Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.15 17:10

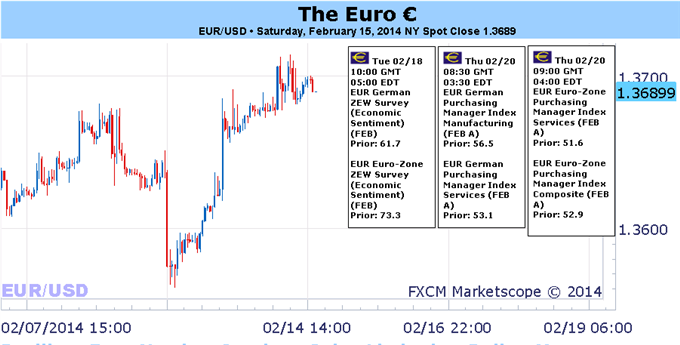

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Bullish

-

The retail forex crowd remains short EURUSD – and has added to losing positions.

- The Euro’s relative fortunes may be improving as the tides have turned against the US Dollar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.15 11:37

Fundamental Weekly Outlook Feb. 17-21 (based on forexcrunch article)

Janet Yellen gave her first official testimony, stressing that the central bank will continue to taper its asset purchases as planned as long as the labor market continues improving. Yellen assured markets that the Fed’s policy will continue in line with the policy approach taken by her predecessor, Ben Bernanke. US retail sales disappointed, dropping 0.4% with disappointments also in the core number and with downgrades for December. It seems that the bad weather might have a significant effect on the economy, and that not all the weakness is due to bad weather. The importance of the NFP is growing. And there are lots of things going on elsewhere: In Europe, stronger than expected GDP outweighed growing fears of ECB action. In the UK, the new forward guidance seems to hint of a UK rate hike earlier than thought and the pound reached new multi-year highs. Things are not looking so good everywhere: In Australia, terrible job figures halted the currency’s recovery.

- Japan rate decision: Tuesday.

Bank of Japan Governor Haruhiko Kuroda said in the last BOJ press

conference that overseas risks have subsided and domestic economy is

progressing in line with the banks projections, therefore no change is

required in monetary policy or in rates. Rising inflation and stronger

economic activity may induce companies to spend more on wages and

investment.

- UK inflation data: Tuesday,

9:30. UK consumer price inflation, reached the BOE target of 2% in

December, pushed down by lower computer games and food prices. CPI’s

return to the BOE’s comfort zone will ease the pressure on the MPC

enabling them to leave monetary policy unchanged. UK consumer price

inflation is expected to remain at 2.0%.

- German ZEW Economic Sentiment:

Tuesday, 10:00. German business climate declined unexpectedly in

January reaching 61.7 from 62 in December, however remained elevated

suggesting an upward trend in German economic activity. Analysts

expected the index to rise to 63.4. Germany’s economy grew by a mere

0.4% in 2013, however stronger expansion of about 1.5% is expected this

year. A small drop to 61.3 is forecasted this time.

- UK employment data:

Wednesday, 9:30. The UK unemployment rate declined more than expected

in the November, dropping to 7.1%, after a 7.4% reading in the second

quarter. This low release moved closer to the BOE’s threshold, below

which the bank will start raising rates. Jobless claims continues to

fall, dropping 24,000 in December after a 36,700 decline in November,

below the 33,800 drop anticipated by analysts. Total workforce

increased by 280,000 to 30.2 million in the third quarter. Jobless

claims are expected to decline by 18,300 for January. The unemployment

rate is expected to remain unchanged at 7.1% for December.

- US Building Permits:

Wednesday, 13:30. Building permits in the US declined more than

expected in December, reaching 986,000, below the revised November rate

of 1,017,000, suggesting construction activity lost momentum in the

early part of 2014. Analysts expected an annual rate of 1.015 million.

Nevertheless, despite the recent decline, 2013 showed a positive upbeat

to housing permits authorizations. Economists expect the housing market

to improve further in 2014. Building permits are expected to go down

to 980,000.

- US PPI:

Wednesday, 13:30. U.S. producer prices jumped 0.4% in December posting

their largest gain in six months amid sharp rise in gasoline prices.

This rise was preceded by a 0.1% drop in November. Nevertheless

inflation remains rather subdued from a year ago. In light of the

current growth in 2014, prices are expected to continue their modest

rise. Meanwhile Core CPI excluding volatile food and energy costs

advanced 0.3%, the biggest gain since July 2012, after climbing 0.1%

the prior month. Since the Fed is planning to end its asset purchases in

2014, low inflation will enable the Fed to keep interest rates near

zero for a longer period of time. Another climb of 0.6% is expected now.

- FOMC Meeting Minutes:

Wednesday, 19:00. In its January decision, the U.S. Federal Reserve

continued to scale back their bond-buying stimulus program but declared

that future decisions will depend on continuous evaluation of economic

conditions. While economic indicators have soured since, the details

that will be provided by the minutes are expected to shed some light on

the thoughts of the members. It is important to note that the

composition of the voting members has changed in 2014.

- Chinese HSBC Flash Manufacturing PMI:

Thursday, 1:45. This independent measure of Chinese strength has a

significant effect on global markets. The previous release kicked off

the emerging markets’ rout after it dropped to the contraction zone,

below 50 points. A small slide from 49.5 to 49.4 is expected.

- US inflation data:

Thursday, 13:30. Core inflation in the US remained unchanged at 0.1%

in December in line with market consensus after climbing 0.2% in

November. Lower energy prices were offset by a rise in other products.

Since Consumer prices are the main indicator for inflation, the Fed

closely monitors its releases. The small rise in prices indicates

inflation is subdued. Core inflation is expected to rise by 0.4%.

- US Unemployment Claims:

Thursday, 13:30. The number of Americans filing new claims for

unemployment benefits declined 2,000 last week to a seasonally adjusted

339,000, indicating the job market remains strong and that the number

of layoffs is decreasing. The reading was higher than the 331,000

forecast by analysts but the average figures have stabilized getting

closer to pre-recession levels. Economists believe unemployment rate

will drop by a quarter of percentage point due to an emergency federal

program, which expired last week. However the general condition of the

US job market is constantly improving, household confidence is and

income have increased and the manufacturing sector keeps expanding.

Unemployment claims are expected to decline to 335,000.

- US Philly Fed Manufacturing Index:

Thursday, 15:00. Factory activity in the U.S. mid-Atlantic region

gained momentum in January climbing to 9.4 after 6.4 in December. This

reading topped predictions for 8.8 points. However the future orders

fell to 5.1 from 12.9 in December while prices paid reading rose to 18.7

from 16.4. Nonetheless the index has been positive for eight

consecutive months indicating continues growth trend in the

manufacturing sector. Factory activity is expected to decline to 9.2.

- US Existing Home Sales: Friday, 15:00. U.S. existing home sales advanced in December to an annual rate of 4.87, after posting 1.82 million in the previous month, reaching the highest level in seven years. Sales in 2013 totaled 5.09, up 19.5% since 2011. However economists expect the housing boom to cool off in 2014 and return to normal levels of a 5.1% growth. Existing home sales is expected to reach 4.73 million.

That’s it for the major events this week.

*All times are GMT.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.16 12:01

Forex Fundamentals - Weekly outlook: February 17 - 21The euro rose to a three-week high against the dollar on Friday, as better-than-expected euro zone fourth quarter growth data allayed fears over more monetary tightening by the European Central Bank.

Monday, February 17

- Japan is to release preliminary data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- Australia is to publish data on new vehicle sales.

- In the euro zone, the eurogroup of finance ministers is to hold a meeting in Brussels.

- Markets in the U.S. are to remain closed for the Presidents Day holiday.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- The Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- The euro zone is to publish data on the current account. Meanwhile, the ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The U.K. is to release data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to produce data on foreign securities purchases.

- The U.S. is to release data on manufacturing activity in the Empire State.

- Australia is to publish data on the wage price index, as well as a private sector report on an index of leading economic indicators.

- The U.K. is to release official data on the change in the number of people unemployed and the unemployment rate, as well as data on average earnings and public sector borrowing. Meanwhile, the Bank of England is to publish the minutes of its most recent policy setting meeting.

- The ZEW Institute is to publish a report on economic expectations in Switzerland, a leading indicator of economic health.

- Canada is to release data on wholesale sales.

- The U.S. is to publish reports on building permits, housing starts and producer price inflation.

- Meanwhile, the Federal Reserve is to publish the minutes of its most recent policy setting meeting.

- Japan is to publish data on the trade balance, the difference in value between imports and exports.

- China is to release the preliminary reading of the HSBC manufacturing index.

- The euro zone is to publish closely watched data on manufacturing and service sector activity, while Germany and France are to publish individual reports. Germany is also to publish data on producer price inflation.

- The U.K. is to produce private sector data on industrial orders.

- The U.S. is to release the weekly report on initial jobless claims and data on consumer price inflation. The nation is also to release data on manufacturing activity in the Philadelphia region.

- The BoJ is to publish monetary policy meeting minutes.

- The U.K. is to produce official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity, as well as data on public sector net borrowing.

- Canada is to publish reports on retail sales and consumer price inflation.

- The U.S. is to round up the week with private sector data on existing homes sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.16 18:05

EUR/USD Fundamentals - weekly outlook: February 17 - 21The euro rose to three-week highs against the dollar on Friday as stronger-than-forecast euro zone fourth quarter growth data bolstered the outlook for the recovery in the euro area.

Monday, February 17

- In the euro zone, the eurogroup of finance ministers is to hold a meeting in Brussels.

- Markets in the U.S. are to remain closed for the Presidents Day holiday.

- The euro zone is to publish data on the current account. Meanwhile, the ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The U.S. is to release data on manufacturing activity in the Empire State.

- The U.S. is to publish reports on building permits, housing starts and producer price inflation.

- Meanwhile, the Federal Reserve is to publish the minutes of its most recent policy setting meeting.

- The euro zone is to publish closely watched data on manufacturing and service sector activity, while Germany and France are to publish individual reports. Germany is also to publish data on producer price inflation.

- The U.S. is to release the weekly report on initial jobless claims and data on consumer price inflation. The nation is also to release data on manufacturing activity in the Philadelphia region.

- The U.S. is to round up the week with private sector data on existing homes sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.18 17:24

2013-02-18 14:00 GMT (or 15:00 MQ MT5 time) | [USD - TIC Long-Term Purchases]

- past data is -28.0B

- forecast data is 24.7B

- actual data is -45.9B according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

The US TIC long-term purchases figure for December was -$45.9bn, according to the US Department of Treasury. This compared with a revised -$28.0bn the previous month and a forecast of -$24.7bnMetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 26 pips price movement by USD - TIC Long-Term Purchases news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.19 15:22

2013-02-19 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

- past data is 0.99M

- forecast data is 0.98M

- actual data is 0.94M according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

US Building Permits worse than expected 937K

US Building Permits released at 937K worse than expected. The potential for this event to affect exchange rates is High. Market impact primarily affects USD currency pairs although currency correlations may impact other currencies as well.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by USD - Building Permits news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.20 11:47

2013-02-20 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - French PMI]

- past data is 49.3

- forecast data is 49.6

- actual data is 48.5 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

French Private Sector Downturn Deepens In February: Markit

France's private sector activity decreased at a faster pace in February, led by a further marked fall in service sector activity, survey data released by Markit Economics and CDAF revealed Thursday.

The seasonally adjusted composite output index, which gauges the performance of the manufacturing and service sectors, dropped to a two-month low of 47.6 in February from 48.9 in January. Index readings below 50 indicate contraction of the sector.

New orders received by private sector firms fell for a fifth consecutive month in February, with both service providers and manufacturers recording faster declines.

In line with the weakness in activity, employment fell for a fourth successive month. Input price inflation in the sector eased to a five-month low, and output prices continued to fall.

The purchasing managers index (PMI) for the manufacturing sector decreased to 48.5 in February from 49.3 in the beginning of the year. Economists had forecast the index to rise to 49.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 32 pips price movement by EUR - French PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.20 15:05

2013-02-20 13:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

- past data is 0.3%

- forecast data is 0.1%

- actual data is 0.1% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

Retail inflation remained in check in January, as new government statistics showed that consumer price growth slowed down from the previous month and matched economists' expectations.

The U.S. Labor Department revealed that consumer prices advanced 0.1 percent in January. This followed an increase of 0.2 percent in the previous month.

Economists had expected the figure to rise 0.1 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 22 pips price movement by USD - CPI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is located inside Ichimoku cloud/kumo below Sinkou Span A line trying to cross is from below to above together with breaking 1.3691 resistance to be reversed to bullish market condition.

W1 price is on bullish ranging, and the price on H4 timeframe is on secondary flat within bullish too.

If the price will break 1.3691 resistance together with breaking Sinkou Span A line (the border of Ichimoku cloud) on close bar so we may see the reversal from bearish to primary bullish (good to open buy trade).If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-02-18 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

2013-02-18 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Survey]

2013-02-18 14:00 GMT (or 15:00 MQ MT5 time) | [USD - TIC Long-Term Purchases]

2013-02-18 15:00 GMT (or 16:00 MQ MT5 time) | [USD - NAHB Housing Market Index]

2013-02-19 13:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2013-02-19 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2013-02-19 19:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Minutes]

2013-02-20 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2013-02-20 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2013-02-20 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - French PMI]

2013-02-20 08:30 GMT (or 09:30 MQ MT5 time) | [EUR - German PMI]

2013-02-20 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - PPI]

2013-02-20 13:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2013-02-20 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Survey]

2013-02-21 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - EU Economic Forecasts]

2013-02-21 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : reversal

Intraday Chart