Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.22 10:27

Forex Weekly Fundamentals : Outlook Feb. 24-28

Weaker than expected data was reported almost everywhere. After

suffering losses, can the US dollar emerge as a winner? Euro-zone

inflation, Us consumer confidence, Housing data, Unemployment Claims and

GDP data from the US, UK and Canada are among the major events on our

calendar. Here is an outlook on the main market-movers this week.

The weakness was seen everywhere: a terrible Philly Fed Index in the

US, a disappointing growth rate in Japan, a weak PMI in China, lower

business sentiment in Germany and a rising unemployment rate in the UK,

among others. Nevertheless, it seems that one central bank is not

deterred: the Federal Reserve. Meeting minutes from the last decision

showed again that the taper train is on the track.

- German Ifo Business Climate: Monday, 9:00. German business confidence soared to 110.6 in January from 109.5 in December, rising to the highest level since July 2011. The reading surpassed forecasts of 110.2, indicating German economy is expanding full steam. The Bundesbank has projected a strong expansion in 2014, after the weak final quarter of 2013 where German economy shifted from domestic demand to global trade. Another climb to 110.7 is expected this time.

- US CB Consumer Confidence: Tuesday, 15:00. Consumers sentiment unexpectedly edged up in January to 80.7 from 77.5 in December, reaching a five-month high amid renewed optimism about the economy and labor market. Economists expected a weaker reading of 78.3. US jobs market improved offering plentiful positions and higher wages propelling consumer purchases and confidence. A small decline to 80.2 is forecasted.

- UK Second Estimate GDP: Wednesday, 9:30. The first release of UK GDP showed a growth rate of 0.7% in Q4 2013, which is quite solid growth. A confirmation of this figure is expected in the second release. According to NIESR monthly estimates, GDP has increased by 0.8% in the three months ending in January 2014. The Bank of England is expected to keep interest rates on hold until the second quarter of 2015 and annual GDP growth will reach 2.5% in 2014 and 2.1% in 2015.

- US New Home Sales: Wednesday, 15:00. The annual number of new home sales disappointed for the second consecutive month with a seasonally adjusted annual rate of 414,000 units, much weaker than the 445,000-unit pace registered in November missing predictions for a rise to 457,000. Many blamed the harsh winter conditions for the ongoing fall in the housing sector with a 36.4% fall in the Northeast which was hit by cold temperatures. This fall is not consistent with the strong demand reflected in the declining inventory for new and existing homes, indicating this is only a temporary setback. Another drop to 406,000 is expected now.

- US Durable Goods Orders: Thursday, 13:30. Orders for long-lasting U.S. manufactured goods excluding transportation items plunged unexpectedly in December by 1.6% after a 1.2% gain in the previous month posting the biggest decline since March 2013. Most orders were weak, with the exception for machinery, and electrical equipment, appliances and components rising. Durable goods orders fell 4.3% in December after a 3.4% climb in November, pulled down by weak demand for transportation equipment, primary metals, computers and electronic products and capital goods. Durable Goods Orders are expected to decline 0.7% while core Durable Goods Orders are expected to fall 0.1%.

- US Unemployment Claims: Thursday, 13:30. The number Americans filing applications for unemployment benefits dropped by 3,000 last week, to a seasonally adjusted 336,000, indicating firing has not increased. The number of applicants became stable in recent weeks despite modest levels of hiring in January and February, signaling business confidence is improving. In recent months, frigid weather slowed down hiring, retail sales and home construction. Job growth for the past two months reached only a half the monthly average for the previous two years. However lower unemployment rate of 6.6% was an improvement from December. Another drop to 333,000 is anticipated now.

- Euro-zone Flash CPI: Friday, 10:00. As the focus of the ECB shifted to inflation (or the lack of it), the importance of CPI has risen. The surprising drop in inflation in October triggered a rate cut in November. Year over year CPI is expected to remain unchanged at 0.7%. However, a strong euro and a fragile recovery could result in a new low for CPI and perhaps for core CPI, which also bottomed out at 0.7% so far. A drop to new cycle lows could trigger a negative deposit rate from the ECB in March.

- Canadian GDP: Friday, 13:30. The Canadian economy expanded by 0.2% in November, in line with market forecast, rising for the fifth straight month amid a recovery in the oil industry outpaced a decline in manufacturing. This increase was preceded by a 0.3% increase in both September and October. Oil and gas extraction rose 2.6%, after a 0.7% decline in October, and mining and quarrying increased by 1.3%. Overall manufacturing output climbed 0.4% while the service sector increased by 0.2%. Canadian economy is expected to contract 0.2% this time.

- US GDP: Friday, 13:30. According to the first release, the US economy grew by 3.2% in Q4 2013. Already at that release, there were worries about the quality of this growth, with an inventory buildup taking a large part in that growth. After a few weak figures, expectations are for a downgrade of growth to 2.6% at the second and not final release.

- US Pending Home Sales: Friday, 15:00. The number of contracts to purchase previously owned homes in the U.S. plunged in December by 8.7% following a 0.3% decline in the preceding month. This was the worst reading since May 2010 amid higher borrowing costs and bad weather conditions halting sales. Analysts expected a modest drop of 0.3%, but unusually cold weather discouraged potential buyers. A rise of 2.9% is forecasted.

- Mark Carney speaks: Friday, 15:30. BOE Governor Mark Carney will speak in Frankfurt on Central Bankers. Earlier this month Carney said there is a need to change the compensation structures so that banks could see whether employees had taken undue risks or behaved badly and that compensation of bankers should be withheld and deferred for a very long time. These comments were made after news that Barclays was paying bigger bonuses despite announcing plans to cut staff in response to a fall in profits. Carney may also refer to the developments in the housing market and the means to prevent a bubble from developing. Any comment on the interest rate will be closely scrutinized after Carney hinted a hike in Q2 2015.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.22 15:47

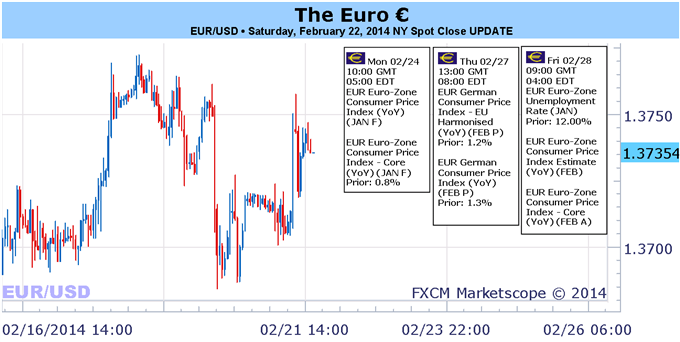

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Neutral

-

Retail crowd positioning warns of an extreme (and potential top) in the Euro.

- EURUSD only vulnerable to a bigger correction under $1.3670/85.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.24 10:51

2013-02-24 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Survey]

- past data is 110.6

- forecast data is 110.6

- actual data is 111.3 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German Business Confidence Strongest Since Mid-2011

German business confidence strengthened unexpectedly in January to the highest level since July 2011 despite a drop in expectations.

The business confidence index climbed to 111.3 from 110.6 in January, the Ifo institute reportedly said Monday. The reading was expected to remain stable at 110.6.

Likewise, the current conditions index improved to 114.4 from 112.4 a month ago. Nonetheless, the score is below the expected level of 112.7.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 19 pips price movement by EUR - German Ifo Survey news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.23 19:44

EUR/USD Fundamentals - weekly outlook: February 24 - 28 (based on investing article)

The euro was higher against the dollar on Friday following the release

of weaker-than-expected data on U.S. existing home sales, amid ongoing

concerns over the impact of severe winter weather on the economic

recovery.

Monday, February 24

- The euro zone is to release revised data on consumer price inflation, while the Ifo Institute is to publish a report on German business climate.

- The European Commission is to publish its economic forecasts for European Union member states.

- The U.S. is to release data on consumer confidence and a private sector report on house price inflation.

- In the euro zone, Germany is to release a report on Gfk consumer climate.

- The U.S. is to release data on new home sales, a leading indicator of demand in the housing market.

- In the euro zone, Germany is to publish preliminary data on consumer inflation, as well as data on the change in the number of people unemployed.

- The U.S. is to release data on durable goods orders, a leading indicator of production, and the weekly report on initial jobless claims.

- The euro zone is to release preliminary data on consumer inflation and a separate report on the unemployment rate across the currency bloc. Germany is to publish data on retail sales.

- The U.S. is to round up the week with revised data on fourth quarter growth, a report on manufacturing activity in the Chicago region, revised data on consumer sentiment and private sector data on pending home sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.25 09:31

2013-02-25 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German GDP]

- past data is 0.3%

- forecast data is 0.4%

- actual data is 0.4% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German Q4 Growth Confirmed At 0.4%

The German economy expanded moderately at the end of 2013, as initially estimated early this month, final data from Destatis showed Tuesday.

The gross domestic product increased 0.4 percent from a quarter ago, slightly faster than the 0.3 percent expansion seen in the third quarter. This was in line with the results of calculations published on February 14.

The expenditure-side breakdown of GDP showed that exports of goods and services were up 2.6 percent from the third quarter. At the same time, imports increased by not more than 0.6 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 7 pips price movement by EUR - German GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.25 09:38

2013-02-25 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - France Business Climate]

- past data is 100

- forecast data is 100

- actual data is 100 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

French Business Confidence Remains Unchanged In February

French business confidence remained unchanged as expected in February, a closely-watched survey showed Tuesday.

The business sentiment index came in at 100 for the third consecutive month, the statistical office Insee said.

The balance of opinion on past change in production has improved and has reached its long-term average. The balance of opinion on personal production expectation fell marginally to 9 from 10. General production expectations weakened to -6 from -4 in January.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 18 pips price movement by EUR - France Business Climate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.25 14:55

EURUSD Technical Analysis (based on dailyfx article)

- EUR/USD Technical Strategy: Pending Short

- Support: 1.3698 (Jan 14 high), 1.3613 (38.2% Fib exp.)

- Resistance: 1.3768 (trend line), 1.3800 (double top)

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.25 13:04

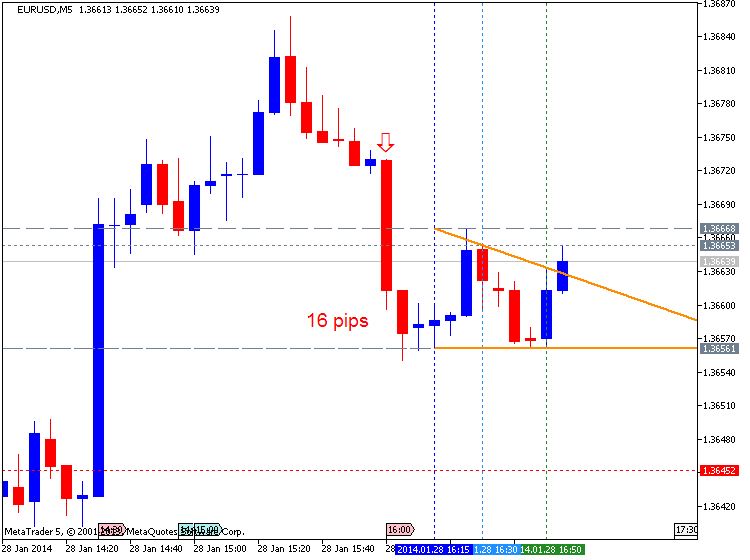

Trading the News: U.S. Consumer Confidence (adapted from dailyfx article)

- U.S. Consumer Confidence to Mark First Decline in Three-Months

- Conference Board’s Survey has Held Above 80.0 for Four Times in 2013

The Conference Board’s Consumer Confidence survey is expected to narrow

to 80.0 in February and a marked decline in household sentiment may

trigger a bearish reaction in the U.S. dollar as it dampens the outlook

for growth and inflation.

What’s Expected:

Time of release: 02/25/2014 15:00 GMT, 10:00 EST

Primary Pair Impact: EURUSD

Expected: 80.0

Previous: 80.7

Forecast: 78.0 to 82.0

Why Is This Event Important:

With the Federal Open Market Committee (FOMC) poised to discuss another $10B taper at the March 19 meeting, a dismal confidence reading may have a greater impact on the interest rate outlook, and the greenback may face additional headwinds over the near to medium-term as the central bank retains the dovish twist to its forward-guidance.

How To Trade This Event Risk

Bearish USD Trade: Confidence Survey Weakens to 80.0 or Lower

- Need to see green, five-minute candle following the print to consider a long trade on EURUSD

- If market reaction favors a short dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

January 2014 U.S. Consumer Confidence (EURUSD M5 : 16 pips price movement by USD - Consumer Confidence news event) :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 30 pips price movement by USD - CB Consumer Confidence news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.25 17:00

2013-02-25 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

- past data is 79.4

- forecast data is 80.0

- actual data is 78.1 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Index Falls More Than Expected In February

With consumers expressing concerns about the short-term outlook for business conditions, jobs, and earnings, the Conference Board released a report on Tuesday showing that U.S. consumer confidence has deteriorated by more than expected in February.

The Conference Board said its consumer confidence index fell to 78.1 in February from a downwardly revised 79.4 in January. Economists had been expecting the index to edge down to 80.1 from the 80.7 originally reported for the previous month.

Forum on trading, automated trading systems and testing trading strategies

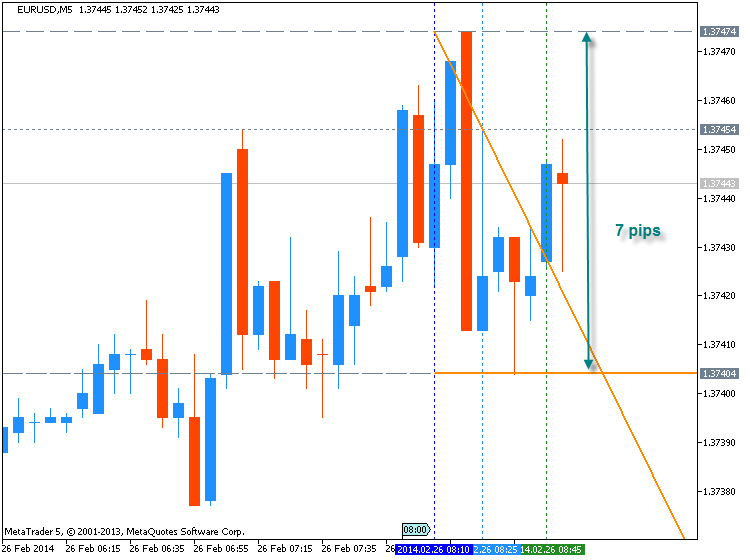

newdigital, 2014.02.26 09:00

2013-02-26 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Survey]

- past data is 8.3

- forecast data is 8.2

- actual data is 8.5 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German GfK Consumer Sentiment To Improve In March

Germany's consumer confidence is set to improve in March, a closely watched survey from GfK showed Wednesday.

The consumer confidence index rose to 8.5 points from 8.3 points in February. The index was forecast to remain unchanged at February's originally estimated value of 8.2.

EURUSD M5 : 7 pips ranging price movement by EUR - GfK German Consumer Survey news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.27 09:14

2013-02-27 07:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Consumer Confidence]

- past data is 86

- forecast data is 86

- actual data is 85 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

French Consumer Confidence 85 vs. 86 forecast

French consumer confidence fell unexpectedly last month, official data showed on Thursday.

In a report, INSEE said that French Consumer Confidence fell to 85, from 86 in the preceding month.

Analysts had expected French Consumer Confidence to remain unchanged at 86 last month.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.27 09:20

2013-02-27 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spain GDP]

- past data is 0.1%

- forecast data is 0.3%

- actual data is 0.2% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Spanish GDP 0.2% vs. 0.3% forecast

Spain’s gross domestic product rose less-than-expected last month, official data showed on Thursday.

In a report, Instituto Nacional de Estadistica said that Spanish GDP rose to 0.2%, from 0.3% in the preceding month.

Analysts had expected Spanish GDP to rise 0.3% last month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 35 pips price movement by EUR - French Consumer Confidence and EUR - Spain GDP news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

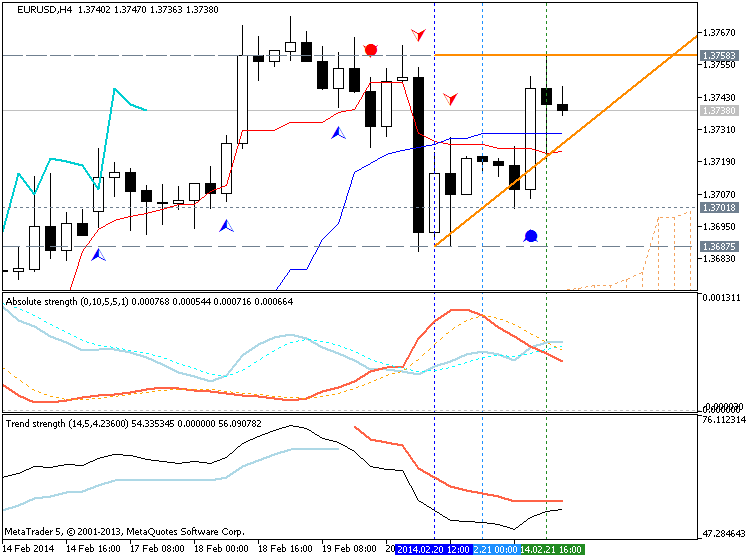

D1 price is located above Ichimoku cloud/kumo - secondary correction inside primary bullish is just started on open D1 bar, and the price is trying to break 1.3773 resistance for bullish to be continuing.

W1 price is on bullish ranging for 5 weeks from now and trying to break 1.3739 resistance to continuing primary bullish market condition.

If the price will break 1.3773 resistance on D1 close bar so the primary bullish may be continuing (good to open buy trade).

If not so we may see the ranging market condition within primary bullish on D1.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-02-24 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Survey]

2013-02-24 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2013-02-25 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German GDP]

2013-02-25 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2013-02-26 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Survey]

2013-02-26 15:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2013-02-27 08:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment Change]

2013-02-27 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2013-02-27 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed's Yellen Speech]

2013-02-28 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2013-02-28 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash]

2013-02-28 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2013-02-28 14:45 GMT (or 15:51 MQ MT5 time) | [USD - Chicago PMI]

2013-02-28 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart