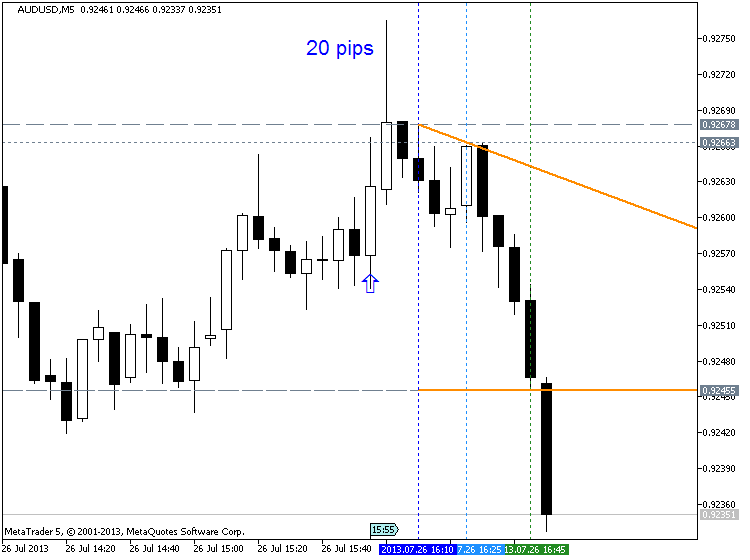

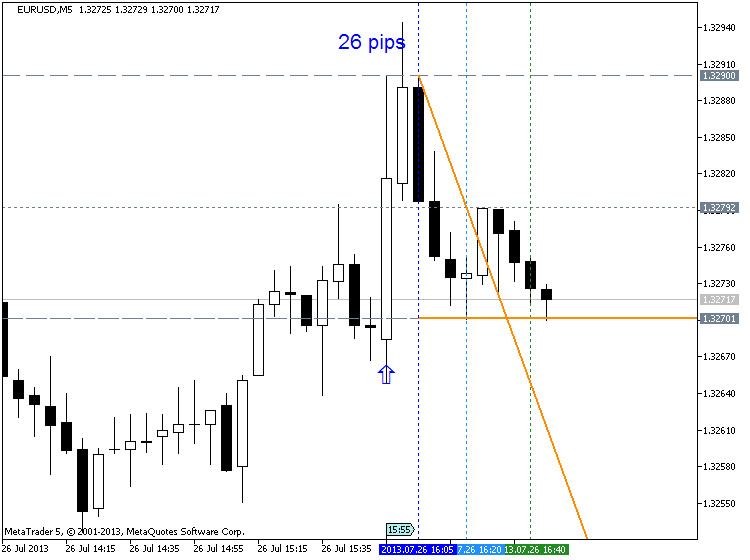

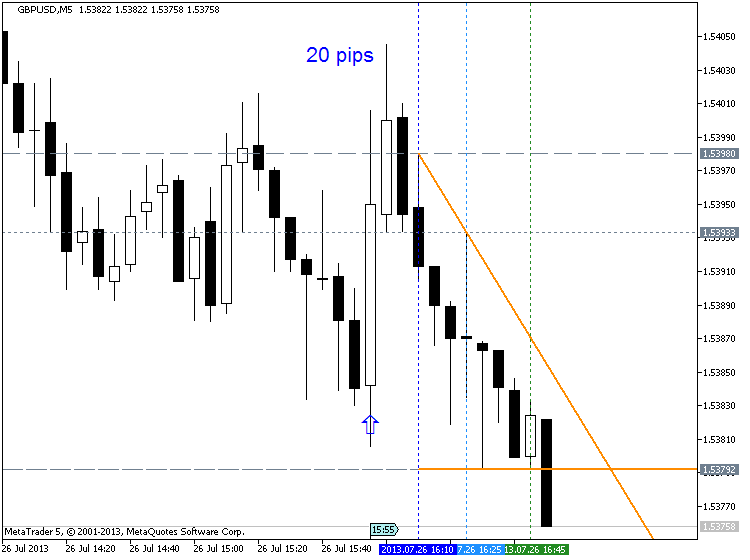

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 20 pips price movement by GBP - Manufacturing Production news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.11 16:33

2013-03-11 15:00 GMT (or 16:00 MQ MT5 time) | [GBP - NIESR GDP Estimate]

- past data is 0.7%

- forecast data is n/a

- actual data is 0.8% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 21 pips price movement by GBP - NIESR GDP Estimate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.14 09:41

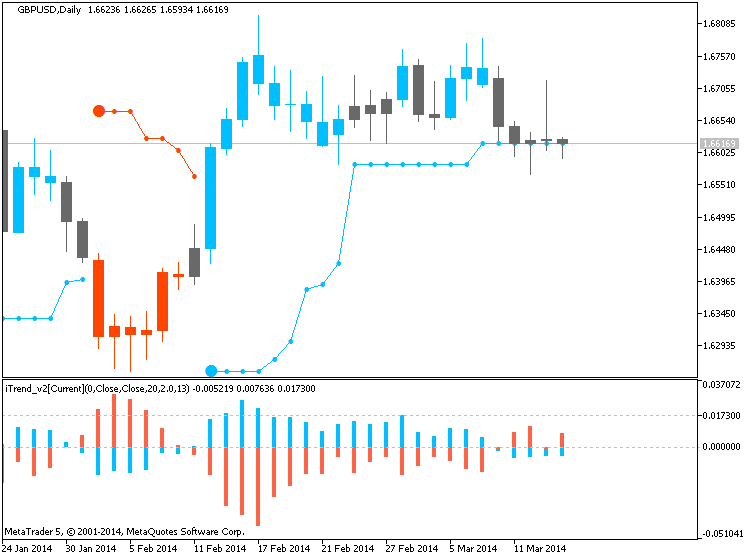

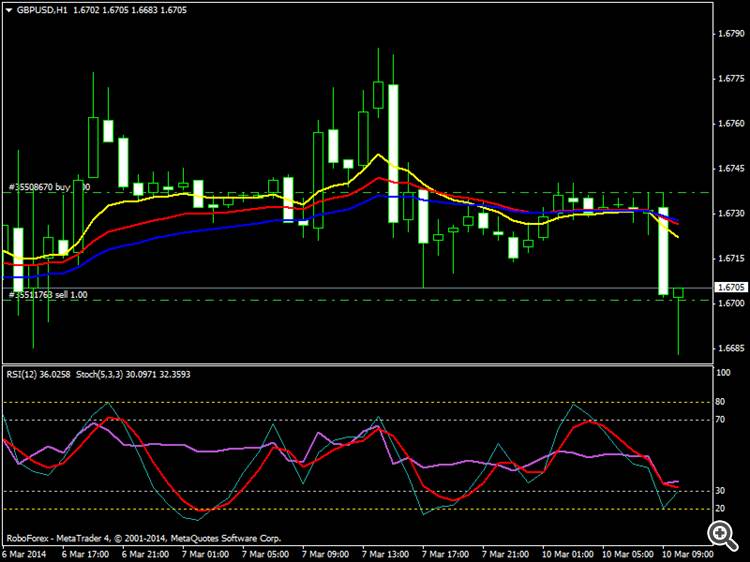

GBPUSD Technical Analysis (based on dailyfx article)

- GBP/USD Technical Strategy: Sidelines Preferred

- Range between 1.6600 and 1.6765/70 intact

- Dark Cloud Cover on weekly warns of larger correction

The range between 1.6600 and 1.6765/70 for the Pound remains in force.

While a test of the range-top looked possible yesterday, sellers at the

50% Fib Retracement level at 1.6690 acted to cap the GBP/USD’s advance.

This has resulted in a Bearish Engulfing candlestick pattern that is

threatening a break of the range-bottom at 1.6600.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.14 08:49

Trading the News: USD - Michigan Consumer Sentiment (based on dailyfx article)- U. of Michigan Confidence to Improve for Second Consecutive Month

- Has Held Above 80 for the Last Three-Month; High of 85.1 in 2013

A further pickup in the U. of Michigan Confidence survey may prop up the

U.S. dollar ahead of the Fed’s March 19 meeting as it raises the

prospects for a stronger recovery in 2014.

What’s Expected:

Time of release: 03/14/2014 13:55 GMT, 9:55 EDT

Primary Pair Impact: EURUSD

Expected: 82.0

Previous: 81.6

Forecast: 80.0 to 83.0

Why Is This Event Important:

Indeed, positive developments coming out of the U.S. economy may heighten bets of seeing another $10B reduction in the asset-purchase program, but an unexpected decline in household sentiment may drag on interest rate expectations as Fed Chair Janet Yellen pledges to retain the zero-interest rate policy even after achieving the 6.5% threshold for unemployment.

How To Trade This Event Risk

Bullish USD Trade: Consumer Confidence Climbs to 82.0 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The Release

- Stalls at Trendline Support, 61.8% Fib Expansion- Higher High in Place?

- Break of Bullish RSI Momentum to Highlight Near-Term Correction

- Interim Resistance: 1.3960-70 (61.8% expansion)

- Interim Support: 1.3600 Pivot to 1.3620 (23.6 retracement)

Previous USD - Michigan Consumer Sentiment :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 38 pips price movement by USD - Michigan Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

There is primary bullish on D1 timeframe, and price is ranging between 1.6616 support and 1.6777 resistance levels. If the price will break this 1.6777 resistance on close D1 bar so the primary bullish will be continuing, if not - we may see the ranging market condition within primary bullish.

W1 timeframe: price with general bullish is ranging between 1.6251 support and 1.6822 resistance level. H4 : secondary correction is started on open bar within primary bullish, and Chinkou Span line of Ichimoku indicator is very close to historical price. If the price will break 1.6685 support from above to below so we may see good breakdown (good to open sell trade on H4 timeframe).

If the price will break 1.6777 resistance on D1 close bar so the primary bullish will be continuing (good to open buy trade).

If not so we may see the ranging market condition within bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-03-10 11:15 GMT (or 12:15 MQ MT5 time) | [USD - FOMC Member Speech]

2013-03-10 14:15 GMT (or 15:15 MQ MT5 time) | [GBP - MPC Member Speech]

2013-03-11 00:01 GMT (or 01:01 MQ MT5 time) | [GBP - BRC Retail Sales Monitor]

2013-03-11 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

2013-03-11 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

2013-03-11 10:00 GMT (or 11:00 MQ MT5 time) | [GBP - Inflation Report Hearings]

2013-03-11 15:00 GMT (or 16:00 MQ MT5 time) | [GBP - NIESR GDP Estimate]

2013-03-12 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Industrial Production]

2013-03-13 05:30 GMT (or 06:30 MQ MT5 time) | [CNY - Retail Sales]

2013-03-13 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Retail Sales]

2013-03-14 12:30 GMT (or 13:30 MQ MT5 time) | [USD - PPI]

2013-03-14 13:55 GMT (or 14:55 MQ MT5 time) | [USD - Michigan Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movement

SUMMARY : bullish

TREND : bullish

Intraday Chart