Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.01 17:47

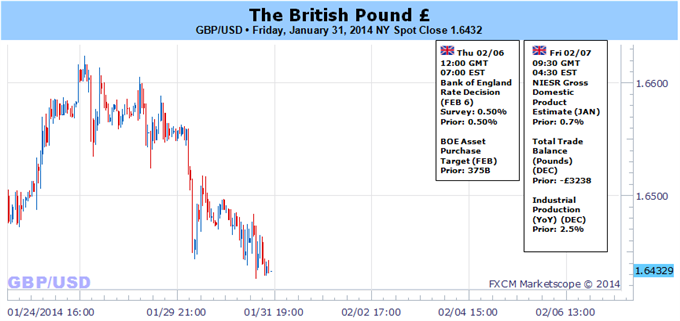

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for the British Pound: Bullish

- British Pound Mixed after ‘In-Line’ 4Q GDP Reading

- Cycle turn window in GBP/USD

See image below

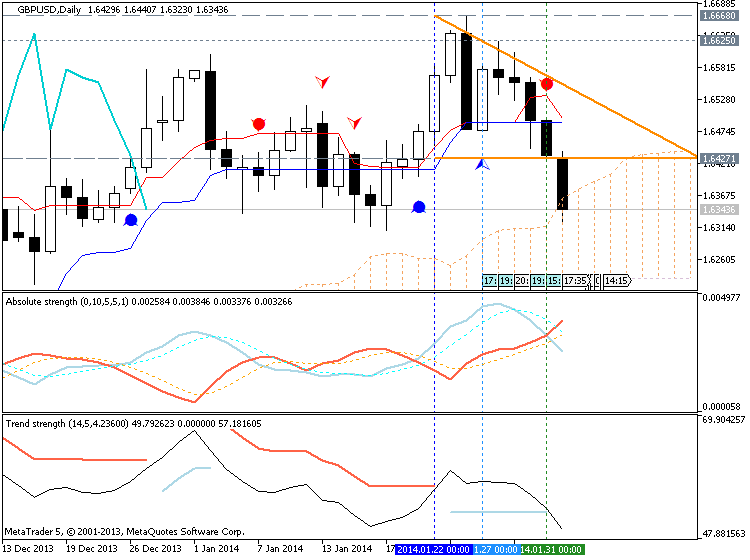

Two consecutive PINBAR was painted on the weekly chart, showing a breakout of the uptrend

Above we see from November 2007, in all PINBAR, was shown a small or a big breakout, minimum of 500 to 2000 PIP

Download of PINBAR MT5, here

My PIN BAR isn't equal this of dowload, is MT4, I did in the jobs, there are some differences small!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.03 12:45

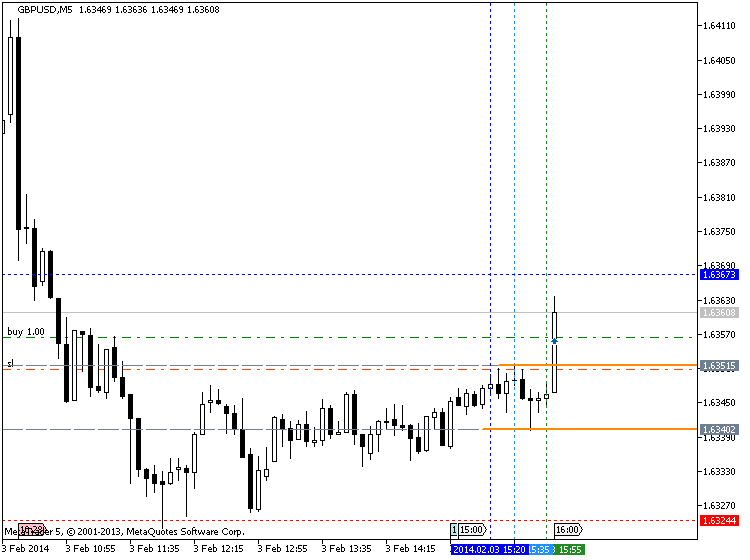

2013-02-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

- past data is 57.2

- forecast data is 57.0

- actual data is 56.7 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

UK manufacturing PMI grows for tenth consecutive month

UK manufacturing grew for a tenth consecutive month in January according to the latest PMI figures, with new orders and employment also rising.

Markit’s UK Manufacturing Purchasing Managers’ Index (PMI), a survey compiled of more than 600 industrial companies, slid to 56.7 in January from December’s 57.2.

Despite the UK’s PMI hitting a three-month low, it was comfortably above the survey’s long-run average of 51.3, suggesting a strong start for the economy in the first quarter of 2014.

“Although the pace of output expansion has cooled slightly in recent months, growth is still tracking at one of the highest rates in the 22-year survey history,” said Rob Dobson, senior economist at PMI compiler Markit.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 61 pips price movement by GBP - Manufacturing PMI news event

If not so we may see the ranging market condition.

- Recommendation for long: n/a

- Recommendation to go short: watch the price for breaking 1.6399 for possible sell trade

- Trading Summary: possible breakdown

Breakdown on open bar (today's D1 bar was open above 1.6399) :

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI] :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.04 10:57

2013-02-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

- past data is 62.1

- forecast data is 61.5

- actual data is 64.6 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

UK Construction Activity Growth Strongest Since 2007

British construction sector activity expanded at the fastest pace in nearly six-and-a-half years in January, a survey by Markit Economics and the Chartered Institute of Purchasing and Supply (CIPS) revealed Tuesday.

The purchasing managers' index, a measure of the country's construction sector performance, rose to 64.6 in January from 62.1 in December. Economists had forecast the index to fall to 61.5.

The January reading was the highest since August 2007. The index has now posted above the boom-or-bust threshold of 50 for nine successive months.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 44 pips price movement by GBP - Construction PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.04 16:56

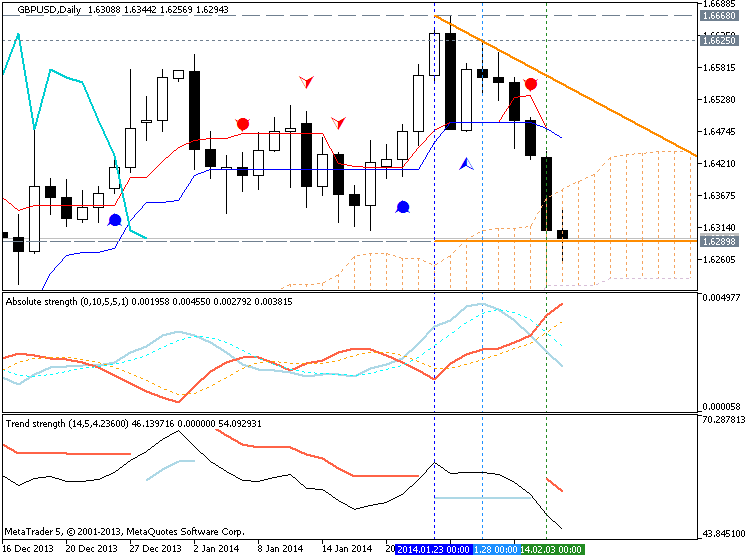

GBP/USD Technical Analysis (based on dailyfx article)Prices declined as expected after putting in a Bearish Engulfing candlestick pattern. The pair is now testing support at 1.6260, the 50% Fibonacci retracement, with a break below that targeting the 61.8% level at 1.6164. Alternatively, a close back above the 38.2% Fib at 1.6356 aims for the underside of a rising channel bottom set from set from mid-December, now at 1.6428.

Risk/reward considering argue against taking a trade

with prices in close proximity to near-term support. Alternatively,

attempting to pick a bottom and trading the pair to the long side

presumes support will hold, which is an assumption that is thus far

baseless. As such, we remain sidelined for now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.05 10:31

I did not find yearly pivot points indicator in MT5 CodeBase sorry (if someone knows MT5 indicator so let me know please).

=============================================

How to Trade GBPUSD Forex Yearly Pivot Points (based on dailyfx article)

- From January to February 2013, GBPUSD fell 1400 pips breaking down through three significant pivot levels before settling

- GBPUSD double bottom bounce from the yearly Forex S2 pivot began a 1700 pip rise

- GBPUSD 2014 yearly Forex pivots may show excellent trading opportunities

But you may be asking, “Why should we look at yearly pivots?” It is a great question. In technical analysis, the longer the timeframe, the more statistically reliable the trendline, support and resistance level becomes as more data has gone into producing each point. This greater reliability added to the large moves that happen after a bounce and a break make these levels attractive buy and sell zones for Forex traders.

If someone is trading the news events so please note that GBPUSD is most risky pair for that (less risky is USDCAD) - just for information.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.05 10:51

2013-02-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

- past data is 58.8

- forecast data is 59.0

- actual data is 58.3 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. services PMI falls to 7-month low of 58.3 in January

Service sector activity in the U.K. expanded at the slowest pace in seven months in January, dampening optimism over the country’s economic outlook, industry data showed on Wednesday.

In a report, market research group Markit said the seasonally adjusted Markit/CIPS Services Purchasing Managers Index fell to 58.3 last month from a reading of 58.8 in December. Analysts had expected the index to inch up to 59.0 in January.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 41 pips up and 25 pips down by GBP - Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.06 11:51

2013-02-06 08:00 GMT (or 09:00 MQ MT5 time) | [GBP - Halifax HPI]

- past data is -0.6%

- forecast data is 1.1%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Halifax HPI 1.1% vs. 1.0% forecast

The UK.’s Halifax house price index rose more-than-expected last month, industry data showed on Thursday.

In a report, HBOS said that U.K. Halifax HPI rose to a seasonally

adjusted 1.1%, from -0.5% in the preceding month whose figure was

revised up from -0.6%.

Analysts had expected U.K. Halifax HPI to rise 1.0% last month.

==========

Halifax HPI is measuring the changes in the price of homes financed by Halifax Bank of Scotland (HBOS). It's a leading indicator of the housing industry's health because rising

house prices attract investors and spur industry activity (source - FF forum calendar description)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 28 pips price movement by GBP - Halifax HPI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

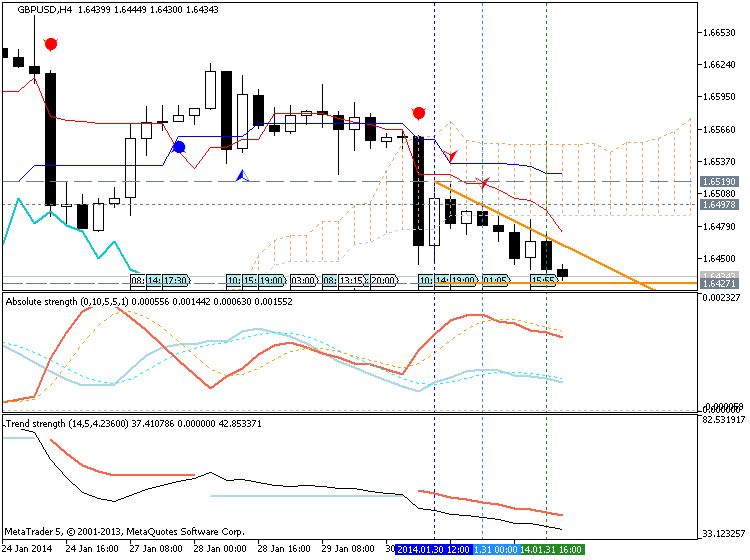

D1 price is on correctional movement, and Chinkou Span line is near to be crossed with historical price from above to below for good breakdown on D1 timeframe.

The price on H4 timeframe is on primary bearish condition trying to break 1.6427 support level

W1 timeframe - secondary flat with primary bullish.

If the price will break 1.6399 support level on D1 timeframe together with Chinkou Span crossing the price on close bar so we may see good breakdown (good to open sell trade).If not so we may see the ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-02-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2013-02-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

2013-02-05 00:01 GMT (or 01:01 MQ MT5 time) | [GBP - BRC Shop Price Index]

2013-02-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2013-02-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2013-02-05 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2013-02-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

2013-02-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Asset Purchase Facility]

2013-02-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2013-02-07 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2013-02-07 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

2013-02-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movementSUMMARY : bullish

TREND : ranging

Intraday Chart